The richest investors have their own specific approaches to making billions of dollars. Nevertheless, sometimes they come against their own recommendations or take a great deal of risk, and the results they come across are not always the best ones.

Bill Gates: Help a competing company

Bill Gates, the iconic founder of Microsoft and a big philanthropist at the same time, reported the net worth of his assets at $ 90.2 billion. One of the world's richest billionaires, Bill Gates's dirty secret, includes helping Apple, a company known as Microsoft's competitor.

Despite the unquestionable popularity of today, the 1990s have been a challenge for Apple. The company's profits fell and there was a net loss period. In the same period, Microsoft increased its revenue by $ 1.18 billion in 1990 and reached $ 23 billion in the 2000s and was living the golden age.

In 1997, Apple needed the money and Apple sold $ 150 million worth of shares and partnered with Microsoft.

Part of the deal was Gates' big mistake:

Microsoft has provided software to Apple's company, which has extended the life of Apple products.

On the other hand, this support to Apple has created tremendous competitive power for Microsoft. The answer to the question whether the Microsoft-Apple partnership has harmed Microsoft in disproportionately over the long term is still controversial, as many factors, such as this and so forth, are on the agenda at times.

Warren Buffett: Disturbing your own judgment

Probably the most famous investor of our time, Warren Buffett will never hesitate to confess his mistakes. According to Forbes, he is the third richest man in America, but he prefers to be modest.

Buffett's dirty investment of $ 78 billion in wealth, which gained vast knowledge of investment and forward-looking, was a breach of his rule. For many years technology investments have been avoided. By making an exception in 2011, the iconic technology company made a major investment in IBM.

In the course of Buffett's investment, purchase prices for IBM stocks averaged $ 167 to $ 197. The current stock price for IBM is around $ 153. By the time, IBM will tell you whether the investment is a mistake.

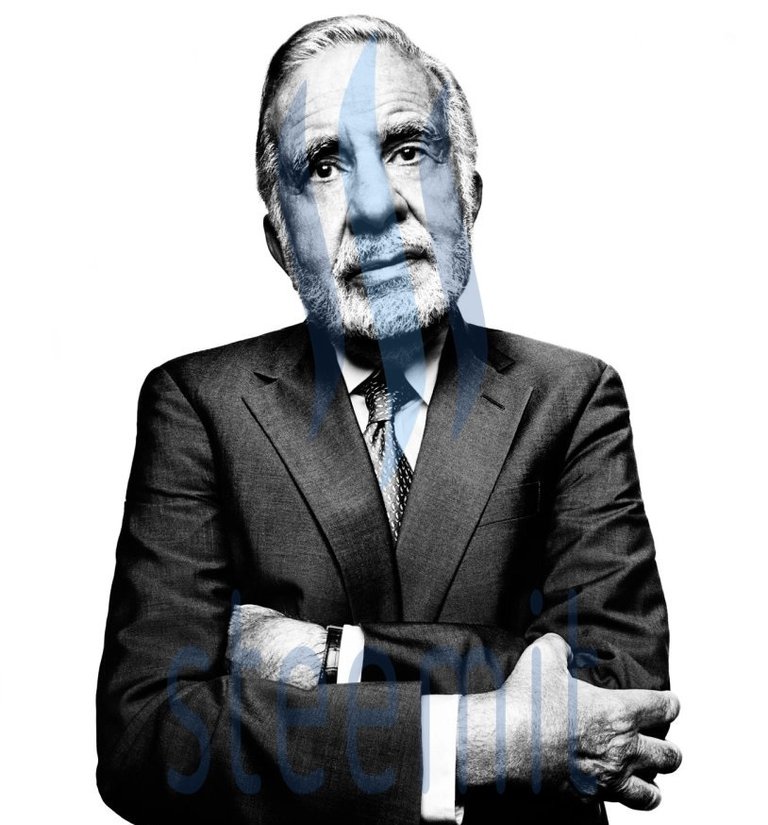

Carl Icahn: Investing in a Blockbuster that can not compete with Netflix

The billionaire Icahn, who has almost caught up in buying shares, and who has given up Yahoo's share when he gave up on Yahoo's plans to distribute Yahoo's governing board, is very successful at anticipating movements in the market and moves on long-term results even in small steps.

Carl Icahn sits on seat number 27 on the Forbes 400 list on property. Himself; he sees them as an investor who demands change by purchasing assets that can not reveal their potential due to financial insufficiencies. Unfortunately, this trend is sometimes causing investment mistakes.

Blockbuster, one of these mistakes, is a website offering movie rental options on the internet. Carl Icahn lost about 200 million dollars after the platform lost blood over time.

Icahn has invested $ 321 million in Netflix and turned his profit back to about $ 2 billion to compensate for Blockbuster's failure.

Steve Cohen: Internal leaked scandal

Steve Cohen is a billionaire who ranks 34th in the Forbes 400 with assets of $ 13 billion.

However, due to the big mistake, SAC Capital, the firm that manages the free investment funds and securities, was closed down. Cohen's dirty investment secret was a serious legal indictment. He invented a large machine that used a data network, and some of it was illegal.

It was discovered that information leaked to the bank by SAC Capital appeared to be contrary to legitimate business rules. The company had to return the money to its customers, and Cohen paid a $ 1.8 billion penalty and was banned for two years for foreign money management.