If trust is what blockchain creates, then game theory is how blockchain creates it. Game theory, which in simple terms can be defined as the study of rewards and punishments to influence behavior, is the machine that incentivizes honesty in industries that have none.

To better understand game theory and how it works within the context of blockchain, you have to know a bit about cryptoeconomics, mechanism design, and proof of stake. From there, we can then explain how game theory helps Lucidity create trust and transparency in digital advertising.

Let’s get started.

Cryptoeconomics

Blockchains aren’t magic. Building secured and sustainable distributed economic systems require careful thinking on cryptoeconomics. So what is cryptoeconomics? Though some have floated definitions, John Starks provides a useful one for designers:

“Cryptoeconomics is the use of incentives and cryptography to design new kinds of systems, applications, and networks.”

Starks points out that cryptoeconomics is not just economics applied to digital assets like cryptocurrencies and tokens. To be sure, cryptocurrencies and tokens are new objects for economic analysis. But all markets have features and capabilities, including digital advertising.

Applying financial incentives and cryptography allows us to be confident that cryptographic primitives work the same everywhere, and market players react to incentives predictably. This view holds for strategic interactions such as the following:

- Bitcoin protocols reward miners for expending computing power to secure the network, allowing consensus among nodes via proof of work.

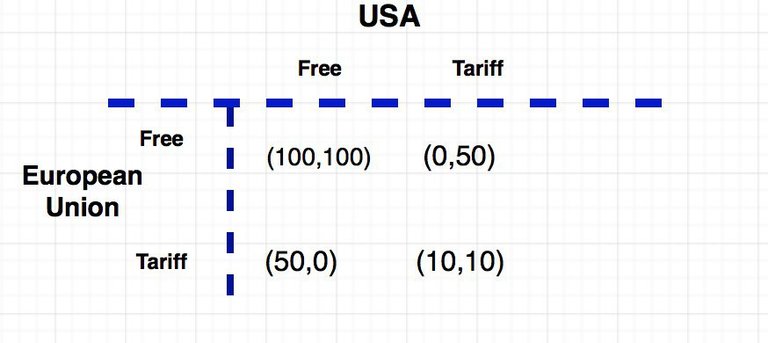

- Nations evaluating payoffs and risks of a trade war (tariffs vs. no tariffs).

- Firms weighing the benefits and costs of digital advertising campaigns (strong marketing vs. light marketing).

Simple Game Theory Non-Cooperative Problem (left diagram): Best outcome is for all parties to adopt free trade practices, with payoff (100,100). But in an adversarial environment, each party has an interest in imposing tariffs to raise individual income at the expense of the other party’s income. When both choose tariffs, the payoff is suboptimal (10,10).

Game Theory for Free Trade

Simple Game Theory Non-Cooperative Problem (left diagram): Best outcome is for all parties to adopt free trade practices, with payoff (100,100). But in an adversarial environment, each party has an interest in imposing tariffs to raise individual income at the expense of the other party’s income. When both choose tariffs, the payoff is suboptimal (10,10).

Mechanism Design

Cryptoeconomics is related to mechanism design, which is treated like reverse game theory. In game theory, we look at the game and figure out best strategies for each participant. A game is a competitive situation with strategic interactions between actors responding to an incentive mechanism. In mechanism design, we look at the outcome we want, and build a game from that.

In blockchain, the outcome we want is a secured, decentralized, and scalable architectures like Bitcoin or Ethereum. Distributed protocols allow us to challenge existing power structures and eliminate centralized middlemen by shaping behavioral economics.

In a competitive landscape, large interests are committed to exploiting institutional weaknesses, inefficiencies and information asymmetries where one party knows something that other parties don’t. Current economic systems have many entities (incumbents) that rent-seek or extract value from users without contributing to the system.

Lucidity’s Design Problem

There are massive problems plaguing digital advertising, including discrepancies between advertising supply-chain partners; payment transparency that benefit middlemen; and fraud practices committed by spoofers to the tune of $50+ billion globally.

Many ecosystem players have a profit-maximizing incentive to retain high volumes from the lack of transparency. To design a game that incentivizes honesty, first we need to set the desired outcome: verifying marketing events, tracking payments, and preventing fraud.

Lucidity’s Game

Digital advertising suffers from a classic non-cooperative game. With the advent of automated trading processes to buy and sell inventory came a vast number of vendors and intermediaries.

Middlemen help to aggregate the supply and demand of inventory, but there are major transparency issues with pricing, coupled with data silos. Exchanges and demand side platforms that want to demonstrate their real value face a broken supply chain.

The payoff is bad all around. Resources are tied up to resolve impression-level data discrepancies for billing. It’s hard to track all programmatic ad costs across exchanges down to the publisher to see who’s being honest. Without certainty in publisher identity, it’s hard to flag fake bid requests.

Lucidity uses cryptoeconomics to align the incentives of players with the goal of full data transparency. The Lucidity protocol tracks, verifies, and reaches consensus on all data and publishes the official record of marketing analytics to the blockchain.

To reach consensus, the Lucidity protocol uses a proof of stake model where each verifier stakes token. Token holders are neutral, 3rd party verifiers of transactions conducted between publishers and advertisers. They submit a verifier-specific, independent record of verified metrics to the platform. To incentivize accurate verifications, the platform rewards verifiers proportional to the amount staked.

Any future applications built on the Lucidity platform will rest on a foundation of clean, verified data.

Ethereum’s Proof of Stake – Game Theory

We draw our inspiration partly from Ethereum’s proof of stake system to guarantee economic security. This proof of stake protocol, Casper, is an example of cooperative game theory. Unlike the proof of work system, in which the player validates transactions and creates new blocks by demonstrating computational work, a proof of stake system requires the player to show ownership of cryptocurrency (i.e. Ether).

By staking their cryptocurrency, players are incentivized to validate the right transactions. Yet, the evolution of thinking on Casper exposed incentive problems that pose long-range attacks and nothing-at-stake problems. The nothing-at-stake issue arises when there are only rewards for producing blocks with no penalties. This creates adverse incentive for the actor for signing all blocks.

That’s why Vitalik Buterin proposed slasher as a penalty mechanism to this proof of stake protocol to solve the nothing-at-stake problem. The Lucidity protocol disincentivizes bad actors with a severe penalty. If an actor inflicts damage on the system by being dishonest or mining on two chains, the actor would lose the stake or security deposit.

In short, they lose everything. And that’s how we incentivize honesty in an industry that isn’t.

Join us at on Telegram at https://t.me/luciditytech and become a part of the Lucidty.Tech movement!

Follow us:

Website

Website