Hello and welcome to this weeks EDSD post.

What are EDSD tokens?

EDSD @eds-d are the last to be released token from @eddie-earner because now all 500k EDS are allocated. Some will be aware that I have been itching to release an HBD-backed token for EDS for a long time but I could never think of a good model. I was thinking how can EDSD compete with the 20% APY being offered for saving HBD currently? This was the wrong way of thinking, let me explain.

I am aware that there is a demand for EDS tokens because they have a small mintage and pay out a handsome HIVE income equal to over 25% APY. We seen from @eds-vote that investors were happy to split rewards and receive 50% of the curation rewards as EDS with the other 50% being powered up to @eddie-earner which increases the EDS HIVE income pool. Win/win. EDSD is based on this model.

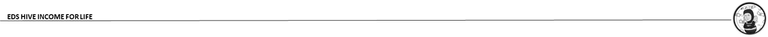

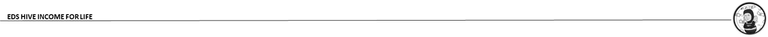

EDSD tokens are equal to a HBD Bond that you buy, hold a long time, get a yield and when you want your HBD back, you convert your EDSD back into HBD. All HBD collected from issuing EDSD is added to the @eds-d saving wallet. 100% of the interest earned is converted to HIVE with 50% used to mint and issue EDS at the value of 1 HIVE each to EDSD token holders and the remaining 50% being powered up to @eddie-earner. Basically, 100% is powered up and we issue EDS rewards on half the amount powered up.

After you exit, assuming you stacked your EDS, you will have an HIVE income for life or at least as long as mine, (38). The longer and more EDSD you hold, the more EDS you will get and the higher your HIVE income will be. Pretty simple, buy it and forget about it. EDSD will not last forever as they have a set amount of EDS allocated to them and when the allocation is done, EDSD will either wrap up or introduce another reward. We're talking a few years, not a few months.

For full information about EDSD and FAQ's, please click below

Week 36s Update

Get ready to embark on another rollercoaster ride through the wild and wonderful world of EDSD with our Weekly Report. This edition is juicier than a pineapple at a tropical crypto party, price shenanigans, and tech breakthroughs that even Elon would raise an eyebrow at. Let's get into it.

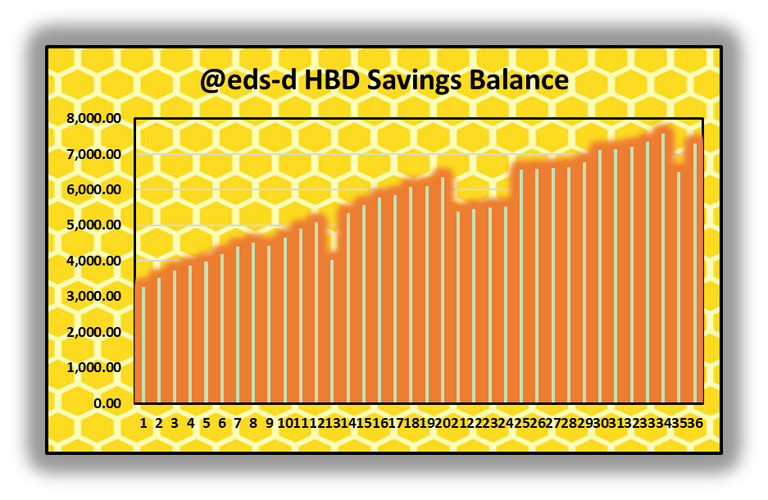

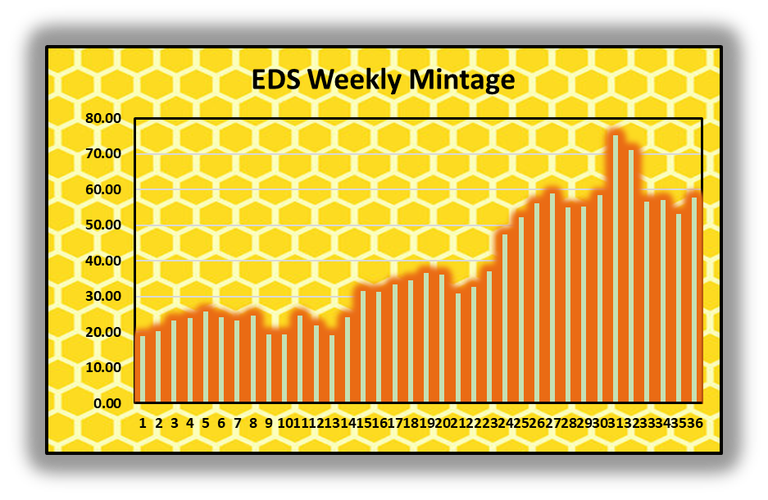

We have somewhat bounced back and that is always the way it has been for EDSD. Every time we got a back sell-off, it's soon after replaced with a new investor. You can see on week 13, we took a big dip and it was replaced within a week. Another on week 21, it dipped for 4 weeks before a new investor jumped in at week 25.

We just got to figure out how to get the big new investors before the bigger sell-offs happen, lol.

The HBD interest amount increased this amount as we have new investment and because HIVE has gone almost sideways in the past week, we converted 20.35 HBD at a ratio of 1 HBD to 5.66 HIVE.

Not too bad with minting 57.63 EDS from EDSD this week. When the bull market picks up again and HIVE is trading at over $1 each next year, these EDS rewards will be worth 6x more than they are today which I think we could agree is much better than earning 15% from holding HBD. Of course, the opposite is true in a bear market but I'll give fair warning long before this time comes.

Investors' Path Start to Finish

- Send any amount of HBD to @eds-d

or - Set up a HBD recurring payment to @eds-d (for Saturday Savers 🤑)

- Receive EDSD in your hive-engine wallet a few moments later

- Hold EDSD to receive weekly EDS rewards each Monday

To exit

- Request cash out in the weekly EDSD post

- Send your EDSD tokens to @eds-d

- Receive your HBD back after 3-4 days