The new Google Pay App became publicly available in December 2020 with a decent sign up bonus and a lot of potential rewards. There are some smart features such as "Insights" which shows you were your spending your money.

Official Sign Up: https://pay.google.com/about/

Who can sign up for the new Google Pay app?

At the moment, the new Google Pay app is still in it’s beta stages and is currently available to residents of the United States, Singapore and India. That’s just for people to sign up for the new Google Pay service. Anyone can use the old Google Pay service that allows you to add credit cards and pay using your mobile device.

$21 Google Pay Sign Up Bonus:

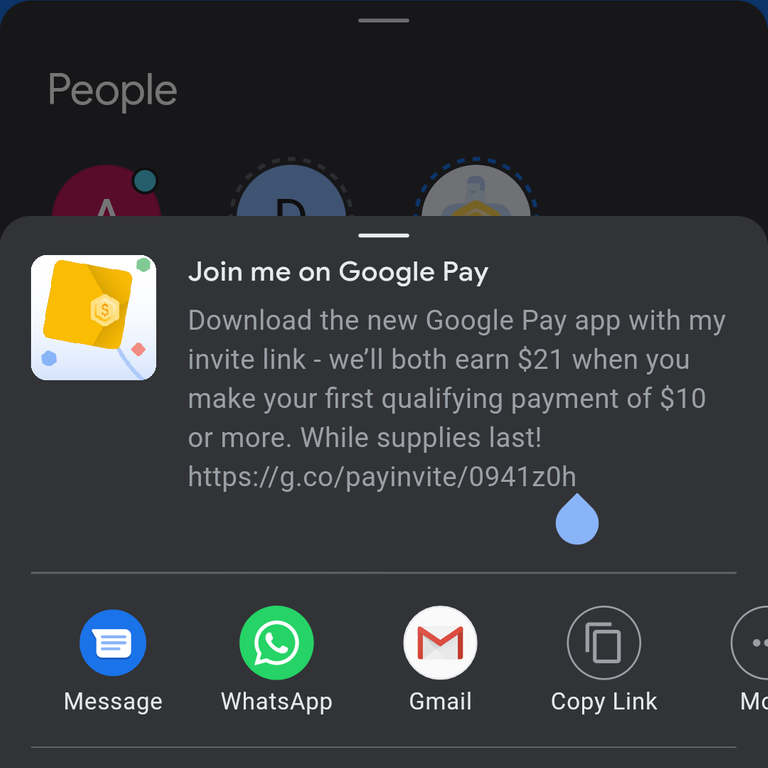

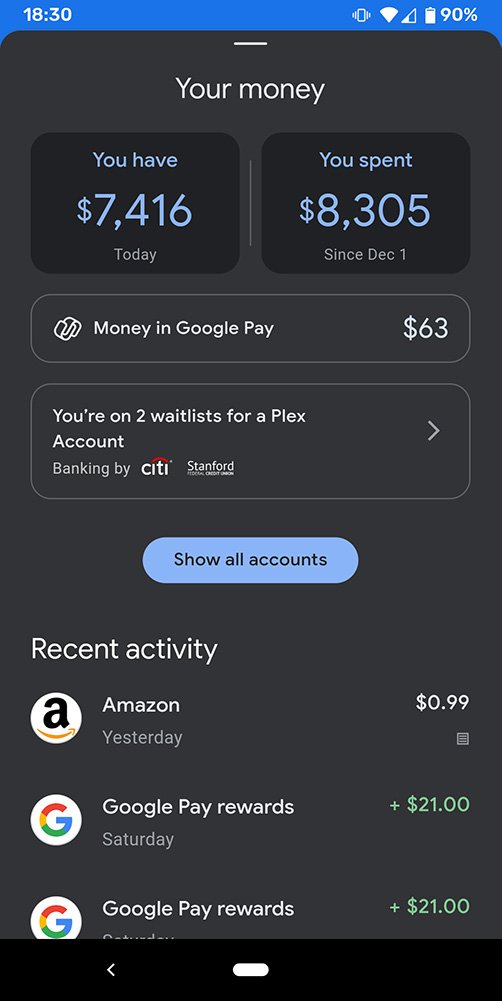

To sign up for the new Google Pay App, you can download the app and sign up directly which will net you $0 and using a referral code will get you $21.

I signed up for Google Pay directly through the app which got me $0. Right now, the Google Pay referral bonus $21 when you use someone’s referral link after making a $10 purchase on a credit card that you’ve linked to Google Pay. That’s right, you don’t actually have to use Google Pay to make a payment, your credit card just needs to be linked to Google.

On my YouTube Channel Full Value Dan, check out the comments in this video for Google Pay Referral links. If you used someone’s link, leave a comment to let them know and then leave your link in another comment.

My invite code is already used up so there may not be a bonus. See link above for referral links

Why is Google doing this (guesses)

This is just speculative based on what’s happening, so I’m guessing that by adding your credit card to Google Pay, Google will use all your customer data to sell to advertisers. Once you’re in the Google ecosystem, they know what you’re searching for. With Google Pay, Google will know exactly where you are spending your money too. Potentially creating incredibly specific ad profiles for every user which makes the data very valuable to advertisers.

Personally, I don’t really mind that. That’s just the name of the game to keep these platforms free while also giving me discounts on service and goods I’d already be paying for.

How do you pay someone with Google Pay?

- NFC Payments: By clicking the credit card icon at the top right, you can add debit and credit cards to your Google Pay account. When checking out at a store or restaurant, you just hold your phone near their payment terminal to process the payment.

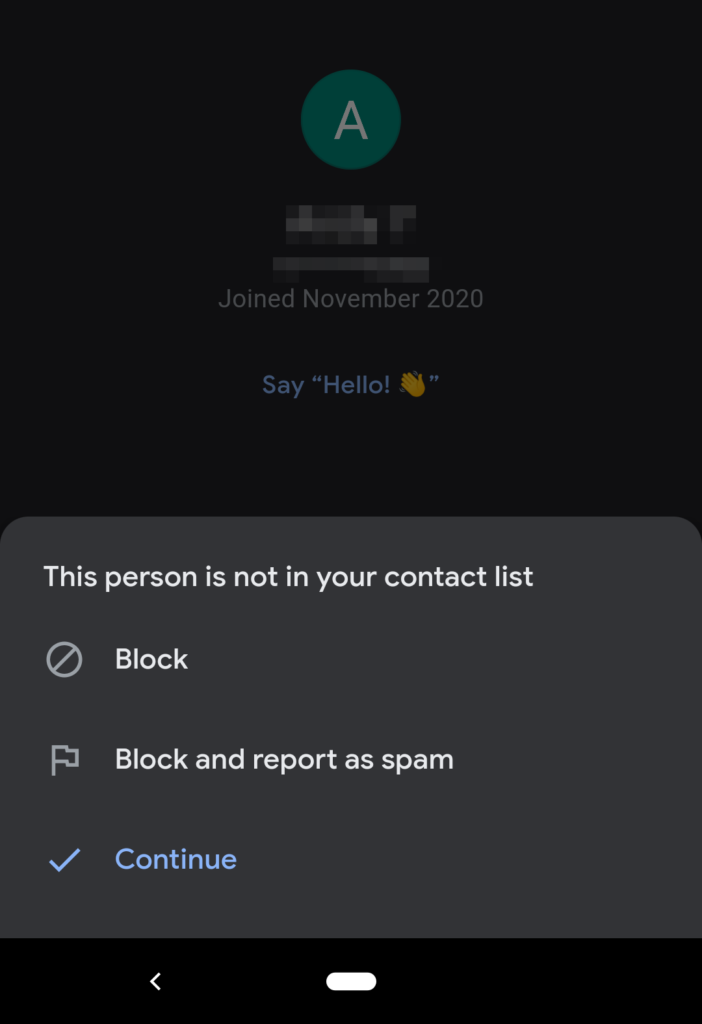

- Via Google Pay Contacts: With Google Pay, if you want to pay someone money directly, you’ll have to invite them to join Google Pay first. Once they join, you can add them as a contact and then you can begin sending money.

- Via Google Pay QR Codes: With GPay, you can directly pay someone with their QR code. Once you scan their QR code, you’ll be prompted to add them as a contact. You will need to add them if you’d like to start a transaction with them.

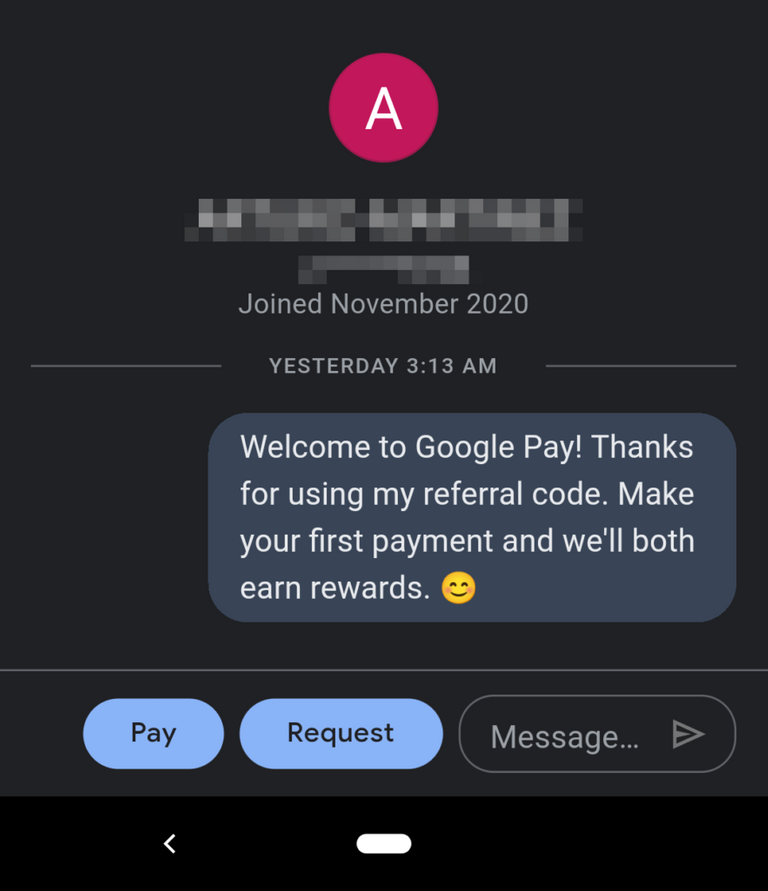

With Google Pay, to send and receive money can only be done between registered users. After becoming a registered user, you’ll then need to add the person you want to pay as a contact in your GPay app. Once you’ve added them as a contact, the Google Pay app will allow you to Send or Request money from your contacts. This will open up a special chat between you and your contact.

Just starting the payment process is very inconvenient with Google Pay. You can’t just “send” money to someone. Just the extra step of having to add them as a contact is incredibly inconvenient when compared to other P2P money apps. I’m really hoping Google improves this if they will be an actual competitor in the send/receive money space.

Once you’ve allowed contact between your account and your contact, you can now send or receive money from each other with the Google Pay App. Unfortunately, you can’t send money via credit card. You can only send money via debit card or linked bank account.

With Google Pay, I had 2 linked banked accounts from the “Insights” page (money management). Even though Insights is part of the GPay App, you still need to link a bank account to your actual “Pay” accounts if you want to send money to other people. I am very annoyed that I would have to add my bank twice within the same app for 2 different functions. This is a very critical Google Pay app, because GPay is showing up to the game late while PayPal, Venmo and CashApp are already doing everything in an easier to use way.

Which banks can you connect to Google Pay?

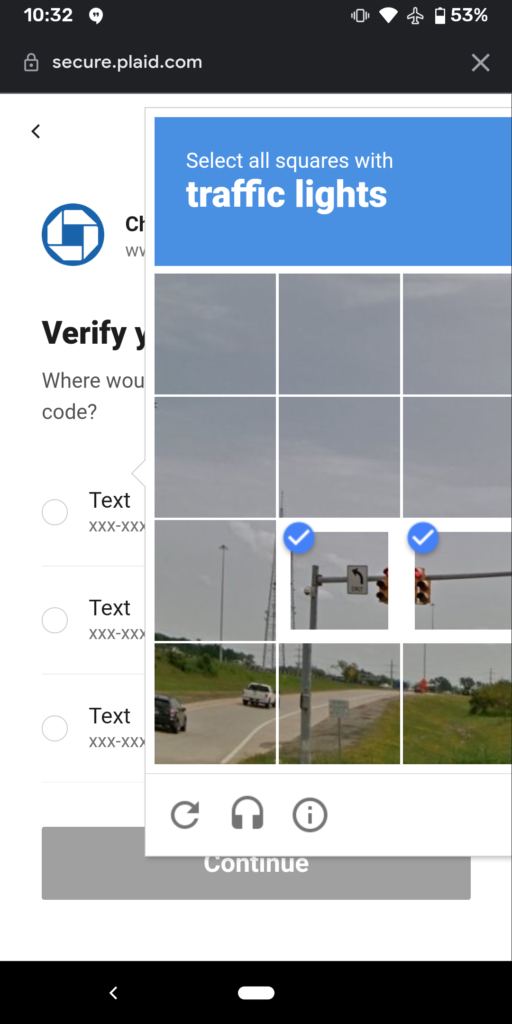

Google Pay uses Plaid to connect to your bank account. Plaid is a secure service that links your bank accounts to various services and is commonly used by many banks and supports a lot of banks. Although for Google Pay, I noticed that they don’t support Capital One for bank transfers and for credit cards. I’m not sure why, but it is inconvenient because that’s one of the banks I have and like to connect.

What if I can’t verify my account with Plaid?

When connecting your bank accounts to GPay, you’ll need to go through that “I’m not a robot” verification. It’s pretty common for Plaid to show you an image too big for the screen to the point where you can’t actually verify the image. My workaround for this is to use the audio function. You’ll hear a sound clip of someone saying several words. Be ready to write those words down and that will be your verification.

Plaid consistently fails me...this is on an android device

Alternatives to Google Pay

The main competitors to Google Pay are PayPal, Venmo (subsidiary of PayPal), CashApp and Zelle. Each of the alternatives to Google Pay are way ahead of Google in terms of user experience and convenience.

How is Google Pay compared to the competitors?

For the person-to-person money sending, the alternatives to Google Pay are PayPal, Venmo, Zelle and CashApp. Google Pay is still very new in the person-to-person money space and has a lot to improve on. The actual money sending is very limited and inconvenient, but Google Pay has some incredible partnerships for cashback deals and an amazing system where you just have to add the card to Google Pay to qualify while not actually using Google Pay for the payment.

For the NFC payment services at stores and restaurants, the alternatives to GPay are Samsung Pay and Apple Pay. Google Pay has been doing contactless payments for years and it basically just holds your credit card information on your phone and transmits the information to a payment terminal. There isn’t any significant difference between Google Pay and its competitors when it comes to contactless payments.

Navigating the Google Pay App

The GPay App is divided into 3 main pages; Pay, Explore and Insights. When you open the Google Pay App, it will default to the “Pay” page, and at the time of launch…that page could use some improvement. Once you scroll down from the “Pay” Page, you’ll lose sight of the Explore and Insights page. To bring them back up, you’ll have to scroll to the top…twice. Meaning you’ll scroll to the top of the pay page and then scroll again once at the top.

If you actually want to pay for something at a store or restaurant using Google Pay’s NFC contactless payments option, you’ll need to select the small credit card icon at the top right of the screen. If you want to pay via QR code, you’ll need to select that at the center of the screen and go in a few menus. If you want to pay a friend, you’ll need their QR code, phone number or email address.

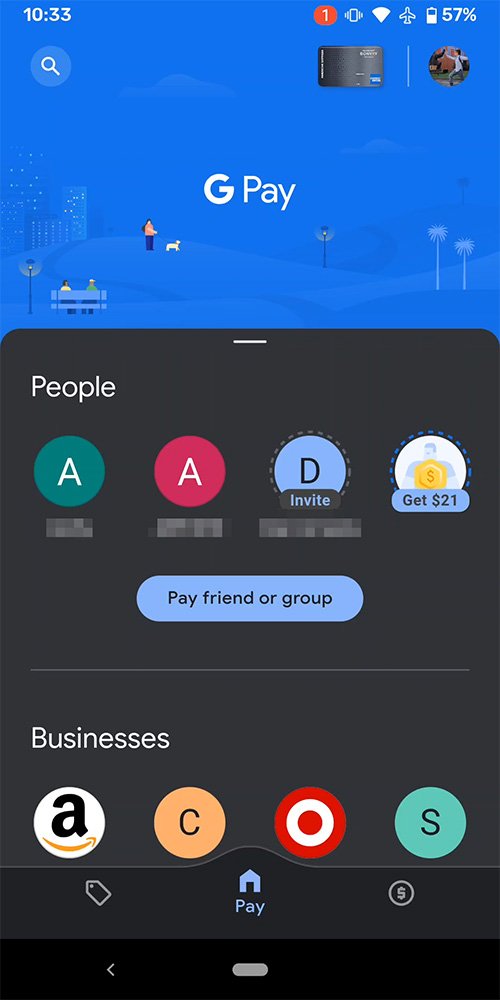

Google Pay home screen (this is what you see when you log in)

[Pay]

The interface is pretty clunky. As soon as you open the GPay app, you land on the "Pay" page where you see your contacts and businesses you made transactions with. Not the actual transaction history, just the businesses. That's not very useful. Personally, I prefer seeing my recent transactions immediately just to make sure I know where all my money is going.

Selecting a person in "People" will allow you to pay a friend or group of people that also have Google Pay accounts. If one of your contacts does not have a GPay account, selecting them will create an email invitation to join the platform.

Can you pay someone with Google Pay using a credit card? You cannot use a credit card to pay someone using Google Pay. Payments between contacts can only be made via bank transfer or debit card. Credit card payments can be done through merchants using an NFC reader.

[GPAY NFC]

After opening the GPay app, at the top right of the screen, you should see a credit card icon or something similar next to your Google avatar. Selecting the credit card will bring you to the old Google Pay app where you can use credit cards and debit cards to make payments through a NFC terminal. Meaning, if you want to pay for food or something at a store, you can pay with contactless payments using Google Pay as long as the store supports Google Pay.

For each credit card you have added to your Google Pay wallet, you’ll have a carousel of credit cards to choose from. If you have very specific credit card rewards on a card, you can add notes to remember.

After selecting which card you’d like to pay with, you can scan your phone over an eligible NFC payment terminal to process your payment. The transaction should process just like any credit card transaction.

The really cool thing is that you don’t even need data or wifi to use Google Pay. Once your credit cards are added to your GPay wallet, it stores your credit card information on your phone just like a physical credit card. You can make payments to a NFC payment terminal while your phone is in airplane mode and it will still process the transaction.

Using airplane mode on your phone does not necessarily turn off your NFC broadcasting on your device. I used to be pretty paranoid about it so I always turned NFC off while I wasn’t using it. The amazing thing about Google Pay is that whenever you make a transaction using a credit card that’s been added to your Google Pay wallet, Google will notify you any time there is a transaction. This keeps me up to date on any form of shady activity that may be happening on any of my accounts.

Nicknames: With every card you add to your Google Pay account you can add nicknames. The nickname can be found when you select and of your individual cards. For myself, I add a note about the card like 5% Groceries December. This is especially helpful for cards with rotating categories. You can add anything you like and it may help you remember how to get full value from each of your credit cards. The only problem is that you have to click on to each card to see the nickname (note).

Virtual Credit Card Numbers: Whenever making payments with Google Pay at an NFC payment terminal for contactless payments, GPay uses virtual account numbers instead of your actual credit card info. It’s substitutes a temporary account for the exact amount you need to pay to the vendor and can only be used when Google authorizes payment. This helps keep your account info safe.

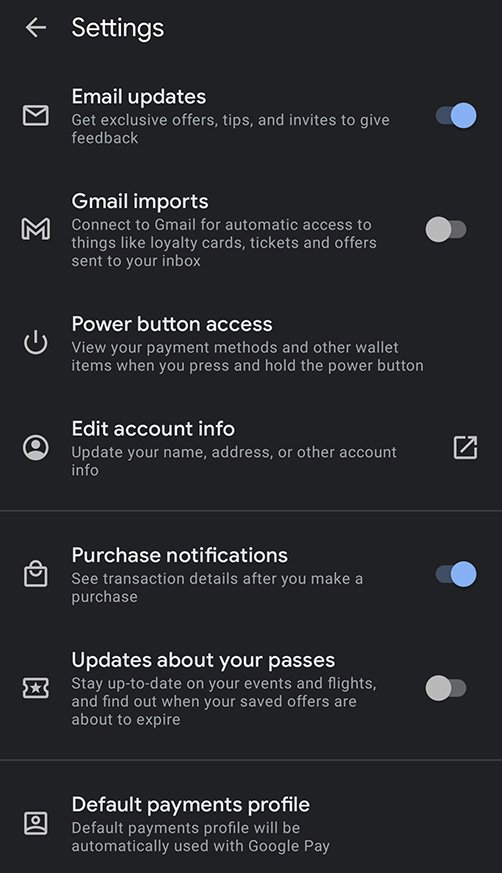

Google Pay settings (I like the purchase notifications on because you will know any time your credit card is being used)

[Other Features]

Purchase Notifications: You can get purchase notifications for every credit card or debit card added to your GPay app. Whenever a purchase is made on your cards (even when not using Google Pay) you will receive a notification. This is very helpful to see where exactly your money is going and to catch any potential fraud immediately. You can manage your Purchase Notification setting in your GPay NFC Settings menu.

How to Get Your Google Pay QR Code:

Finding your Google Pay QR code is not very obvious and can take some hunting around. So I'll explain the 2 ways to find your GPay QR code. To get your Google Pay QR Code, you'll need to do the following steps:

[Method 1]

1. Open Google Pay (you'll land in the "Pay" page)

2. Select your profile photo in the top right

3. Select your profile photo again

[Method 2]

1. Open Google Pay (you'll land in the "Pay" page)

2. Select "Pay Friend or Group" from the People section

3. Select "Scan QR Code" at the top left

4. Select "View your QR Code" at the bottom.

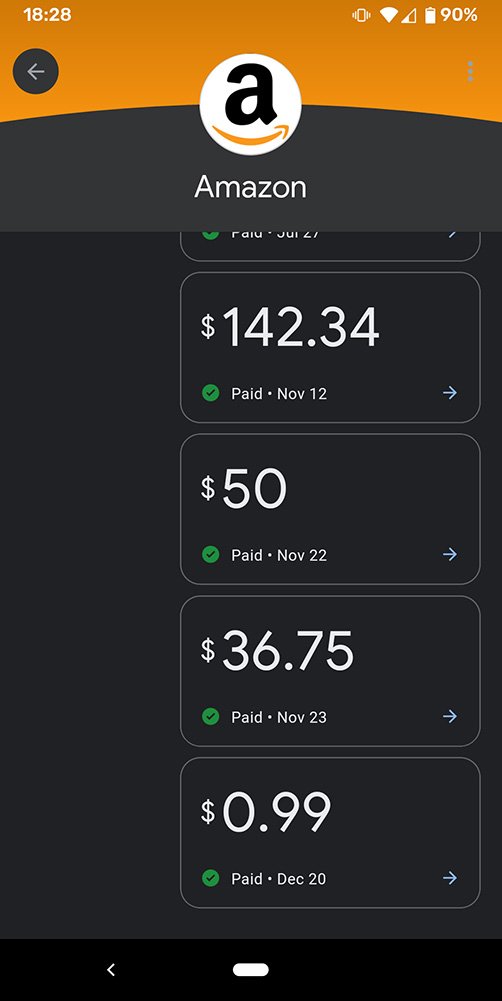

Payment history when selecting a "Business" in Google Pay

[Businesses]

At the Google Pay home "Pay" page, you'll see a list of the last 8 businesses you made transactions with. You can't see any more than the last 8. Selecting any one of the businesses listed will show your transaction history with that business based on all the credit cards you have listed with Google Pay. The business listing also extracts all your transactions from your email and adds them to your transaction history (up to 2 years of history).

The business listing of your transactions will show you how much you spent, when and with which credit card. GPay also extracts receipts from your emails, so it will directly show you the email. Now that's convenient, but Google really has all your data at this point and there's no dancing around that fact.

I find the transaction history both useful and useless. It doesn't let you sort the transactions and it doesn't tell you how much in total you've spent with a service. It's really just showing each individual transaction with no filters or overviews on your spending. Definitely a lot of potential in the future if they decide to add that function.

[Discover]

The discover section allows you to find restaurants in your area for takeout or delivery. There’s also a section to find gas stations in your area that support Google Pay so you can activate the gas pump from your phone. You’ll still be touching the shared gas pump so remember to sanitize your hands after.

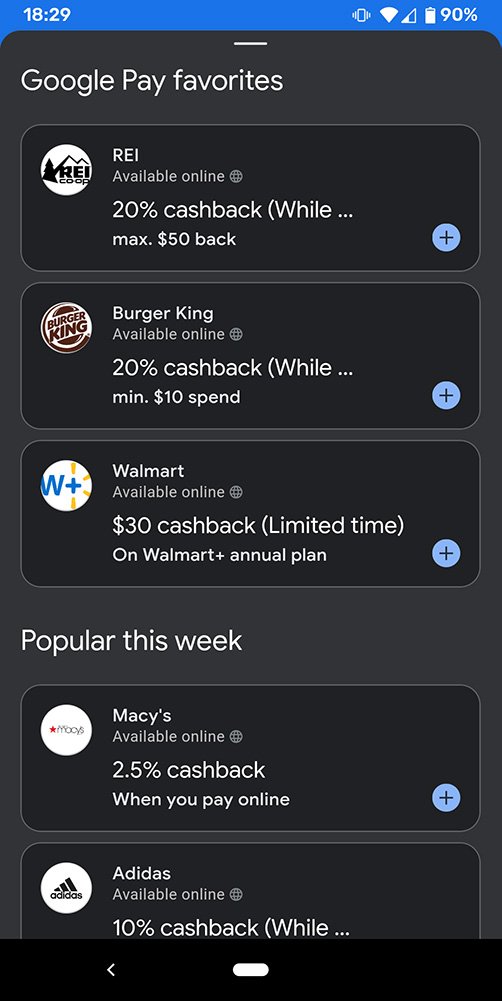

Google Pay "Explore" deals

[EXPLORE]

The Explore section of the Google Pay app is my favorite feature. In Explore, you can find all the rewards you’ve received and all the rewards that are currently available to you. A majority of the retailers available are individual companies but you can find some sweet deals every once in awhile.

Right now, there isn't any way to sort through the deals or really view them all at once without digging into each section. There's a lot of room to improve here.

How do you get Google Pay Rewards?

Each of the Google Pay promotions have a limited number of sign ups so it makes sense to check it regularly if you want a good deal.

- Find and Sign up for a Google Pay promotion in the Explore section of the Google Pay app

- Add your credit card to Google Pay

- Use your credit card that you have registered with Google pay at the retailer. You don’t actually have to pay with Google Pay.

- Google Pay will read the transaction from your credit card and which will qualify you for the Google Pay bonus.

When I signed up for Google Pay, they had a $21 back after spending $50 at Target promo. That’s 42% cashback which is incredibly generous. After signing up for the promotion, I already had a few credit cards registered with Google Pay so I went directly to the Target website and purchased a $50 gift card for Target. Within the next few hours, Google picked up the transaction and showed my bonus was pending.

Not all bonuses are immediate and some may take time to reach your account. Google Pay Rewards are actual cash payouts that you can transfer directly to your bank account.

LOL "Manufacture Spend" and moving money around

[INSIGHTS]

By connecting your banking info to your Google Pay Insights page, you can get updates on your account balances and where your money is being spent in your accounts. The only drawback is that accounts that were added to GPay Insights still need to be added to the Google Pay Payment methods section since they are considered two different features.

Last Thoughts On Google Pay

I’ve been using Google Pay for years and will continue to do so. The mobile wallet for contactless payments is incredibly convenient. I won’t be a user of the P2P money sending feature since there are drawbacks of not being able to use a credit card, but I do see myself using the Explore and Insights features. The new Google Pay app is still in its early beta stages and I hope to see a lot more improvement in the user experience and features in the near future.

Posted from my blog with SteemPress : https://slycredit.com/google-pay-review/