I just read this great article on investing (in cryptocurrencies) via https://www.cryptocoinsnews.com/boring-investors-guide-cryptocurrency-investing/. I think it really hits the nail on the head how this market works. I didn't write it myself so I hope I don't offend anyone by copy pasting this below.

What are your thoughts?

“If investing is entertaining, if you’re having fun, you’re probably not making any money. Good investing is boring.”

◤INVESTING

Talking about lambos, yachts, and moon-cheese is fun, but it probably won’t make you any money. What will make you money is thinking about investments like a good investor.

When I say, good investor, I don’t mean day-traders or swing-traders. There are a few consistently profitable day-traders out there but they are rare, even more scarce when you consider those with sustainable profits over extended periods of time.

When I say good investors I don’t mean people who’ve had a good year in a bull market. When I say good investors, I’m talking about individuals who ask certain questions. Asking certain questions can lead to investments that perform consistently well, sometimes over multiple decades.

According to BCG (Boston Consulting Group), “from 2010 to 2015, the number of millionaires in the US jumped by 2.4 million. Another 3.1 million will be created by 2020, at the pace of 1,700 new American millionaires every day.”

Investing in cryptocurrency will probably not make you the next Warren Buffet, Charlie Munger, Carl Icahn or some other billionaire magnate. However, by being sensible, asking good questions, and being educated with your investing decisions, you will significantly increase your chances of accumulating wealth. You might not become a billionaire overnight, but you sure as all heck can become of those many millionaires.

The questions below aren’t a secret, but like most people, you probably don’t think about them when investing. And the truth is, we tend to not think about them because they’re kinda boring. Boring because they require effort, work and more thinking than you’re usually used too. The secret then, is to actually ask these questions, and seriously weight their answers before making investments.

◤THINGS TO THINK ABOUT BEFORE INVESTING

◹THE PROBLEM

What problem are they addressing? Why is it important to solve this problem? How important is solving this problem?

◹THE SOLUTION

What is their proposed solution to the problem? Are there other solutions to this problem? Why is this solution better than other solutions at addressing the problem? Has the solution been explained clearly and succinctly? Can you describe the solution in simple words? Is this solution live and usable?

◹THE TEAM

Can the management team implement this solution? How does their previous experience relate to the opportunity? Why are they qualified to implement this particular solution and deliver it to market? What is missing from their team? How “hungry” is the management team?

◹THE MARKET

Is the market large enough to support substantial growth? How large is the overall market? How large is the market segment being targeted? Who will be the customers? How will they get people to use their product? Why will people use this product? What do people use now? Why will people switch from their current product?

◹THE COMPETITION

If there are existing competitors, what will they do? How is their solution/product differentiated from the market? What technologies may compete with theirs in the future? What is their unique value proposition? Are there any barriers to entry that will make it difficult for competitors to enter this market? What will new entrants to this space do? How will this team respond?

◹THE BUSINESS

What is the business plan? Why hasn’t this opportunity been taken already? How much money do they plan to raise? When do they need this money? Why do they need this money, and how exactly will this money be spent? How quickly can this be implemented?

◹THE RETURN

Investor’s want to see a return on their money, has this been addressed by the management team? Are there appropriate incentives to potential investors?

◹TRANSPARENCY

How transparent is the management team? Has anyone ever seen their product? Do you know how their product will work or is it vaporware? Do they have a github where people can go and check their code, smart contracts, etc? Does the team have a Slack channel where you can go and talk to members of the team? How responsive is the team?

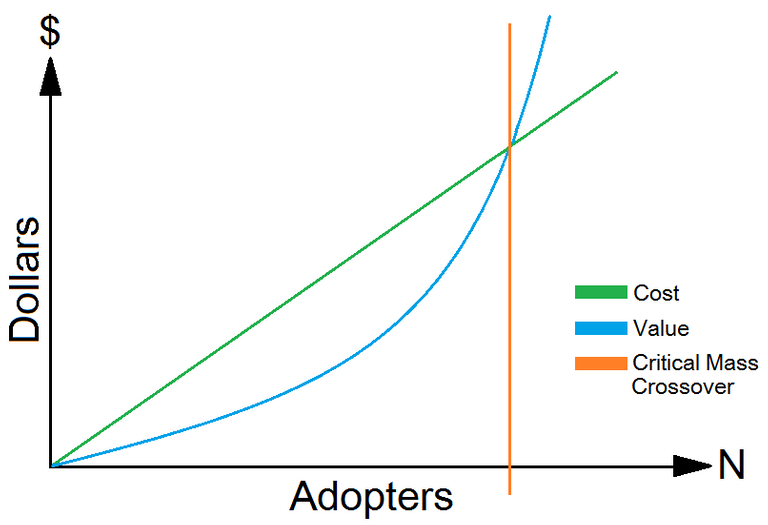

◹LIKELIHOOD OF CRITICAL MASS

This is referring to Metcalfe’s law. Metcalfe’s law states that there is a critical crossover point where the value of a network grows more than it costs to acquire the next new user. This is also sometimes called the network effect. In other words, as more people use this product, the more useful this product becomes (phones, the internet, Facebook, etc). In competition, Metcalfe’s law is useful because once a product has critical mass, it creates a barrier for new entrants which makes it really hard to compete with the product. Does this product have the potential of achieving critical mass?

◤IN SUMMARY

I hope you noticed that there are a lot of questions to consider. I hope you noticed how silly it is to make investing decisions on the fly. I also hope you realized that while this seems tedious, it is not out of reach. Most of you are new entrants riding the bull wave, seeing double and triple digit returns, feeling like enigmatic mavericks of the internet. And the truth is, I think you guys are onto something. Cryptocurrency is a cool and exciting space, and you are its pioneers.

The realm of cryptocurrency is speculative, but you can make it more of an investment by asking the right questions. If you’re going with your gut and looking for information to confirm your feelings your going to have a bad day.

So in closing, try to be more diligent. Those of you that do, will thank me for it later.

A very good read, keep it up.

Dont forget to check out my post for a linck to collect free crypto..a once in a life time opportunity

True, also I noticed risky trades mess up with my sleep, regardless of if I'm winning or losing. It really took me some time and lots of sleepless nights to find I strategy that feels safe enough to allow me a good night sleep and lets me make some profit in the mean time.

Good points in the article but in this market, all boats are lifted by the tide.