Hi Hive Community,

I just started my financial planning journey a little over a year ago. I am a 24-year-old and started my first full-time job in February 2023. I have only had side jobs beforehand that made me a bit of money every month to be able to invest besides my basic cost. This allowed me to invest well over 12k (75% in crypto and 25% in stocks/ETF's). However, the moment I started my full-time job, I also moved out of my parent's home so I obviously have more expenses at the moment.

I am now trying to find out what would be the best way forward with regard to financial planning and investing. The big question is: do I put all of the money I made from selling off my crypto portfolio into stock or do I buy real estate?

I am able to save 25 to 30% of my net income, but I need to first save up to create an emergency fund. My goal is to build an emergency fund of 10.000 euros, which would mean that the emergency fund could last 5 months of the total monthly expenses. I live together with my GF and she also has a full-time job, so I would be able to support total job loss for her and myself, even though the chances of that are very slim. We both have a degree and the job market is booming where we live.

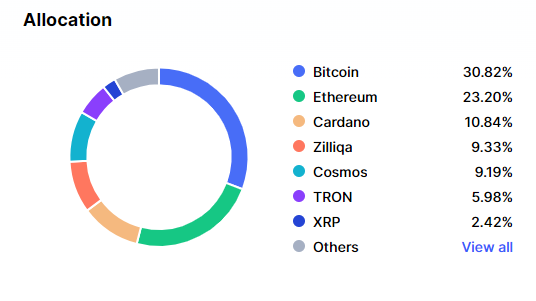

I am now investing a mere 200 euros each month, due to my goal to save up the 10.000 euro emergency fund. I still have a 75% to 25% crypto-to-stock portfolio, even though I have invested in crypto only in the past few months. The recent downturn of the crypto market has impacted my portfolio quite a bit, but I am not worried. I strongly believe in the cyclical movement of the crypto market, so I am expecting my portfolio to grow again strongly in the future. Once the crypto market will reach ATH again, I will be selling off my entire cryptocurrency portfolio. I will continue to load up the bag with crypto until that time comes... if it ever does obviously ;).

What would you do in my position? Investing the money I will make from selling off the crypto into the stock market or buy real estate?