Everything you do Is An Investment!

There are many types of investments, however, at least 80% of people who do invest normally act on their emotions in accordance with their likes/dislikes which can lead mostly to losing your capital.

Just like the different types of investment, there are various reason why you may want to invest your hard earned capital or maybe just your time/thought.

We shall cover some of them now.

Reasons To Invest

I would personally say that the most common reason, is to change ones financial status thus giving you the time to focus on the things you are most passionate about.

- Inflation Hedge “Inflation Will Always Eat Away At Your Fiat”

- Retirement Fund “Low Risk Investments”

- Passive Income “Make Your Money Work For You or Not”

- High Risk/High Reward “Life Changing Investments”

So these are for me the main reasons why you may invest your hard earned capital.

Most people in my eyes, realise the life changing potential in investing just have no idea where to begin.

Ways To Invest

As mentioned above there are various ways to invest your money.

- Stocks/Bonds/Commodities/Funds “SNP500”

- Real Estate

- Cryptocurrency

Stocks, Bonds, Commodities

There are literally tens of ways you can invest in these instruments, generally you sign up to a “Broker” or an “Exchange”, through these two methods you can invest in pretty much any publicly traded company or put some bonds, commodities into your portfolio.

Typically if just investing a small % of your earnings, you would want to “Cost Dollar Average” into them, so buying a set amount each time you got paid.

To do this you would need to sign up to an exchange such as “Etoro”, no doubt many of you have seen their adverts, you can also use them to buy “Cryptocurrency” or “Commodities” but we will get to that later.

There are some world class companies/products that you can invest in when it comes to the stock market, however, for me personally I do believe that the stock market is way over valued.

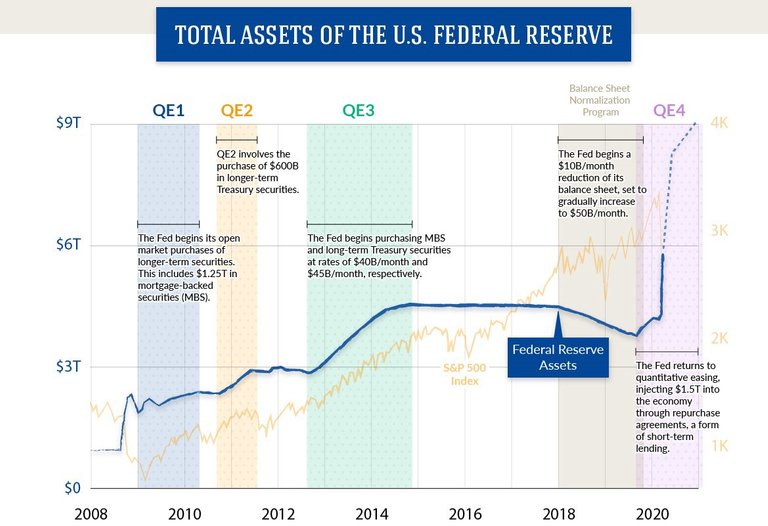

If you look back through history, a correlation between the “Federal Reserve” printing USD and the SNP pumping is quite apparent.

Meaning this graph below has only grown since April 2020 plus factoring in that there may be another stimulus deal heading for the US.

This economy is unsustainable and eventually will bust, this sucks for those who hedge their bets with “Stocks”, however, this opens up great opportunity in other assets.

This was taken from an article back in April of 2020 from Visual Capitalist.

Maybe you can see why I do not have much faith left in this outdated system where money is essentially worthless and that it can be printed anytime the central bank likes thus making it completely worthless.

The only thing that really keeps it relevant is the fact that billions of people “believe” that it is exchangeable for goods “anywhere” in your country and now days even outside.

Investment wise, you want to make money maybe not short term but long term at least, if you are simply trying to protect your wealth from inflation well then you need assets like Real Estate, Cryptocurrency and precious metals like Gold.

Precious metals such as Gold, Silver and others have always been a way to protect your wealth, if the economy or markets are looking bearish and bleak well these gave you way to exit to save as much of your “Fiat” wealth as possible.

Now as we move into an age where space travel is ever more expected, along with various private companies working out ways to mine asteroids and explore the solar system, this leaves the question to be asked.

What happens if we find trillions worth of precious metals plus metals you can’t find on earth? Essentially our current safe havens become worthless once again…

So we must be cautious over the coming decades about how safe precious metals are and our current financial system which is already outdated, it is only a matter of time before we can pick a comet/asteroid and then bring its contents home with this comes massive changes to society.

Real Estate

The age old investment in “brick and mortar” is still one of the most popular and strongest investments when it comes to storing wealth while being able to flip a profit if using the right strategy.

Plenty of billionaires buy property in cities like “London” “New York” and various other wealthy places because they know, the value of that property will no doubt continue to increase.

Houses around London have done nothing but go upwards, even with the recline in 2008, properties are easily worth double what they were before 2008. Houses that were around £200,000 are now worth £350,000 upwards depending on the location.

If you look at the luxury properties in London they have added millions to their evaluation even through all the Brexit situation, the properties there still remain some of the most expensive places to own in the world.

Generally this investment means two things for the everyday person like you and I, either you worked your arse off from a young age to really hustle and get the initial deposit for your first place then worked up from there or….

You are in debt way past your eyeballs and if anything interrupts your schedule to pay that mortgage on time you are bust. Now this is not ideal however, many people get into property this way.

They have a mortgage and get close to paying it up, they re-mortgage to buy another place in the hopes to sell for a nice profit in the short term or they buy to lease which means they take out another mortgage then rent that out to a professional who can pay the rent which covers the monthly payments on the property so it really is a game of “relying” on people to do the right thing.

Photo by Tierra Mallorca on Unsplash

Photo by Tierra Mallorca on Unsplash

For me personally is not a good way to do business or a good way to make money, hoping other people pay your bills is risky.

I would prefer to buy the property then sell however but the market has to be right or your property has to be in the right location so this takes some knowhow and most importantly the funding to do it.

This can take years and be a extremely costly learning curve so make sure you put in the time to learn!

Personally a smart move in “land” ownership would be to buy a patch big enough for a 3 bed house somewhere near a thriving city then wait 10 or even 20 years, eventually the government or a private developer will offer you a silly sum to build there potentially paying back 100x what you paid.

Quite a few people in England who bought land after the second world war and up to the 90s have now sold that land for millions more than they bought it.

Cryptocurrency

This is an extremely volatile market, you could go 100x then go 100x DOWN… in the matter of hours so it requires patience or nerves of steel.

As proven over the last decade “Bitcoin” is the best performing asset you could have owned.

For those who got into Bitcoin all those years ago would have either spent £to get hundreds or used their laptops, PCs to mine it which back then it came in the hundreds/thousands to the point where one guy spent 10,000 BTC on two pizzas… WOW…

Now those 10,000 Bitcoin would be worth £98,171,400, that is costly dough.

Regardless of this, it showed this could be used as a medium of exchange eventually leading to now where millions of people own Bitcoin, going from just a handful of coins/tokens to now having over 3000 projects in this space.

Just like the traditional financial/technology industries, Crypto aims to solve many problems around the world, in an attempt to further our advancements within various industries like Gaming, Politics, Finance, Automotive along with others.

Fundamentally the technology which enables “Cryptocurrency” is revolutionary and has already impacted the financial sector mostly but now we see it slowly branching into gaming plus others.

This technology is called “Blockchain”, its other name is DLT “Distributed Ledger Technology” which is a decentralised database maintained by a unknown collective all working together to keep the network thriving.

This provides various benefits so from an investment standpoint has some great potential with the right research.

Coinbase Cryptocurrency Exchange

Things You Need To Know

There is a saying in Crypto, “Not your keys, Not your Crypto!”

This means that using an exchange or a third party provider to store your “Cryptocurrency”, you do not control this, so at anytime that company could easily restrict your access to the platform even take your Crypto and lock you out.

So you should definitely do your research and make sure you have the correct wallets to store that in, so you remain in control and in full ownership of your investment.

Two wallets that have always been highly spoken of in the Crypto sphere is “Ledger” and “Trezor”, you get various types of wallets, however, hardware is more than likely your safest bet when it comes to protecting your investments.

It is also extremely important to remain sensible with your Crypto, you will see plenty of “Too good to be true” offers such as “Send me 0.1 ETH and I will send you 3 ETH back”, these are just scams so make sure you know where you are sending your Crypto!

This Not Financial Advice or a speculative article but its purpose is intended to help educate those who have never invested in understanding the different ways they can invest their money/time.

If you enjoyed my article, it would be appreciated if you would be so kind to leave some "Claps" on the original medium post of mine :) Thank you in advance if you do!