Litecoin has struggled to build momentum in recent weeks, as altcoins failed to keep pace with a surging bitcoin. But fortunes may soon change for the world’s fifth-largest crypto after a major South Korean exchange enabled LTC trades.

Just so you are aware: South Korea has driven the lion’s share of cryptocurrency trade volumes since China shut its doors to the alternative asset class.

Coinone Embraces LTC

Coinone, South Korea’s No. 2 crypto exchange, has officially brought Litecoin to its platform. In the first 24 hours of trading, the exchange processed $3.2 million worth of LTC-won trades. Right off the bat, it became one of the top Litecoin exchanges on the market.

To get a sense of just how vital the South Korean market is to Litecoin, consider that roughly a quarter of global LTC trades are processed by Bithumb, the country’s largest crypto exchange. As a matter of fact, Bithumb overtook Bittrex to become the largest cryptocurrency trading platform in the world this past summer.

Back in September, South Korea overtook China to become the third-largest bitcoin market, according to CCN. Prominent bitcoin trader Tuur Demeester tipped his hat to the Asian country for its emergence as a key blockchain player.

It therefore stands to reason that Coinone’s embrace of Litecoin will contribute net gains to the altcoin. While we acknowledge that higher trading volumes don’t guarantee higher prices, the trend in the altcoin market is clearly going in one direction. This is especially true for Litecoin, which is often called the silver to bitcoin’s gold. It is capable of four times as many transactions as BTC, and has faster confirmation times.

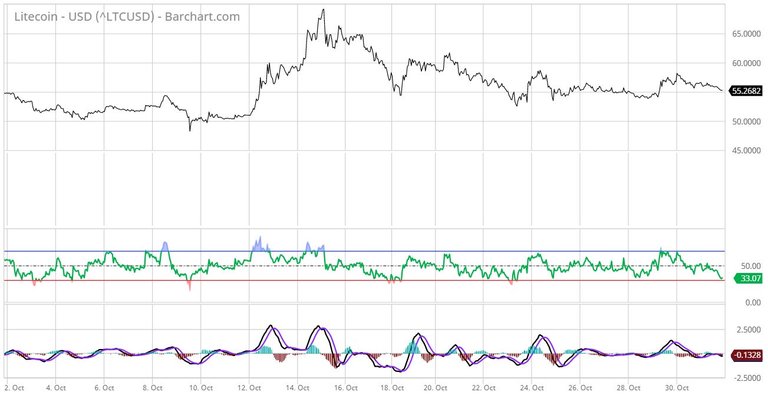

LTC/USD Price Levels

Litecoin traded lower against the dollar on Wednesday, with LTC/USD hovering within a narrow range. At press time, one LTC was worth $55.25 USD for a total market cap of roughly $2.97 billion. Only bitcoin, Ethereum (ETH), Ripple (XRP) and Bitcoin Cash (BCH) have a higher overall cap.

Prices are well supported near $52, which represents the swing low from Oct. 23. On the opposite side of the spectrum, the market has run into strong resistance near $58. Prices have failed to breach that level on successive occasions going back to Oct. 24.

Proponents of the Relative Strength Index (RSI) are likely to find Litecoin’s current valuations attractive from the perspective of overbought/oversold conditions. An RSI of 33 clearly suggests that prices are due for a rebound relatively soon

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://hacked.com/litecoin-faces-trade-paralysis-outlook-bright/

Congratulations @abhishek63! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP