It's time for us to update all things LBI, in our first update post for 2026. So many changes for LBI over 2025, and no doubt we will need to keep adapting to circumstances thrown at us throughout 2026. I have a "year in review" post half written, but will have to make time during the week to get back to it and finish it off. Our regular weekly update post however is important so here it is. So, let's see what has been going on for LBI this week.

Here are the prices at cut-off time today.

And here is last weeks report for comparisons:

https://inleo.io/@lbi-token/lbi-weekly-holdings-and-income-report-year-2-week-22-week-ending-28-december-2025-2bc

Assets

@lbi-token

Not much doing this week, aside from adding some more DUO again. I plan to unstake the PWR, and add to the liquidity pool instead. Should have done that to begin with, but was unsure of how much impermanent loss we could experience. Price has remained fairly stable however since delegation rewards are being ended, so the pool is a better option than staking. The HIVE will come from the power down from the dedicated @lbi-pwr wallet we had, that is being wound down. So the pool rewards will contribute to our weekly income, and our PWR will become an income producing position again.

BEE delegation rewards have been ended by the @bee.voter project as it is getting shut down. The BEE we have is currently un-delegating, and then once I unstake it, I'll move it to the @lbi-cent wallet to add to pools there and boost income from that wallet. The end of BEE rewards is one reason our income across the week is down this week.

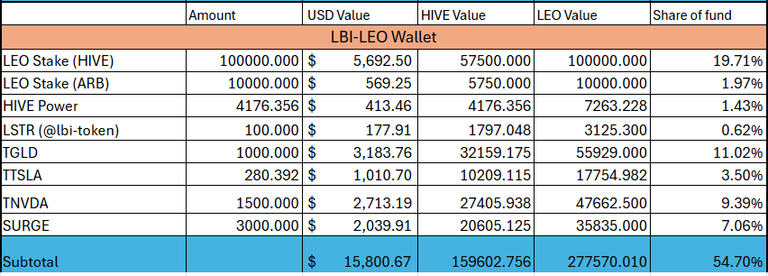

@lbi-leo

Value's have held up ok this week, with the wallet total being very close to last weeks. A bit of missing income from the Leostrategy tokens, with a missed amount here and there. I've posted a list for them of which ones we are missing, and can add in a missing TNVDA today. Still, most have come through and those tokens are by far our biggest source of income for LBI.

I may unstake the 10K sLEO we hold on Arbitrum, and bring it back to HIVE. Rewards have been switched off for months now, and there is no information on when they will resume, so it seems pointless to keep LEO over there. Very possible I have missed some important information about this, as I'm super busy irl and don't have time to watch AMA's or keep up with everything.

@lbi-eds

Standard week for the EDS wallet, adding 47 EDSI over the week. No news to report.

@lbi-dab

Bought another 500 RUG this week, bringing us up to 9400 total. Excluding that, the organic growth this week was 34 DBOND and 48 DAB, so a total of 82 Hive value growth over the week. Goal is to bring that up to 100 per week.

@lbi-cent

Value's here are very similar to last week. This wallet will grow with the addition of the BEE as it un-stakes from the main wallet. Yields are good in these pools, and the wallet contributes well above it's 1.3% of assets in income. It is 1.3% of assets, but generates 3.8% of our income.

@lbi-pwr

The unwinding of this wallet continues, with most of the remaining HIVE earmarked to be paired with the PWR we hold now in the main wallet into the LP. Any spare HIVE will likely buy more DUO.

Totals

Pretty similar overall to last week. USD value up slightly, just a few hundred dollars. Down a touch in HIVE terms, and up a little in LEO terms.

Income

A bit disappointing this week. BEE yield is gone, so that knocks us down about 35-40 LEO per week. some missed payments from Leostrategy also take another 30-40 LEO away over the week. They will get back paid, but it means our income is below expectations this week.

$10 in the @lbi-payments wallet ready to go out as the weekly dividend, and 17.695 LBI burned for the week.

Liquidity

A busier week for the LBI pools than the last couple. A HIVE pump (and subsequent dip back under $0.10) made for a bit more volatility that arbitragers could work with. An interesting thing to note here is that while the LEO pool is by far the deepest, both the HIVE and the SURGE pools had more trade volume going through them. I've felt for a while that the HIVE pool needs more liquidity.

SURGE is the real interesting one. @taskmaster4450le added a nice amount of liquidity to the pool, making it our number two pool by depth. And volumes have tracked along, with this pool becoming much more active over recent times. The pool itself is a good one for yield hunters, with a decent APR base APR from the pool rewards, combined with extra yield from the weekly SURGE payout and also the weekly LBI dividend. Keep this one in mind if you are chasing a high yield investment.

The LEO pool rewards have one week left to run, and they will get renewed after next weeks update.

22,178 LBI is spread across all of these pools, which is virtually identical to last weeks amount. This represents 11.3% of the LBI supply in pools.

Conclusion.

With the first update in the books for 2026, we can see that while it's been a quiet week for us, we still grow our asset quantities, and slowly reduce our token supply. A few tweaks over coming weeks to boost other sources of income so we become less dependent on the Leostrategy tokens is what I'll be working on.

I hope you all had a great New Year's celebration, and lets hope 2026 is kind to our bags.

Cheers,

@jk6276 for LBI.

Posted Using INLEO

My PWR rewards have been down lately. I am not sure what recently changed. I need to jump into the Discord I think. It's nice to see LEO up though.

Do you mean PWR rewards for delegating Hive? If so, that program is ending and there are no more delegation rewards.

Yes, but I pulled my delegation awhile ago. I still have funds in the LP, but I am barely earning anything from it now.

Looks like they are waiting for more people to migrate their sLEO between wallets before they reactivate the rewards. They say rewards accumulate, but you can't claim until they activate it.

I'm one of those who haven't migrated. Haven't found an easy way to migrate from my Keystore wallet to the new wallet, and now I don't have time to look into it more either.

Yeah, a firm timeline would be nice, but it is what it is I guess.

Good luck with getting it figured, if it is a decent amount it's probably worth working it out. Must admit I haven't used Keystore so can't give any advice.

Thanks for dropping by.