After China regulation shutting down on cryptocurrency trading and mining operations, Tesla putting on hold further purchase of Tesla’s vehicles with Bitcoin back in May — June 2021, due to Bitcoin mining not being environmentally friendly have caused the cryptocurrency market capital tumble down to 1.2 trillion USD however, we recently saw a bounce back to 1.93 trillion USD in August at the time of writing this article.

The recent U.S. infrastructure bill will benefit the technology industry with the expansion of access to the internet, encouraging electric vehicles and improving cybersecurity. In the same tech realm, the bill also includes taxation on the cryptocurrency industry to partially fund the infrastructure plan. As claimed by Congress, it would raise 28 billion USD through the implementation of requirements to cryptocurrency participants who may be deemed as a “broker” and changing how the IRS taxes “digital assets”.

Not opposing to imposing tax on crypto-transactions, taxation can actually benefit the industry as it can maintain the upkeeping and improvement of the infrastructure for better end-user experience.

Majority in the crypto-community is opposing the infrastructure bill due to it being “badly” written with the inclusion of tax declaration by a broker in the cryptocurrency industry.

In the bill, the “broker” is defined as:

“any person who (for consideration) is responsible for regularly providing any service effectuating transfers of digital assets on behalf of another person”

It means that miners, software and hardware developers or any entities who are facilitating in a crypto-transaction falls into the “broker” category and is now required to collect and report information on users, which is impossible to perform in a decentralised financial system. Failing to comply would further drive this critical technology outside the U.S., those that are more crypto-friendly and regulated with more clarity.

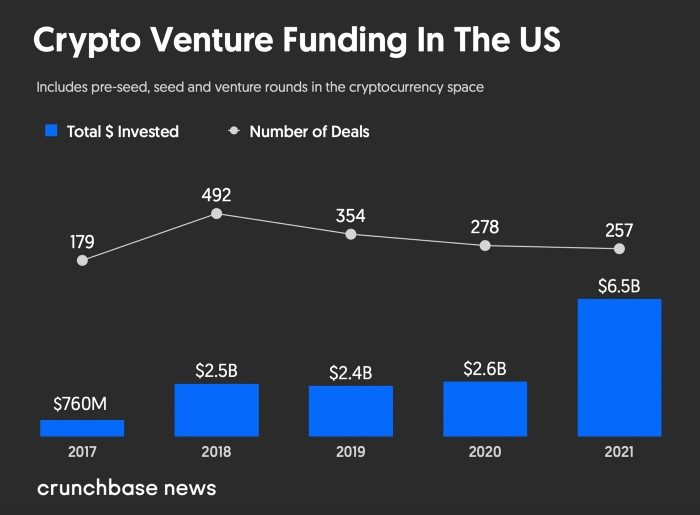

Investments have been venturing in to the U.S. based cryptocurrency development where the total investments have increased exponentially in 2021. If the bill is not amended accordingly, not only will the technology migrate outside of the U.S., the investors/ venture capitalists would also start looking for opportunities elsewhere[1].

.

.

Venturing outside of United States?

As reported by Nasdaq[2], the 7 Most Crypto-Friendly Countries are measured by two characteristics with the degree to which it regulates and taxes cryptocurrency.

- Portugal

- Switzerland

- Germany

- Singapore

- Malta

- Cyprus

- Bermuda

Let’s dive into one of the South East Asia country that made it onto the list, Singapore. With 93% of the population have heard of cryptocurrency and 66% of the youth owning some and/ or planning to purchase more cryptocurrency[3]. This is due to the government of Singapore’s stance in being pro-crypto with a programme worth 12 million SGD to promote the development and adoption of blockchain applications beyond financial services[4].

According to Akash Takyar, CEO of LeewayHertz, Singapore is reaping the advantages of the adoption of blockchain technology in the following sectors[5]:

- Airline Industry

- Education

- Government / Public sector

- Real Estate

- Food Industry

- Healthcare

- Supply chain

- Energy

- Financial services

Singapore Dollar also aims to diversify the landscape dominated by USD with an XSGD stablecoin, pegged to the Singapore dollar that is officially released by a Singapore-based payments company Xfers[6]. In our opinion, this can potentially nurture more unicorn startups in the future.

Besides the rapid increasing adaptation rate in Singapore, you may find other emerging countries such as Vietnam, India, Malaysia, Indonesia, Philippines and countries in Latin America starting to adopt cryptocurrency in this link here, which could be the next blockchain incubator.

.

.

You may find more interesting blockchain applications in various sectors from above in the link here. It truly shows how blockchain can be diversified beyond DeFi, which has previously been stressed by Vitalik Buterin himself in July 2021.

Reference

[1]. Metinko. C (2021). US Crypto Companies, Venture Investors Voice Concern Over Infrastructure Bill. Crunchbase news. Available at: Link. (Accessed on 15 August 2021)

[2]. Sirois. A (2021). 7 Most Crypto-Friendly Countries for Bitcoin Investors. Nasdaq. Available at: Link (Accessed on 5 August 2021)

[3]. Shumba. C (2021). In Singapore, 93% of people have heard of cryptocurrency, 66% of the young own some, and more plan on buying, thanks to the nation’s pro-crypto stance, a survey finds. Market Insider. Available at: Link (Accessed on 5 August 2021)

[4]. Tan. A (2020). Singapore government to boost blockchain adoption. ComputerWeekly.com. Available at: Link (Accessed on 5 August 2021)

[5]. Takya. A. Why blockchain development in Singapore is emerging? Available at: Link (Accessed on 5 August 2021)

[6]. Shevchenko. A (2020). Crypto Singapore dollar aims to diversify landscape dominated by USD. Cointelegraph. Available at: Link (Accessed on 5 August 2021)