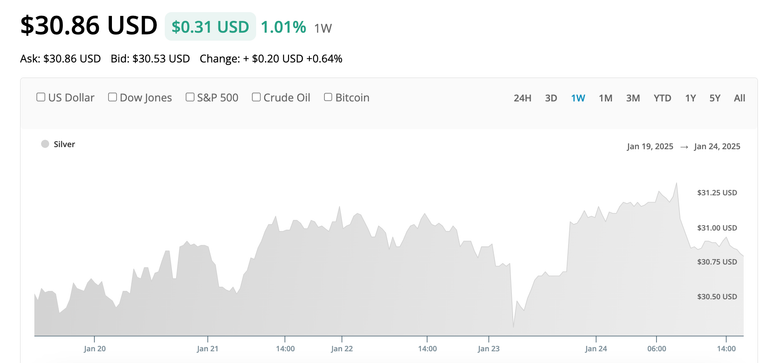

Silver Price Analysis

Silver was up a little this week at 1.01% we have have the Fed talking next week which is likely to make things a little wild. If we can keep some upward movement I think we can get back into the bullish channel, but right now we are trading sideways. Being that we are currently capped on the upside and the downside, by key resistance and support levels, sellers need to clear the 50-day SMA to breakdown my thesis for a good start to the year.

Silver Chart

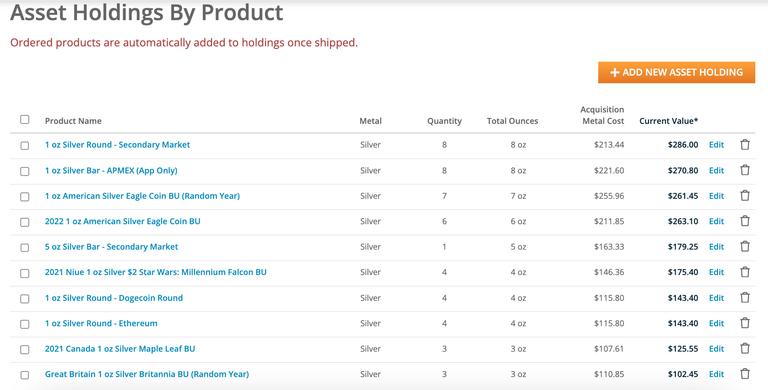

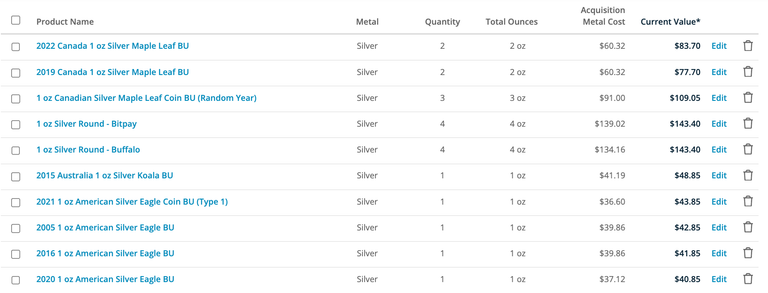

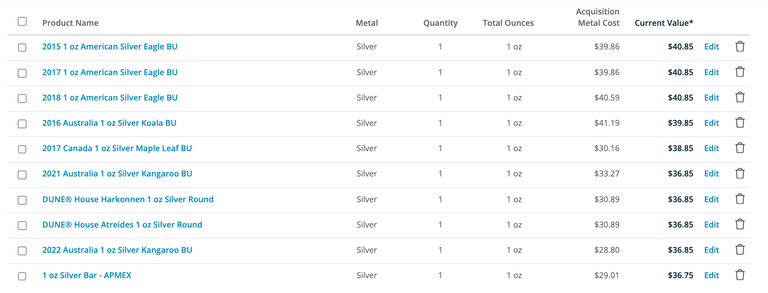

Portfolio Update

My current assets are valued at $3,257.40 with a total acquisition cost of 2,814.68. So far it's been a pretty good year and I expect more our of the silver market.

Asset Allocation Chart

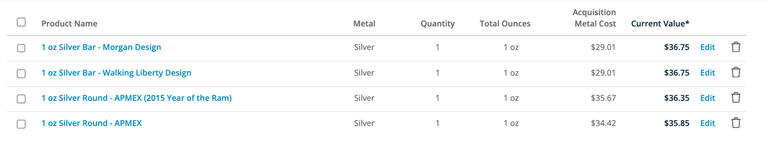

Asset Holding by Product

Gold is doing very well, but silver is not very keen to follow gold, so it is lagging behind. Let's see what happens.

I think if markets turn bith gold and silver will be good to own.

Everyone is going to be shocked about the coming Melt Value of Silver... It will be awesome for all Silver Stackers...

I hope so too what are the factors that you think will drive prices up?

The United States will soon be returning to "Circulating" and "Collector" Silver and Gold Coins... The Face Values of our Silver Coins will range from $1 to $10 and will 100% back our Paper Coinage and Common Coinage... The Face Values of our Gold Coins will range from $10 to $100 and will 100% back our U.S. Crypto Coinage... It will take $10 in Common U.S. Coinage or 1,000 of today's Fiat USD's to obtain an exiting $10 U.S. Silver Coin... It will take $100 in Common U.S. Coinage or 10,000 of today's Fiat USD's to obtain an existing $100 Gold Coin... In other words a One Ounce $10 Silver Coin will have the "Spending Power" of 1,000 of today's Fiat USD's and a $100 Gold Coin will have the "Spending Power" of 10,000 of today's Fiat USD's...There will be a 100 to 1 Exchange Rate "away" from Physical Fiat USD's... Digital Fiat USD's may not be so lucky... But Physical Fiat USD's will be the safest Fiat Currency to be holding at the time of the U.S. Monetary Correction...

I have a very good feeling for metals this year.

I thin k it will be this year or next. Stock markets are too frothy with rates at almost 5%

Keeping an eye on the Fed’s influence and technical levels like the 50-day SMA is a smart move. Hopefully silver will get back on the bullish track soon!

The Fed will be key next week.

You received an upvote of 100% from Precious the Silver Mermaid!

Thank you for contributing more great content to the #SilverGoldStackers tag. You have created a Precious Gem!

This is a positive sign. I think the market will still perform quite well in the next few weeks

You are still doing great, I think there's still there will be some increases in silver yet this year. The Feds are always a wildcard, and sadly they do drive prices. We do need to get past that upper resistance point, I agree.