When the global financial system took a nosedive in 2008, I was coming of legal age & was interested in investing in the stock market.

- Investing in Mutual Funds with small expected rates of return did not interest me,

- Especially as i just watched the global markets collapse.

- If I was going to invest in something I wanted it to be smarter than that.

And there was Netflix

- A company whose services I used and believed in.

- I thought this company was the future of entertainment , streaming!

But as a young kid risking all my money I wanted to be sure.

I searched on cnbc.com and other financial news networks to determine if I was going to be right and if the stock's future was as rosy as it seemed to me... NOPE!

Quite the contrary! All I could find was FUD!

Netflix stock sinks 35% as subscribers flee

Is Netflix the next AOL?

Netflix Blunder Could Cost It 30% of Subscribers

https://www.marketwatch.com/story/thinking-of-buying-netflix-press-pause-2012-12-04

https://www.fool.com/investing/general/2011/04/29/5-threats-that-could-kill-netflix.aspx

http://deadline.com/2012/07/netflix-stock-down-306838/

https://seekingalpha.com/article/242320-whitney-tilson-why-were-short-netflix

I could just go on, the news was really pessimistic, essentially Losing Subscribers & Content Partners and there is no way they can recover from it... and yeah the FUD on a sure thing like Netflix was really this bad.

(If you ever want to go back in time with google. Use the search tools to define a custom range, I Know Rite?)

But I got scared. If I was wrong, I could not handle the fear that others knew the truth and I didn't.

The FUD tricked me. And I didn't do it. Instead I invested in some other stupid thing which I didn't believe in but I did it because I did not trust myself. I did not use my own brain to do my own critical analysis to determine what is real and what is not!

The reason this story is relevant is because we are in that moment with currencies I believe.

- Netflix was an up and coming stock with skills & strategies which the typical analyst didn't understand. And because they did not understand it, it was rejected.

- Bitcoin/Cryptocurrencies is an up and coming technology (Blockchain/ Distributed ledger system) with influence and impact the typical establishment doesn't understand. And because they did not understand it, it is being rejected.

...............................

- Netflix's waning subscriber base, as cited numerously for reasons to not invest, was a lagging indicator. It sparked Netflix to produce it's own content and succeed in the industry. This FUD was necessary to the overall performance of the company.

- FUD is a lagging indicator. FUD is priced in. Capitulation/Market sell offs are NECESSARY for a bull market to continue.

Through my experience I see now that Investing & Trading are games one plays against him/herself. You can trick yourself into believing anything, but finding truth is a difficult task.

The truth I found was to stay true to myself. What do I believe in? What will make the world a better place to live? There is where I am going to invest.

This is why now I do not fear any market capitulation, I know that the items I believe in will be worth its value when it's time comes. Yesterday was a very red day, across all asset classes: Cryptocurrencies, Stock Markets, future markets etc. In times like those I try to identify what do I believe in which is being dragged along with everything else, and take it at a cheaper price.

What determines price?

Supply & Demand...

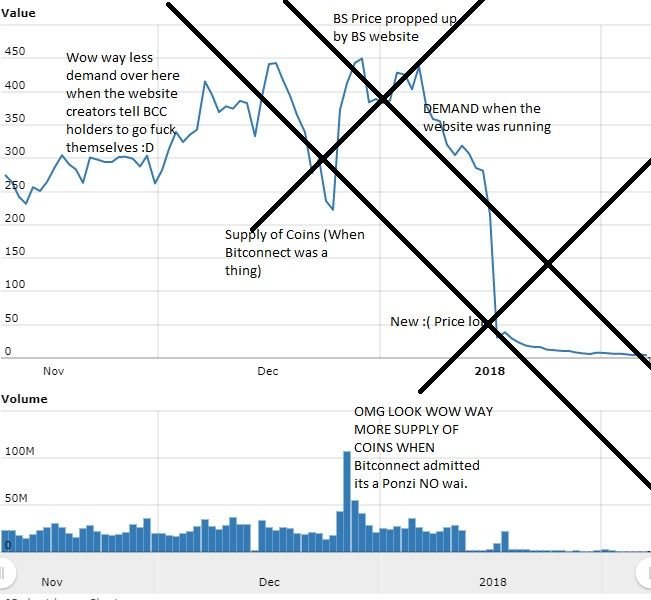

Here is a fun little thing I made with Paint. (this is not a legit Demand Supply chart but it still resembles the point well enough)

Now Bitconnect is a bad example because it was a BS Ponzi,

but at the end of the day thats why it's the greatest example ever!

- All Bitconnect participants were operating under the assumption bitconnect was paying really high rates.

- That's literally the only reason

- When that reason stopped, the Supply Shifted right to reflect the huge increase in supply of coins, & Demand shifted wayyyy left, cause nobody wanted that shit anymore (Not even Trevonjb, trust me).

In legitimate markets, many factors determine price, such as short term reduction of demand

Or changes in supply,

I mean honestly this chart is all the evidence anyone needs for Bitcoin 100,000k.

##But understanding the difference between long-term factors and short-term factors are very important:

Short Term Factors:

- Access to funds & capital/Credit Card Bans/Government Bans/ Etc.

Long Term Factors:

- Total Supply

- Energy Cost

- Network Security

- Societal Applications and Efficiency

Note: (This is why I am VERY skeptical and bearish on Ripple, I believe any asset worth investing in needs to have value & scarcity!, be very wary of high supply coins!)

This is why having the appropriate time horizon and objectives are paramount to being successful

I hope you learn as much or more from my story as I did!