I tried out the ChatGPT from OpenAI and I must say I am impressed. Though at this moment it is a glorified search engine, the search results are still quite impressive.

How Land Value Tax should be the only tax and all other taxes should be abolished

A land value tax (LVT) is a tax on the value of land, regardless of any improvements made to it. The purpose of this paper is to argue that LVT should be the only tax, and all other taxes should be abolished. While there are valid concerns about implementing a land value tax, the benefits of this tax outweigh the drawbacks and it should be considered as a replacement for all other taxes.

One of the main benefits of a land value tax is that it is a more efficient and fair tax than other taxes. LVT is based on the value of land, which is not subject to the same fluctuations as other economic variables, such as the income or wealth of individuals or corporations. This makes it a more stable and predictable source of revenue for governments. Additionally, LVT is considered a progressive tax, as it is typically paid by those who own the most valuable land, who are often the wealthiest individuals or corporations.

Another benefit of a land value tax is that it promotes the productive use of land. When land is taxed based on its value, there is an incentive for landowners to put their land to its most productive use, rather than leaving it unused or underused. This can lead to increased economic activity and development, which can benefit both the landowner and the broader economy.

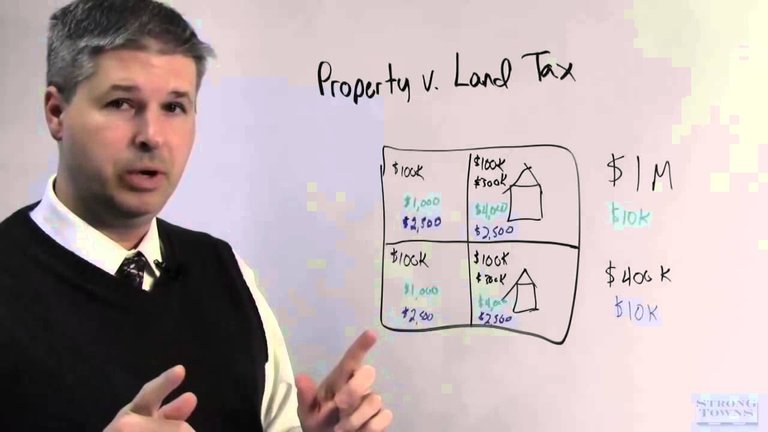

A third benefit of a land value tax is that it can help reduce economic inequality. LVT is often seen as a more equitable tax than other taxes, as it is based on the value of land, which is generally beyond an individual's control. By contrast, income and sales taxes are often regressive, meaning that they take a larger percentage of income from those with lower incomes. Property taxes, which are based on the value of buildings, can also be regressive, as they can disproportionately affect lower-income homeowners who may not have the resources to maintain or improve their property.

There are also several drawbacks to other taxes that make a land value tax a more attractive option. Income tax and sales tax are often regressive and can discourage economic activity, as they create a disincentive for individuals and businesses to earn or sell more. Corporate taxes can lead to negative externalities, as companies may try to shift their profits to low-tax countries in order to avoid paying high corporate tax rates. Property taxes, while they may be based on the value of land, can also discourage investment in property and development, as they create an ongoing cost for property owners.

However, it is important to consider potential objections to a land value tax. One concern is that LVT might discourage development or investment in land. Landowners may be less likely to invest in or develop their land if they are being taxed based on its value. Another concern is that LVT might be difficult to implement or administer, as it requires the accurate valuation of land, which can be challenging in some cases. A third concern is that LVT might lead to higher rents or land prices, as landlords may pass on the cost of the tax to tenants or buyers.

Despite these concerns, the benefits of a land value tax make it a compelling alternative to other taxes. LVT is a more efficient, fair, and equitable tax that promotes the productive use of land and can help reduce economic inequality. While there may be challenges to implementing a land value tax, these can be addressed through careful planning and administration. In conclusion, replacing all other taxes with a land value tax

Based on how you started, I am assuming that this entry is created/modified from #ChatGPT? Yes. #AI is demonstrating a considerable change in how we create content.

Yeah, exactly.

Very interesting. Thanks!

Congratulations @themonetaryfew! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 36000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Support the HiveBuzz project. Vote for our proposal!

Hello sirr , why do you stopped posting?