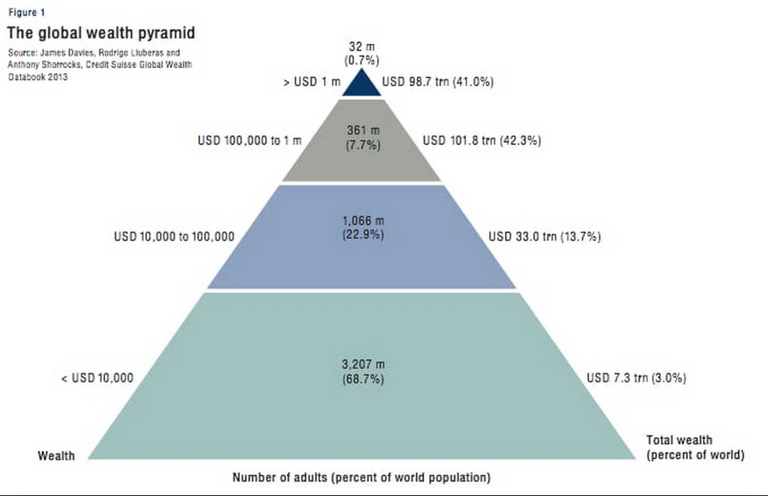

We can't get away from the fact that bitcoin and other cryptocurrencies are creeping into our daily lifes more and more. We have started to see bitcoin and some other alternative (alt) coins being covered by the mainstream media in recent times. The whole crypto currency train is gaining momentum at every turn. Whether through the release of new initial coin offerings (ICO's) on a near daily basis or the huge following crypto currency has on some social media platforms such as Youtube, twitter and now Steemit, its clear to see that the crypto currency space will likely only expand in the future.

Does the rise of cryptocurrencies threaten the current global banking system or was cryptocurrency actually created by the banking system to herald the rise of a cashless society?

What does this mean for the future of the financial world and how much do we really understand about our current monetary system?

Is the banking system no more than a ponzi scheme or is it in reality even worse than that?

In the 1930's, Herny Ford supposedly said that if American people really knew how the banking system worked there would be a revolution before tomorrow. That's a bold statement from someone who clearly had a good idea on how banking worked.

When we look at some of the financial statistics from around the planet its easy to see that somethings are very wrong.

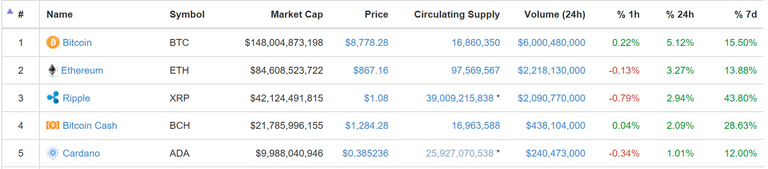

1% of the population owns 45% of the worlds wealth. This is a conservative number, the true % could be much higher.

50% of the worlds population survives on less than 2.5 dollars per day.

More than 30 thousand children die each day from preventable diseases and poverty.

More than 82% of the wealth created last year (2017) went to the richest 1%.

![Capture.PNGwealthpyrimid.PNG]

(

The entire world now operates under the global finiancial system, we use money everyday to purchase food, to shop online and to pay our bills but how much do we really understand about this system of global control? We go about our daily lives never giving a second thought to how our money is created, the policies in which it is governed and how it truely affects our society. Therefore understanding this institution of monetary policy is crucial in understanding why our lifes are the way they are.

Economics is often viewed with confusion and boredom. With endless streams of finiancial patter coupled with frightening mathmatics quickly deters the the average person from the attempt to understand it. However the fact is so ingrained with the financial system is a mere mask designed to obscure one of the most socially debilitating systems humanity has ever know.

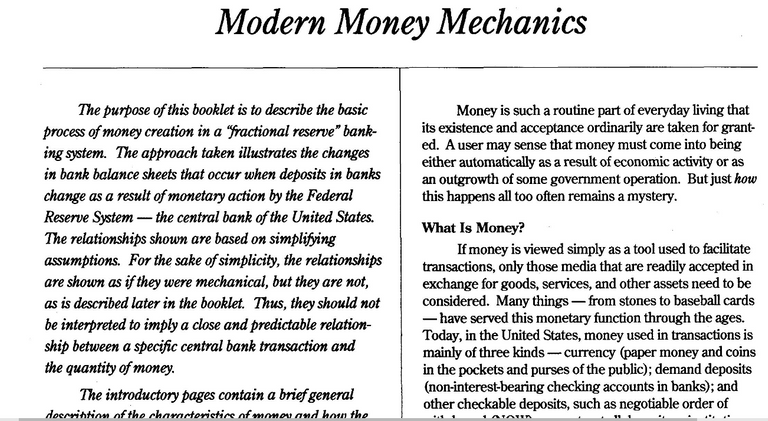

Many years ago the Federal reserve bank of the United States produced a document entitled modern money mechanics. This publication detailed the instituationalised practice of money creation as utilised by the federal reserve and the web of global central banks it supports.

On the first page the document lays out its objective. You can easily google this and check it out for yourself although I doubt many will.

The booklet gos on to describe money creation using banking terminology. A easier translation go's somthing like this.

The United States government decides it needs 10 million dollars so it approaches the Federal reserve bank with a request for that amount. The Federal reserve relpies saying sure we will purchase 10 million in government treasury bonds (picies of paper). The Fed then exchange the bonds for more paper called Federal reserve notes to the value of 10 million dollars. The governement then take the Federal reserve notes and deposit them in a bank account. At this point paper notes become legal tender money adding 10 million to the US money supply. In actual fact this would now take place digitally with no need for the exchanging between government and Federal reserve. The 10 million just appears in the designated bank account. Only 3% of money exists as paper money or cash. The other 97% exists in the computerised banking system.

The Federal reserve just created this 10 million dollars out of thin air and now the government owe the Fereral reserve 10 million dollars so in reality this new money has been created out of debt. This is a socially crippling paradox in its very design and along with the interest added the tax payer will now foot the bill. Any wonder why our mordern governments are in so much debt and never seem to be able break free no matter how much they tax the people. This system by design is enslavement of the masses. Money = debt is the sad conclusion.

Heres where it gets interesting. Based on the fractional reserve practice the 10 million now becomes part of the banks reserves the same as all deposits do. Now regarding reserve requirments as stated in modern money mechanics the bank must maintain legally required reserves equal to a prescribed percentage of its deposits. It then go's on state that the current legal requirment is 10%.

This means that $1,000,000 is held as the legal requirment and the bank can then make loans on the remaining $9,000,000. It would be obvious to think that this $9,000,000 would come out of the original $10,000,000 but in reality it is does not, the bank simply creates another $9,000,000 on top of the original 10,000,000 now giving the bank $19,000,000. So this is how new money is created, it can simply be created out of nothing because there is a demand for it.

For arguments sake lets say someone borrows the $9,000,000. They are more than likely to deposit that in their own personal or business account. The process then repeats itself, the new deposit becomes part of the banks reserve, the bank must hold the legal reserve requirment of 10%, in this case being $900,000. The bank can then make loans on the remaining 90% or $8,100,000 and this process can go on to infinity. In actual fact for every deposit that is made into a bank x9 that can be created out of nothing. Even worse is the fact that for every loan a bank executes it adds interest on top.

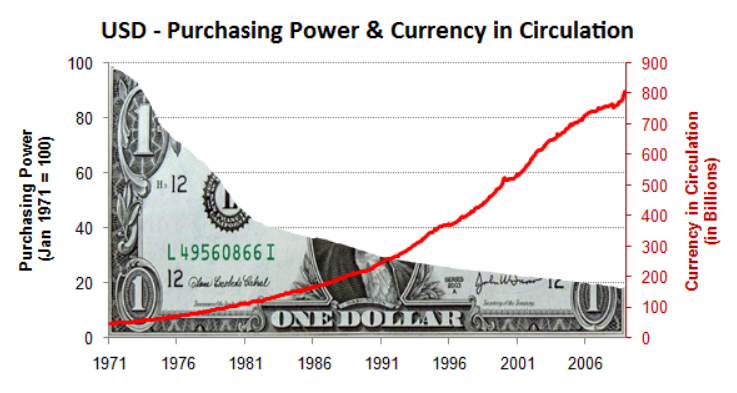

What gives the newly created money value? Its actually the money that already exists in the system. Essentially the new money steals value from the existing money supply because the money supply is being increased irrespective of the demand for goods and services. As supply and demand finds stability prices rise diminishing the purchasing power of each individual dollar. This is often referred to as inflation. You can dress this up any which way but in actuality inflation is nothing more than a hidden tax on the public. They don't say devalue the currency or deface the currency but that is exactly what they are doing, inflation is the devaluation of the currency by adding more money the system. This go's on indefinetly keeping us all in debt as a society. The banks continue to make profits out of the debt of the public. It is impossible for any country which operates under this system to ever clear its debt because the system is totally rigged against it. The more money in the system only means more debt. At current figures, if all the debt was settled in the US there wouldn't be $1 in existance. The graph below shows the money supply vs the US $ purchasing power.

The current monetary system is clearly flawed and designed to make the banks and the rich richer keeping the poor in a never ending spiral downwards into more poverty but is there anyway or anything that we can do as a society to take back some of our power and make this world a better place for all humanity. We must be able to do something because clearly our governments cannot be trusted to run the show.

Is bitcoin or cryptocurrency the answer we need to this broken financial system we are all enslaved by? I have listened to many arguments about crypto currency, I have certainly heard more positive than negitive arguments. With crypto currencies being peer-to-peer this would certainly do away with the need for a middle man ie banks. The fact that all cryto currencies have a max supply, bitcoin being 21,000,000, this would near enough solve the current problem of inflation.

We are still very much in the infancy of the cryptocurrency revolution and who knows exactly what the future holds within the space but one thing is for sure we need and must move away from the current finiancial system.

Sort: Trending