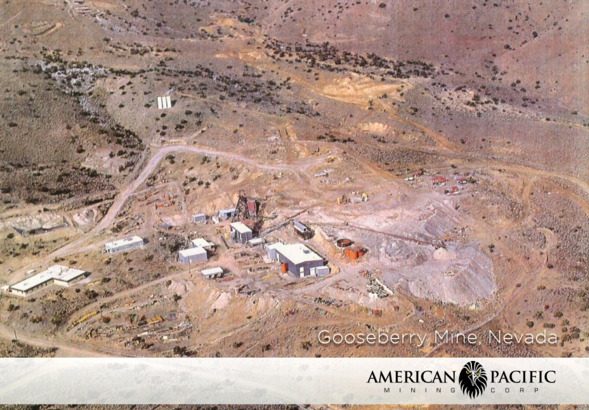

Located just 25 miles east of Reno, Nevada, the Gooseberry Mine encompasses 708 acres of high-grade gold and silver mineralization hosted in quartz carbonate veins. The thought that this expansive, mining-ready asset could be acquired for a mere $20,000 is almost unimaginable – and yet, in a fresh and unprecedented deal, that’s precisely what’s happened.

The price tag of twenty grand is an absolute steal, considering the infrastructure alone (tailings impoundments, dams, permitting, etc.) cost around $10 million to construct. And yet, this fits perfectly into the cost-effective acquisition model employed by American Pacific Mining Corp. (CSE:USGD, OTC:USGDF), a Western U.S.-focused precious metals explorer with an eye for lucrative assets.

It’s been an exciting month for American Pacific, to say the least, as the Gooseberry Mine acquisition comes on the heels of a major capital infusion from mid-tier producer Oceana Gold. Combined with American Pacific’s 1,818-acre Tuscarora asset, the Gooseberry project solidifies the company’s dominance in the Nevada mining space.

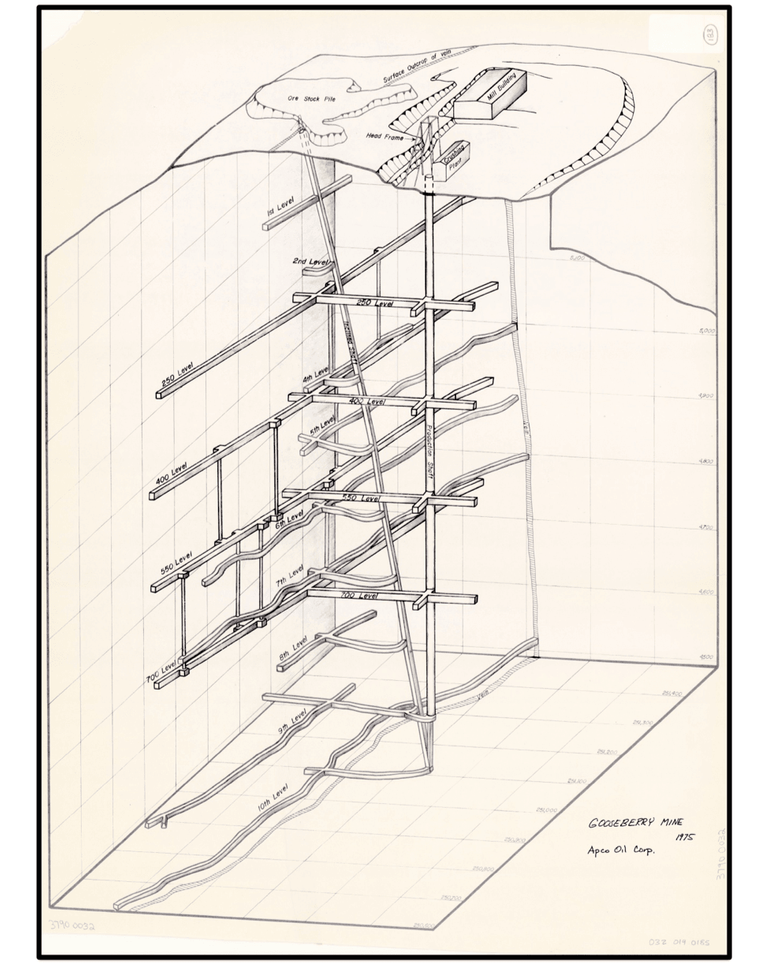

Much like Tuscarora, the Gooseberry asset has a rich history of mining activity: last in production in 1991, Gooseberry was previously mined down to 1,100 feet, with no exploration below that level. The potential for mineral discovery is big, as we see it and much of the hard work has already been done by previous miners.

American Pacific President Eric Saderholm commented on the huge potential for mineral discovery and extraction with the company’s newly acquired asset: “The Gooseberry Project is a low sulphidation, epithermal system with high-grade gold and silver mineralization… It’s our belief that there is a lot of exploration potential remaining over the project area.”

Furthermore, Mr. Saderholm is understandably eager to commence operations on this mineral-rich asset: “When the last operators were mining at Gooseberry, gold was only $353 dollars per ounce, so little exploration was taking place. I look forward to reviewing the historic data and starting the 2019 sampling programs as soon as possible.”

The Ramsey district, where the Gooseberry Project is located, remains underexplored compared to many other areas of Nevada. Infrastructure in the region is already in place, including power to the area, main highways, and some roads through the project.

So, to sum it up: the expensive groundwork has already been laid, the region has a well-documented history of past production, and American Pacific acquired the asset for next to nothing. As American Pacific CEO Warwick Smith put it, “the company should have an exciting year ahead” – exciting indeed, and by all indications, spectacularly profitable.

This work is based on SEC filings, current events, interviews, corporate press releases and what we’ve learned as financial journalists. It may contain errors and you shouldn’t make any investment decision based solely on what you read here. It’s your money and your responsibility. Wallace Hill Partners, a Canadian LTD, which is owned by the individuals that own Wealth Research Group, has entered three year marketing agreement with American Pacific Gold and has been compensated two hundred and fifty thousand dollars and has received two millions and eight hundred thousand shares directly by the company. The information herein is not intended to be personal legal or investment advice and may not be appropriate or applicable for all readers. If personal advice is needed, the services of a qualified legal, investment or tax professional should be sought.

Please read our full disclaimer at WealthResearchGroup.com/disclaimer

Original Article Available HERE

Warning! This user is on our black list, likely as a known plagiarist, spammer or ID thief. Please be cautious with this post!

our discord. If you believe this is an error, please chat with us in the #appeals channel in