Welcome to the New Format party! It's been adjusted again; I'm aiming for ease-of-readability! Let me know your thoughts on it's progression!

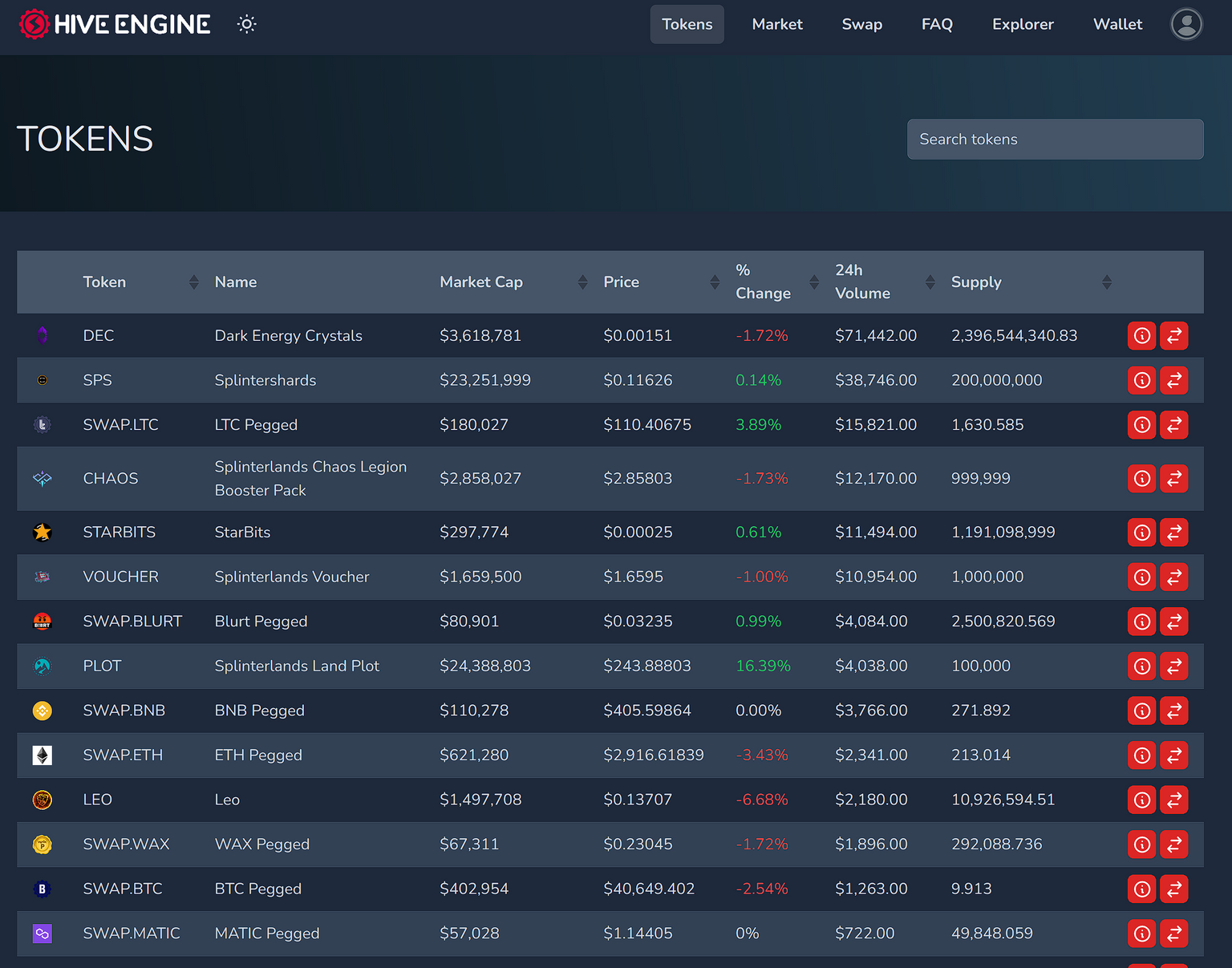

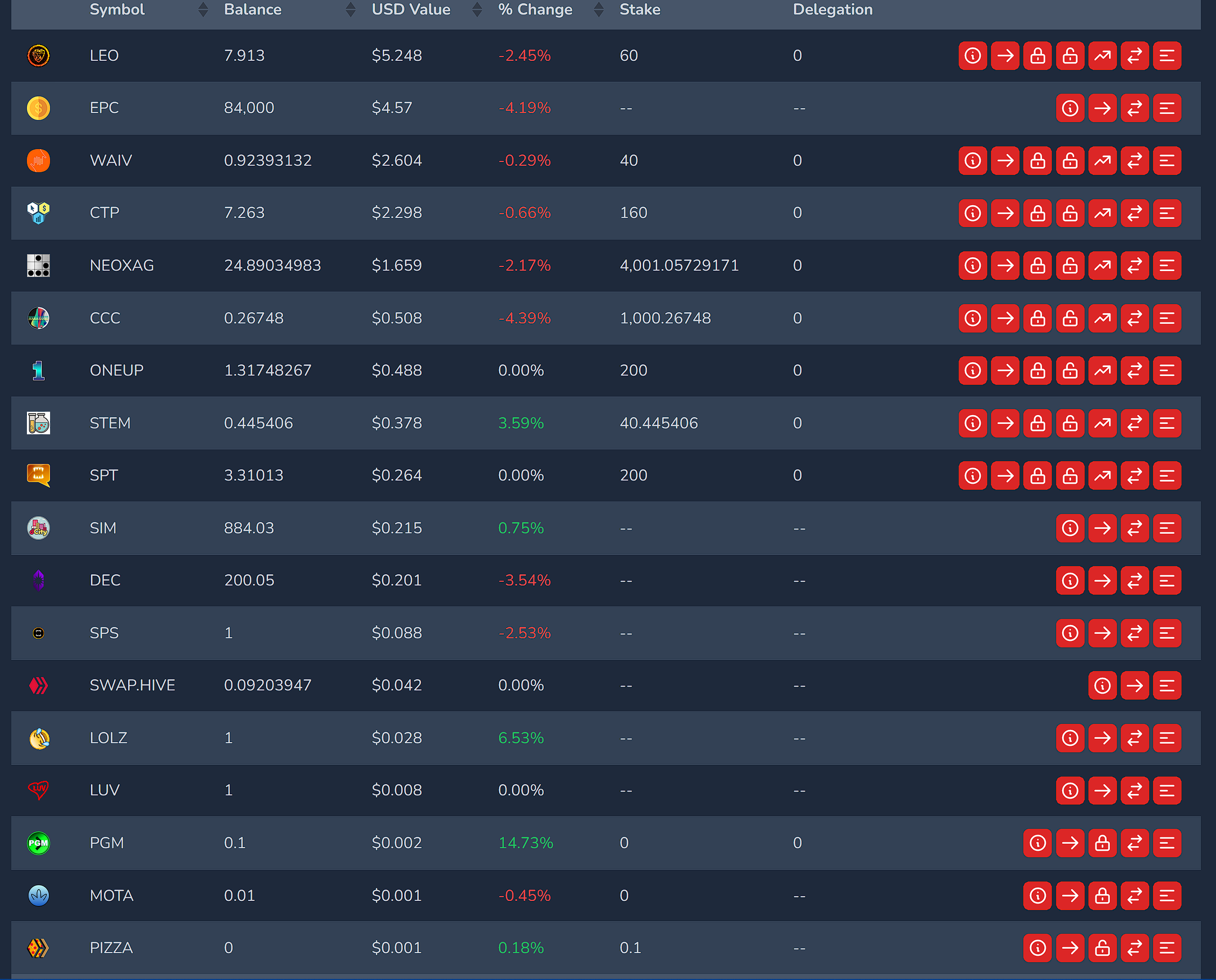

Hive Engine (Hive Sidechain) Investments

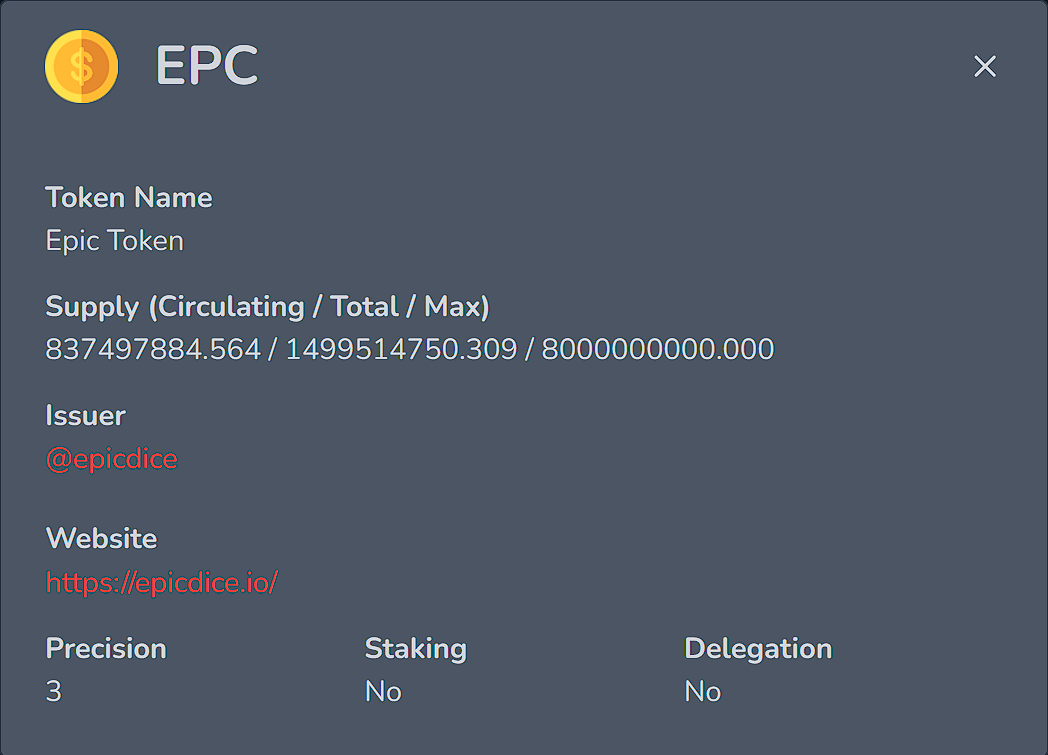

EPC

| Epic Token | 1 | |||

|---|---|---|---|---|

| ||||

| Invested | ||||

| 40,000 EPC | 0.00012 Hive | 44,000 EPC | 0.00008 Hive | |

| Sold | ||||

| None | None | |||

| ROI | ||||

| 1: 0.018 Hive | 2: 0.002 Hive | 3: 0.045 Hive | 4: 0.002 Hive | |

| 5: 0.002 Hive | 6: 0.013 Hive | 7: 0.007 Hive | 8: 0.002 Hive |

Nothing today from EPC, maybe tomorrow! :P

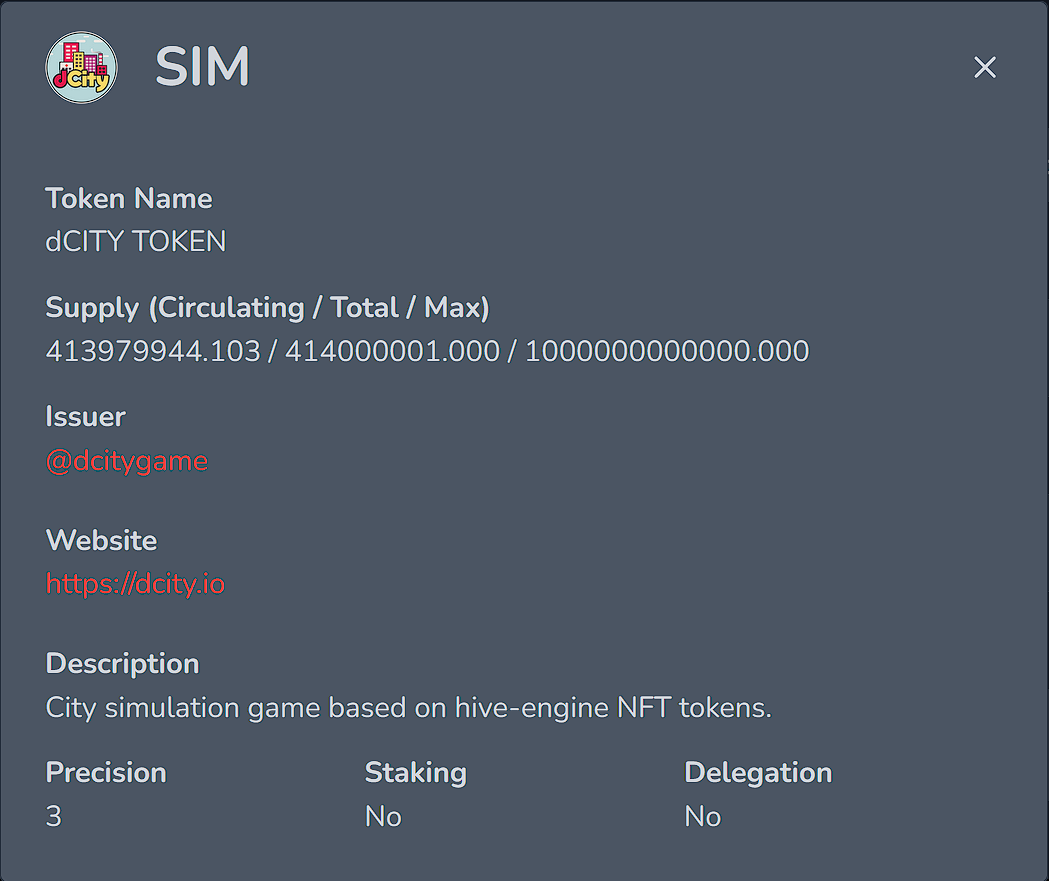

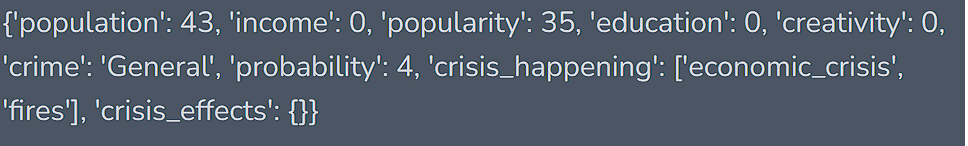

SIM

| dCity Token | 2 | |||

|---|---|---|---|---|

| ||||

| Invested | ||||

| 4,000 SIM | 0.000408 Hive | 6,000 SIM | 0.000512 Hive | |

| "Staked" | (Cards | Bought | Value) | |

| 9,200 | SIM | |||

| Sold | ||||

| None | None | |||

| ROI | Returns | To | Date | |

| 1: 0.01 SIM | 2: 0.01 SIM |

Another solid SIM earning today! :) It seems a "0" income can still mean it's fractions of a whole, just that it won't display as a whole. Interesting enough and a good interesting!

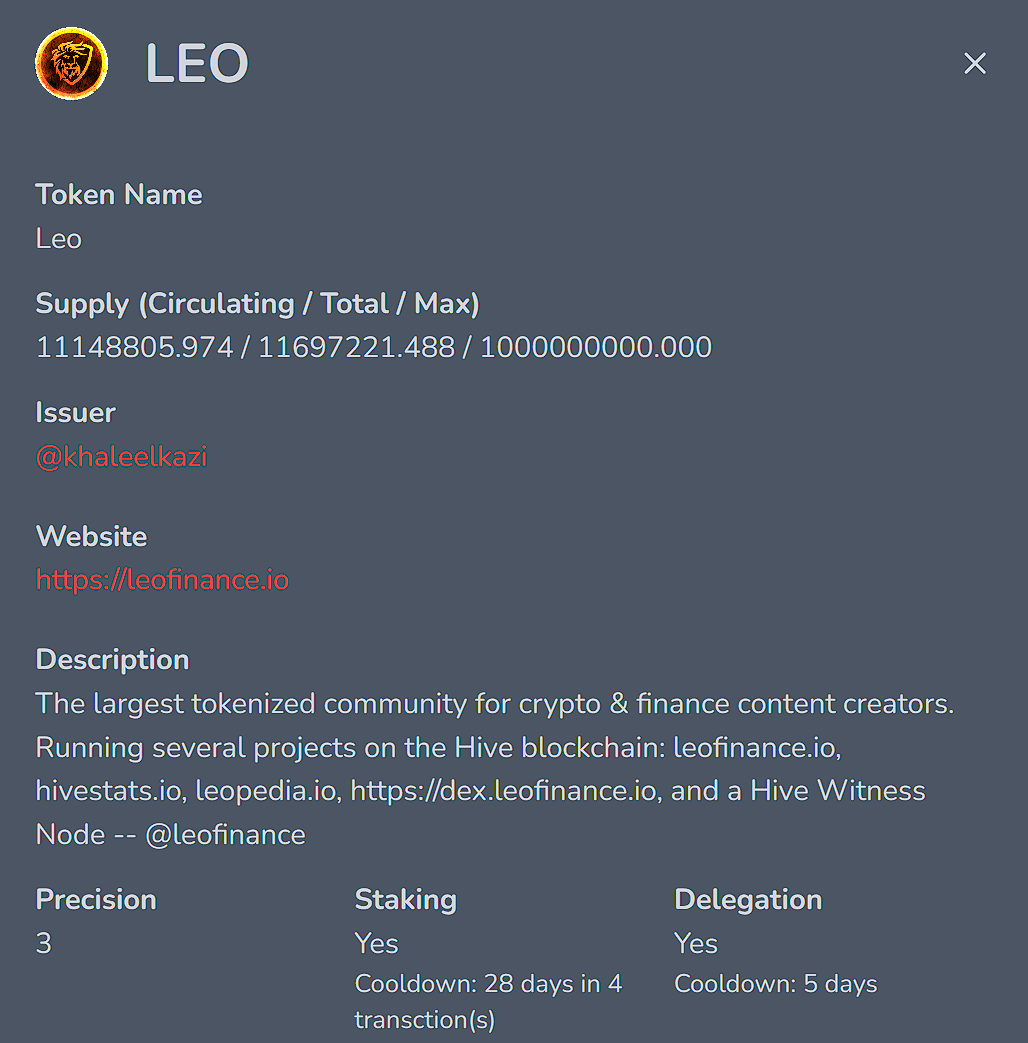

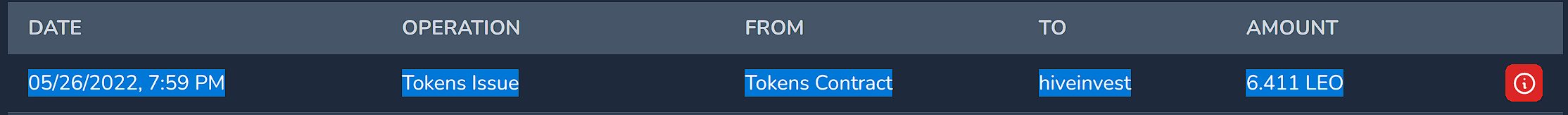

LEO

| LEO Token | 3 | |||

|---|---|---|---|---|

| ||||

| Invested | ||||

| 40 LEO | 0.173 Hive | 20 LEO | 0.172 Hive | |

| Staked | ||||

| 60 | LEO | |||

| Sold | ||||

| None | None | |||

| ROI | Returns | To | Date | |

| 1: 0.025 LEO | 2: 1.477 LEO | 3: 6.411 LEO |

Today's LEO payout was pretty substantial compared to the rest, honestly. I'm happy to see it and I figured I'd start to stake a good portion of my earnings, so I'll be sorting out what % I want to put directly back in and what % I want to trade with. LEO is looking strong so far and it stands to reason it's because most things in life are in fact, an investment!

Thank you to those supporting me in the LEO community. You're awesome! :)

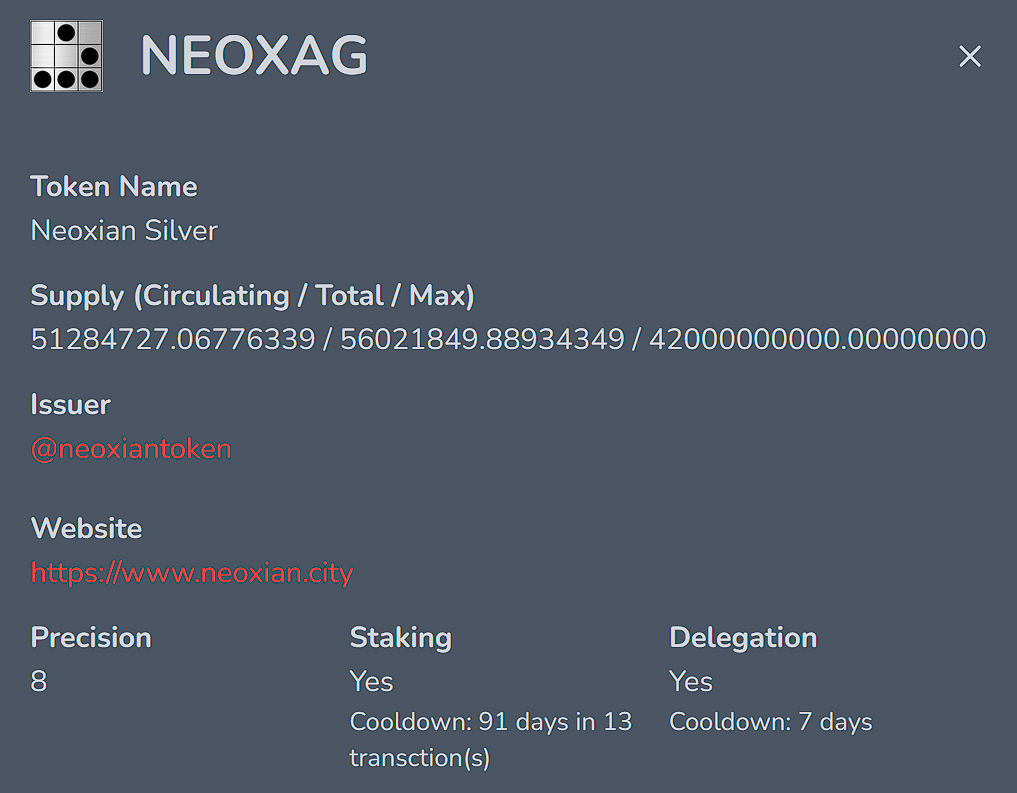

NEOXAG

| Neoxian City Token | 4 | |||

|---|---|---|---|---|

| ||||

| Invested | ||||

| 2,000 NEOXAG | 0.00096 Hive | 2,000 NEOXAG | 0.00092 Hive | |

| Staked | ||||

| 4,000 | NEOXAG | |||

| ROI | Returns | To | Date | |

| 1: 11.88 NEOXAG | 2: 11.88 NEOXAG | 3: 0.026 NEOXAG | 4: 1.1 NEOXAG | |

| 5: 0.6 NEOXAG | 6: 1.02 NEOXAG |

A whole NEOXAG token today! Now that's what I like to see! Mostly curation as usual, so I feel like I don't need to keep mentioning that haha. It seems that's what most of my earnings will be from ultimately when it comes down to it.

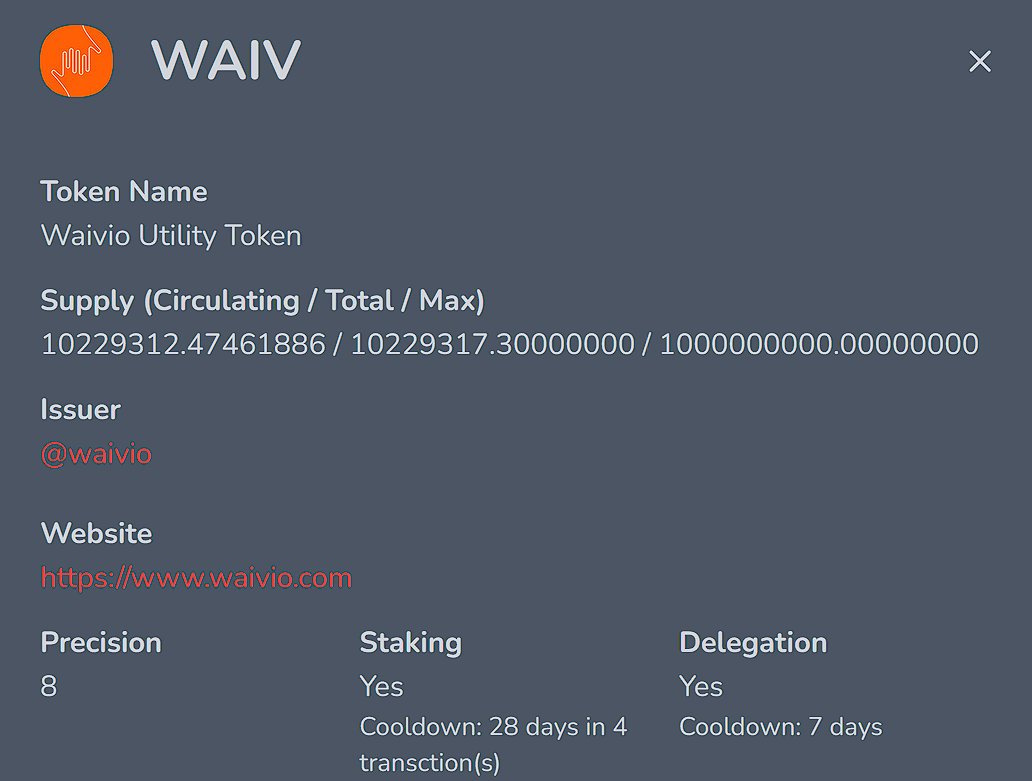

WAIV

| Waivio Token | 5 | |||

|---|---|---|---|---|

| ||||

| Invested | ||||

| 20 WAIV | 0.14 Hive | 20 WAIV | 0.138 Hive | |

| Staked | ||||

| 40 | WAIV | |||

| ROI | Returns | To | Date | |

| 1: 0.46 WAIV | 2: 0.004 WAIV | 3: 0.449 WAIV |

A 0.449 WAIV payout is fairly sizeable and it seems staying consistent will provide returns in this ballpark. Curation is my focus across the board and this is no different when it comes to staked tokens!

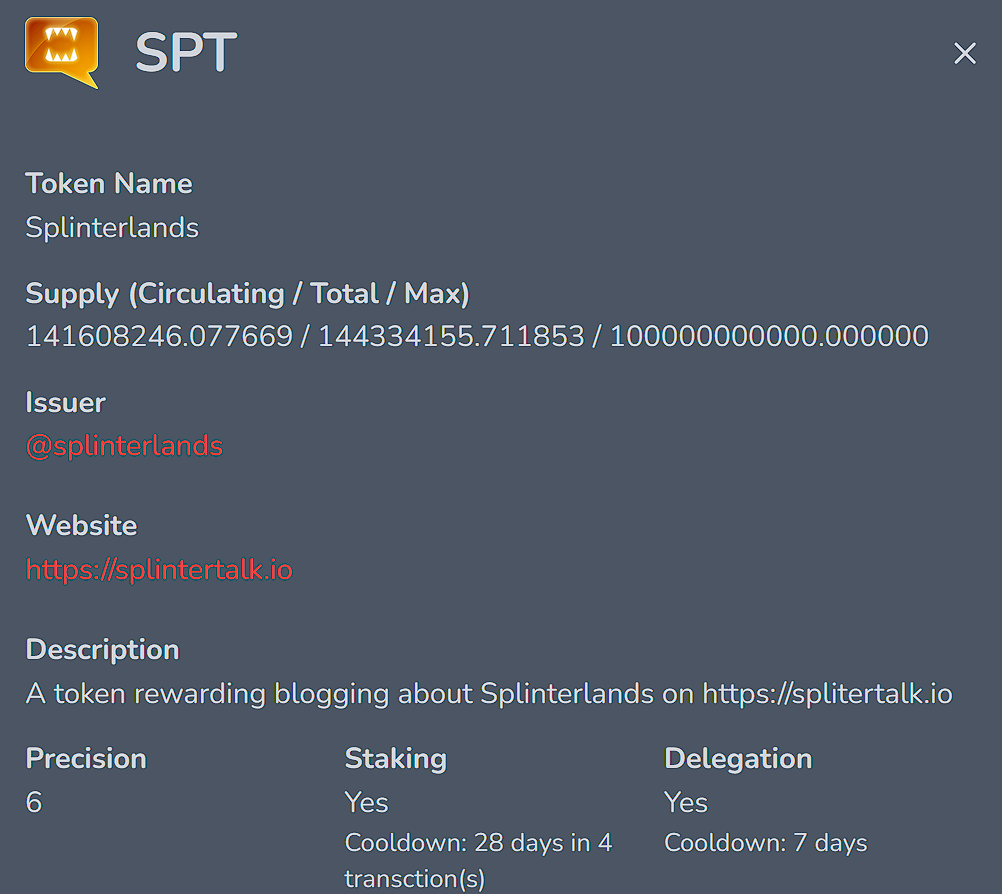

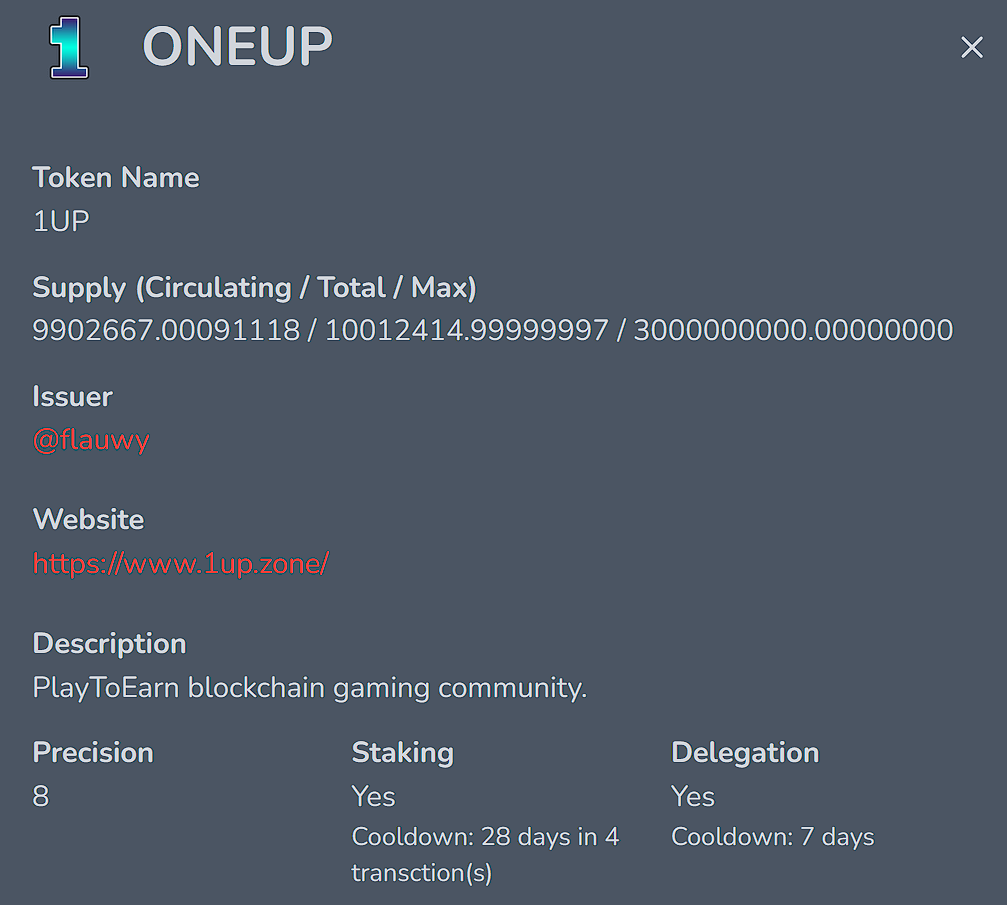

SPT & ONEUP

| Splinterlands & OneUp | 6 | ||||

|---|---|---|---|---|---|

|  | ||||

| Invested | |||||

| 200 SPT | 0.00235 Hive | 200 ONEUP | 0.0056 Hive | ||

| ROI | Returns | To | Date | ||

| SPT | ONEUP | ||||

| 1: 1.49 SPT | 2: 0.23 SPT | 1: 0.24 ONEUP | 2: 0.072 ONEUP | ||

| 3: 1.79 SPT | 4: | 3: 0.036 ONEUP | 4: 0.72 ONEUP |

Both SPT and ONEUP have paid again. Consistency seems to prove consistent returns. Stay with it, anyone who's on the fence or struggling to maintain! You've got this!

Other

| Other notable investments | 7 | ||||||

|---|---|---|---|---|---|---|---|

| Symbol | Invested | Sold | Unfilled | Staked | Earned | ||

| ? | H = Hive | ||||||

| DEC | 1,000 @ 0.00182 H | 800 @ 0.00219 H | B: 600 @ 0.00188 H | N/A | 0.05 DEC | ||

| SPS | 4 @ 0.139 H | 3 @ 0.192 H | B: 3 @ 0.144 H | N/A | None | ||

| CCC | 1,000 @ 0.00111 H | None | None | 1,000 CCC | 0.534 CCC | ||

| CTP | 100 @ 0.0237 H | None | None | 160 CTP | 7.263 CTP | ||

| STEM | 20 @ 0.03 H | 20 @ 0.0364 H | None | B: 20 @ 0.02 H | 40 STEM | 0.89 STEM |

These are all great investments with a low barrier to entry that you can have fun with and experiment on how "Tokenomics" works and what returns you can expect to see numerically, across the board based on different code settings and configurations!

HODLing is done for some, some still have some room to move. :P As you can see, DEC rose to a point where I simply couldn't afford to miss the returns! As with any crypto or investment, I believe in fractionally selling off assets or buying back. This allows some wiggle room and gives a bit of a "safeguard" of sorts in the unfortunate event an investment goes wildly one way or the other and you weren't prepared or missed an opportunity. I also believe in buying back at slightly higher lows than I previously did, as the idea behind an investment you seek to trade long term is that the value still appreciates over time and that the new bottoms are higher than the old bottoms or what you deem a "bottom" in your mind for a market. SPS Had some serious motion too, considering my initial investment cost, so I sold off a portion of that as well and have put buy orders on for both for a bit higher than my initial offers. STEM popped off a bit too, but the gap in the market is almost 100% of the price... so I bought some @ market and then tried my hand at seeing if I could get half of my purchase request at well below market. Get it where you can!

Thanks for reading. Feel free to share opinions of your own and discuss the topic in the comments! :) Always open to new ideas/investments.

Congratulations @hiveinvest! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 20 posts.

Your next target is to reach 400 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!