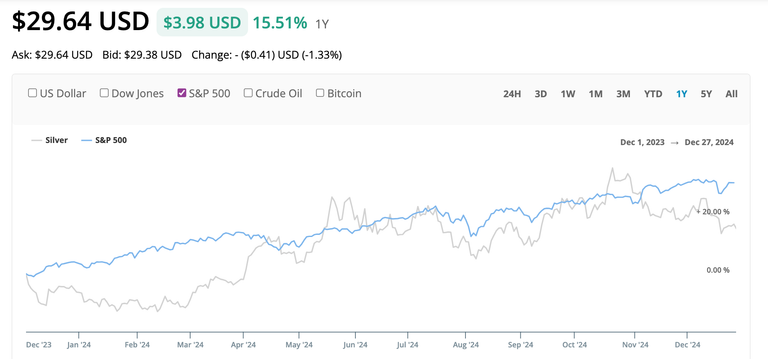

Silver Price Analysis

After yesterday's selloff there's bearish momentum heading into 2025 with near term targets at $28.74 – $28.40 as Treasury yields surge. After traders failed to push prices above the 200-day moving average at $29.73 on Friday. This level will remain a key technical barrier, with potential for a breakout if silver can regain upward momentum. However, the rejection has shifted focus to the downside.

Silver did not have a bad year up 15.51%, but trailed the S&P 500 which is my benchmark.

Silver Chart

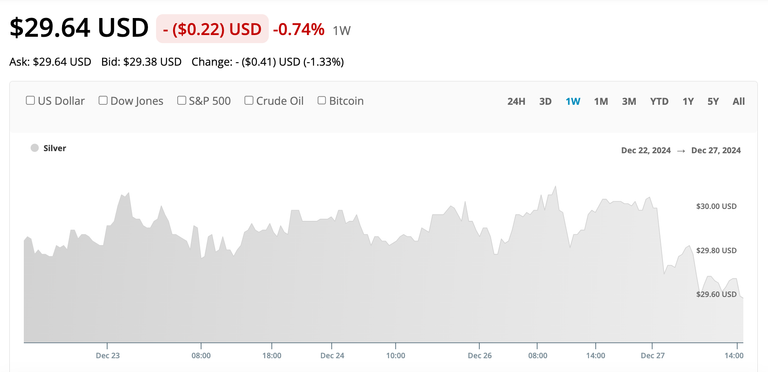

the weekly chart show us down 0.74% after a big swing Friday.

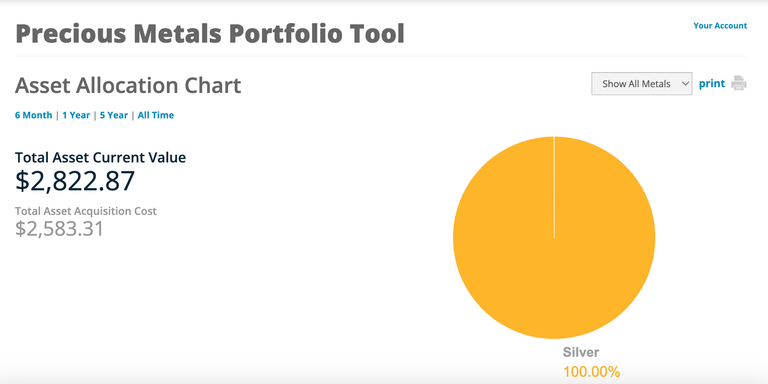

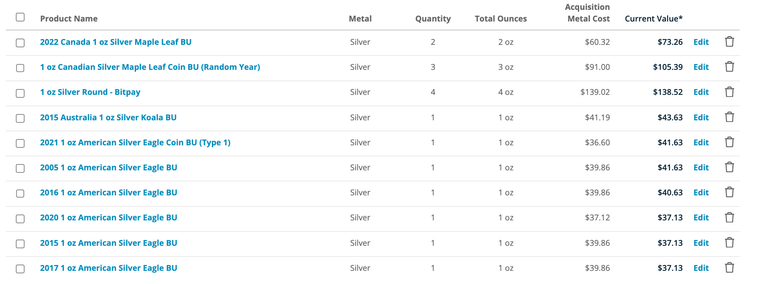

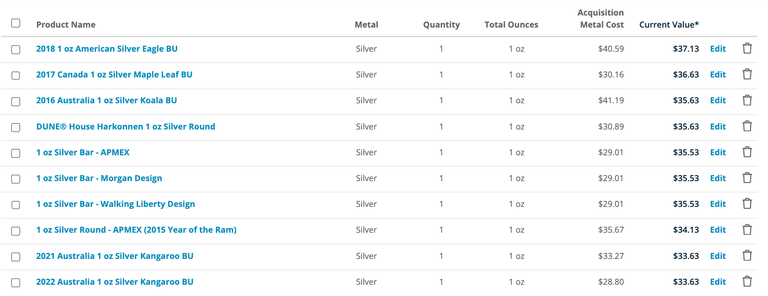

Portfolio Update

My current assets are valued at $2,822.87 with a total acquisition cost of $2,583.31 which means I should close the year in the black. I believe this is my first year ending in the balck since starting to stack!

Asset Allocation Chart

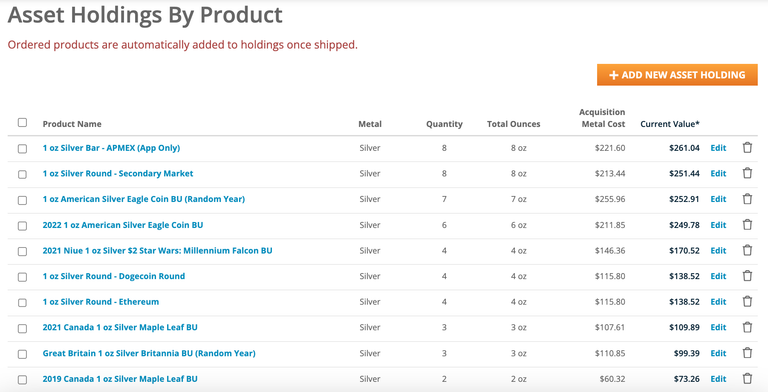

Asset Holding by Product

Getting yourself a nice little stack there.

Trying if we dip more I think there's some maples in my future. I picked up some more eagles that I need to share.

You received an upvote of 100% from Precious the Silver Mermaid!

Thank you for contributing more great content to the #SilverGoldStackers tag.

You have created a Precious Gem!

Silver price is stuck in neutral, we will see where the price goes this week. Expect to go up.

It's in a slight downtrend right now with the rest of the market.