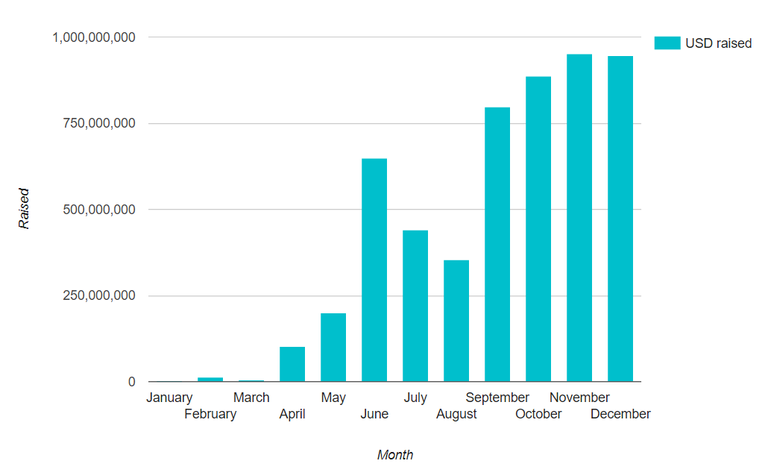

The market for initial coin offerings (ICOs) showed little signs of letting up in December, as the total amount raised approached $1 billion through the first three weeks of the month.

ICO Funding Surpasses $5 Billion

Factoring December data, startups have raised a whopping $5.3 billion USD in 2017, according to ICOData, a firm that tracks the burgeoning crowdfunding economy. Just a few months ago, Hacked reported an annual crowdraise of roughly $3.3 billion for all ICOs.

After an abrupt slowdown in the latter half of summer, ICO fundraising surged between September and December. At the current pace, December crowdraises are poised to outpace the November tally of $951 million.

Source: ICOData.io.

A total of 752 ICOs have been launched this year for an average raise of $7.1 million.

To get a sense of just how quickly the market has grown, ICOs barely raised any funds in March. In 2016, a total of 29 token offerings raised a collective $90.2 million. In 2015, that number was $6 million spread across only three projects.

ICO Leader Board

The ICO leader board has changed in recent months, with the Hyundai-backed HDAC raising $258 million in its December sale. HDAC allows IOT devices to effectively communicate with one another, enabling a new interconnected economy for the future. Industry research shows that the Internet of Things (IOT) represents a $19 trillion opportunity once productivity gains are factored.

A full breakdown of the top-ten ICOs by amount raised is listed below:

Rank Project Funds Raised

- HDAC $258.0 million

- Tezos $230.5 million

- Filecoin $205.8 million

- Bancor $153.0 million

- Polkadot $144.4 million

- Status $107.6 million

- Comsa $95.3 million

- QASH $86.5 million

- TenX $83.1 million

- TRON $67.7 million

A Maturing Market

It’s still early days for token sales, but the market has already undergone significant growth, with investors raising the bar on what they consider to be acceptable investment opportunities. Unlike six months ago, the prospect of raising $15-$20 million on the back of a whitepaper is slim. Investors require a proven business concept, active community engagement and a high-caliber team.

Market participants are also looking for guidance on how token sales are structured and whether a given investment opportunity will fall under the purview of federal securities regulators. This has given rise to the biggest debate within the ICO sphere: how to classify tokens.

Most startups are apprehensive about their ICO being labelled a security, as this would put them under the watchful eye of regulators like the U.S. Securities and Exchange Commission (SEC). For the most part, ICOs would much rather be called “utility” tokens as opposed to securities, as this would negate having to deal with federal regulators. That is, after all, the biggest draw of ICOs. Startups are eager to use the crowdfunding model because it allows them to raise millions of dollars with very little regulatory pressure.

A lack of regulatory oversight has proven to be a double-edged sword because it has invited fraudsters and opportunists to the market. This eventually gave rise to a project called the Useless Ethereum Token (UET), which labeled itself the first honest crowdfunding project.

UET claimed the following: “You’re going to give some random person on the internet money, and they’re going to take it and go buy stuff with it. Seriously don’t buy these tokens.”

Despite not having any product or service, it managed to raise some $200,000 worth of ether tokens.

Even with unscrupulous characters, the ICO market offers plenty of opportunity for both startups and investors. As the crypto craze continues to balloon, the ICO market will see plenty of foot traffic. This is especially true as institutional money begins flowing into the cryptocurrency economy following the successful launch of bitcoin futures contracts. Major exchanges are already gearing up for bitcoin-based exchange-traded funds (ETFs), a product that could open the door wide open to institutional money.

However, it remains to be seen whether new regulations will crash the party. At present, regulators are struggling to even define cryptocurrencies, let alone the crowdfunding model used to launch them. The cryptocurrency market is now 1,400 coins deep, according to CoinMarketCap. Collectively, these coins are worth more than half a trillion dollars, with daily trade volumes in the tens of billions.

Source: Hacked

Keep posting nice post

Merry christmas

Thanks! Follow me for more great content.

Wow so much money is in ICOs!

Yeah it's pretty crazy!

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://hacked.com/icos-raise-5-billion-2017/