If there ever was an example of stupid money, the money that has moved into POW mining equipment this last year would be perhaps one of the best. On the other hand, if we ever wanted confirmation of the extremely unexpected price rise in Bitcoin and other POW Altcoins in 2017, that same equally unexpected rise in mining activity might just as well be one of the best of confirmations for that too.

Let’s look at the figures.

- Bitcoin’s price rose more than 10 fold, and its mining activity did the same.

- Litecoin was no exception with a 50x gain, and its hashrate did the same too.

- DASH’s price was more than 100 times higher by the end of the year, and its hashrate actually outperformed by ending the year almost 500 times higher!

- Groestlcoin was a 1,000x bagger, and even here, with a GPU minable coin, its hashrate multiplied by over 400!

And the list goes on and on.

People have thrown money at mining equipment with the same exuberance that they have thrown money at cryptocurrencies themselves!

Some might see this as confirmation of current prices. After all, if people are willing to pay the equivalent of 1 year’s mining proceeds (the average expected ROI time for most) in order to mine, then we certainly would have a very important demand source that corroborates price action, wouldn’t we?

Or would we?

Would it be the kind of quality confirmation we’d be looking for? Is it based on sound economics, or emotional irrationality? The P&L numbers suggest the latter, which, if the case, would actually confirm the opposite, which is to say, the worst of our fears that the POW sector of the crypto bull market is really based on lots of hopium.

Is mining POW crypto really a good business to get involved in?

Guess what?

On average, in 2017 you would have made more than 10 times as much money by directly investing than trying to mine.

That’s right, 10 times more!

Yes it would still have been a stellar mining year though. You not only got to ROI in just a couple of months thanks to the spectacular price rises, but you also made a nice chunk of money during the rest of the year – something never seen before, and likely never to be seen again.

BUT YOU WOULD HAVE MADE 10 TIMES AS MUCH BY SIMPLY BUYING AND DOING NOTHING ELSE!

Who in their right mind is going to invest in something that makes 90% less than what simply buying the raw material itself would make you?

Only stupid money would do that.

And I’m no exception. I bought state-of-the-art mining equipment in early January of 2017 thinking it would be a good long term investment.

I never dreamed that mining activity would rise just as fast and in equal proportion to prices.

Yes, I’m guilty of being stupid too.

Yes, I’m drawing from personal experience as well as from the widely available data whose numbers can be crunched by anyone willing to take the time.

At the beginning of 2017, I was fairly confident that crypto was a good long term investment, but I had no idea we were about to see one of the biggest bull markets in the history of mankind. No idea! I sold eventual big winners thinking I was making unbelievable profits only to shake my head in disbelief as I watched them climb even higher. I made lots of mistakes, but mega-bulls are thankfully very forgiving.

Everything was paying off big, but, as mining activity rose in direct relationship to price, I began to regret not having just bought outright instead of having dedicated an equal portion to mining.

Don’t get me wrong, I’m not complaining, even after having left huge sums on the table by taking profits too early or by buying miners that made only 1/10 of what my direct buys made me. Complaining about that would make me the biggest ingrate the world has ever seen. Nonetheless, I can and should learn from my mistakes, and just like I learned to HODL a little longer, I also learned that buying any more mining equipment was absolute insanity.

I don’t see the 2017 POW markets repeating, and, unless prices continue higher at similarly accelerated rates, there are going to be a lot of very disappointed miners in the future.

And God forbid that POW prices stagnate or fall.

Yet people continue to invest in mining equipment instead of simply buying direct, locking in a guaranteed 10 times better return on their money (regardless of how much things go up, it’s a fairly constant ratio).

I didn’t expect mining activity to increase at the same rate as prices. I was wrong. It has, and the lesson learned is that this will likely continue, leaving miners looking like idiots, at least until POW prices turn south, when they'll simply become losers hoping other losers will quit before they do.

And all this brings me to the even greater opportunity cost in the form of missing the boat with the likes of STEEM, BTS, EOS and ADA, all of which have nothing to do with POW and are the best examples we have today for the leaders of tomorrow.

Why mine a POW when buying it will outperform by a factor of 10?

Why, for that matter, even buy a POW when a STEEM, or a BTS, or an EOS, or an ADA will outperform POW by at least another factor of 10?

Imagine just how happy the smart money will be after having decided to reallocate all that money intended for POW mining into direct buys of crypto like STEEM, BTS, EOS and ADA with at least 100 times better returns. At very least!

And those poor schmucks who stick with POW mining?

Knowing what I know now, I would have to be stark raving mad to buy more mining equipment!

If it's not clear by now, I think the sustainability of POW crypto is in serious doubt. I wouldn’t even be directly buying POW crypto anymore, much less even thinking about purchasing mining equipment. It’s enough to try and eek out gains from current levels if your cost basis is simply the price of your favorite POW, but adding the extra costs of mining equipment and electricity would be just nuts in my opinion. Check out my previous post for more P&L analysis on that, and then, after reading that, and in combination with this, ask yourself if this might not be a good time to get out of mining while you can, and maybe even out of POW altogether.

And don't forget to let me know what your answer is!

Data Sources:

http://blockchain.info/

http://coinmarketcap.com/

http://chainz.cryptoid.info/

http://whattomine.com/

https://www.coinwarz.com/cryptocurrency

@cryptographic,

You are absolutely correct! I had a good example about POW and DPOS! I think I want to write it here to make a nice entry to the discussion!

5 Months back, one of my good friend asked my help to install a mining rig! He wanted to invest 3260.00 USD on it! I told him, better you invest that money on STEEM, so you get power of stake (POS) and the Delegate Power of Stake (DPOS) as well. The Price of STEEM was at 0.8-0.9 USD at that time

If he invested on STEEM, he gets 3000 STEEM Power and he had a chance to make more by using his SP! But that guy wanted to build the rig! I helped him and he is still made 1/3 of his investment! Paying for electricity bills and complexity of algorithm is not making a decent income to him. But STEEM price made an up trend and if he did his investment on STEEM now he almost earned his profit and making more money by holding SP!

If someone wish to invest on mining rig or any other mining equipment, you better invest that money on BTS or STEEM or EOS! I do believe this is the future.

The most important thing is, you are the person who helped me to see this path! Thank you very much friend! Actually this is pretty amazing! That's how I feel it!

Cheers~

Thanks for that first hand experience. Your story is typical and I'm glad you shared it - it might be just what someone else needs to hear in order to avoid making the same mistake.

@cryptographic,

Funniest thing is one more guy asked the same thing yesterday and he said the same thing as the previous one said :D

Cheers~

You are right... STEEM, BTS, EOS and ADA, all of which have nothing to do with POW will be the leaders for tommarow..I have very few knowledge about mining . Thanks for such an useful information when we make money just by investing and then why should we mine.

Upvoted & resteemed

Huh - I guess I shouldn't be surprised by this but wow. I still think a lot of this comes down to herd mentality. Folks see others having particularly incredible success and fail to take into account a significant first mover advantage that may have played a major role in the person.

That being said, in a perhaps too Machiavellian view, I think there's an investment opportunity in stocks of companies that touch upon crypto mining parts manufacturing. TSMC has started to add crypto miner revenue into its earning calls and Nvidia is facing a limitation in video cards. My bet would be that even if there was a dip in crypto valuations - mining demand would lag that deep as folks see an opportunity to gain "share" in the market. A potential hedge to cryptos...?

(Or if people could just be a bit more rational that'd solve a lot of this!)

I think you're right about the herd mentality aspect of things, and when you couple that with the romantic overtones that "mining" has - we all know about the gold rush and how the possibility of hitting the mother load was a magnet for gold miners in California in the 19th century - then I think we've got a double fun emotional attraction that is hard for many to turn down.

I did buy some contracts on hashflare and genesis and I feel it has been a bad investment. If I had put that money directly into buying cryptos would have made more.

No doubt about it, and it's all in the math.

Problem is that the people selling you the mining product don't want you to know that, and they do everything possible to make it look better than it really is.

Direct buying is the winning option, and better still if it's 3rd generation crypto that is as far away from POW as possible!

yes agree. The more they mine the more slower it becomes and in the end less ROI.

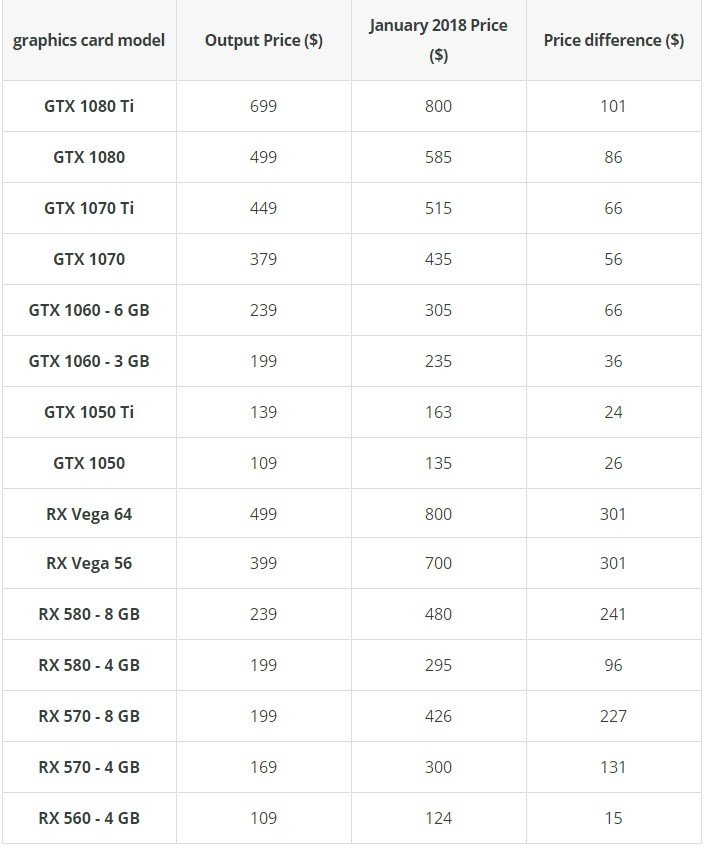

With the proliferation of mining, the prices of graphics card have increased too much. It's disturbing. When people demand, the companies wanted to take advantage of it. capitalism!

Man and how! Everything's up! My ASIC miners were up by 500% just 3 months after I bought them! I remember thinking back then that hell would have to freeze over before I'd buy more at that price. And that was the story just about across the board, and as prices went up, mining proceeds went down.

Prices will soon rise and the mining ratio will rise with it

This price difference is too much, don't you think? When mining became widespread, prices rose. Same goes for ASIC.

Great post @cryptographic. I never really looked at the mining prices in such a way but it makes total sense.

Why would you drop $40K on a bitcoin miner as opposed to putting $40K into STEEM or BTS? Like you said, are the odds great that the mining rates repeat in 2018? Not likely. Hell it isnt even likely that the biggest jumping coins in 2017 will sustain it in 2018. I doubt BTC will be another 10x + gainer this year.

It is time to move to other tokens that didnt run to the extreme in 2017. STEEM and BTS are mine hodlings for this year....been scaling out of the Big 3 and adding to them (mostly BTS).

Another insightful post. Thanks for sharing your experience with mining.

Ignorance?

And I don't mean that in a negative way. I just think that, simply put, that's got to be one of the best answers, and one of the main reasons why I wrote this post.

Remember, Enlightened Self-interest and Steemit: the more we help others, the more we help ourselves. 😉

Just drop it into STEEM or BTS!

I cant argue with that since I added a bit more BTS last night...I have some powder ready if it drops into the 20s, I will be adding more....might do it in the morning regardless of where the price is at.

I will see.

Looks like we barely dipped in. Not much time to catch it though. Was a good opportunity for the low 30s though. How did you do?

Very good post! Very interesting dynamic here related to Bitcoin... If miners are out of the market in the long-term, who will support the market? Do we rely on big company to continue dominating the mining space? What consequences could that have to adoption and the overall technological development? Thanks for the perspective!

You've hit on one of the key questions that has very negative consequences, especially with Bitcoin, where the difficulty retarget is 2 weeks. It could literally freeze up!

my knowledge about mining is very poor, but steem, bts, ada, eos has nothing to do with mining. i won't bother about mining equipments due to these genius projects. this is the future. hardware mining is the past & memories of crypto evolution. impressive article with lots of information why we focus on 3rd generation crypto currencies. @cryptographic

@resteemia

Miners snatching up all the video cards at retailers have forced companies like Nvidia to put buying limits on graphics cards. One of my buddies built a rig and bought as many extra graphic cards he could get his hands on, flipping them for profit. No desire to mine, HODLin strong! If we break down from this bull run, I will be prepared to pickup more of the said cryptos.

Just incredible how far a stream the effects have gone!

@cryptographic...yes bro what you said is really correct..i am also using a hash powers and also some mining sites i was invested and loose the money by cheated...some are good and most of them are bad ..actuallly they do a business by using our investments...if we invest money in the crypto directly we will get more profits compared to this...thank you for sharing with us....

Their sales pitch is that you can make easy money, but, as you say, the reality is that they are making the easy money off their customers. Thanks for sharing your experience. Hopefully it will help someone else!

yes bro...initially i lose lot of btc because of this fraud sites...within 2 days they used to give 5lakh santhoshi and 10 lak santhoshi ..after that they ask if you want to withdraw ammount..plz send maintanance charge of half of that amount..if we send afeter that no responce comes ..and if you login after some days it shows your account was suspended...this is the thing happend to me 3 times..beacuse of youtube promotions and fake withdrawal proofs i used that and got cheated..

@cryptographic - Sir I never invested on mining equipments... But once I tried mining via my CPU/GPU by using minergate... It was not a profitable idea Sir... Moreover, I invested on their cloud mining, but it didn't work well too... Therefore, I don't believe much in hardware mining Sir... Specially while coins are at their peaks, mining is not profitable Sir... I understood it now by reading your post... You explained it well Sir...

I will stay with STEEM, BTS, EOS & ADA... I believe you & all your predictions, reviews & analysis of crypto market & it behaviors are working well Sir...

+W+

Thanks for sharing your experience. It's extremely important so that others at least have something to contrast the hype with.

Hello @cryptographic,

Extraordinary good article & you highlighted few facts that's why we think twice before invest on mining equipments. Price of Mining equipments, Electricity cost, Net Hash Difficulty makes a complex scenario & average return of investment went 6 months to 1 year in now a days.

If it's not clear by now, I think the sustainability of POW crypto is in serious doubt.Incredible point you discussed here. Yes, I don't believe POW will remain so long. It's outdated & expired version. Incredible discussion & excellent review you made here.

~@mywhale

Great suggestions. The diversify and reinvest is sound for the passive investor.

To me, it all comes down to research. If people would research what they are into, they would fare better.

At present, my main token holdings are BTC, ETH, LTC, BTS, STEEM, and another coin that is being introduced shortly. The later three are projects I believe in and follow very closely.

Recently, I took some off the table in both BTC and ETH after nice run ups. I dropped my BTC holding about 1/3 and my ETH 25%. In terms of percentage of portfolio, BTC is no longer my largest holding, it dropped to 3rd and moving towards 4th. Ironically, the run up in other tokens helped to rebalance my portfolio (along with additional capital).

As much of a loudmouth blowhole that he is, one thing that I like which Cramer said, if you cant spend at least an hour a week on each stock you own, you shouldnt own them.

I believe this with coins..if you cant spend an hour a week studying what is going on with each of your holdings, do not own them. Things can change very rapidly.

I also thinks that mining coin is poor investment when we can make money just by investing coin then why we should took up the botheration of mining. Very nice article , i always find something new in blog.

Keep guiding us

thank you so much.

Upvoted & resteem!

Investing in mining(POW based) as on date is bullshit concept and people must listen to those omen where the dynamics to going to shift towards POS and POS based mining is the future.

PoS is next cryptographic revolution in terms of mining development. And the reason it was not adpoted with Bitcoin early in 2009 was the fact that at that time no decentralized currency was there and when you are innovating something decentralized then how can you adopt the mining based on a centralized currency like paypal, debit card, visa etc.and might be for that reason Bitcoin have had to adopt the POW system of mining.

But now we can...... because we are already in the era of cryptocurrency and this generation is crypto generation, so we have ample resources to go for "proof of stake" mining.

And that is the reason why I love STEEM, BTS and EOS which are third generation cryptocurrency.

Thank you.

POW mining is going to be outdated very soon and the evolution of cryptocurrecnies are already shifting to DPOS based mining and that is the future also, and if you look at online market so many old miners are selling their old mining rigs and mostly chinese people are selling their mining rigs. here I would like to mention that china used to be the hub for 25% of the mining. But now a days even Chinese people are also no more interested in mining.

We must also remember that POS is not only cost effective but also environment friendly.

And my all time favorite crypto is EOS and this is my darling and its the crypto this generation and just mark my comment here in 2018 it will cross 100 usd for sure.

Thank you @cryptographic ....steem on and stay blissful...

Crypto's fundamental concept is decentralization and if we look at the POW (Proof of Work) based mining then with the passage of time it would tend to be a centralized one and that is the reason why we must think of an alternative which would not only cater the disadvantages of POW method of mining but also keep the very fundamental principle that is "decentralization" intact. And for this to achieve, PoS can be the best possible alternative which not only save the tremendous amount of energy but also keep the decentralization principle intact. And in addition to that it would make the cost of a "hacking" unbearable for a hacker.

So the bottom line is that the future of mining in crypto is POS only and that will be a broad based concept 1/2 year down the line.

Thank you and Have a great day.

Mining this is very excellent I adore this

I allocate 25% of my capital only to me Mining in 2018 will be the year of mining par excellence Consider this talk well

I advise everyone who has some potential to do it

Mining

Steemit changes my lifestyle 😎

The first cryptographic currency to pay attention to when deciding which of the crypto currencies to invest is the Ripple. While Bitcoin is attacking the external and internal markets, Ripple increases the price of small but sure steps. The advantage of this koin is that its value is not influenced by various rumors and speculation.

The first feature of Minergate is that you will be able to mining through your computing power with software that you will download according to your operating system. Mining software suitable for Windows, MAC, Ubuntu and Fedora operating systems. You need to register to download the software, afterwards you can easily download and install the program from the Downloads link on the main page. Then open the software you need to do and choose which coin you want to dig. The software will start to produce coin immediately and will continue to work as long as you do not turn it off.

The second mining form of the site is the Web Mining feature, which can be used without downloading any programs via the browser. To use Web Mining, you can start the mining of the desired Coin by clicking on the Web Mining section of the main page. The image below is taken from the Web Mining section, here is what you need to do is just click the start button. Winning crypto money will appear instantly on your account.

Great post about POW, I alway love mining only I couldn't afford it ... until now. But i usually read and like to know what is going on in that section. Nice @cryptographic

I have heard that the ethereal mining is profitable. you only need to install the system yourself. $ 4,000 a month was earned. they even paid for the electricity bill. there is no exact knowledge. thanks for sharing. @cryptographic

I read what you wrote. Unfortunately, I'm stupid. I have not seen it before. A big difference from 10 times. I wish I could take the time back, but I wish I did not know it. I analyze it with a story. Edison tried a 2000 faulty road when he found the bulb. The apprentice said you made it 2,000 times wrong. Edison said I had to learn 2,000 things we needed to not do. This is a really good story. I remember this story to take lessons from mistakes. Just like it is now. I'm glad you learned from your mistakes. Are not we the ones who do not make us anyways?

After that I will investigate the mining section before investing. I will make the data comprehension so. Thank you very much for showing me this mistake. @cryptographic

Hi @cryptographic, After reading this post, I invested in sys and it is proving to be right decision.

Many thanks.

Steem On!

@cryptographic - Sir I feel I just read a professional market analysis report just now... Your suggested investment portfolio is outstanding Sir... In 2018 onward I'll make a investment plan like you said & follow it till the end of the year Sir... Thank you very much for sharing your genius knowledge of investment & crypto portfolio & a well know reference for the people who wish to be a part of this journey... A brilliant article & excellent advice you provided to us Sir...

+W+

Really great write up @cryptographic :) A balanced as well as diversified Portfolio is definitely important and quite easy to be done by everyone. But just like you mention as well in the end it´s the emotions that might make you take exactly those actions that you shouldn´t...

Controlling your emotions on such a volatile market is especially tricky as you never know how high or low it´ll go, so that FOMO & FUD might mislead you into selling low and buying high instead.

I would therefore always recommend to keep a certain percentage of your Portolio invested in the long term and just use a portion of it for short term gambles. That way you minimize your risks while still having a chance on high profits :)

Hello @mywhale,

the statistics show that 95% of would be traders eventually go broke

Well said, I also heard a lot of bad experiences & made myself to keep away from trading. But with your guidelines, holding is the securest & most profitable methodology.

Many thanks for the wisdom and kind words! Love the cartoon!

No doubt about it, the statistics show that 95% of would be traders eventually go broke, and there's a very good reason why.

Thanks again and looking forward to having you around.

Outstanding perfomance for bitcoin...

Thank's for sharing

sir your work is great and i appreciate that

sir i want buy this coin

thanks for your blog

Thank you very much

I am glad I found you article

I am interested in the civic coin

I will definitely buy a few and make an exodus wallet too

It seems to be a very good useful coin

Thanks again

Can you use your POW computer for anything else?

I think you undervalue mining and PoW in general as a hedge of risk.

Although profits looking back are higher for direct investment vs. mining are much higher, what happens if the market stagnates or even goes down? Mining continues to provide a passive revenue source. Additionally, a CPU/GPU has value for the hardware it is, and these can be sold down the road as additional risk mitigation.

No doubt PoS and other PoW-free or PoW-lite consensus mechanisms are spreading, but these are nowhere near as rigorously tested as PoW. There is a lot of value in knowing that an existing system is secure and highly vetted, so PoW will continue to remain a big player for the foreseeable future until other methods can be thoroughly tested in academia and empirically in the real world.

This post has received a 0.73 % upvote from @booster thanks to: @cryptographic.

This post has received a 10.27% upvote from thanks to: @cryptographic.

thanks to: @cryptographic.

For more information, click here!!!!

Send minimum 0.100 SBD to bid for votes.

The Minnowhelper team is still looking for investors (Minimum 10 SP), if you are interested in this, read the conditions of how to invest click here!!!

ROI Calculator for Investors click here!!!

**Judging from your article, I'm a real lucky one. I also wanted to invest in equipment for the production of crypto currency. But, I could not figure out how to do this and found STEEMIT, where you can get the crypto currency without equipment. The truth is told, fools - lucky :) Resteem

You got a 1.04% upvote from @postpromoter courtesy of @cryptographic! Want to promote your posts too? Check out the Steem Bot Tracker website for more info. If you would like to support development of @postpromoter and the bot tracker please vote for @yabapmatt for witness!

This post has received a 26.32 % upvote, thanks to: @cryptographic.

For me it is obvious that POW just isn't sustainable. Take for instance the story of the russian who just bought two power plants to power mining centers.

This is just getting ridiculous.

Furthermore this results in centralization because you need lots of cash to enter the market. Cryptos were supposed to bust up the old

centralizedmonopoly financial systems.Clearly for sustainability and decentralization, not to mention most everything else, DPOS is far superior.

Add in the performance of graphene based systems over all the others.

Yeah, we don't need no stinking POW.

Thanks for the post.

Keep Steeming!

people will throw money in everything which gives the profit in no time they are not behind the concept anymore i guess

Thanks for great post @cryptographic!

What's your standpoint on consequences of the end of POW era in regards to the whole crypto world? Do you believe the transition will be smooth or should we get prepared for some kind of crisis when the broader audience will start sharing the same understanding?