This crazy video clip from the National Geographic TV Show, Brain Games, illustrates how random behaviours can become social norms through our human tendency to conform.

Conformity is a social influence where the desire to fit in with a group leads a person to change his or her beliefs or behaviour. This inclination to mimic the group leads people to think or act in a certain way without first establishing a rational reason why.

The girl in the video had no reasonable basis for why she kept standing up at the sound of the beep. She was simply going along with the crowd. She saw everyone else doing it and figured the crowd must know something she didn’t, so she followed along.

It’s important to note how she described her decision to continue standing up: “Once I decided to go with it, I felt much more comfortable.” She made a decision based on her unconscious desire to conform to the group, and then that decision, together with the ongoing example of the crowd, provided reinforcement, and made her feel like it was the right thing to continue doing.

The meaningless behaviour became so ingrained that she was able to influence other unsuspecting people around her to conform. She transferred her random, irrational behaviour to the newer members of the group, who also wanted to fit in.

What does conformity have to do with investing?

I mentor property investors in Australia, a nation that has one of the highest median home prices in the world. The average house in Sydney costs about $1 million. That's about 12 times the median income for the city. In Melbourne, you can expect to pay about $750,000 for a home, or 10 times the median income.

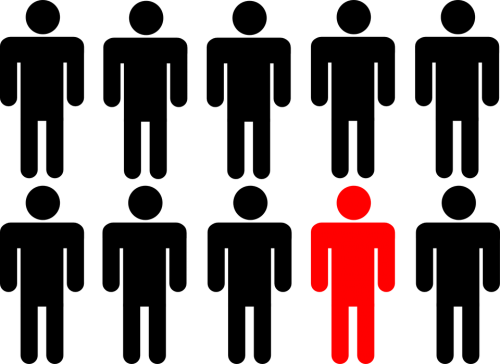

In investor psychology, there’s a dynamic known as “herd behaviour.” It’s a mindset characterized by the lack of individual or analytical decision-making. People think and make investing decisions based on what they see or hear other people are doing. Quite simply, they subconsciously conform.

The herd mentality says, “This many people can’t be wrong.” People tend to gravitate to the same or similar investments, simply because many others are also buying those assets or using that strategy.

Is it possible that similar forces have subconsciously shaped the way you think and act as an investor?

One of my biggest jobs working with property investors here in Australia is to keep them from doing dumb things with their money. In fact, one of the first tasks I have with people is to help them unwind some of their previous unwise investing decisions.

Why Australian Real Estate is So Expensive

Real estate is so expensive here in Australia for several reasons, but at the root of it all is investors conforming to the crowd.

Aussies have a love affair with real estate.

According to the latest survey from National Australia Bank (NAB), investors are responsible for nearly 40 percent of total demand in the residential real estate market. Because homes are so expensive, and first homebuyers often can’t afford to own where they want to live, many choose to “gain a foothold in the market” by renting where they want to live and buying for investment in a less expensive area.

Aussies tend to believe that all real estate will always go up in value.

I often hear Australians say something like, “It doesn’t really matter where you buy; you’re going to be fine in the long run.”

It’s been 25 years since this nation has experienced a recession. We call ourselves, “the lucky country.” Anyone under 45 has only ever seen home prices continue to rise, year after year. The crowd believes that the housing market here is immune to declines in value.

Thanks to this flawed mindset, and herd bahaviour, I come across investors regularly who have recently borrowed against the equity in their home or other investment properties to use that cash as down payments for more real estate purchases.

Why not when real estate only ever goes up in value?

Aussies are leveraging up massively to continue speculating on capital growth.

I know from talking to hundreds of investors that many homes are purchased here because people feel left behind if they’re not buying investment properties. It’s not uncommon to hear people talking at social functions or dinner parties about their latest rental property purchase. They throw around investment advice like professionals, pointing to their unrealized gains as evidence of their prowess.

Because of this herd behaviour, Australians are some of the most indebted people in the world. The Bank for International Settlements just released its latest global update on household debt and guess who’s at the top of the list? You got it; the land Down Under.

Of the 44 countries surveyed, Australia has the highest ratio of household debt to GDP in the world, at 125 percent. That makes us one of just four countries where households owe more than one year's worth of their total economic production.

The vast majority of the increase in Australia's household debt over the last few years has been driven by growth in home prices. How do we know? Back in 2012, our household debt level was at about 110 percent of GDP, and that was still relatively high. Since then, real estate around Sydney and Melbourne is up about 40 percent.

This current pace of debt growth is certainly unsustainable, and soon, something will have to give. The crowd is putting a lot of faith in our central bank to somehow orchestrate a measured slowdown. Actually, they probably don’t even understand the RBA’s roll in driving home price growth. They’re just happy to be saving money on interest payments.

Aussie tax benefits justify irrational conformity to the crowd.

According to the 2012-13 taxation statistics released by the ATO, of the nearly 1.9 million landlords in Australia, 1.26 million of them recorded a loss on their rental income. This adds up to two-thirds of all property investors losing money each and every month by holding onto real estate.

In Australia, we call this strategy negative gearing, and it’s one of the prime examples here of herd behaviour. Yes, believe it or not, it’s common practice for real estate investors in Australia to intentionally lose money in hopes of capital growth.

If you’d like to learn more about negative gearing, you can read an extensive article I wrote about it here for PropertyInvesting.com. In a nutshell, it’s a strategy where property investors purposefully incur a cash flow loss in order to write off that loss against their personal income.

The crowd believes the ultimate benefit will come through the capital growth of the property. Negative gearing is simply speculation that the future capital gain on the asset will eventually amount to more than the annual income loss, which can be justified in the mean time through the tax benefit.

These investors who negatively gear are completely at the mercy of the market. This is gambling, not investing. Just like at the casino, sometimes investors win with negative gearing, and sometimes they lose big. It just so happens the casino has been very generous the last few years.

How Successful Investors Win

John Templeton was one of the wealthiest investors of all time and gave away over $1 billion to charitable causes throughout his life. I’ve written about him here on Steemit a few times before.

He had a knack for creating wealth by ignoring conventional wisdom. He made $86 million shorting NASDAQ stocks before the March 2000 crash. When everyone was bullish and buying, he foresaw the carnage that was to come.

Here’s some investing wisdom from Templeton:

“If you want to have a better performance than the crowd, you must do things differently from the crowd.”

The most successful investors ignore what’s commonly considered to be conventional wisdom, and instead chart a different course.

What do you think?

How does conformity and herd behaviour shape the world that we live in?

How could non-conformity make the world a better place to live?

@jasonstaggers

Image Credits: featured image, following the herd, trust my gut, John Templeton

Try not to conform but hard not to sometimes.

Up voted and following.

Very true. In fact, I'd go so far as to say it's impossible to avoid conformity at some level in our lives. It's deeply ingrained in who we are as social beings.

I think the answer in part is to try to think about the reason why we do what we do and also try to spend time with the right people, rather than those that will lead us off course into unwise behaviours. But yes, it's easier said than done.

Thanks for the follow :)

People purchasing real estate here in the United States are very irrational as well. I was surprised to see how much debt there is per household in Australia.

It is crazy. And the debt levels are still growing here as people can't imagine a scenario where real estate goes down in value.

Great post Jason! Btw, I think that China also has a love affair with Australian real estate ;)

Haha! Very true! Chinese investment here has been ridiculous although it's starting to decline. It's tougher for them to get their money out of China, the banks have tightened up on foreign investment lending, and the States have increased taxes and regulatory costs for foreigners. It's all a show really, to give the impression that they're doing something to help the little man. It's easy to throw stones at those damn foreigners.

Thanks for stopping by :)