So I recently went through a Investment Committee meeting where I presented 5 investment themes that any investor must consider in the context of 2018. Some of these themes might not necessarily but new or revolutionary but I think it helps to be reminded of the fact that although all of us invest in cryptocurrency, the larger and broader market exist. And to ignore the broader market is to ignore reality. Cryptocurrencies are a tangent of the larger and more liquid market. What happens in bonds, equities, currencies, countries always trickles into Bitcoin and cryptocurrencies.

My hope is that the following information is helpful to you as you ponder your own investment portfolios.

We believe there are 5 investment themes to consider for this new year, and based on our research and recent discussions with various managers and investment houses (PIMCO, Oppenheimer, Doubleline, Guggenheim, Van Eck, Capital Group, JPM Morgan, Goldman Sachs, Morgan Stanley, Voya Vanguard, and various others firms), most of the themes we outlined are not new….but a continuation. There might be some tweaks to consider but the general gist remains.

To summarize we are looking at the following 5 themes

- Second Longest Bull Market Rally not over; remain overweight to global equities

- Policy uncertainty (Central bank policy around the globe, tax reform, Brexit implications)

- Correction will come, but not in the same way as 2008; pursue more active strategies (including long only and long biased) than passive index strategies = Rotation away from Passive to active strategies

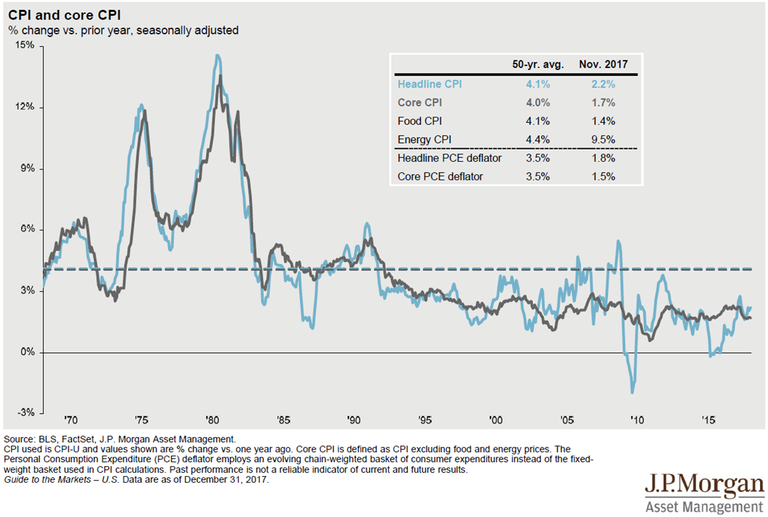

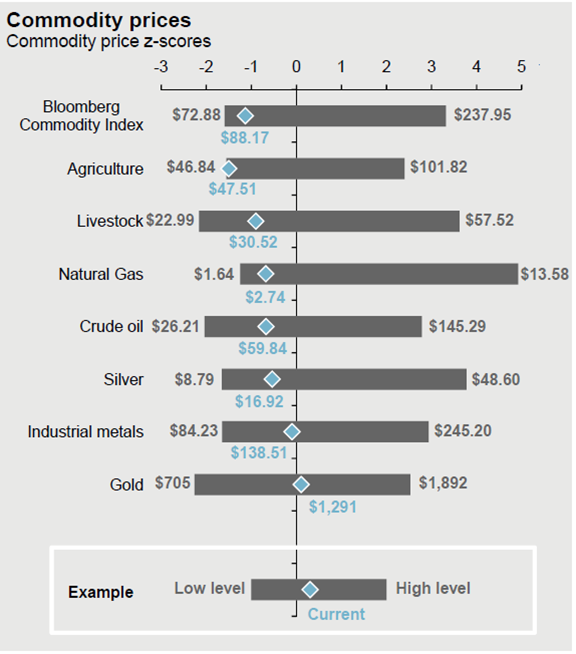

- Inflation is low, Not on the immediate horizon, buy cheap real assets

- Income is KING - Focus on Income – as a risk mitigator

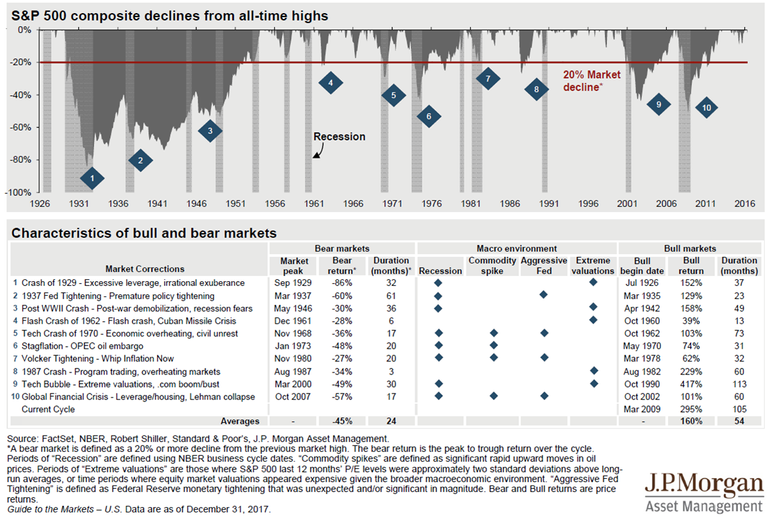

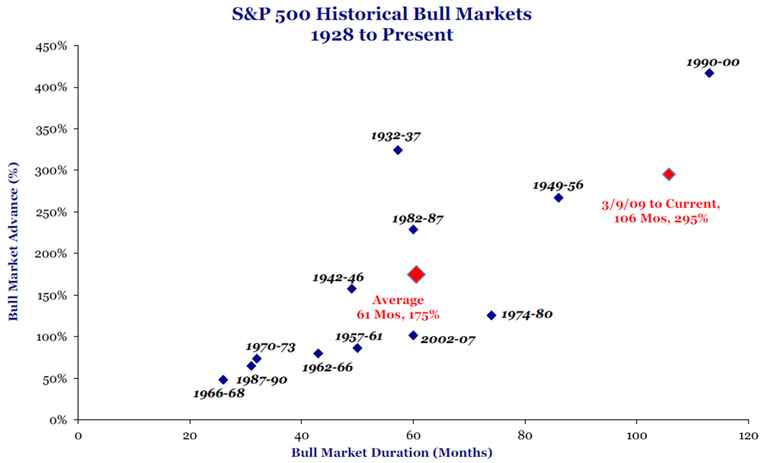

• Theme 1 – 2nd longest Bull Market Rally continues

o Second longest bull market rally is not over; remain overweight to global equities. We are at 105 months.

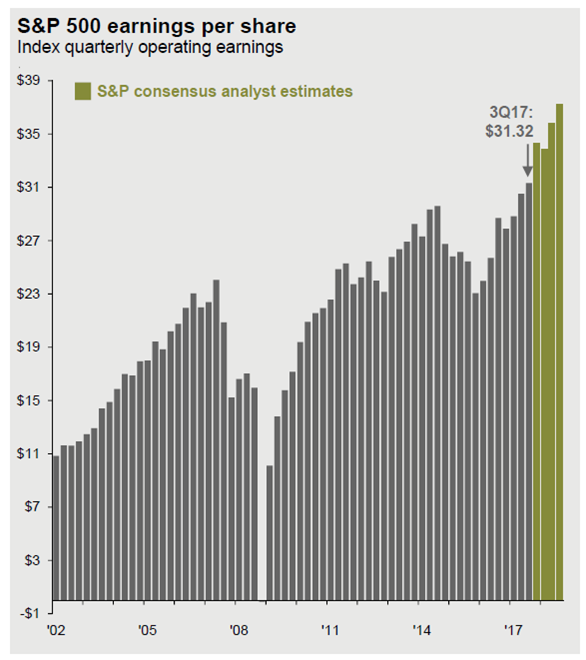

Earnings from S&P 500 companies continue to surprise on the upside. We believe with tax reform, that trend will continue....so stock prices will continue to rise.

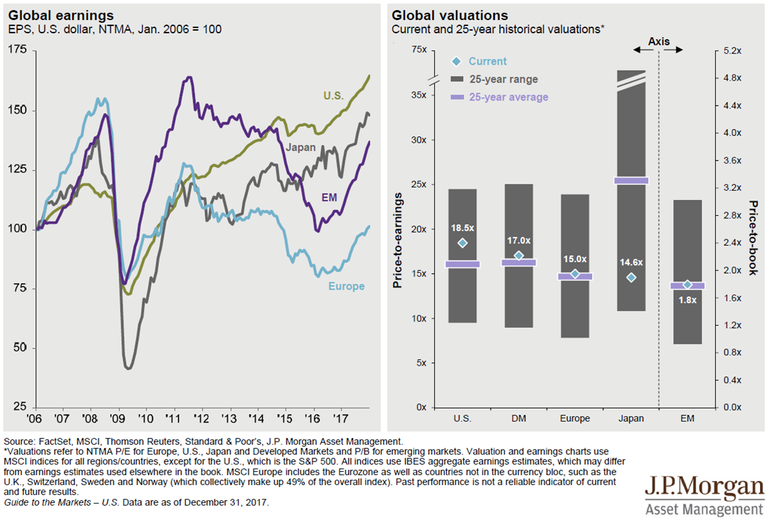

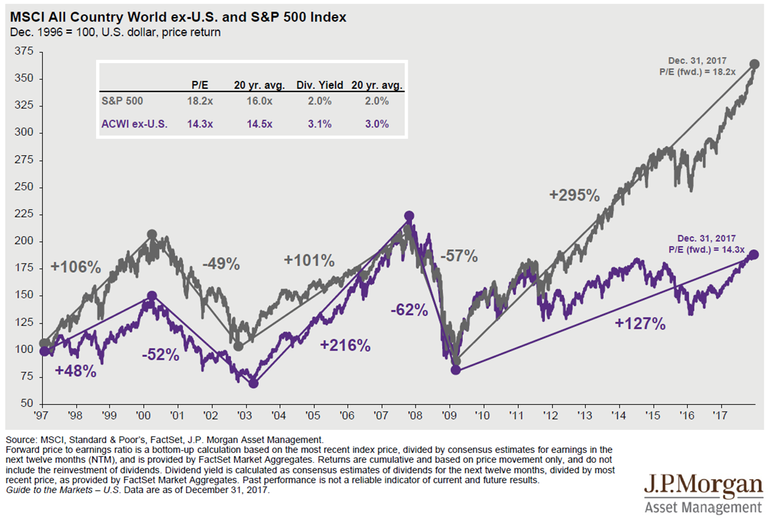

o Overweight international equities vs. underweight US equities

o US equities not that expensive: 0.7 std. dev. above average. If it gets to 1.5 standard Deviations, then we have some concerns. But right now, its not crazy expensive.

o International equities offer better valuation

o International equities offer better valuation opportunities compared to US

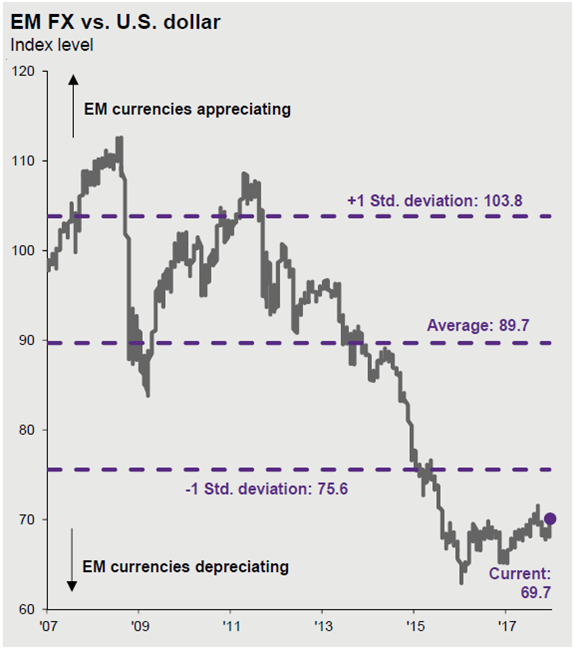

o Emerging market equities offers the highest attractive return of global equities. The emerging market currency opportunities are cheap and is a tailwind or EM/arguing for us to be overweight to the asset class

• Theme 2 – Policy uncertainty (Central bank policy around the globe, tax reform, Brexit implications)

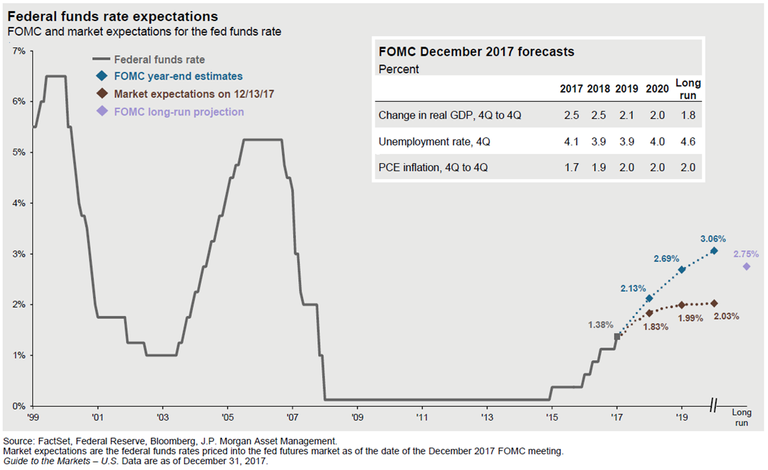

o Interest rates will rise in the front end; yield curve will flatten

o Certain asset classes will fare better than others in a US rate hike

o Floating Rate; Convertibles; EM Debt?

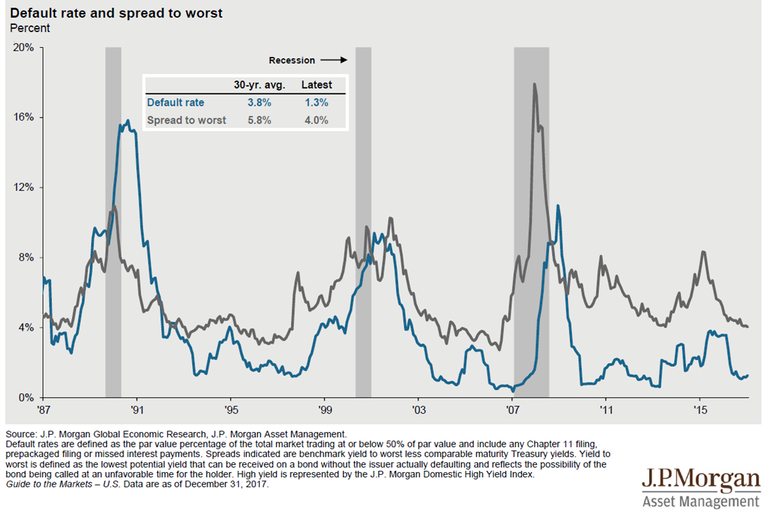

o High yield is very expensive and could see a correction (very low probability). So look to trim/move high yield to underweight.

o Interest rates will rise, with the goal 3x per year for two years so 150 bps of rate rises and trying to hit 3% by 2019. Some firms predict that the Fed might move 4 times this year.

o Fed has begun reducing their balance sheet, implying higher interest rates

• Theme 3 – Correction is coming but not in the same way as 2008; Switching from Passive to Active

o pursue more active strategies (including long only and long biased) than passive index strategies

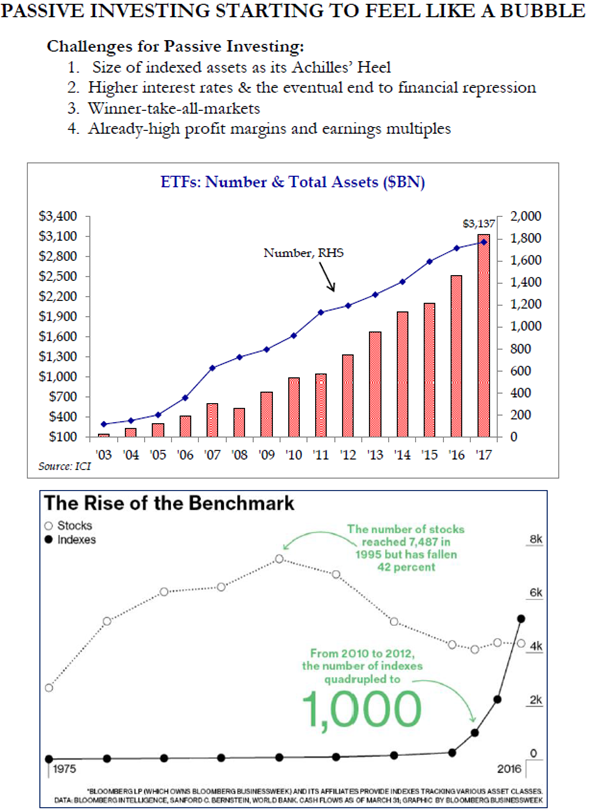

![3 - Correction 4 - Passive.png]

( )

)

Passive strategies look like a bubble. If market corrects, then people will start to throw the "baby out with the bath water"....we see that ETF/Passive might head in a similar direction if people start to freak out and dump their positions indiscriminately.

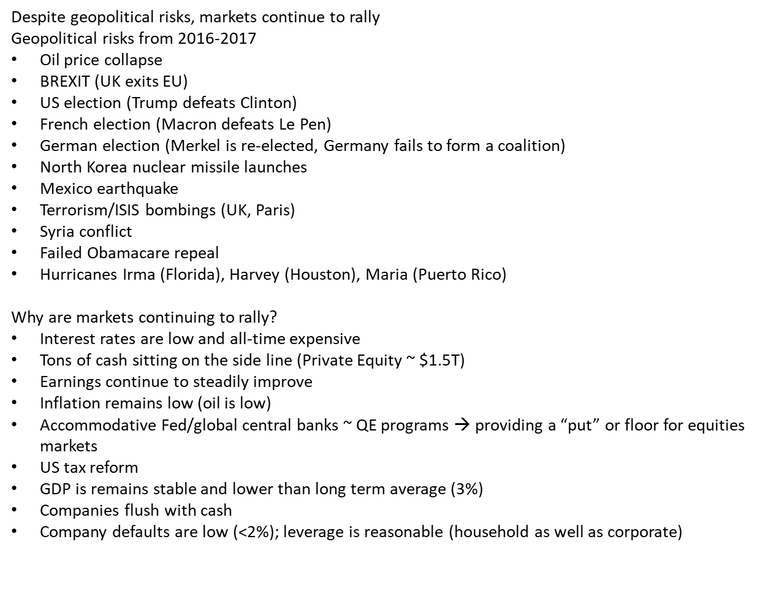

o Geopolitical risk has not destabilized markets… yet.

o Tax reform impact

o global trade optimism is high and stable.

o geopolitical risks that have happened and despite that, markets remain exuberant.

o And If correction were to occur, we should look to rotate into active strategies.

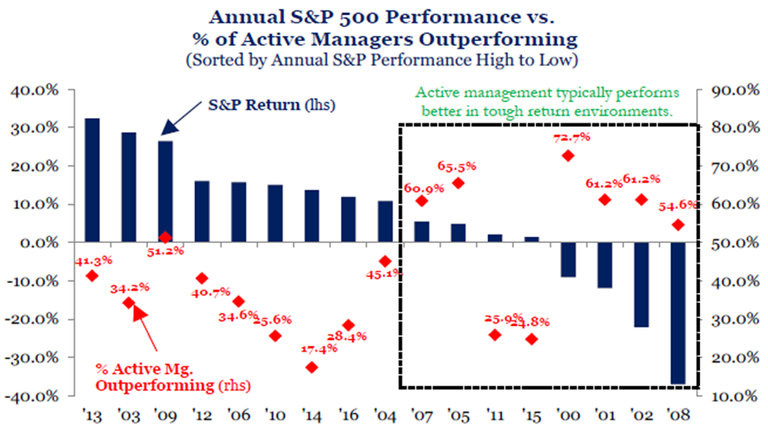

o In down periods, active has done a better job of protecting than passive. The below chart shows how Active strategies tend to do a better job in down markets. Unfortunately, we haven't seen a down market since 2008....or the 2015 was more of a slight hiccup. People have short memories.

• Theme 4 – inflation is still low.

o Look for opportunities that are cheap in the real asset space

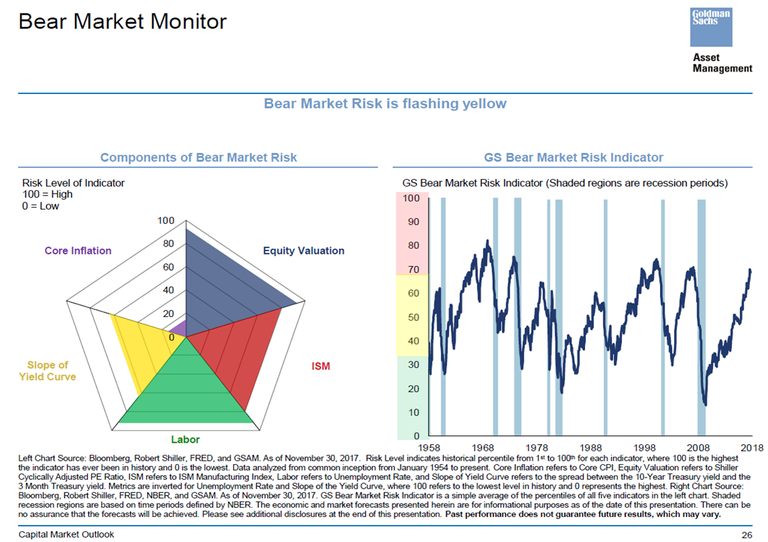

o Chart shows a Goldman Sachs chart that shows that for a recession to occur, all 5 indicators should be at elevated levels. Here we see that one of the key missing items is Inflation. Which in GS’s opinion tends to delay/mitigate concerns about a pending recession.

o Excessive wage growth is a leading indicator of a potential recession. “Growth in average hourly earnings of 4% often precedes recession. Today, we are at mid 2%.

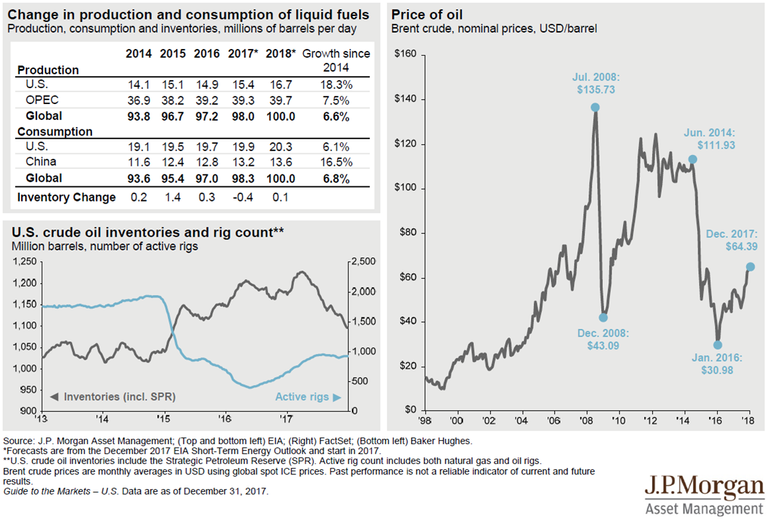

Oil has bottomed out and now starting to rise.

o Commodities as being unloved and cheap. Interestingly, Jeff Gundlach, from Doubleline who has been an great predictor of various events (he predicted that Donald Trump would be president, during a period which seemed very unlikely), has stated that he believes that Commodities are poised to be one of the best performing asset classes this year, but is also a leading indicator of a recession, as commodities tend to be bought during a late market cycle, before a recession.

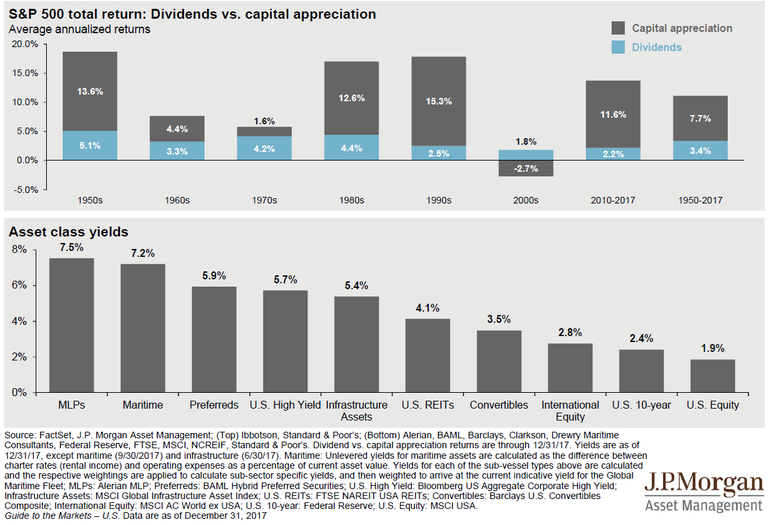

• Theme 5 – Income is King

o Pursue strategies that have more income in the return component

o With an income focus, it helps transfer some of the risk of a market equity price correction, which could happen this year.

o Focus on identifying Private credit; preferred securities; direct lending opportunities.

o With yields now low in equities and debt, we need to look at alternative asset classes.

o Preferred equities (Cohen and Steers have a interesting fund), and other income oriented strategies are attractive right now.

o Focusing on income helps mitigate risk in the sense that we are able to not only find strategies that meet our payouts but as well as distribute income so we can mitigate our risk. Income oriented strategies tend to have lower correlations to equity markets

Key Takeaways:

• Still too early to take off risk in your portfolio.

• The Recession/correction that everyone is waiting for is still 1-2 years away. Look for leading indicators in the credit/high yield market to be a barometer of when that will happen.

• Look for inflation to pick up before a recession begins. Right now inflation is very benign (<2%). The Fed will be concerned when inflation hits +3% ~ 4%. Until that happens, we have time

• Wages are still very low. If you’re focusing on inflation, focus on wage inflation. Until that picks up, we are safe.

• Equities are attractive, don’t sell everything. If you want, feel free to trim a little but know that this year might be another strong year, like 2017….not as strong as +20% but could be in the +10%. Through Jan 26th, the market is up +6% already…

• In order of best returns, I think 1) Emerging market equities, 2) Japan and Europe, 3) US and 4th UK/Great Britain.

• Within Emerging markets equities, have a focus on China, India, and small cap companies. Look for ETF/Mutual funds that give you exposure to emerging markets countries that will benefit from a weaker US Dollar. And can give you exposure to the local onshore consumption story. E.g. Look for China’s equivalent Johnson and Johnson and Nestles. Look for Brazil’s equivalent of General Mills and Krafts. Look for Indonesia’s Beer manufacturer (like Imbev/Budweiser). With emerging markets, the story of neglect the last several years is the lack of earnings from smaller companies. That trend has shifted back. Smaller companies are seeing local consumers come back to the market and buying local goods. That will be positive for emerging market small cap equities.

• FIXED INCOME/Bonds are going to be challenging to generate a positive return (like last year)…which benefited from 30 yr bonds that performed very well (+11% in 2017). The yield has declined for the long end and might remain there for awhile but it has a probability to see 30 yr yields to rise, which can hurt all fixed income bond holders.

• Bank loans / leveraged loans might be a good substitute for high yield (where due to the floating rate nature of the bank loans, that could help generate 3-4% returns as interest rates are poised to go higher)

• Buy cheap commodities. I’m specifically looking to add MLPs and Commodity equities that have not moved in line with the commodity futures. Those firms are also going to benefit from the tax reform.

• US tax reform that was approved in December has not officially trickled into the US economy yet. Firms are still working through the implication. I think it will benefit the US economy. When one says that most of that has been priced in, the is probably 50% true. Why? Because we haven’t see the earnings come through yet. A corporate tax rate that moves from 39% to 25% is a material impact on small companies. I think Small caps will do much better this year. Someone mentioned that the last 7-8 years of this bull market was driven by consumer (where the economy now is 70% consumption oriented and is the highest that has ever been) but with the tax reform, we believe that the companies are poised to take the baton from the consumer and see companies increase CAPEX (capital expenditure) and ultimately lift earnings which will further lift equity prices.

• I’m currently 80% equities (with big slugs to emerging markets) and 20% income generating vehicles that are yielding me 12% of income. My portfolio last year generated me 25%. Not too shabby.

• Good luck out there and happy hunting.

Follow Me @epan35

Reply (with a good comment) and Upvote and I'll return the favor! I need Feedback!

u got some great info here, i will follow for sure . i love crypto world

Thanks.

You mentioned 80% equities, what was the remaining 20%?

good question, mainly Private Credit strategies. Hard money lending funds that are backed by real estate properties. Its been a good space. I've averaged about 12% (annualized) yield paid out monthly.

That's impressive, nice job!

Managing digital assets like crypto through hedge funds if you are a big investor or buying ETFs or Index fund designed using cryptocurrencies from the reputed asset management firm would be a safe bet for investors who do not have stomach for the huge market fluctuation in cryptocurrency world. But in any case, for more mature investors who do not like day trading and do not want to follow the bitcoin news daily, it worth putting at least 10% of your investment in cryptocurency either using hedge fund or through index funds.

Nice! I am Investment Blast. Check www.investmentblast.com. Twitter @investmentblast. #upvoteforupvote

Very thorough and well written. Thank You so much for all the info. My portfolio gained 12% in 2017 from Index Funds that were 80% equities.

I am now CDA more into them this year. Thanks to your post I feel more confident for 2018.

I would love it if you would share your insights into altcoin asset allocation in a post. I really like your writing style as its simple to digest!

Thanks #tradrhacks. I'll try and tackle that request some time this year. I feel I still have a lot to learn about the top 15 ICOs first. But once I have a better grasp, I definitely plan to roll out a Asset allocation model.

it is always a nice step to invest for the future...

That's cool I'm in Sherman oaks ca. Steemit all the way. Great post tnx for sharing I just upvoted.

Check out my new posts if you can plz

upvote resteem comment @gclipse