Markets sell off time is not a good time to be rolling over a short safe haven asset. It's OK to be selling US Dollars and buying Aussie though

Portfolio News

Market Selloff

Friday saw a big sell off in US markets to end a yo-yo week taking all indices to 2018 lows.

The focus of the fear is slowing global growth with data on China industrial production and retail sales coming in below expectations. China did make some concessions on tariffs on US autos and increased orders for US corn. The asbestos report about Johnson & Johnson baby powder did not help. This is not really new news as J&J are already paying out claims on a large number of settled cases and they have cash holdings to weather the storm.

Data from Europe indicates that growth is slowing there too

This is a challenging time for European Central Bank, who chose to end their quantitative easing program as planned despite the slowing growth. They are caught between a rock and a hard place with interest rates still negative.

Meanwhile in my portfolios, my short on Japanese government bonds took a hit as the safe heaven money went buying JGB's at an unprecedented level.

The Bank of Japan may well escape their quantitative easing quandary of how to unwind their huge holdings of JGB's - let the market buy what they want to sell - and prices are rising. I doubt though the BoJ sees it this way as they have a yield policy of keeping 10 year yield near zero - this buying is taking them away from that and it is making it very hard for Japanese Banks to make any profits.

Shorts

Japan 10 Year Government Bonds (JGB): 3 Short contracts rolled over on December expiry to March 2019. 2 for 157 basis points and 1 for 107 basis points loss. Of note is the closeout price was 15175 and new contracts were opened at 15187 - i.e., at a higher entry point. This is not normal - there is normally a lower set of prices at rollover. Bank of Japan is aiming for a zero yield on the 10 year JGB. This level of move is the equivalent of between 1 and 2 rate hikes taking the bonds yields to 2018 lows.

BoJ are committed to continue their tapering which means they are no longer the primary buyer in the market. These prices could well collapse when the world markets get over the current round of fear - if they do.

Cryptocurency

Bitcoin (BTCUSD): Price range for the 6 days was $368 (11% of the high). Price tried to push up to the $3600 resistance level and failed and drifted to make a new lower low of $3122 - unlike Ethereum which held its levels. This is "do or die zone" before testing the $3000 level (dotted blue line)

Ethereum (ETHUSD): Price range for the 6 days was $10 (11% of the high). Price tried to push up but then drifted down to test the short term low at $81. It is encouraging to see that level hold and not slide down to the longer term low of $70

CryptoBots

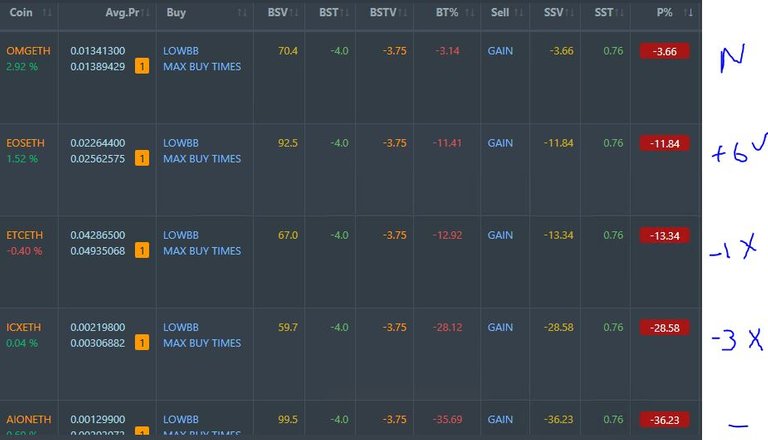

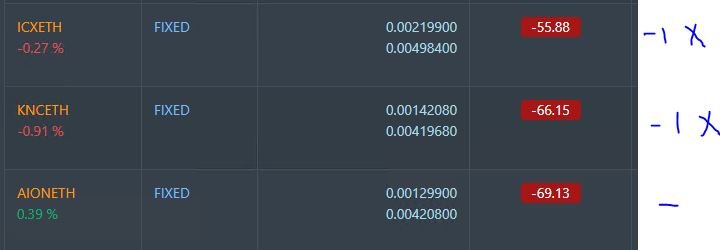

Outsourced Bot No closed trades. (222 closed trades). Problem children remains at 19 coins. (>10% down) - DASH (-74%), ETH (-74%), ZEC (-69%), AE (-42%), LTC (-53%), BTS (-65%), ICX (-87%), ADA (-77%), PPT (-86%), DGD (-88%), GAS (-89%), SNT (-68%), STRAT (-78%), NEO (-87%), ETC (-68%), QTUM (-80%), BTG (-72%), XMR (-55%), OMG (-78%).

Coins moved in a tight band of 1 or 2 points, mostly up. LTC rose 5. GAS (-89%) remains the worst coin and is nudging 90% loss. AE (-42%) dropped a level giving away 5 points. Membership has 50 days to run. I will change strategy once the membership completes. The flaw in these robots is that they require 15 coins - my whitelist does not stretch to 15 coins - I have about 10. The implementation mistake I made was not to implement a stop loss system at the start - this is what learning is about and why I run trials.

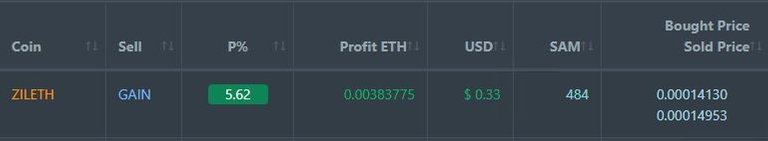

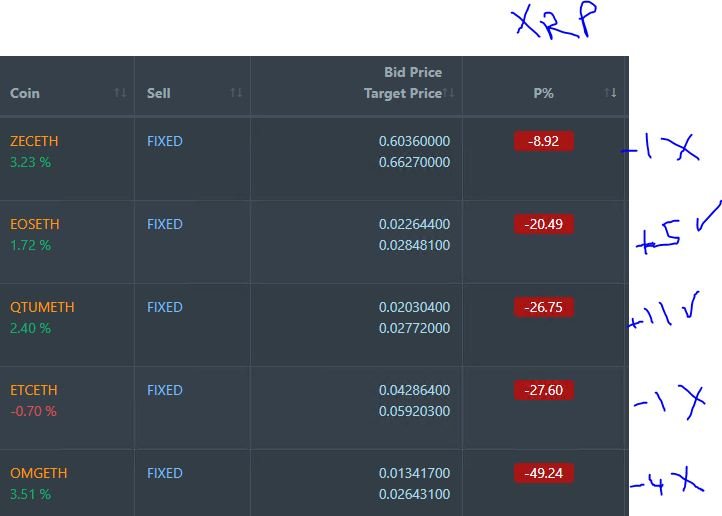

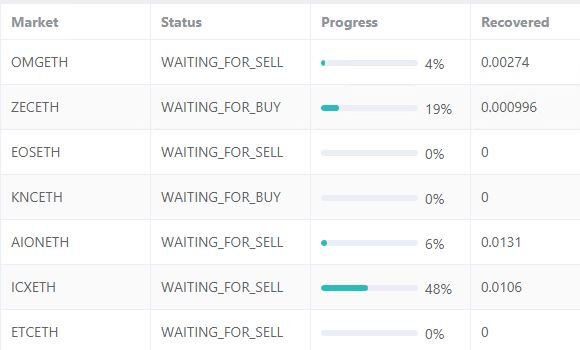

Profit Trailer Bot Two closed trades including XRP through PT Defender (3.41% profit) bringing the position on the account to 4.92% profit (was 4.83%) (not accounting for open trades).

Dollar Cost Average (DCA) list increases to 5 coins with OMG joining on a PT Defender trade. All coins have done 1 level of DCA

Pending list drops to 8 coins with XRP exiting and 2 coins improving, 1 coin trading flat and 5 worse.

PT Defender now defending 7 coins after completing defence of XRP.

New Trading Bot Trading out using Crypto Prophecy. No closed trades. Trades remain open on FUEL, XLM, VET and SC

Currency Trades

Australian Dollar (AUDUSD): With margin activity on my IG Markets account funded in AUD, I needed to sell US Dollars. Disappointing to see sale at 0.7229 and then AUD drops below $0.72 one day later. I only need the funds in Australia on December 20 but have to allow two days for the forex trade to settle and then overnight transfer between broker and bank.

Forex Robot did not close any trades and is trading at a negative equity level of 2.6% (same as prior 2.6%).

Outsourced MAM account Actions to Wealth closed out 10 trades for 1% profits for the period.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

December 11-14, 2018

For me it just all seems wrong and out of place... I am glad I got out for the year to relax although most of my short positions would have done fantastic, I am sure the positions I would have added would have been decimated. Waiting for the new year again but watching carefully!

Posted using Partiko iOS

December selloff is unusual indeed. Retail outflows have been massive. When those happen the ETF managers sell right across the whole index = so the selling looks indiscriminate. It is very much a stock pickers market right now