When interpreting and enforcing smart contracts, third-party intervention may be unnecessary. The overall goal of smart contracts is to provide security that can be attained by the traditional contract but reduce the additional transaction costs that you are charged by traditional contracts. Currently, Neluns is using both the blockchain and smart contracts to solve various challenges in the insurance industry. Smart contracts are computer-based protocols that facilitate a contract’s performance and implementation. Smart contracts only perform depending on the specific instructions given to them. You can trace all transactions on smart contracts but you cannot reverse them. The smart contract can be compared to a vending machine which needs certain instructions to give out a particular product.

The terms of a contract are coded and placed in a blockchain. Bitcoin also uses this technology. After a triggering event has been performed and it is consistent with the available terms the contract can be fully performed.

Insurance agreements

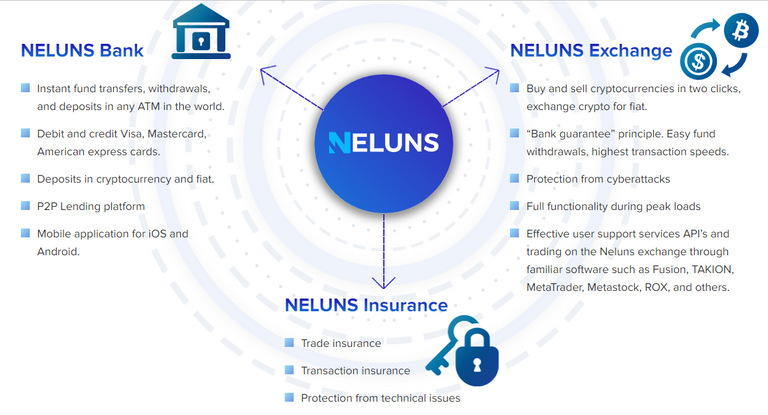

I believe there is room for smart contracts in the insurance industry. Neluns wants to introduce smart contracts in the insurance industry. They have a potential to play an important role in different aspects of the insurance industry. Smart contracts could be used to allow policy documents to be stored on different ledgers so that they can be made available for review and amendment by multiple parties. The policy documents can never be changed without all parties agreeing to change them. Smart contracts will help to secure policy documents and improve the processing of claims. They will also help to remove the barriers brought about by administrations.

Smart contracts will help to affect the automated payment of claims process. Policyholders can receive payments for claims that are not contested immediately with the help of smart contracts. Payments will be sent to the account of the customer directly without using an intermediary. What we can hope for is for the claims management process to be smoothed by algorithms within a code. These advancements will enhance the satisfaction of customers and it can lower the insurer costs and reduce premiums in the long run.

Natural disasters such as lightning, floods, earthquakes or tornadoes can constitute triggering events that can lead to payouts automatically with the aid of smart contracts. Experts can even program the contract to ascertain the scope of events and this can ease adjustment process by reducing the time spent to investigate and verify a claim. Smart contracts can also be programmed to ensure that a payment only occurs when the holder of a policy uses a prodder of its choosing. They can program it further to ensure the money returns if the insured does not comply with the terms of the agreement. This could help to make the process to be more transparent.

What are the potential drawbacks?

Smart contracts may also have their flaws. Some experts say that we can use smart contracts to avoid having ambiguities in policy language and prevent lawsuits and disputes over ambiguous terms. This will be unrealistic if we expect ambiguous language to be eliminated by smart contracts. If we wanted to eliminate this ambiguity then we can do it now on the currently written contracts. Policymakers should be advised to review the terms they use before even considering smart contracts.

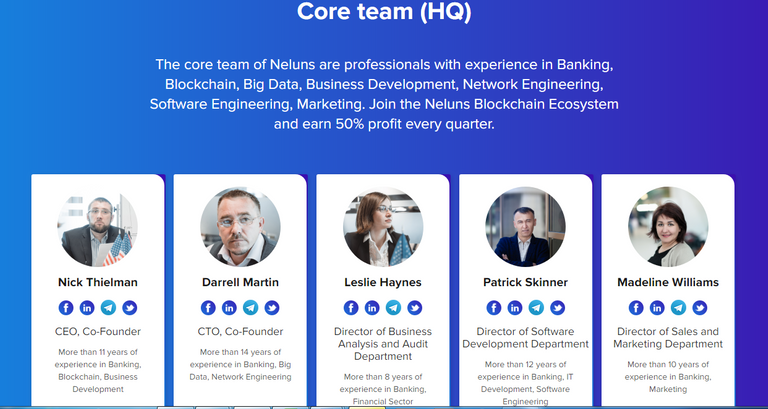

Smart contracts should be coded by a programmer who has the knowledge and the necessary skills to do the job. The programmer is a third-party and requiring a third party to design a smart contract makes it less of a smart contract because one of the strengths of smart contracts is not to involve third parties. Neluns has their own professionals working on their project. They will have their internal experts to do the coding but of course, they will have to consult other stakeholders.

We are headed towards a world of advanced technology. The insurance industry is also evolving and players like Neluns are determined to take the necessary measures to ensure that the platform is transparent and customers get timely, cheap and secure services. Smart contracts have a potential and the insurance industry has the chance to improve. Implementation of smart contracts will reduce fraud and this will benefit all stakeholders involved.

Reach out to us on the following channels:

- Website: https://neluns.io/

- Telegram: http://t.me/TheNelunsChat

- ANN Thread: https://bitcointalk.org/index.php?topic=4694028

- Medium page: https://medium.com/@iconeluns

- Bitcointalk profile: https://bitcointalk.org/index.php?action=profile;u=2028190

Good company

Congratulations @mariawilson24! You received a personal award!

Click here to view your Board

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness and get one more award and increased upvotes!

Congratulations @mariawilson24! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!