I certainly believe as well as others that at some point countries around the world in particularly western countries shall be going through a depression, recession or worse.

Although I fear the worst, I sometimes can't help wonder. Will it be as bad as I think it will be?I don't know.... what I do know is that I shall be positioning myself to profit from what is to come.

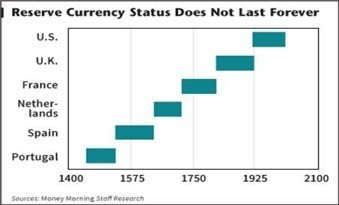

Throughout history time and time as you can see from this chart

The world reserve currencies of the last 600 years only last on average 45 years. Ever since the United states declared bankruptcy in 1971 coming off of the gold standard, a sand timer has been set and a count down ticking to the day that the US dollar is no longer used to facilitate international trade around the world to be and replaced by contender more than likely China or Russia and other countries whom are both increasing their gold holdings and encouraging their citizenry to do the same to protect their wealth through gold ownership.

Each and every time this happens, a wealth transfer occurs and guess what? There are always winners and losers in such a scenario. Now the winners will be the individuals who thought rationally about the whole situation, who assessed the situation and took steps for the betterment of themselves. Investors even before the Weimar Germany hyperinflation took place saw the writing upon the wall and made out like bandits. Whilst their counterparts were wiped out with nothing to show for their savings and hard work with except Monopoly Money. Which in times of crisis doesn't exactly put food upon your table.

To ensure you'll prosper. Down below I've outlined what you can do to ensure you get out on time through these perilous times.

Precious metals and gold and silver stocks - Due to Gold and Silver being a a historic crisis hedge during times of crisis, you need to shift your apart of your portfolio. Do know that it is based upon personal financial circumstances. But 10-20% would be fine. My favourite company in the space is First Majestic Silver and Goldmining that are both gold companies with lots of potential.

Stocks - position yourself in companies that are very cash flow positive and a low P/E ratio, low P/C.F. ratio, sales to price ratios. Invest in upcoming trends that are guaranteed t such as Solar Window which is a company looking unveil a spray on solar panel with a break even rate of 1 year compared to 5 off traditional panels today.

Commodities are very hot right now and are very good for long term plays.

30-40% networth

Compound Your net worth with use of dividend companies.

Land and Real Estate - "Buy land, they aren't making anymore of it" said Mark Twain and the saying rings true today. I don't believe It can put any other way.

20-30% is a sufficient allocation within your portfolio.

Cash - The ticker CASH is a core part of a portfolio as it allows you to be liquid. You're able to take advantage of opportunities that arise on the way to success. Cash allows you to buy assests at fire sale prices when the need arises.

Cryptocurrency - investing in world class projects. Micro-payments would be a leap forward from the current payment system we have today. Coins that are focusing upon making privacy paramount shall be one of the runner ups in my opinion.

10% would be sufficient for this up coming asset class.

If you thought this information was valuable in any way. Then.......

( )

)

To Follow and Resteem if you feel this post was beneficial to you!!

Happy Steeming

Good points. You are right about buying commodities. Oil isn't going away. Everywhere I look I see gasoline fueled cars. What are your favorite crypto currencies? I think speed is also critical with crypo currency. For example, Litcoin runs four times faster than Bitcoin.

No it isn't going away right away but i would like to argue it shall be going away at some point in the distant future. So oil isn't the place to be low term that is unless it's a satellite company and everybody needs to use to get things done like KNOP . The shell CEO has actually recognised that there is a transition taking place and it could very well be left behind and/or non existent. Speed is one component yes but not the end all be all. Like the world survived on Windows 90 0___o but it does ease the process of adoption because of quick settlement. Which is why banks are entering he space. i am looking at a privacy coin i did highlight my favourite one in the space if you run through my blog called Cloakcoin i wrote a piece about it.

if you like my work i'd also greatly appreciate a follow for the hard work :D

http://www.dailymail.co.uk/wires/reuters/article-3606900/Shell-CEO-warns-renewables-shift-spell-end-swift.html