What a rally the market had this month. S&P is up near 7% after a massive sell off in December 2018. The sell off towards the end of December was probably magnified due to tax purpose selling. Perhaps we may continue to see more cash coming back into stocks after Decembers massive sell off backed by decent corporate earnings.

When stocks fall, I get excited. I only wish I did more shopping during the Christmas Stock Sale! There were some great bargains on stocks. However, I continued my shopping in the first half of January for some great dividend and growth stocks.

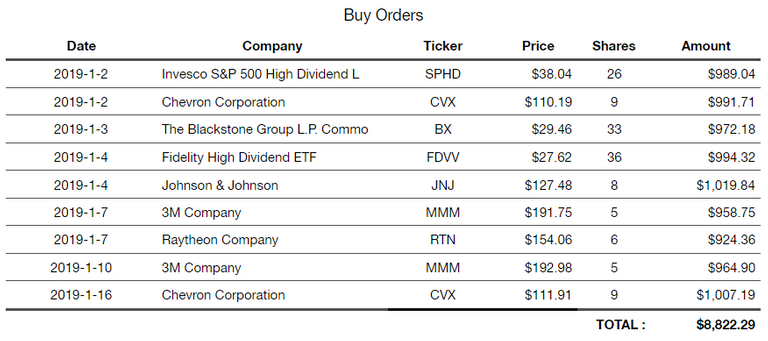

Buy Orders

Companies like 3M, Chevron, and J&J have always been some of my favorite stocks. Looking forward, I will continue to build a long term position specifically for the purpose of dividends under this portfolio.

Sale Orders

There were no sales for the month.

The holdings for the LBF dividend portfolio are all long. My goal is to use ETF's along with individual stocks to build a sustainable long term dividend portfolio that will grow over time. My focus will be towards companies with great long term track record of raising dividends consistently over decades.

Being a growth investor at heart, I added an ETF (FDVV) that contain some companies with growth that also have decent dividend yields.

When positions for the stocks above have been established to the desired amounts, my plans are to add some of the following stocks listed below in the future. Hopefully, I get a chance to buy them on sale which would be ideal.

Stock Wishlist

Waste Management (WM)

Realty Income (O)

JP Morgan (JPM)

MC Donalds (MCD)

Procter & Gamble (PG)

United Technologies (UTX)

Boeing (BA)

Altria (MO)

The last 3 months definitely had many investors worried. There is a quote that comes to mind, "Stocks take the stairs up and the elevator down." It's nearly impossible to time the market. Learning this fact nearly took me a decade. My philosophy is not to time the market but to be prepared to take advantage of the opportunities that come with market volatility. This means always having cash is crucial. The difficult part is how much one should hold in cash. Hold too much and you trail market performance. Hold to little and you miss the opportunity to buy on sales.

At the moment, my cash holdings have come down by nearly half. Being late in the economic cycle without a recession for almost 10 years, I will remain cautious and continue to raise more cash.

Yet, with many experts and investors worried about a recession in 2020, I feel that may not fruition. With so many questioning 2020, I believe we will have less investments being made resulting in slowing of growth rather then a recession. Slower growth is better then no growth in my opinion. Some of the worst mistakes I have made investing was holding too much cash anticipating a recession.

Overall, this month has been great with earnings looking better than I expected so far.

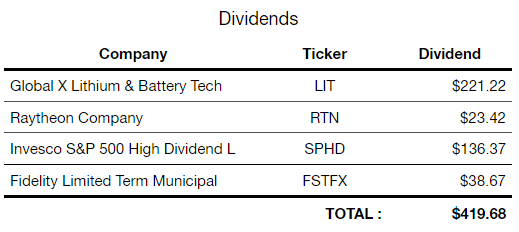

Dividends

What can $419.68 do for me this month? It can pay for most of my utilities! The amount can cover most people's car payments or one month worth of groceries. Luckily, I don't need to use this money so I can roll this over to purchasing more dividend stocks and continue having the snowball rolling larger.

It's hard to explain how great it feels to sit back and have the dividends rolling in. I feel blessed and thankful to have this freedom in my life. Financial freedom may not be everyone's goal but it surely does bring peace of mind. One of the most appealing attributes to financial freedom definitely is neutralized levels of stress.

What's more exciting is anticipating how the growth of the dividends will pan out over the years. Hitting the target of $10,000 in annual dividends would be a great way to diversify my passive income away from real estate rental income.

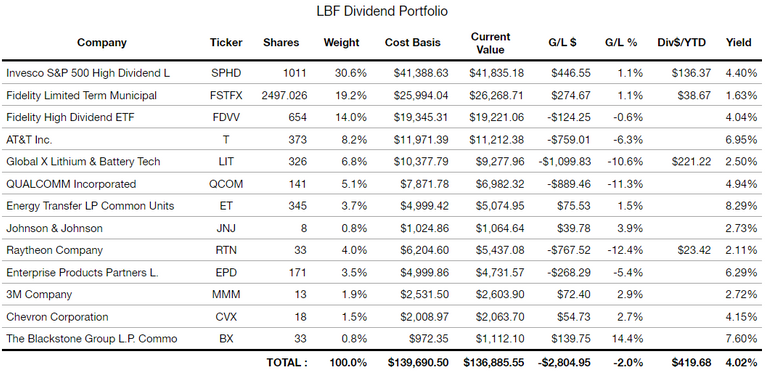

LBF Dividend Portfolio Summary

"Click Image above for larger view."

Last month the portfolio ended with a loss of -$9,263.44 but this month it recovered to -$2,804.95, which results to recovering 70% on the loss! Also got to pick up some great stocks at much better valuations! Sure feels like we took the elevator up with stocks this month.

Currently, the portfolio is expected to generate around $5,621 in annual dividends. That is 13.9% higher then the previous month which was at $4,933.08. The average yield remain nearly the same at 4.02%. This puts me roughly halfway to my goal of $10,000 in annual dividends.

Conclusion

Overall, this month has been great. My total portfolio including the dividend and growth portfolio has almost recouped all losses from the recent correction.

I use Personal Capital to track my investments and personal finances.

The current earnings and economic data being released lately looks decent but I anticipate this year will not be a home run. Resolution between China and the US trade deal, combined with a more dovish fed may help reduce volatility in markets resulting from slowing in the economy over the next few months. But who knows, markets and the world in general are filled with unexpected events!

Looking forward to sharing ideas with fellow readers and I'm curious what you guys think about where we are in the economic cycle. Thank you for reading as always!

Follow me at my website: www.LifeBeyondFIRE.com

Congratulations.

Congratulations @insidelook! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!