The US stock market had the worst October since 2008 so far, I read today. I don’t know how long this fall will persist, I suppose nobody knows it for sure, so the question is, how to prepare for a possible crash?

Three huge crashes

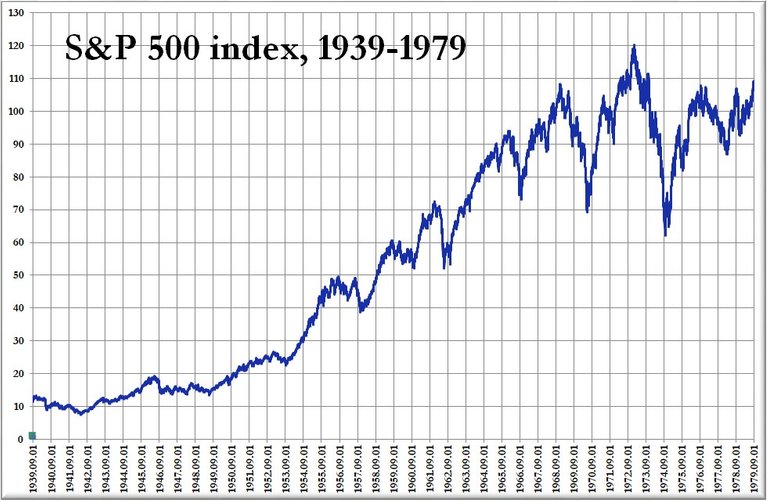

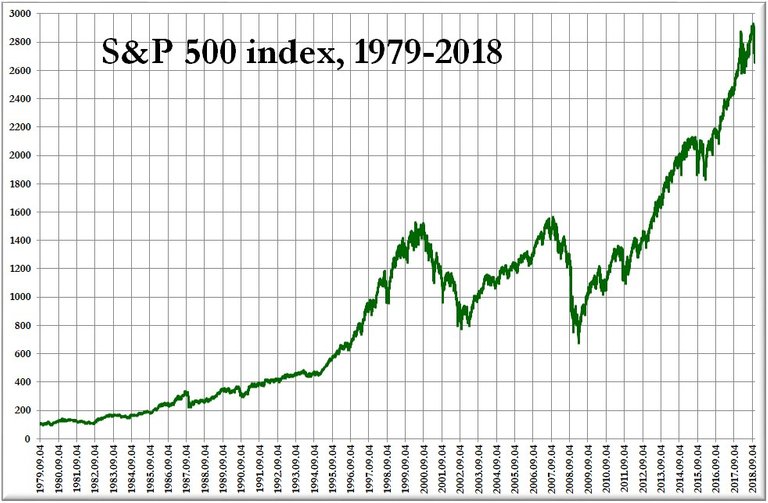

I have seen three major stock market crashes: the “Russian crisis” in 1998 (including some sort of “foreplay”, prelude of it, the smaller Asian Crisis in 1997), the burst of the Dotkom Bubble (2001-), and the “great financial crisis” of 2008-2009 beginning with the Lehman Crash. One common characteristic of all of them was: soon after the collapse, a new boom began.

Bear markets can be very vehement, stormy, but are much shorter in average than the bullish ones. In the fresh statistics of Ftportfolios.com, “the average bull market period lasted 9.1 years, with an average cumulative total return of 480%”. “The average Bear Market period lasted 1.4 years with an average cumulative loss of -41%.” The analyzed period extended from 1926 to September 2018.

Bulls on the heels of bears

The other statistics on Marketwatch.com, included also smaller price trends, falls of 10-20 percent which is mostly considered only corrections. Here, the average bear’s size is 29,7 percent, and bulls achieved 81,5 percent in the trends. But here you can see also, that on the heels of every bear, a new bull is approaching.

Another post on Seekingalpha wrote, “According to Sam Stovall from the American Association of Individual Investors, since World War II there have been 57 pullbacks: on average one every six months, average decline 7%”. These pullbacks are even smaller than the corrections, 5-10 percent every one. And we have only one of these now, so far.

The guru’s indicator

Stock valuations are at very high levels, for example, see this map presenting the famous “Shiller P/E” values. The USA and many other regions are painted to an alarming red. I know there are other indicators and other opinions, also analysts saying stocks are still cheap. But the “Shiller P/E” seems to be very accurate for me – for that matter, the guy received the Nobel Memorial Prize in Economic Sciences, for analyzing the asset prices.

Powell put?

Market analysts were talking on Bloomberg about the “Powell put”: How much the S&P 500 index has to fall to urge the Fed to seize back the interest hikes? Possibly to 2500 points, said BNP Paribas to Bloomberg a couple of days ago. Meanwhile, it’s got very close, at 2659 on Friday. Others say this critical level should be located much lower or even non-existent.

Where are you, Santa?

Maybe this actual fall, what we see this month is the beginning of a new crash. But also may be only a bear trap before the next Santa Claus rally. A new crash will appear some day, that one thing is sure. “Buy when there’s blood on the streets”, said Rothschild allegedly, maybe literally, maybe, not. If it is a good idea to try to buy a crash, where should be the right point, how to identify it? How much should prices fall?

Surely I won’t get a Nobel Laureate because I can’t report any very new discoveries, only give you my opinion based on many years of experiences. It seems to me that after a 30-50 percent of the bear market, it’s very probably a good idea to buy stocks. Maybe in two or three portions: by 30, 40 and 50 percent. Hold some cash ready.

Better be patient

It’s nothing sensational, I know, but it can mean survival. Imagine you buy a stock on 70 dollars, other on 100 dollars in a short period of time. And it surges to 120 in three years. In the first case, you earn 71 percent, means, 19.7 percent per annum. In the second, only 20 percent, that is 6.2 percent p. a. So, I better wait for the crash than buy stocks now.

It’s necessary to mention that the only really obviously terrific idea to buy the crash was in the Great Depression of 1929-1933. The stock market fell in an extremely huge extent, more than 80 percent and recovered incredibly slowly after that. (I think it took almost 15 years US stocks reached the 1929 level again, in 1954.)

Don’t blame me if history repeats itself.

Other posts about investments you may want to read:

- Blood On The Streets Of Europe? – Banks

- Is This Indicator Really Predicting A Huge Rally? – Gold, Silver, Mines

- Black Sugar, Baby, And Hot Money – Sugar and Coffee

- And The Very Best Stock Market In The World Was…

- Tales From The Crypt – Greek Blood On The Streets

- Deadly Coffee, With Cocoa Flavour

- 8 Reasons Why Gold Mines Can Rally Again

- Buying At Prices Of 2009? – Turkey

- The Curse Of The Disaster – Uranium mining

Disclaimer:

I am not a financial advisor and this content in this article is not a financial or investment advice. It is for informative purposes only, or simply to make you think, entertain, increase testosterone and adrenaline level. Consult your advisers before making any decision.

You can message me in Discord.

(Cover photo: Pixabay.com)

(Chart data: Stooq.com)

It's still really high up and have room to fall. Look to S&P500 at 2000 for strong support. Actually, not sure if it'd even hold. The market will probably panic hard.

I personally belive their is an 8% chance we bounce here and big....thw other 15% option is an 87' style flah crash that does not let everyone get out and with liquidity airpockets it shoots way lower. (As always it will recover in due time bt will cause major issues short term)

It’s important to look at past crashes to predict future crashes, but they each have a life of their own & will always surprise those who think they know.

That being said, this particular crash on the horizon could easily fall 50% or much more based on the debt can being kicked down the road & filled up on the way.

There is also a possibility Of a hyperinflating dollar which could shoot the markets up beyond anyone’s grandest predictions, but we will have a host of other problems happening at that point.

Crash it first, buy up all the assets, then sink the dollar & watch the US & global economy unravel. Seems like a good plan for the elite

I hope gold miners and cryptos can give some protection from "hiperinflating dollar".

But it is also possible, i.m.h.o., that the dollar will skyrocket in a positive spiral. All debtors are suffering from high dollar interests -> repaying dollar debt if they can -> buying dollar -> dollar surging -> even more actors repaying dollar debt -> even more dollar strength. Like by the Swiss francs 5-10 years ago.

That is a very possible feedback loop. We are at one of the most interesting economic crossroads in history imo, anything is possible. I’d love to see goldminers catch fire, they will soon enough!

It seems it's finally time for a new round of "Peter Schiff was Right" videos.

The massive national debt is probably going to cause confidence in the dollar to tank (remember, the US govt's credit score was already downgraded for the first time ever a few years back), which will lead to higher interest rates, which will then just snowball the problem.

Not to mention all the inflation we can probably expect.

You seem very knowledgeable on the subject. I think you are correct in waiting for a sudden bull market that may be upcoming soon after the crash. I am also holding on to buy a few specific stocks, but when it makes more value sense. Currently, price levels are very high, but not many value deals.

What sectors do you think will show the most growth after a correction/recession?

Maybe stocks which fell the most? Banks are leading often the crashes, but also skyrocketing in good sentiment. Maybe in a possible future crash tech shares will fall like hell because these are overbought, and in a new bull run tech ll jump again.

May be new sectors like marihuana, space exploration, electric carmakers, (especially flying electric cars?) or blockchain companies.

That is a correct assessment. Banks and Tech will be lowered the most, because they are overvalued.

The next wave, I would also bet on tech companies, new energy, but also ocean exploration instead on space exploration.

I appreciate your time. Have a great day!

You got a 98.36% upvote from @bdvoter courtesy of @deathcross!

Delegate your SP to us at @bdvoter and earn daily 100% profit share for your delegation & rewards will be distributed automatically daily.

500 SP, 1000 SP, 2500 SP, 5000 SP, 10000 SP.

If you are from Bangladesh and looking for community support, Join BDCommunity Discord Server & If you want to support our service, please set your witness proxy to BDCommunity.

realy

buen post excelente es educativo