This blog post explores the vulnerability of the Hive blockchain to legal attacks, particularly focusing on the USD/HBD pegging and APR settings as the potential weak point.

Exploring the Legal Vulnerability of Hive Blockchain

Premise:

The U.S. Securities and Exchange Commission (SEC) has intensified scrutiny on various digital currencies, categorizing many as unregistered securities.

Numerous crypto issuers are already subject to SEC enforcement, with SEC Chair Gary Gensler urging certain crypto exchanges to register as securities trading platforms.

Stablecoins and other tokens are facing increased regulatory scrutiny.

The SEC has initiated numerous enforcement actions within the crypto space, leading to the conclusion by its chair that the industry is "rife with abuse."

Identifying the Potential Legal Threat to Hive Blockchain:

Considering the regulatory environment and the possible motives of the banking sector, it's crucial to analyze the most likely scenario in which Hive could face legal repercussions. Should the controlling entities behind the SEC opt to target Hive, lacking a front company for direct legal action, they may focus on the witnesses. Each witness plays a significant role in setting the APR for USD-pegged HBD and authorizing fund movements without KYC, which could attract allegations of money laundering and other illicit activities. This makes the HBD/USD APR setting the prime target for a legal assault on Hive.

Legal Vulnerability of USD/HBD Pegging and APR Setting:

The process of printing USD-pegged currencies without proper registration is unlawful in many jurisdictions, a loophole which Hive blockchain currently exploits due to its lack of official registration. Consequently, the most feasible legal approach would be to target identifiable witnesses who dictate HBD APR percentages and oversee the blockchain's internal mechanisms. Given the deep pockets of the banking cartel, they could feasibly pursue legal action against witnesses worldwide, leveraging their knowledge and involvement in setting APR rates.

Potential Real-World Implications of Legal Attack on Hive:

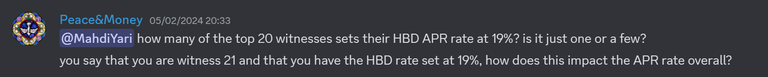

The first step in such a legal offensive would involve infiltration and evidence gathering, particularly focusing on conversations within platforms like Hive Discord where witnesses can be questioned. The primary focus would be on gathering evidence related to the allegedly unlawful HBD/USD APR settings, as each witness independently sets APR rates. This evidence would form the basis for potential court cases in the event of legal action against Hive.

Suspicious Activity and Behavioural Analysis:

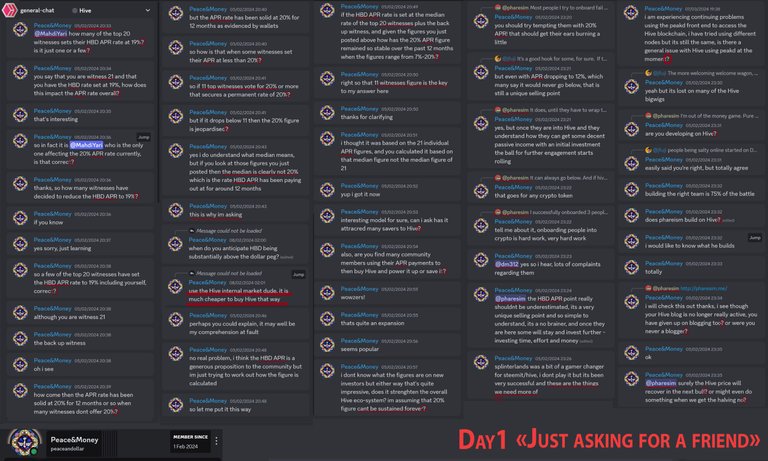

first appearance on HIVE server: straight into interrogation mode, targeting Witnesses

I am raising concerns regarding the behaviour of a particular discord user, @peaceanddollar, who doesn't have a Hive account and who exhibited peculiar actions upon entering the Hive Discord server. The user's immediate and intense focus on querying witnesses exclusively about HBD/APR percentages raised red flags. Despite claiming to be new to HIVE, their deep understanding of the internal mechanisms and relentless questioning of Witnesses seemed incongruous. I have to highlight several inconsistencies in @peaceanddollar's behaviour, suggesting potential ulterior motives.

This is not an organic conversation of somebody without a Hive account, new in the Hive Eco sphere !!

Conclusion:

While the hope is that such suspicions are unfounded, we would like to emphasize the need for vigilance within the Hive community. As experts in communication techniques and Behavioural Analysis, the author has engaged in an in-depth analysis of the potential vulnerabilities facing Hive in the face of legal scrutiny.

Big shoutout to @elgeko for providing me with this free HIVE account and the CC0 Hive logo title picture.

Thank you for your attention and have a great day

Ps.: The FTX Multi Billion Dollar Heist was carefully planned as a scapegoat to go after a wide range of unregistered blockchains and blockchains transferring funds without KYC and chains not complying with all those brand new regulatory obstacles.