In Wednesday's trade along with the emergence of important world economic data and the ending of the Fed's interest rate meeting later in the night, it seems that the US dollar is still comfortable to put pressure on gold and other major world currencies where investors are still comfortable taking assets risky than safe haven.

In general, the US dollar can still strengthen again with the start of the redset situation of the Korean Peninsula post Trump threat that will exert its military power and will determine the interest rate of the Fed on Thursday morning.

In previous trades, the US dollar generally underwent thin pressure from world currencies and gold as US transactions grew in deficit with Trump as he spoke at the United Nations. EURUSD closed up at 1.1994, GBPUSD closed up at 1.3505, AUDUSD closed up at 0.8009 and USDJPY closed slightly higher at 111.58.

In Wednesday's trade along with the emergence of important world economic data and the ending of the Fed's interest rate meeting later in the night, it seems that the US dollar is still comfortable to put pressure on gold and other major world currencies where investors are still comfortable taking assets risky than safe haven.

In general, the US dollar can still strengthen again with the start of the redset situation of the Korean Peninsula post Trump threat that will exert its military power and will determine the interest rate of the Fed on Thursday morning.

In previous trades, the US dollar generally underwent thin pressure from world currencies and gold as US transactions grew in deficit with Trump as he spoke at the United Nations. EURUSD closed up at 1.1994, GBPUSD closed up at 1.3505, AUDUSD closed up at 0.8009 and USDJPY closed slightly higher at 111.58.

The geopolitical situation of Korea today still will not disrupt the course of money market movement and the world commodity market after the Trump threat, so investors will turn to world economic data such as how UK retail sales when there is Brexit, if data worsens it will keep the US dollar in positive areas.

The market is actually still anxious about the Fed's work plan that will improve the deficit from its balance sheet or the $ 4.5 trillion balance sheet with our forecast that the deficit burden will be an initial reduction of about $ 3.2 trillion. Whether the Fed starts fixing its deficit by undertaking to dispose of its $ 30 billion worth of assets back into the public market or not. If the work plan is done, then the condition of the US dollar can still fight again and make gold will droop again.

It is also certain that the Fed will not change its interest rate policy, but the explanation of further work plans is the starting point of the US dollar and where gold will go until December.

In addition, the certainty of US tax reform seems to be coming closer and seems to get support to be completed soon this month and do not get delayed next month. But Trump's desire for income tax below 20% will be difficult because according to the US parliament that the eligible tax is at 22%. At least this week can find out the tax reform.

As we know that if tax reform passes and becomes a new tax law then the US economy could grow 4% or almost match the growth of the developing country's economy.

Daily Technical Analysis - September 20, 2017

Note:

The MetaTrader data we use may differ from the MetaTrader data that readers use. However, we try to present the objective analysis as possible.

This analysis is just a guide for traders to see the market conditions today and not a transaction suggestion.

EURUSD

EURUSD climbed on Tuesday, reaching 1.2007 and ended positively at 1.1994. The EURUSD bulls continue to struggle to bring this pair through the 1,2000 psychological level that has been repeatedly tested to survive.

On September 8 EURUSD was at 1.2092 but on the same day it immediately turned down, a sign of resistance of the bears in this zone is very strong.

This time still remains a question mark whether EURUSD will be able to penetrate the strong resistance. We see little chance of successful penetration of this area, at least until the moment the Federal Reserve's decision is released on Thursday early morning.

The current rising potential may also shrink if on the 4-hourly chart there is a considerable close close below 1.1970 support. Next support at 1.1915.

![1EURUSDDaily.png]

( )

)

USDJPY

On Tuesday USDJPY rose to 111.88 then fell slightly and formed a doji at the end of the session, an indication of a trend reversal or just a correction. The potential of the doji also combined with strong resistance at 61.8% Fibonacci retracement level at 111.75 and yesterday's closing session at 111.59.

So in short today until before the Federal Reserve's decision is released on Thursday early morning, USDJPY has a chance to move down. Downside opportunities will be enlarged during strong penetration of the support zone 111.40. Next support is at 111.15 and 110.83

GBPUSD

GBPUSD moved relatively thin on Tuesday and ended positive at 1.3512. The pair is slightly away from Monday's session lows at 1.3465 which now serves as one of the intraday supports. Other support is 1.3420 which is the first correction target against GBPUSD move up from 1.2774 up to 1.3619.

While the pair is likely to move sideways in the range of 1.3465 to 1.3552. Both consolidation limits in the intraday time frame can be used as a benchmark to see the future potential of GBPUSD when the Federal Reserve's decision is released on Thursday early morning.

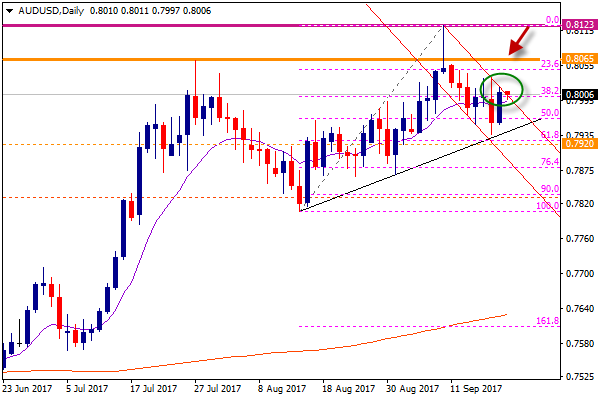

AUDUSD

In yesterday's trading session AUDUSD managed to strengthen up to 0.8018 and closed green at 0.8009. As depicted on the daily chart, the AUDUSD's surge is still limited by a downtrend line, today at 0.8000.

When the analysis is written AUDUSD slightly above the trend line is also above the other support zone which is also at 0.8000. Other intraday support is at 0.7968. Although there is a chance up, it will likely remain limited as the market tends to be less active until the Federal Reserve's decision is released early on Thursday.

The strong resistance above Tuesday's session high was 0.8050 / 65.

XAUUSD

On Tuesday the gold price (XAUUSD) rebounded to 1311.45 and closed positively at 1310.40. However, as seen on the daily chart, the price of yellow metal remains inside the bearish corridor.

On Wednesday morning on the 4-hourly chart the commodity price is still struggling to produce a close enough close above the resistance of 1311.15. As long as the expected close is not formed, XAUUSD remains vulnerable to be hit back with the target in the nearest support zone now seen at 1304.45 and next at 1299.00.

But a significant move seems to be about to happen at a time when the Federal Reserve's decision was released on Thursday morning.