Markets may have found the interest rate crossroads. I take a punt on US sports betting perhaps from an unusual corner. Medicinal cannabis is one of my themes - I added another one at a nice discount. Profits in European steel go into Italian telecom. Some technical options trades in engineering services and semiconductors.

Portfolio News

Sports Betting in USA US Supreme Court ruled that Federal Law outlawing sports gambling was unconstitutional and that the States had those powers.

The market reaction was to push up the shares of existing operators who could be well placed to use their physical presence to support sports betting. The talk is that betting could be legalized in 32 new states and that there could be a market addition of $150 billion. There is a lot of skepticism about this number as it is an extrapolation from some old data and it does not answer the question "will illegal betting channels move over to legal channels?"

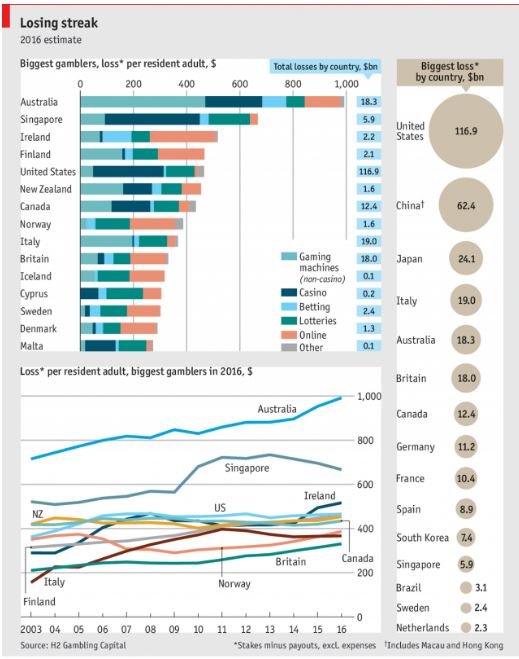

First step is to identify the size of the pie. Ths chart from The Economist suggests a loss pool of around $100 billion in US. That will change as some illegal betting moves to legal channels. A 20 to 50% uptick would be a key move and would suggest an addition of at between $20 to $50 billion.

https://www.economist.com/blogs/graphicdetail/2017/02/daily-chart-4

Next thing to explore is how gambling is doing compared to the market overall. I present a buy:sell chart of S&P500 compared to the Gaming industry (represented by VanEck Vectors Gaming ETF (BJK)). [Means: Buy the first named stock and sell the second named stock. If the chart goes up the first named stock is outperforming. If the chart goes down the second named stock is outperforming]

This shows that gaming has been out-performing since early 2017. That feels like a missed boat. An announcement like this does change the dymanics.

Marijuana Takeovers Marijuana made it to headline news with the biggest ever marijuana deal with Aurora Cannabis taking over MedReleaf.

There was a big spike in cannabis stocks when the legalization votes happened in the US election. the euphoria did not last - consolidation comes next.

Bought

First pass on US sports betting was to pick UK businesses that already have a US footprint. they can move fast as they have footprint and they have capability in sports betting in UK.

Britain’s bookmakers are already jockeying for position. They have years of experience because of Europe’s more liberal approach to sports gambling, while sharing a common language reduces barriers to entry

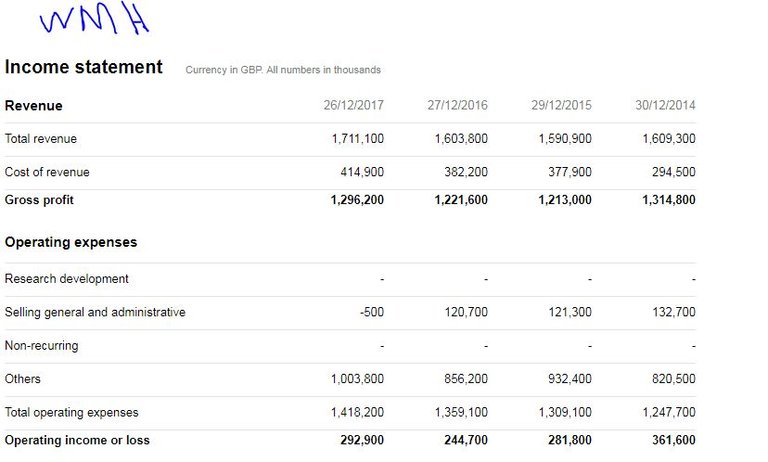

William Hill plc (WMH.L): UK Betting. William Hill is well placed to move quickly in US markets as it is already licensed and operating in Nevada where it is legal and licensed in New Jersey. The charts for William Hill are challenging. It is under-performing the UK market (using iShares UK ETF (IUKD.L - orange line) though it was showing signs of recovery from early 2018.

It is also underperforming its industry represented by the van Eck Vectors Gaming ETF (BJK - ochre line) - 40% percentage points right there. The orange line is Paddy Power Betfair - its main UK competitor. - they look the same. What I liked was the financials - William Hill is profitable. This change could get them a solid kicker on the revenue line without much change in the cost line. - e.g., if they could grab 5% share of an extra $20 to $50 billion.

Paddy Power Betfair plc (PPB.L): UK Betting. Paddy Power is a leading sports betting business across many jurisdictions and already has casino licensing in New Jersey.

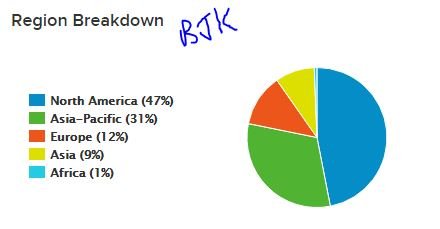

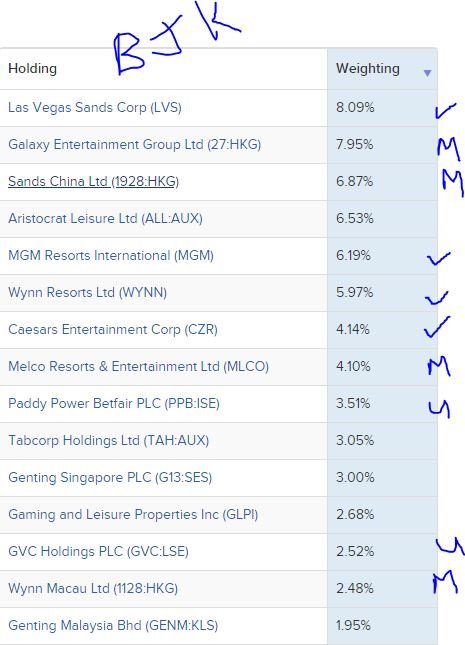

VanEck Vectors Gaming ETF (BJK): Global Gaming. I like to use ETF's as a way to start an investing idea. I got an idea from @stocksncrypto suggesting this ETF as one way to play the US sport betting possibility. First cut suggestions were that existing US gambling owners would be winners - i.e., the casino owners. A quick look at the holdings for this ETF tell me that there is some coverage here though there is a lot of other stuff. I was happy to open a small parcel to see what would rise to the top.

First cut look shows that 47% of this ETF is US-based. Increase that by 20% say and that is a 10% increase in value right off.

Now there have been some key changes in the pressure being applied by China on Macau gambling. Macau accounts for quite a large slice of the ETF (labelled M). Their stock prices will be improving too. The ETF gives coverage of the 4 US properties likely to benefit fastest (LVS, MGM, WYNN, CZR - all ticked). the ETF also covers two UK stocks one of which i added specifically.

Telecom Italia S.p.A (TIT.MI): Italian Telecom. Telecom Italia keeps popping up on investing screens. I averaged down my entry price with proceeds from the sale of Arcelor Mittal call options.

Aphria Inc (APH.TO): Canadian Marijuana Pharma. I have long been invested in marijuana opprtunities. My preferred model is to invest in companies that are operating in legalized markets and adding value for the medicinal uses for cannabis. Hence my investment in MMJ Phytotec (MMJ.AX) which has established growing and medicinal positions in Australia, Canada, Israel and Switzerland. Following on from the Aurora Cannabis announcements, one of the talking heads was talking about cannabis stocks - he likes to find stocks with a medicinal bias. He liked this one. Now I seldom take advice from talking heads - I use them as the starting point for research.

The chart looks compelling. Firstly we can see that the downtrend has been broken and it made a new high in yesterday's trade. My trade went in at market open and caught the 7% uptick for the day.

More than that we can see where price has come from as the euphoria fell away from US cannabis stocks. Price will double if it gets back to the 2018 highs. I have overlaid on the chart the chart for Aurora Cannabis (ACB.TO - orange line). Even without getting back to highs there is a 82% points difference between the two charts. Close half that gap and price will go up more than 50%.

There are risks in investing in marijuana. The medicinal side is subject to drug agency regulation - that messes with cash flows and timing. The crop growing side is easy to copy and follow. Do not be surprised to see the price become totally commoditised just like every other agricultural commodity.

Fluor Corp (FLR): US Engineering Services. Fluor announced results a few weeks back that disappointed markets. Price was knocked back hard from close to touching $60 to the low $40s. Was the market right?

Shares of Fluor (NYSE: FLR) got devastated after earnings last week

https://au.finance.yahoo.com/news/fluor-stock-buy-last-week-161049146.html

I did not do anything about the trade as I am holding the stock and I had just written the May covered calls against the stock. I have been watching oil services stocks recover as the oil price has risen. What is stopping Fluor from regaining those $60 levels? Fluor has an important part of its business tied to oil services. that will grow. Will that be enough to take them through the challenges in the power energy side of the business? Merrill Lynch think they will - they just upgraded the stock.

I bought a January 2020 47.5/65 bull call spread. [Means: Bought strike 47.5 call options and sold strike 65 call options with the same expiry]. How does that look on the charts which shows the bought call (47.5), and 100% profit as blue rays and the sold call (65) as a red ray with the expiry date the dotted green line on the right margin.

First thing that stands out for me is the highs in 2014 do reflect oil price highs. This business is driven by oil prices. All price has to do is get back to where it came from before the drop and it will make 100% profit.

Looking back at the last price wobble in 2015 I have cloned the size of the 2nd run up (left hand blue arrow). It is the same size as the next price wobble (middle blue arrow). All I need is price to recover the same amount and 100% profit is possible. My instinct is that price will make a new higher high and get close to the maximum profit level - maybe not before expiry but close. The technical analysts will see that two of the prior three retracements have been to the 0.76 Fibonacci level - this one too.

QUALCOMM Incorporated (QCOM): US Semiconductors. Qualcomm is a leading supplier of chips for smartphones. it has been in the news with its own takeover of NXP Semiconductors (NXP) being reviewed by Chinese regulators and a bid for it by Broadcom (AVGO) being vetoed by Donald Trump. It has also faced a number of patent infringement issues. Hence the share price has seen something of a see-saw journey. I have long been a older of Qualcomm stock.

The talking heads discussed a short term trade idea - if the NXP deal gets approved, price will spike. If the deal does not get approved, price could tank. That said, Qualcomm's future does not hinge on NXP. The trade idea was a bit complicated and was short term - June 2018.

- Buy a bull call spread - I did 55/60 - basically looking for price to spike above $60

- Supplement the sold call premium by selling a strike 50 put option. If price collapses, $50 would be a great price to get back into the stock.

I gave it a try. The bull call spread cost a net premium of $1.98. If price gets to $60 before expiry in 5 weeks time - i.e., half way to where it came from profit is 152%. Adding in the sold put increases the profit potential to 195%. Worst case scenario is price drops well below $50 in the next 5 weeks and never recovers. I think Qualcomm is a cheap stock at $50.

The chart has me very interested.

Price has made a floor around that $50 level (dotted red line). It has twice tested right up to $68. The sold call is halfway (the blue ray). I am seeing a longer term trade set up here too - I will explore some more.

Sold

ArcelorMittal (MT.AS): Europe Steel. Closed December 2021 21/30 bull call spread for a 98% profit since May 2017. Spread had reached maximum profit potential with price passing the strike of the sold call. This was a rolled up options trade (reported in TIB82) in which I said I was expecting a 284% profit - I got 98% - which tells me that implied volatility for the stock reduced dramatically in the last 12 months. I did write "All I need to be right is for economic growth to continue developing as it has been the last 12 months"

The chart suggests to me there is still scope for a long term trade. I will explore again. I do still own the stock and I do have some call options open in other accounts.

Fifth Third Bancorp (FITB): US Regional Bank. I have had a profit target on a January 2020 strike 30 call option in my small portfolio for some time. With the spike in US Treasury yields overnight, this profit target was hit for a 123% profit since November 2017. I wrote extensively about regional banks in TIB144 - I got this one right. Was it better than anything else? I need to find out as I need to replace the trade.

Shorts

I have been going on about interest rates for some time. When I woke up this morning I checked my portfolios before I listened to the talking heads. My portfolio was split in two - all the interest rate oriented investments were up strongly and all the emerging markets stocks ( except Malaysia) were down. I knew exactly what had happened without seeing the overall market. Yields rose strongly and Emerging markets got smacked in a new fear driven rout. On Monday I snapped this chart - it is of Euribor interest rate futures dropping on a day that Eurodollar futures rose. I knew it was important - hence snipping it.

Eurodollar 3 Month Interest Rate Futures (GEZ9): I have had a price target on one of my Eurodollar contracts at 96.95 - implying an interest rate of more than 3% in December 2019. That price target was spiked to and hit overnight for a 23.9 basis points profit since March 2018. It feels good to win when the market misprices rate hikes.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $465 (5.2% of the high) for another day of low volatility. The price chart shows an interesting pattern with 3 successive long tailed bars and then a moment of indecision and then a collapse with a speech by Federal Reserve Governor, Lael Brainard spooking Bitcoin holders.

Price remains in "no-mans land"

CryptoBots

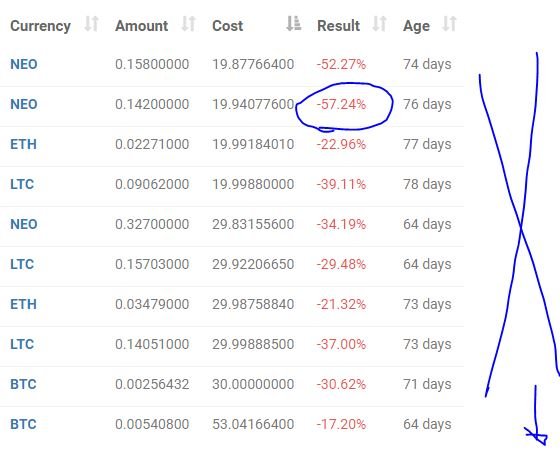

Outsourced Bot One closed trade on this account - ZEC (1.98% from February 26 - a manual DCA order I placed) (200 closed trades). Problem children was increased by two with TRX, XMR coming back above the 10% threshold (>10% down) - (14 coins) - ETH, ZEC, DASH, TRX, ADA, PPT, DGD, GAS (-42%), STRAT, NEO (-44%), ETC, QTUM, BTG, XMR.

There remain a few trades that are worse than 40% down. NEO remains the worst. The ZEC chart shows another pump - we wait for the dump. It was good for me this time.

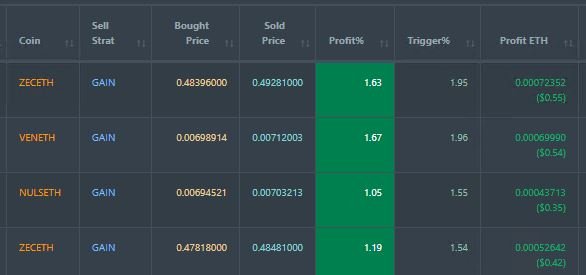

Profit Trailer Bot The bot closed 4 trades for an average profit of 1.39% and a positive 0.36% (was 0.32%) on the account (228 trades). (190)

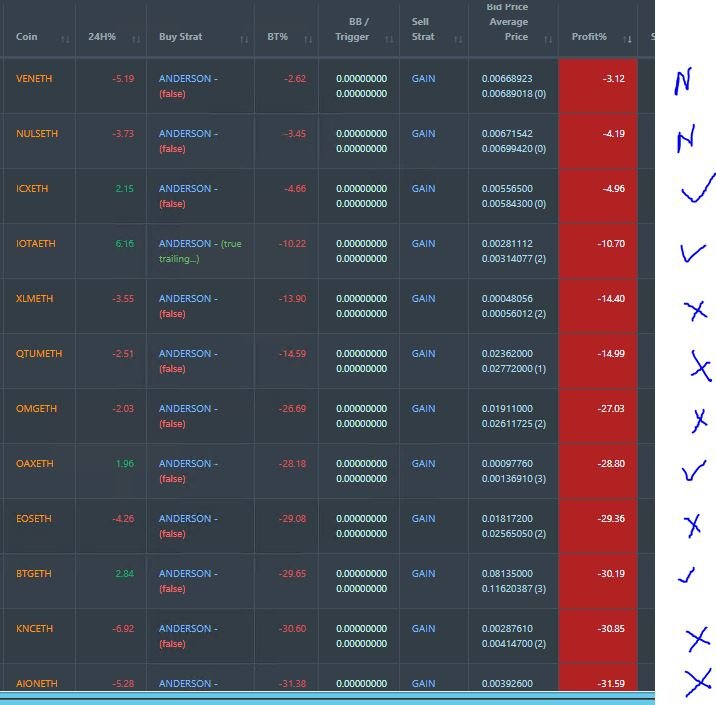

Dollar Cost Average (DCA) list stretched out to the maximum of 12 with VEN and NULS joning the list and with 6 coins trading worse and only 4 marginally better. ICX did make a run for freedom and at one stage had come off the list.

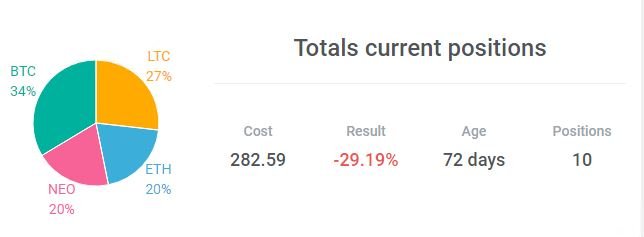

New Trading Bot Positions dropped to -29.2% (was -25.3%)

All coins traded worse with NEO dropping below 50% down.

Currency Trades

Forex Robot did not close any trades and is trading at a negative equity level of 20.6% (higher than prior day's 18.6%). No surprise really on a big day for US Dollar

Outsourced MAM account Actions to Wealth closed out 1 trade for 0.07% loss for the day. Not bad for the day of the New Zealand budget. Normally I do not trade on days like that.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. BJK images are credited below them. All other images are created using my various trading and charting platforms. They are all my own work

Cannabis image embedded in the title image By Cooljuno411 [CC BY-SA 3.0 (https://creativecommons.org/licenses/by-sa/3.0) or GFDL (http://www.gnu.org/copyleft/fdl.html)], via Wikimedia Commons

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

May 15, 2018

Upvoted ($0.22) and resteemed by @investorsclub

Join the Investors Club if you are interested in investing.

An important metric to consider is that the S&P 500 dividend yield is now below the 3 month Treasury yield so momentum can now shift to more stable capital stable assets considering the risk associated to volatility currently in financial markets.

True for those with a US centric view of the world. It is not true for European or Japanese equities.

My tax status is such that I do not invest for yield. I am always looking for capital growth.

Yield investors do need to be wary. I am very nervous holding fixed interest securities with yields still rising. Capital will be taking a big smack when yields cross 4% from the current 3%

i will always support you @carrinm ... i like you @carrinm .. all the people of Indonesia support you @carrinm. Suppose we have free time to help us @carrinm

All I do here is write. On investing, it is about the way I think about the things I do. That way I learn and readers learn

On my photography posts, I like to tell stories about the way I found the things I photographed and the way I was feeling.

I do not spend time looking for followers and asking for support.

I do run some curation automation - I use Steemvoter to upvote posts from my friends who I know write well and share good material. I also help out a few people who then help me back. @riostarr is a good example - the photos are great.

As I watch your posts I will decide how best to give support.

Another excellent post.

Thanks

Honestly, I am very impressed with your post sir @carrinm

This is very interesting @carrinm brothers, you choose to invest well and this program is very good. I really support the program you do and I really support you. resteem let others see it and thank you for sharing this information. this became a science for me.

yes .... I do a little to understand the current market price problem, but with what you say, I can understand a little about investment and what you do very well. I support what you are doing and for that you stay focused and concentrated to invest.

Hello, sir. Will it be stable?

Will what be stable?