This past week brought some bad news with it. My wife has been stood down from her work while this virus situation is worked out which makes us a single income household. I mentioned this in a previous post however it's unlikely that anyone read that post given its' poor performance. And this is fine. I don't have much of a following here and I don't write with the expectation that every little creation of mine results in lots of votes and attention.

But back to the topic at hand; so with a decrease in income, re-creating my investment portfolio becomes slightly more challenging, but I'm still going to make it happen, even if I only start very small.

So where should I put my limited funds?

Most of my investment experience is in the Australian stock market, so I am most comfortable playing in that arena. I've done OK with my investments the stock market previously, so it's a natural place for me to gravitate to. So this is where I'll put my available funds for the time being.

Diversifying into different investment options in the future is certain, especially in regards to the property market, however for the time being, I'll keep things simple.

So many companies, which ones to choose?

I tend to prefer stocks that pay some sort of income, or dividends for those who have some experience in this world.

Dividend paying stocks are attractive given that you can either set the dividend payments to be re-invested (you essentially get free shares with the company that you have chosen to invest in) or you can receive your dividends in cash, and then choose what to do with those funds yourself. Dividends are, in many cases at least, paid every 6 months. But this can vary from company to company.

When growing my investment portfolio, I tend to choose a share that has a high dividend yield and then immediately set the dividend payment to re-invest. This way my investment becomes a compounding one, which continually grows with the dividend payments growing every 6 months and cushioning a falling share price should the market be performing badly.

Which companies then?

So right now (in Australia at least) my preference is bank shares and telecoms. My first step back into the stock market was with ANZ, which is one of "big 4 banks" in Australia. My reason for purchasing ANZ is that they have the highest dividend yield of the top 4 banks and also because I have invested with them previously so know quite a lot about them as an organisation. As you can see here, a dividend yield of 9.66% is quite attractive. And the recent dip in share price has taken the price back below 2011 levels. So once we start seeing a recovery in the coming months we should see some good capital gains.

As you can see here, a dividend yield of 9.66% is quite attractive. And the recent dip in share price has taken the price back below 2011 levels. So once we start seeing a recovery in the coming months we should see some good capital gains.

It doesn't all have to be about dividend yield though

A good defensive share is always attractive as well. And by defensive, I mean shares with a company that is designed to withstand the current economic disaster that we are experiencing while offering some potential for growth as well.

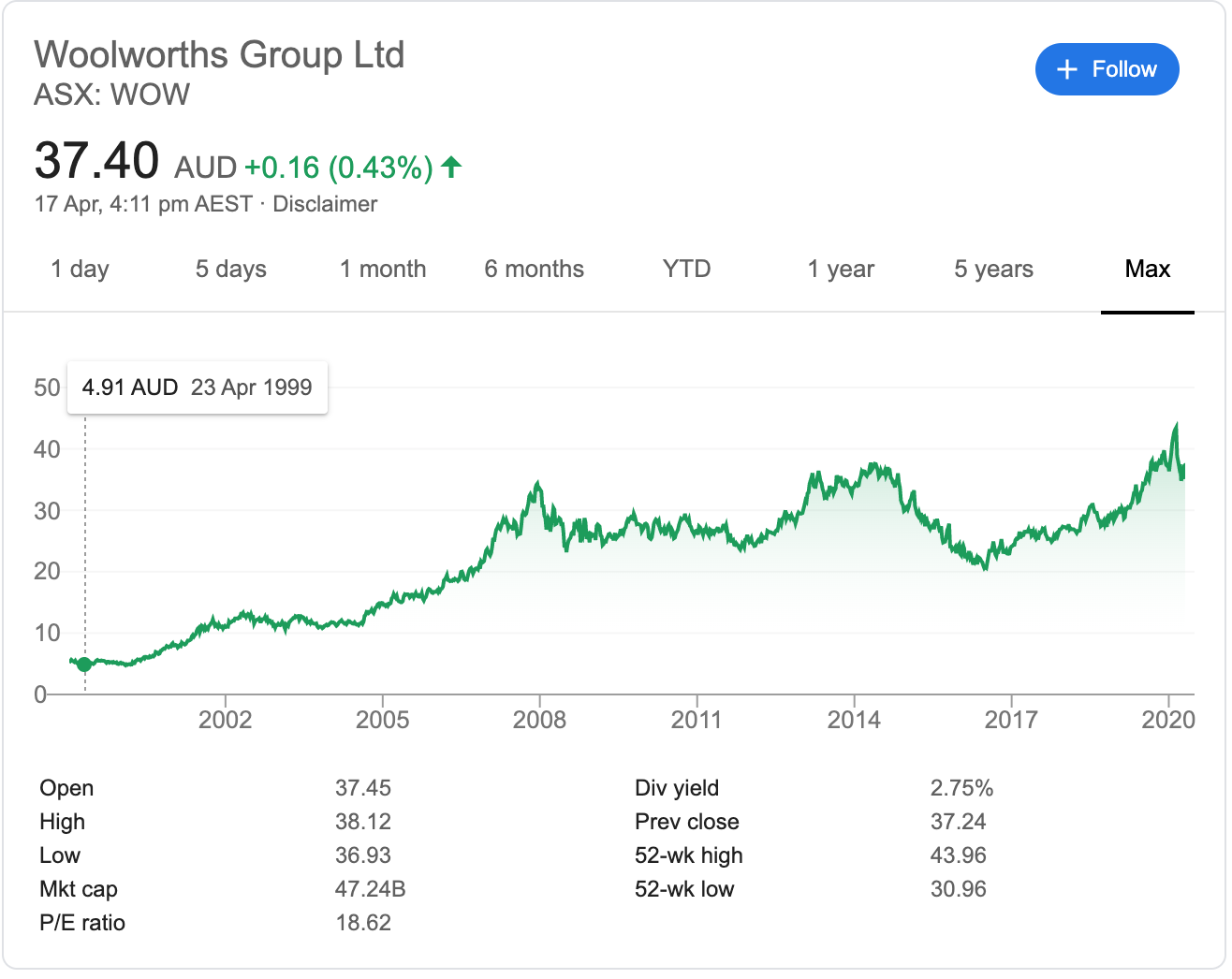

The second share that I purchased is with one of our major supermarkets here in Australia - Woolworths (WOW). This company has barely seen a dip in price during these times for the simple fact that their revenue has seen quite an increase, and people will always need to shop for groceries, regardless of how long this virus lingers for.

This company has barely seen a dip in price during these times for the simple fact that their revenue has seen quite an increase, and people will always need to shop for groceries, regardless of how long this virus lingers for.

Conveniently, WOW also pays a moderate dividend. So, while I mainly purchased this share for capital gains (I bought in at $35 and saw an immediate gain here), the regular dividend will also be reinvested to continually grow the value of my holdings.

Future investments

Once I have more funds to invest I have plans to either increase my holdings in the companies above, or purchase shares in the following companies:

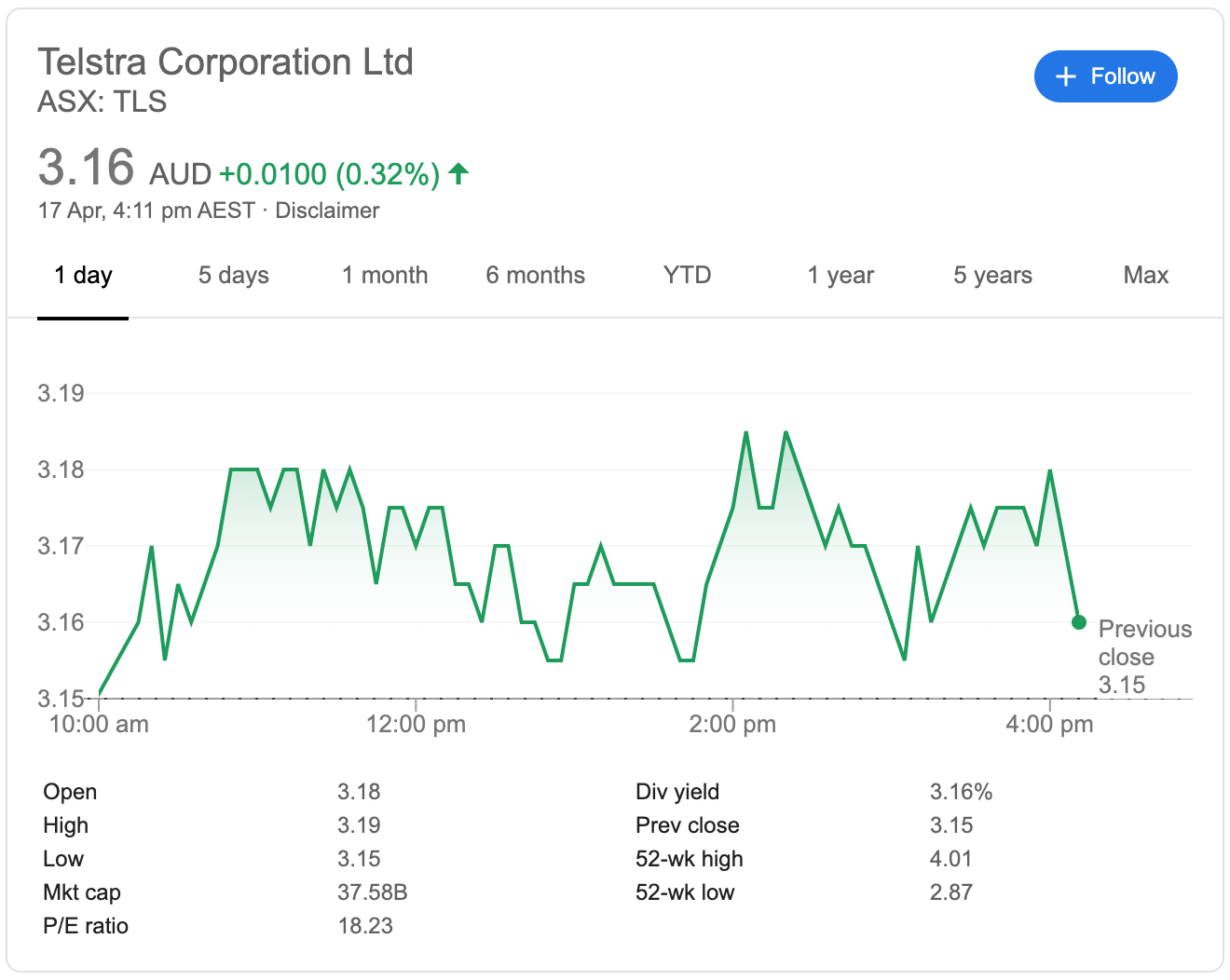

Telstra

Telstra is the largest telecommunications company in Australia, and has been a consistently good payer of dividends over many years. It's a popular investment choice given a long history of good company performance, large market share, and the fact that it's a very common investment choice by mum and dad investors.

The share price doesn't typically consistently rise, however while the price is discounted, it's a pretty solid choice.

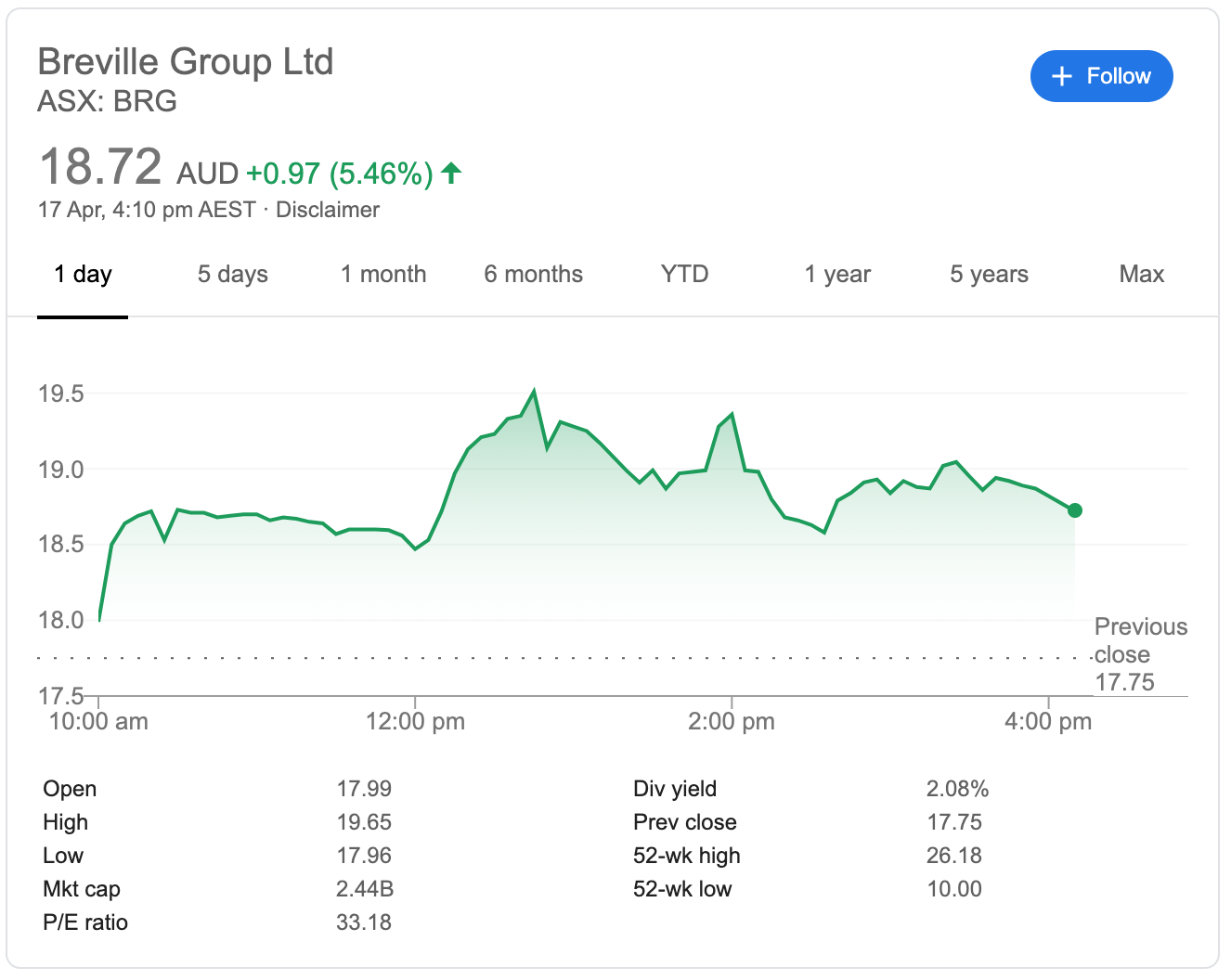

Breville

This may not seem like my typical choice of company to invest in, however the long term performance of Breville cannot be questioned. The long history of continual growth and solid company performance makes this a pretty decent choice.

This isn't a company that to purchase for dividend yield, however for capital gains, while the price is at a discount, I also consider this to be a great choice for some relatively quick capital gains.

Concluding remarks

I should note that I wouldn't normally invest with less than $10,000 to put into the market. However, in this case, I've chosen to re-enter the market with smaller sums for the simple fact that prices are heavily discounted at the moment and I want to re-familiarise this method of investment.

Also, it should be pretty obvious that this is not financial advice. I am simply discussing my recent investment decisions and future plans.

Happy investing, Hive!