Grayscale Investments was the first company to launch an investment fund dedicated solely to Bitcoin, while still very underground. Grayscale had then multiplied the funds, all devoted to a cryptocurrency in particular. This time, Grayscale changes tack and launches a fund focused on institutions that will contain several cryptocurrencies.

The "Grayscale Digital Large cap" will be multi cryptos

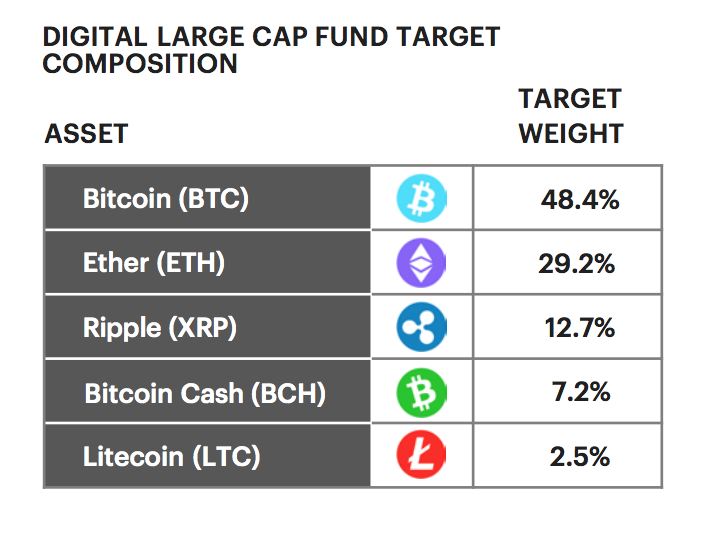

The new fund of Barry Silbert - CEO of Grayscale - was announced yesterday at an event organized by Yahoo Finance, the "Yahoo Finance All Markets Summit". It will position itself on 5 cryptocurrencies and will be rebalanced quarterly to respect the following proportions:

- Bitcoin (BTC) which will represent 48.4% of the fund;

- Ethereum (ETH) which will represent 29.2% of the fund;

- Ripple (XRP) which will represent 12.7% of the fund;

- Bitcoin Cash (BCH) which will represent 7.2% of the fund;

- Litecoin (LTC) which will represent 2.5%.

The fund will initially only be open to institutional investors accredited by the SEC. They will have to justify an annual income of at least $ 200,000 or will have to be estimated at least $ 1 million. The objective of Grayscale is to be able to open the fund to the general public after 1 year of activity.

The GDLC portfolio: Bitcoin, Ethereum, Ripple, Bitcoin Cash, Litecoin

Grayscale disappointed by mono crypto funds?

The Digital Large Cap Fund is the fourth investment fund launched by Grayscale, which operates in the cryptocurrency market. In 2015, the "Bitcoin Investment Trust" was launched to allow investors to position themselves on Bitcoin without owning it directly. In 2017, it was the turn of Ethereum Classic - Ethereum Classic Investment Trust - and Zcash - Zcash Investment Trust - to be the subject of a dedicated fund. Silbert, seems disappointed by the success of previous funds. He told Yahoo France:

"Investors do not know or care what cryptocurrency will win [...] They just want to be positioned on asset classes. There are people who want to invest $ 100 million in it. "

Grayscale's assets under management are $ 2.17 billion. The company is a subsidiary of Silbert's Digital Currency Group (DCG), the largest investment company in crypto-startups. DCG's portfolio has shares in most of the big names in the industry. There are for example BitGo, Blockstack, Chain, Coinbase, Kraken, Ripple, Shapeshift, or Xapo.

So, good or bad news?