The DeFi ecosystem continues to grow.

The value of assets in the decentralized finance (DeFi) market has reached its highest ever level thanks to the rising price of leading cryptocurrencies, Bitcoin and Ethereum.

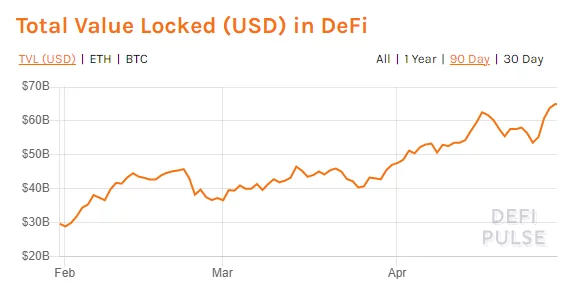

According to analytics data firm DeFi Pulse, the total value locked on DeFi protocols (TVL) has risen to an all-time high of $ 65 billion.

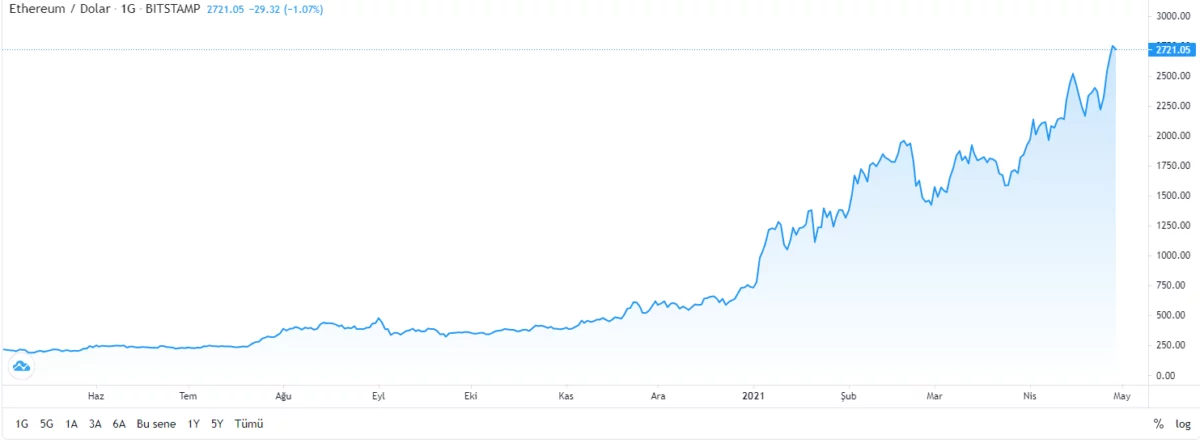

The recent apparent growth in the metric expressed in US dollars is based on the rising price of Ethereum (ETH), which has increased since the beginning of December. As it is known, Ethereum price has risen above $ 2700 with its sudden increases in the last few days.

DeFi, which stands for decentralized finance, represents a collection of blockchain-based protocols aimed at providing financial services at lower costs and with greater accessibility. Protocols that use automated blocks of code known as smart contracts provide services such as lending, asset swap, and interest on deposits. The vast majority of these actions take place on the Ethereum network.

To facilitate these activities, DeFi protocols rely on deposits of cryptocurrency assets such as Bitcoin and Ethereum to provide basic security for loans and exchanges. As the value locked in the DeFi increases, more participants can use loan and exchange services at a better interest rate. Users who lock their assets are rewarded with interest payments and offer more annual returns than most traditional financial industries.

Among the DeFi projects, Maker takes the biggest piece of cake with 15.86% dominance. However, Compound, Aave, Uniswap and Curve Finance stand out as the top 5 DeFi projects.