I came to crypto community recently. From 2005 I develop investing strategies in fiat exchanges and invest using them in some periods. In other periods I needed money for my real bussines, which now has big problems. Now I look at how crypto-currency investors make the same mistakes that I made at the beginning of my investing journey. It's normal. This is the natural way. I just want to share those investing and statistic developments that have been tested in real exchange conditions. If someone thoughtfully reads everything and applies in the future, then I will be only happy. Also there will be those who will until the last believe in their investment illusions. Time will show.

Investor-beginner approaches the investment of money at the betting level or signals to the entrance. Now even the Telegram flourish in various communities for the issuance of paid signals. There are experts who say - the asset will fall or it will fall. Someone even organized the ICO on this wave (not on Waves :)) and collected an impressive amount of money. There are a lot of IT people in the crypto world now and it seems to them that they can "encode" the chaotic price movement. I will disappoint them: any signals will provide 49-51% of correct inputs for symmetrical output options (on short timeframes) for a long time. If the timeframe is long (for example, we will predict the movement for a month ahead), then the percentage of correct signals will increase to about 60%, as with the increase in the period, the probability of an increase in prices also increases. This has long been known on the fiat exchanges. The layout is something like this:

- The probability of a price increase in the next minute: 50.01%;

- Probability of price increase in the next hour: 50.5%;

- Probability of increasing the price per day: 51%;

- Probability of a price increase for the week 53%;

- The probability of an increase in the price for the month: 60%;

- The probability of an increase in the price for the year: 65%;

- The probability of an increase in the price for 10 years: 99%.

This layout is already statistically proved on real data of the fiat exchanges. I joined a community of experts and try to see the real statistics of their trading signals. I suppose, that it will be close to the market: if the market of the first 200 assets grew 150, and the signals were only for growth, then about 75% of experts will confirm their importance (150/200=0.75). In fact, they will only be deceived by chance, or rather they just repeat the course of the market. Does this mean that you do not need to invest on the exchange? Of course not. First, I think that it is still possible to earn someone who is able to fundamentally estimate assets. Secondly, with an impressive supply of money and low liquidity on the exchange, it is possible to organize certain manipulations and earn on very short timeframes (in principle, this is a pump). Well, in the third place, you can build assel allocation portfolios and perform some manipulations inside portfolios that can significantly increase the efficiency of your investments (this option I like most!).

I want to pay special attention. When investing, the "final score on the scoreboard" is important. It is important how much your portfolio has earned, and not whether you have guessed the movement of the asset. Suppose you guessed the movement of the asset by 100%, but put 3% of the capital there. The increase in your portfolio is 6%. This, of course, is also good, but if the portfolio method shows the result in 10%, then doubt already creeps in. Maybe it was worth simply investing in asset allocation portfolio, and not looking for the "flight to the moon" in one asset? I am a member of several Telegram chat rooms on investments and there people are already starting to write character messages: it would be better if I sat in the assets than jerked back and forth. Gradually comes the understanding that speculation on signals is a harm to your portfolio in the long run. Now we are using simple examples to analyze the essence of one portfolio method (this is 70-80% of the success of the future portfolio). The advantage is that even a beginner can apply it. The main thing is to understand, how it works in simple examples.

The essence of the portfolio method

To understand the results, let us examine the essence of the portfolio method with periodic rebalancing. Rebalancing is a change in the structure of assets within the portfolio during the investment period. The rebalancing in the portfolio method will work under two conditions:

- Assets have a correlation below a high level (ideally even negative);

- The general trend of assets should be, at a minimum, not negative (with some assets may fall significantly in price).

Now let's analyze the work of rebalancing on the simplest examples:

Example 1:

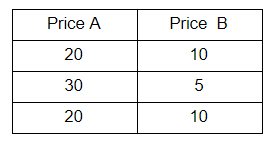

We have 100 BTC. There are 2 assets: A and B. Now we turn to the table of prices for assets A and B:

For the entire period, the price of A has not changed, the price of B has not changed. If we invested our money in half in a portfolio and did nothing more, our portfolio would remain unchanged. Now we'll use rebalancing:

- We divide the funds equally. At 50 BTC we buy asset A (2.5 quantity), for 50 BTC we buy asset B (5 assets);

- At the second step, the value of the portfolio is 30 * 2.5 + 5 * 5 = 100 BTC. It is necessary to make a rebalancing. Again, we divide funds equally by assets. At 50 BTC we buy asset A (1.67 amount). At 50 BTC we buy asset B (10 amount).

- We estimate the value of the portfolio at the third step = 1.67 * 20 + 10 * 10 = 133.4. Thus, even with the invariability of assets within the portfolio, rebalancing helped us to earn 33.4% of the portfolio through a change in the structure of assets within the investment period.

Pay attention, at the second step rebalancing does not give any advantage (we have the same 100 BTC). The effect of rebalancing does not appear immediately (but it necessarily manifests itself in the long periods!).

Example 2:

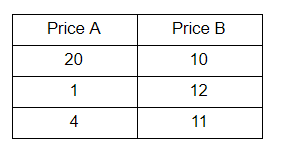

We again have 100 BTC. There are 2 assets: A and B. Again, look at the price table for assets A and B:

As we see asset A 20 times fell in price at the second step, lost 95% of the cost. If we simply invested money in a portfolio and did not make rebalances, we would have the following result at the end = 2.5 * 4 + 5 * 11 = 65 BTC, that is our portfolio would lose 35%. Now turn to the rebalanced portfolio:

- We divide the funds equally. At 50 BTC we buy asset A (2.5 quantity), for 50 BTC we buy asset B (5 amount);

- At the second step, the value of the portfolio is 1 * 2.5 + 12 * 5 = 62.5 BTC. It is necessary to make a rebalancing. Again, we divide funds equally by assets. At 31.25 BTC we buy asset A (31.25 amount). At 31.25 BTC we buy asset B (2.6 number);

- We estimate the value of the portfolio at the third step = 4 * 31.25 + 11 * 2.6 = 153.6 BTC. Thus, even with a significant decrease in the asset within the portfolio due to rebalancing, we managed to make a profit in the portfolio as a whole.

Do not be afraid of a significant decrease in the asset. Rebalancing and the subsequent restoration of the price of the asset make it possible to obtain a profit in general on the portfolio.

Example 3:

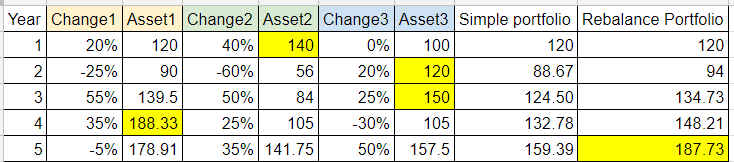

Now let's look at the example a little more difficult. Let's look at the table:

You can see the calculation file by this link.

Here we have three assets, the price of each starts in the zero year with 100 conventional units. In the first year, the price of an asset1 grows by 20% and becomes 120. Other assets change too. Yellow is the best investment for years of holding a portfolio. Just a portfolio is a portfolio when in the zero year we are equally investing in assets and then do nothing. A rebalancing portfolio is a portfolio in which we distribute assets equally each year. From this example we need to draw one important conclusion (it is proved on examples and with more numerous data - I have a table with 1000 assets and 1000 periods, that is, a million data, but the output is similar):

A rebalanced portfolio of several assets eventually always outperforms an individual asset and overtakes the portfolio without rebalancing.

In this example, in step 4, we get that the most profitable asset1 (gave + 88.3% growth, the rebalanced portfolio gave + 48.21% growth). The rebalanced portfolio surpassed all assets only at the last step and gave an increase of 87.73%. It is important to understand that the property of rebalancing does not manifest itself immediately, but it necessarily manifests itself in the long run. Until we go deeper into the theory.

P.S. If it was useful and interesting for you, then in the next post I will tell you how to apply the portfolio method on crypto in real data + I will give an example of how it worked for the last year.

Thank you.

Follow @cryptoved with smart investment strategies

Thank you for sharing!

This article helped for my investment expierence , i do respect your work here, thanks for sharing this useful article.

Have a good day!

I will write more in my future articles)) Thank you!

Congratulations @cryptoved! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPBy upvoting this notification, you can help all Steemit users. Learn how here!

Revoted