Introduction

Let's make no bones about it, cryptocurrency has been the best investment (or gamble) one could have done in the past 5 years. It personally lifted me up quite a bit and I think we haven't seen the end of it yet.

But, we have to be careful and learn from history.

High Risk / High Rewards

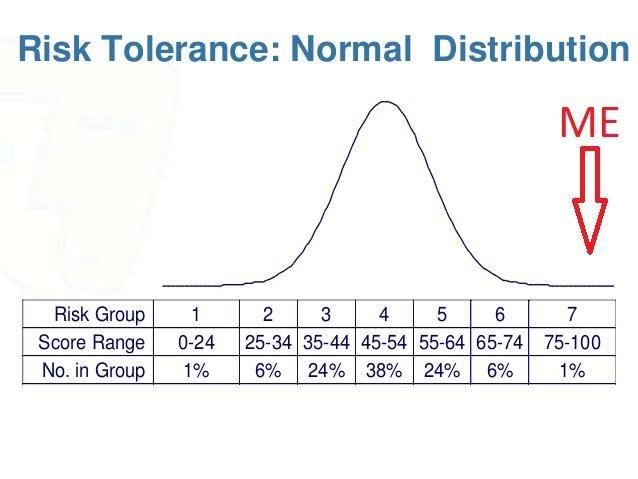

When I went to the financial planner, I was presented with the investor risk tolerance questionnaire. It's a standard operating procedure to understand how someone deals with the risk associated with investing. Then everyone is graded on a normal distribution scale.

If you are the kind of person that is able to deal with market swings of over 200%, you belong in that category. Not everyone can stomach that kind of volatility, that's for sure...but so far it has paid off.

Past Performance Are Not Indicative Of Future Results

That is where I (and people with a high-risk tolerance profile) have to be careful. It's easy to get cocky, believing that it can only keep going up and up. Only to realize 2 or 3 years later that you are back where you had started. I'm old enough to remember the 2000 Dot Com Boom and Bust.

Companies had crazy valuation without ever selling a thing or even having a product. Just having a cool name like "pets.com" was enough for people pore in over $300M dollars into it.

If that doesn't remind you of the current ICO situation, I don't know what is. I was looking at a project called "BYTOM" that mooned yesterday. This project is now evaluated at over 1 Billion Dollars. That's a lot of money and the website seems have been done by a complete beginner. Tons of grammatical errors and I really don't see any real-life application on it.

Fortunately, I have a mentor who himself was one of those companies that went through the DOT COM Bubble. He told me the story of how he went from a valuation $1 per share to almost $60 and then back down. He is a very successful businessman, but he is truly helping put everything in perspective.

Good Ol' Diversification

I know you've probably heard that one a thousand time and to be honest, it's really not sexy. There is simply no market like cryptocurrency. Steem alone in the last month went up by 78.41%. That's the kind of gains that make your palm sweat.

So what am I doing? I personally do not liquidate my position in any cryptocurrencies BUT I'm shaving off the top every month. I hold on to my principal like grim death, but I generate some extra tokens via curation and authorship and move that into the kind of investment that makes sense to me...things such as land and other real tangible assets.

Conclusion

If you have nothing to lose, I would say cryptocurrencies are your best bet right now. It has a crazy upside potential. BUT if you are heavily invested in crypto with almost no real life assets, maybe it's time to think of purchasing something like stocks, bonds, lands, gold or whatever is more stable over the long term.

Tell me your thoughts below.

I do think diversifying is the wisest option for people who already have a lot of crypto. It will simply give mental peace which is very important, especially in your case with a baby coming :)

Nevertheless, since crypto is just beginning, holding the right ones will still provide massive gains in the coming years, the issue here is knowing which ones are the "right" tokens, I hope steem ends up being one of them.

A much needed reflection. Most professional investors sell half their investment when they double thereby pulling out original principal and then playing with the houses money.

Take some gains from this beautiful creation that is Crypto and diversify. If Crypto should fail you will be less disappointed than leaving everything on the craps table hoping for another 6.

I personally take gains every so often and add to my stock portfolio to keep investments mostly passive. One day I hope to truely diversify into rental real estate.

You have index funds?

Yes, I 100% agree - for those in a good place through their crypto investments, you'd be crazy to leave all your eggs in one basket.

I too think the crypto market still has a LOT of upside, especially over the next 5 to 10 years, but there's also a chance Bitcoin gets hacked/broken tomorrow and the whole thing turns to s**t.

Being a paper millionnaire means nothing - you might be an ex-paper-millionnaire just a fast. And all you have is a good hard-luck story to tell.

There's no need to cash out, but even moving, say 10% out of crypto into something else makes a lot of sense. It can still be invested, but just not in something as high-risk. You won't make the crazy returns, but you'll also have something safer to fall back on. And, you'll still have your 90% riding the crazy, crypto rolla-coaster.

I try to hold 10% of my investments in Gold. Rest in crypto, obviously :)

Diversify is always better as you spread out the chances of losses.

The future of blockchain based cryptocurrencies is bright and I am confident that blockchain is the way ahead. Decentralised and hybrid apps will take over the market in the coming years. For that you need to be prepared to have some cryptocurrencies in your kitty. Very soon companies might even start paying salaries in bitcoin/ethers or other cryptocurrencies.

Amazing post dear, thanks for sharing with us

I like the concept of diversification, however, in this current era, everything you would have diversified in, is about to come to an end.

Stocks

The stock market is about to crash, and then crash, and then lose all credibility as the DTCC shenanigans are made known to the people.

And then the stock market is going to crash for good.

So, unless you register your stock with the company, which means taking possession from your broker (they hate this) then you don't own any stock.

Bonds

Bonds have been in super-bubble territory for a while. If... no, when, the derivatives market implodes, say so long to the bond market.

Gold

Gold is much more common than we are lead to believe. Further, it won't be long till we can vibrate gold out of rocks. And the supply of gold will jump. Then the supply of gold will be, go get however much you need.

Property

Property values are in the stratosphere (or in the tank) and they are only held up by the banks being able to lend more and more on a house. This is going to come to an end as cryptos knock out the last pillar holding up banking. Then there will be none who can buy a house at the high rate. No loans, no leverage.

So, if you do not live in it, and expect that place to be your fallback position when things go nuts as the dollar collapses, than it isn't a good investment.

Silver

Silver has a lot of new uses coming online. It will become the worlds most valuable industrial resource. And since all the stockpiles have been used up keeping the COMEX lie going, then the price of silver will skyrocket. (because the new technologies using it are going to be worth that much)

It is so true to get more and nore into real lives if your crypto banks are already filled up...but in my country the scenario changes here the crypto has been banned..that sucks...

I had made an investment....

You have any suggestions on that how to deal with the problem....

Cryptocurrency has turned the lives of many people around in a positive way. I have friends who have become billionaires. As a girl, I was a little bit sceptical to key in at first. I am regreting now, so much because right now I would have had enough money to become a whale or at least a Dolphin but no, I was there doubting and doubting.

I have learned to be a risk-taker. In the future, I will key into opportunities nomatter the risk involved . I f I lose, I lose. The richest men in the world are risk takers.

I agree. Crypto currencies have got the best of everyone. And your are absolutely right to say that high risks are always associated with high rewards. One can't do business without risks. Every business has risks, but we have to minimise the risk factors which can be done with proper knowledge and accurate data.

Nonetheless not much more we can do because it has been banned in our country. So maybe it's bye bye time for us or is there an alternative ?

You trully said that we have to be careful and learn from history.It is very important for every man.

Thanks to the internet, there is an endless amount of free information to consume. The information uptake compared to when I was a kid in the 1980s (pre-internet) must be 1,000X greater. Further, the ability to invest smaller sums of money is much easier and access to once unaccessible deals is much more available.

Going through history of crypto and seeking advise from various sources on Internet can help a lot.

Its true that most people are risk averse and therefore true increase in crypto adoption may first come from institutions and later if crypto becomes a norm, then mass retail adoption will happen.

Risk tolerance also happens when one is playing with significant saving in an asset class. I think placing a small amount of disposable income can bring in a lot of risk averse people into the game. Large volatility on a small capital will not worry most people. Return potential is still substatial. There are more gamblers than risk taking individuals in my opinion.

I really think your points have a strong claim in the sense that Crypto as we know it is not a stable market whether now or later and the best thing to do is to play your card smartly which I believe is the best way to get around this

i also think as like you . and that was very usefull post man , i always follows you :)

Anyone who's read up on basic principles of investing knows the golden rule for making any investment portfolio work over the long term: diversification. When you invest in multiple types of assets, with multiple levels of associated risk, you spread your risk out and reduce the possibility for any one investment to crash the value of your portfolio disproportionately. You also increase your chances of finding a better-than-average return, and through rebalancing, you can adjust your portfolio to reflect your current risk and return goals as they develop.

Typical assets in the past have included stocks, bonds, index funds, and real estate, but with the rise of cryptocurrencies--especially Bitcoin--more investors and professionals are turning to new frontiers in their portfolios.

So is it a good idea to diversify your portfolio with a cryptocurrency?

In a nutshell, cryptocurrencies are electronic cash systems that rely on peer-to-peer exchanges. They're fully decentralized and have no central authority or central server to manage those transactions. Instead, they rely on a network of individual computers to recognize, validate, and record transaction data; every device on the network needs to agree that a transaction can be verified, and once it is, it's added to a permanent, unalterable ledger that exists on that network--as a new "block" on the chain of data (otherwise called the blockchain). Other than their method of exchange, cryptocurrencies function just like other currencies, rising and falling in value.

I'm fairly new to all this, convinced of the tech, risk aversive and taking a long term view, so for those reasons, I'm building a portfolio of the 3 on Coinbase - Bitcoin, Ethereum and Litecoin and at this point evenly weighted on each of them. Nice job on the channel Bobby, you present the information well man, keep it up. (and whats up with the buy limits on Coinbase, ridiculous and have googled around on it, seems there is no way round it. If there was, I'd have invested 10x more Fiat than I have)

That is what i think for so long... i will use my investment dividen to buy some gold. Because after meteor landing in this earth,,nothing will be worth it. Only a gold

Diversification = Victory

I've been thinking about diversifying for awhile and i'm preparing to execute the first steps of my plans by buying some silver coins, since i have been highly encouraged by a few friends to buy silver and gold. I will start with a bit of silver here and there.

But that's mainly to hold value in a strong form that is not fiat money, I've been exploring other, less volatile markets like commodities, food and stuff but the entry barrier into those markets is huge, i guess trading those things was as easy as buying crypto, everyone would do it.... I'm still working my way into it thought.

It's always good to think about diversification not only from the perspective of reducing volatility and risk (especially with many crypto markets essentially correlated with one another and regulatory effects) but also from the perspective of taxation, liquidity and more. Having a sizeable crypto portfolio has certainly helped over the last few years -- but in case the game changes slightly, you want to be ready.

Even though my investment is very small i have made sure that i have diversified it. The only thing that i don't own right now is bitcoin. I wish to invest in it soon.

I completely agree that you need to diversify your holdings.

I can imagine that a lot of people were left without anything, or without a large portion of their money, after DOT COM bubble like your mentor did.

But, what if your holdings are small and investing in stocks won't get you some serious profits because they're not as volatile as crypto.

Then, I'd suggest you to invest only in crypto, but only the amount which you can lose.

Just like you said, cryptocurrencies are the best bet right now.

I'm a young guy, only 20 years old, and my holding are small since I'm still on college.

So, I invested only in crypto.

At older age, if crypto blossoms, I'll most surely diversify my holdins.

Yeah it's a gamble and has most possibility to win.

that's an interesting article @cryptoctopus There are surely many donkeys in the crypto world and most wil perish, turn to dust. In fact I'm going to write an article in response to this about how to evaluate potential projects... thanks for the genie

Always learning a lot with you. Thank you for keep bringing this type of content to us. I always feel that i am a little bit more clever after i leave one of your posts lololol

That is what i think for so long... i will use my investment dividen to buy some gold. Because after meteor landing in this earth,,nothing will be worth it. Only a gold

I'm somewhat diversified but really feel that crypto is the most solid investment right now as long as we aren't picking crap coins, I have some money in stocks, mostly my company stock that almost always is 15%+ per year, and some value invested in a house, but where I want to put my money is crypto

@cryptoctopus This is a one-in-a-life time opportunity to get in early before all of the major funds and investment banks. The blockchain technology will change the way we live - much like the Dot Com boom. Yes there is volatility, but that is heaven for a trader. In the long run, those that invest wisely will prosper.

Really nice article relating important concepts in Finance and applying them to the world of cryptos!

I do like your conclusion! Sound advice!

Warm Regards

@Shenobie

One hundred percent agree. If I were in your shoes, I'd be doing the exact same thing. Holding onto your principal, and then buying "real life" investments, such as housing or land in good areas. Stuff like that (at least where I live) has an average of 3% yearly increase, and more depending where it is. While it's not as exciting as crypto, it's a very stable investment. Depending on your preferences, you could always buy up a few houses over time and become a landlord, to get some real life passive income. If I was in your situation, I'd probably aim for that. For me, I don't have enough money in crypto to pull out and really make a big difference in my life. I'm basically investing all my Steemit earnings right back into crypto, until I have a large enough amount to slowly start pulling some out bit by bit, which hopefully I get to that point.

I think diversifying is a good idea for any number of reasons, although in my case, I don’t have enough starting capital for most non-risky investments to grow very significantly, so at this point I’m probably more invested in crypto than I want to be in the future, largely in the hope that the explosive nature of crypto currencies will build my capital enough that I’ll have something to seed other investments with. It’s a long play, but so far, even my (tiny) investments in crypto have been money that existed outside of my family’s normal budget. So I’m both playing risky games with cryptocurrencies in the hopes of striking a couple of super-high yields, but I’m also isolating that entire portfolio from my “life money,” because I don’t make enough to be able to lose a lot.

If crypto yields enough for me to substantially augment my longer-term diversified investments, it’ll be an absolute godsend, and I won’t ask it for more than that.

its very good idea....no risk no gain

First, when you're starting to invest in crypto you need to invest what you can lose. Then, if you're making money, you need to figure out what you want to do...

Personally, I'm staying about 95% in the crypto world.

At first, I've taken 20% of the money I would usually invest in the stock market and put it in in the cryptomarket. I've cashed out 1/20 after 3 months, but next time I'm just going to add more Bitcoin in my portfolio.

I think there's plenty of room for the crypto in the financial market and I feel like it's a good investment... But I keep in mind I could lose it all!

Diversifying is absolutely necessary for De-risking. I think a lot of people, myself included, expose themselves to unnecessary risk because they got greedy and think "if such and such ICO goes to the money I need to put in more to become really really rich". But the reality is it is a big if. There needs to be some risk involved in order to earn money of course, but there should be some part of your investments in less risky assets. Real estate is a good bet as even if house price drop you still have the tangible asset that can be used or rent out for income.

How about food storage? :) That's one of the best stores of value. And easy to get a return on investment.

Absolutely agree! High risk high reward or speculative investment.

Real estate

Stocks in companies that you follow and do homework on

Silver

Cash

Some type of intellectual property that earns income (like steemit)

Great article, thanks for sharing. I've smashed the upvote button for you!

Also, if you are looking to get some tokens without investing or mining check out Crowdholding (https://www.crowdholding.com). They are a co-creation platform were you get rewarded for giving feedback to crypto startups on the platform. You can earn Crowdholding's token as well as DeepOnion, ITT, Smartcash and many other ERC-20 tokens.

Companies had crazy valuation without ever selling a thing or even having a product. Just having a cool name like "pets.com" was enough for people pore in over $300M dollars into it.

Great. Tnx for your amazing content

Flagged for comment spam. Copy and past commenting is considered spam and spam diminishes the overall quality of the steem platfrom. @steemflagrewards

Please be creative.

Steem Flag Rewards mention comment has been approved! Thank you for reporting this abuse,@steemseph categorized as comment spam. This post was submitted via our Discord Community channel. Check us out on the following link!

SFR Discord

best desktop app for view cryptocurrency stats and signals https://usignals.com