When I just started trading on my own I lost a little over $10,000 the second week. I had made the full-time jump and therefore was desperately emotional to make it work. Looking back now, I probably did things I would never do today. I pushed trades into the market when it wasn't a good time to trade, I let trades run up huge losses without stops, and took any profit I got quickly.

The Fear Of Missing Out (FOMO)

Here's the scenario: you've been sitting on the sidelines while watching the market rally nearly 100% off the March lows from 2009. Are you itching to jump in and buy? Are you frustrated because you are missing profits that others are making?

Many traders I've been talking to feel this way right now and it's not uncommon. We have all watched the market rally much further than anyone expected. And, it's not just the swing trader who feels this way. Day traders are feeling the heat as a trending market offers little entry opportunity.

Even though it may be hard, sitting on your hands can be one of the most difficult things a trader NEEDS to learn. If fact, I really do feel like it's a requirement for a successful trade - one lesson I learned quickly during my first few weeks trading at home. We have to treat trading like a business not a hobby - and sometimes waiting for the right entry is part of the business.

Treat Trading Like A Business

After talking with some former traders whom I worked with, I realized I was doing 1 thing completely wrong! I was blindly waking up each day and trading with no real direction - how stupid of me right? Sure I had traded for the banks and knew what to do - but being at home was completely different.

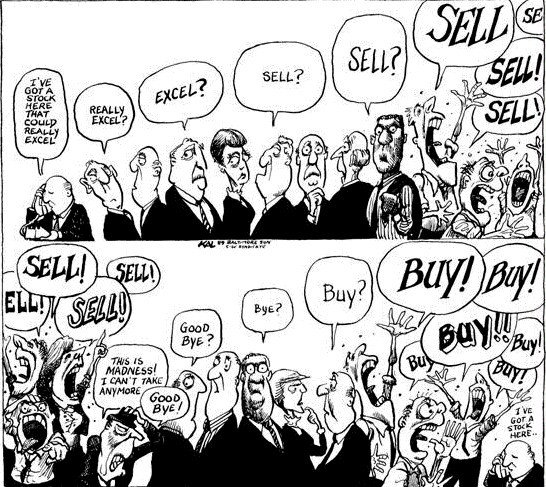

What helped me get over the hump was to treat trading like my own personal business. I wrote a business plan, had specific achievable goals, and daily activities to keep my emotions out of the way. What this helped me do was to remove my emotions from the traditional Fear and Greed cycle.

The trader who can remove themselves from this cycle and treat it like a business is much less likely to force trades out of boredom or because he/she feels an internal pressure to be productive. Case in point - this is where I went wrong when I lost that $10,000.

Let's Control Those Emotions Shall We

Productivity can be extremely helpful when starting to trade. If you are bored then you are more likely to make stupid trades. If you are business searching, analyzing, reading, etc then you are more likely to find amazing trades with great risk/reward.

Here are 5 practical tips to help you learn to be productive and control your emotions:

Learn Something New About Trading. Maybe you have wanted to learn more Iron Condors or Credit Spreads, or maybe you have been wanting to learn more about RSI and MACD indicators. Well, stop thinking about it and schedule some time to sit down and do the hard work - pick up a book, get some coaching, watch a video tutorial.

Perform Some In-Depth Market Research. You have to be curious about something that's happening in the market right now right? Down times in the market can be great opportunities to do some intense market research.

Paper Trade Until You Fall Over. I STILL paper trade each week. I test out new strategies, new indicators, new ideas with paper money first before I ever put real money to work. Focus on a particular setup and paper trade it on a simulator 10 or 20 times. A great new tools is thinkorswim's ThinkBack trading that allows you to "replay" an entire day of trading just as if you were reliving it all over again!

Write A Trading/Business Plan. If you don't have one you need one and if you have one you need to revise it monthly. These can always be improved. Take a section of your plan and think carefully about how you can improve it, and then do it already!

Analyze 5 Completely New Charts. Pick out stocks or ETF's you'd like to trade and analyze the charts carefully, making a list of the bullish and bearish reasons to trade it. This will help you think carefully about the trade and remove your emotions completely after making the list.