Disclaimer

GOPAX Insights or listing decisions should not be considered as endorsements or solicitations to purchase the featured assets on our platform.

Overview

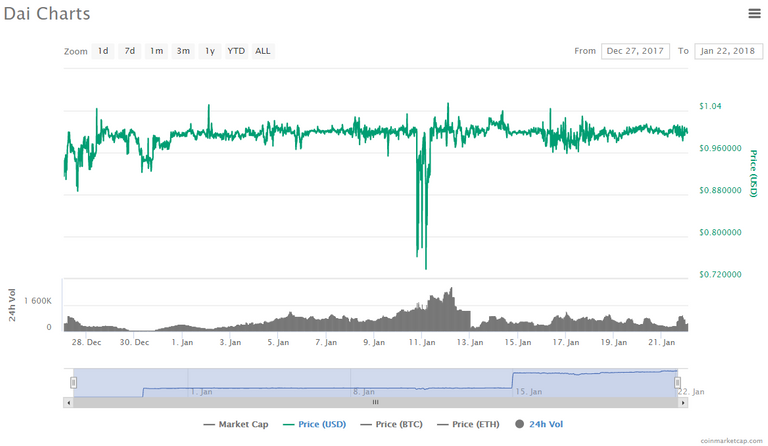

Dai is the first live attempt of a nearly completely decentralized and fully transparent coin with a stable value. Dai Tokens (DAI) derive their value from collateralized debt positions (CDP) of Ether and engages a Target Rate Feedback Mechanism (TRFM) to control its value in the event of market volatility. Although at the time of this report the daily trading volume for DAI tokens is low, it has already demonstrated its ability to hold value despite extreme market volatility.

Business Landscape

Current Challenge

Most cryptocurrencies and digital assets are far too volatile to be used as a medium of exchange. Value fluctuations as much as 20% per day are not uncommon, making it difficult for pricing items or exchanging goods. This derives from the fact that nearly all digital assets are priced primarily speculatively, meaning that emotions of fear and greed dominate demand.

Proposed Solution

Dai tokens were created as a means to provide a stable value currency through the use of pricing control mechanisms backed by other digital assets. The pricing controls are governed through a decentralized autonomous organization (DAO) called MakerDAO, and MKR token holders may participate in the governance of the price controls. Dai tokens begin with a soft price equal to the US Dollar.

Current Major Players

Dai enters competition with the US Tether Dollar (USDT) operated by Tether. Tether claims that each of their USDT are backed by a real US dollar in a bank account, but have not released a formal audit for some time. Dai has the advantage of the backing collateral being visible on chain at all times, which may give it a significant advantage over USDT. Despite its lack of transparency, USDT has grown to a size of $1.4B at the time of this report.

Technical Specification

The primary driver of the value of Dai is in the collateralized debt positions (CDP) used to create it. For the first phases of Dai, only ether can be used for collateral, but if no major issues arise then other types of collateral will be accepted.

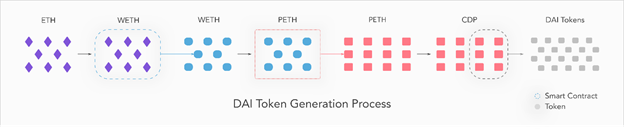

To create Dai tokens, first ether is wrapped into an ERC-20 token named “WETH”, or wrapped ether. This allows the ether to be more easily handled by the Dai smart contract. Once the ether is converted to WETH, it can be pooled together into a smart contract in exchange for “PETH”, or pooled ether. PETH ideally has a 1 to 1 exchange rate with WETH, but extreme conditions in the Dai and Maker smart contracts can either increase or decrease this ratio.

Once WETH has been converted into PETH, a CDP can then be created though the Maker smart contract. A CDP takes PETH and locks portions of it in exchange for Dai tokens. Dai tokens are created when PETH in the CDP is locked up, and destroyed when PETH in the CDP is unlocked. A “stability fee” is charged in MKR tokens (and subsequently burned) when a user wishes to unlock portions of their CDP, in accordance to a low APY interest on the outstanding debt of Dai tokens.

Controlling Price Volatility

Since there is some delay between the creation of a CDP and its redemption, there is the chance that the value of ether will change dramatically enough to affect the value of the generated Dai tokens. If the price increases dramatically, then the value of Dai tokens will also tend to increase, and if the price decreases, then the value of Dai tokens will also tend to decrease.

To combat these changes, Dai uses three primary means of controlling its value through extreme market volatility.

The first is that collateral must always be posted in excess of the value in Dai tokens to be generated. This is done in accordance to a target rate (which initially is 1 Dai token per equivalent value in USD). For example, if $100 of ether is used to create a CDP, only 90 Dai tokens might be generated for the CDP. This excess allows the value of the collateral to decrease by 10% without risking liquidation.

The second is an adjustable target rate feedback mechanism (TRFM). It is engaged by MKR holder governance in times of extreme volatility or persistent market imbalance in supply and demand for Dai, by voting to set the "TRFM sensitivty parameter" to a nonzero value. Once engaged, the TRFM adjusts the Dai target price, affecting how many Dai tokens are produced per unit of value of collateral when creating a CDP. If Dai tokens fall under their target price, the target rate is automatically lowered to make it more expensive to create Dai tokens. Conversely, if Dai tokens are above their target price the target rate is automatically raised to give more Dai tokens per unit of value of the collateral when creating a CDP.

External Actors

Although the CDP creation and redemption process happens mostly through public smart contracts, Dai depends on the actions of a set of external actors to properly function.

The first are price oracles to report the price of ether for the purpose of generating Dai tokens from CDPs. These oracles are elected via the Maker DAO and can be replaced should a price oracle act maliciously or their service is disrupted.

The second are called “keepers”, who trade on the fluctuations of value in Dai Tokens. Keepers can buy Dai tokens when they are below the target price in anticipation of the TRFM engaging, and sell them when they are over the target price for the same reason. These actors help keep the value of Dai from engaging the TRFM and further reduce volatility.

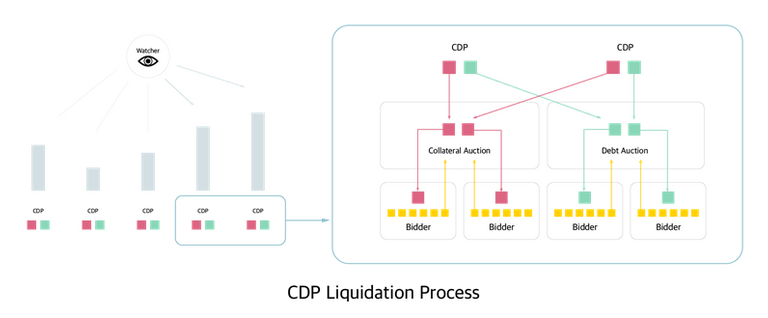

When a watcher detects that the outstanding debt (in green) is too near to the value of the posted collateral (in red), then they can trigger liquidation auctions where the collateral and outstanding debt is sold for DAI tokens (in yellow).

The third are “watchers”, who watch for CDPs whose value of collateral has fallen below the outstanding debt. Watchers can trigger liquidation on these CDPs, which is purchased by the Maker DAO and then posted for sale to raise Dai tokens to mitigate the loss. Any excess value gained from the posted collateral is returned to the original owner of the CDP. Depending on the magnitude of price volatility and CDP liquidations, the exchange rate of PETH to WETH may also change to socialize extreme debt to all PETH holders. Conversely, the liquidation penalty is paid in PETH and burned, increasing the PETH to WETH ratio to offset the effects of a decreased PETH to WETH ratio. This system will be removed once multiple types of collateral are supported.

Once Dai tokens support multiple types of collateral, this process will change to include two separate auctions. The first is a debt auction, where bidders can own the outstanding debt in Dai tokens in exchange for an equivalent value of new MKR tokens. The second is the collateral auction, where the posted collateral may be purchased with Dai tokens.

Governance and CDP Risk Parameters

Governance of the Dai smart contract system is handled through the Maker DAO. MKR token holders may vote on parameters that affect the settings of newly created CDPs. MKR holders may change the following parameters for CDP types:

- The Debt Ceiling, or the maximum amount of debt a single CDP can create

- The Liquidation Ratio, the minimum collateral to debt ratio before a CDP can be liquidated

- The Stability Fee, the fee paid upon redeeming collateral with Dai tokens

- The Penalty Ratio, the maximum amount of Dai raised from a liquidation auction to buy MKR

And the following global system parameters: - The sensitivity parameter

- The target rate when the TRFM is not engaged

- The set of price feed oracles

- Engaging global settlement

Global Settlement and Graceful Unwinding

Should the Dai smart contract system encounter a flaw or fail in a substantial way, MKR token holders may vote in the Maker DAO to activate Global Settlement. Global Settlement is an emergency measure that halts the creation and redemption of CDPs and will be able to claim a fixed amount of ether proportional to their holdings.

Use Cases

If Dai maintains a stable value on the blockchain, then it can be used as a reliable medium of exchange between exchanges, merchants, and users. Additionally, CDPs can be used to create a form of “on-chain margin trading”. If collateral is used to create a CDP, the Dai tokens generated from that CDP can be used to purchase more of the underlying asset. If the value of the collateral increases, a small portion of the newly purchased collateral can be sold again for Dai tokens, which can be subsequently used to close the original CDP. In this way, one can increase their position of an appreciating asset in an entirely decentralized manner.

Token Market Structure

Pre-mine and Inflation

Since there was no ICO for Dai tokens, all Dai tokens are created via the CDP creation process in accordance to the market price at the time of CDP creation. Dai tokens are destroyed when they are used to redeem collateral in a CDP with outstanding debt. When the platform supports multiple forms of collateral, Dai tokens will also be destroyed when new MKR is sold at a debt auction.

For MKR tokens, there are a total of 1 million tokens in existence. MKR tokens are destroyed when used to pay the stability fee for redeeming collateral in a CDP with outstanding debt, and created in the event of a debt auction. This number is expected to decrease on average.

Initial Coin Offering: Sales Model

There was no ICO for either Dai tokens or MKR tokens, rather MKR tokens were sold through private agreements with development partners. MKR tokens are available on secondary markets.

Maker Team and Experience

- Nikolai Mushegian - CEO of DappHub, Software Engineer at Google, Developer at BitShares

- Ryan Casey - Software Developer at NexusDev, Full-Stack Developer at RyePDX

- Kat Obermeyer - Co-Founder of DappHub, Head of Design at Vengo Labs

- James Reidy - Co-Founder of DappHub, Senior Business Intelligence Analyst at Truven Health

- Denis Erfurt - Co-Founder of NexusDev, IT Consultant, Software Engineer at LifeT.me

- Rune Christensen - Co-Founder, Co-Founder at Try China

Secondary Market

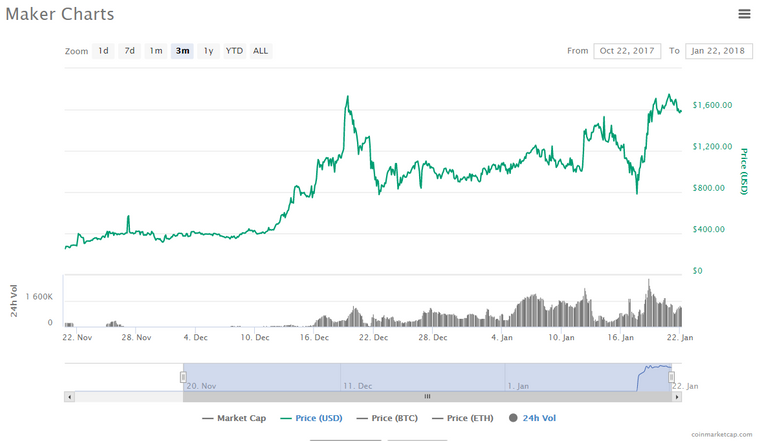

Market Capitalization (USD)

Jan. 22nd, 2018

Source: https://coinmarketcap.com

| MKR Tokens | Price per Token | Circulating Supply | Volume (24h) |

|---|---|---|---|

| $975,773,619 | $1,578.34 | 618,228 | $1,233,490 |

| DAI Tokens | Price per Token | Circulating Supply | Volume (24h) |

|---|---|---|---|

| $9,943,462 | $0.994078 | 10,002,698 | $517,226 |

Volume by Major Exchange

MKR Tokens

| Exchange | Volume % |

|---|---|

| Bibox | 60.63 |

| OasisDEX | 25.13 |

| OKEx | 8.332 |

| Gate.io | 4.72 |

DAI Tokens

| Exchange | Volume % |

|---|---|

| Bibox | 74.98 |

| OasisDEX | 13.87 |

| Gatecoin | 7.84 |

| Gate.io | 2.49 |

Market Price Volatility

Jan. 22nd, 2018

Source https://coinmarketcap.com

Risks and Limitations

Dai tokens depend on multiple systems of smart contracts and external actors, thus the biggest risks to the Dai stablecoin project are related to those components.

As the smart contracts have not yet been fully formally verified, there may exist a flaw which enables unauthorized users to gain access to open CDPs or circumvent the liquidation process. To combat these, Maker has implemented a global settlement “escape hatch” for the entire system should a serious flaw be found. While to date there have been no major reported issues with the Dai smart contracts, as the token gains popularity it may become more profitable to attack if an exploit is discovered.

The next largest risk is a black-swan type event causing a quick and significant drop across a collateral used to back CDPs. This is mitigated by initially restricting collateral to ether, and even further with the PETH to WETH exchange rate. Once multiple collaterals are supported, this becomes less of a systemic risk to value of Dai tokens.

Another risk present in keeping the value of Dai tokens stable are malicious price feed oracles. As these are not decentralized, collusion among price feed oracles may cause the value of Dai to deviate from the target price. Mitigating this risk is the fact that Maker token holders may vote to remove and replace a price oracle if malfeasance is detected.

Other risks are also present, as without keepers trading the price of Dai the TRFM may be frequently engaged, resulting in undesirable volatility of the value of Dai tokens.

Despite these risks, Dai has managed to stay mostly within 5% of the target price, with few short exceptions, from the beginning of 2018, despite major moves in the price of its only currently supported collateral, ether.

Additional Resources

For more information about MKR and DAI tokens, please consult the following resources:

- Maker Website - https://makerdao.com

- Maker Whitepaper - https://makerdao.com/whitepaper

- Maker Purple Paper (Technical Specification) - https://makerdao.com/purple/

- Maker Blog - https://medium.com/@MakerDAO

- DAI Price Information - https://coinmarketcap.com/currencies/dai

- MKR Price Information - https://coinmarketcap.com/currencies/maker

Final Remarks

We here at GOPAX hope you found this insight useful and enlightening. We are constantly striving to improve the quality of the information presented, so please leave any feedback, including questions, corrections, or suggestions in the comments below!

This is great information. It's very nice to have you on Steemit, giving us some important knowledge of these crypto projects.

Thank you for your feedback! We are doing our best to make sure these projects can be easily understood, as it is a vital part of this phase in the growth of the industry.