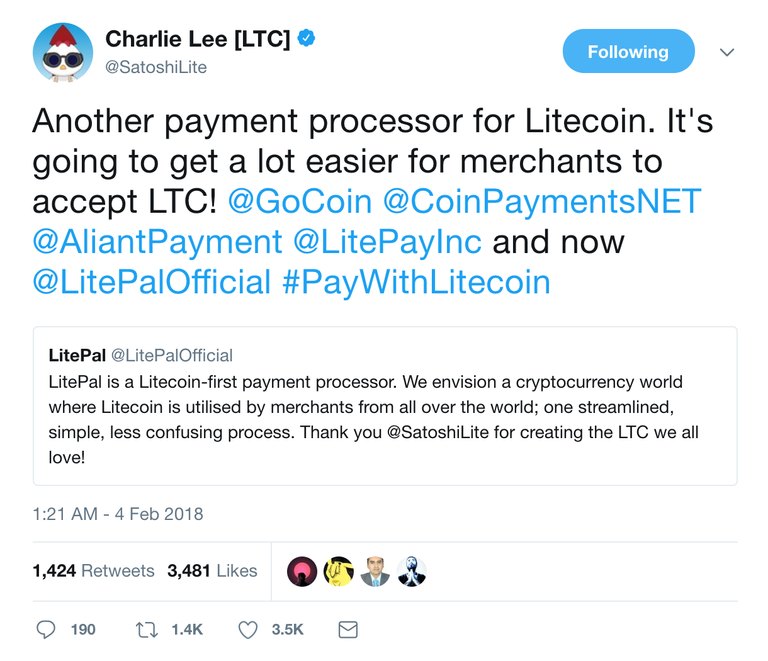

Litecoin founder Charlie Lee last night used Twitter to post about the upcoming launch of a new payment processing service, in addition to the one that is to be launched in a few days.

The service is called LitePal. A tandem LitePal announcement said:

“LitePal is a Litecoin-first payment processor. We envision a cryptocurrency world where Litecoin is utilised by merchants from all over the world; one streamlined, simple, less confusing process. Thank you @SatoshiLite for creating the LTC we all love!”

LitePal is expected to be released later this year. According to the official website, users will be able to use the service with PayPal, Western Union, Bitcoin and Litecoin, and the fees will be “bone chillingly low”. Apart from the vaguely-worded landing page, no information is yet available regarding this service, so I suppose a ‘watch this space’ is in order.

The Litecoin community is already excited about the imminent launch of LitePay, which is going to make Litecoin useable anywhere that Visa is. It will convert all payments to/from US dollars immediately, and all deposits will incur “a simply, flat 1% settlement charge” as opposed to the 3% charged by credit cards, according to the official website.

Palwasha Saaim, a research analyst at Lombardi Financial, explained the repercussions to the Sunday Express: “It would allow businesses to accept Litecoin without worrying about price volatility. Payments would be processed by LitePay instantaneously and settled directly with their banks. Take note that BitPay is currently charging about $5.00 transaction fees for processing Bitcoin transactions that take ages to confirm. The best part is that Litecoin users will be able to convert litecoins to dollars and vice versa through their Visa-compatible LitePay cards, which will be usable at all ATMs or businesses that support Visa payments.”

Litecoin is currently number 6 in the cryptocurrency rankings, and is worth over $9 billion dollars at market. It is popular because it is almost identical to Bitcoin, but solves many of its shortcomings. It is designed to be faster and lighter and it achieves this by generating new blocks at four times the speed and having a coin limit four times as large.

Institutions that decide to use cryptocurrency in some format always begin with Bitcoin, as that is the most well-established and valuable, but Litecoin is usually amongst the second wave of coins that said institutions add in the event that cryptocurrency works out for them. For example, Bloomberg Terminal added it in just this manner, and the two big Chicago exchanges that have been offering Bitcoin futures for a few months now are considering adding Litecoin too.

Litecoin was one of the first forks of the Bitcoin blockchain. It was created in 2011 by a former employee of Google named Charlie Lee. Interestingly, Lee gave up all of his own litecoins back in December, claiming that he was tired of being unfairly accused of a conflict of interest.

The price of Litecoin spiked drastically after Lee published his message about LitePal.

Source(s):

~~~ embed:960035458343251968?ref_src=twsrc%5Etfw&ref_url=https%3A%2F%2Fwww.financemagnates.com%2Fcryptocurrency%2Fnews%2Flitepay-litepal-two-new-litecoin-payment-processing-services-way%2F twitter metadata:U2F0b3NoaUxpdGV8fGh0dHBzOi8vdHdpdHRlci5jb20vU2F0b3NoaUxpdGUvc3RhdHVzLzk2MDAzNTQ1ODM0MzI1MTk2OHw= ~~~

Disclaimer: I am just a bot trying to be helpful.