Navigation:

(click the text below to navigate the the document)

++Chapter 1 (Innovation in General)++

++Chapter 2 (Innovation & the Games Industry)++

++Chapter 3 Investigation, Data Analysis and Conclusions, Recommendations and Conclusion++

Chapter 3

The aim of this chapter is to provide an empirical contribution to an understanding of innovation's role in the industry, putting research to the test. It is also worth mentioning that this paper uniquely, unlike methods outlined in this paper, uses this information not to predict games sales, but to find out what role innovation plays in the industry.

Investigation

There are variables and limitations at play when comparing the success of a game to its sales and indeed what role innovation has played in this. The use of games sales figures may not indicate how well the developer has performed but, instead how well both the developer and publisher have performed. In search to prove my hypothesis and to reduce co-incidental results, a mixed cross section of games will be analysed, including examples that help provide empirical data to corroborate arguments outlined in this paper. Of course, the larger the cross section, the more comprehensive the results become, but importantly, at the end of this chapter, I develop a technique used to validate this data via cross-referencing it with levels of innovation to either prove or disprove the hypothesis. This technique may be proved adaptable to serve as a basis of studies for expansion into new markets, but it was not built for this purpose.

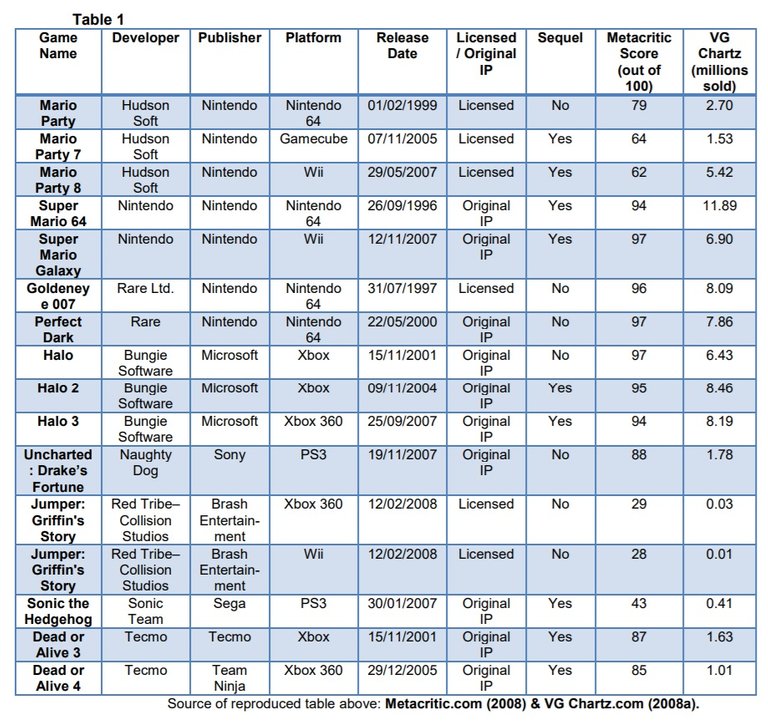

The table below sets about exploring the relation of the variables, limitations and methods described earlier, associated with the headings of each column. The final two headings firstly describe an average industrial review score and lastly, recorded global sales figures for that game. The advantage of having an average critic’s review score, helps differentiate general opinion of the game from games sales, investigating the effect of reviews and previews on games sales.

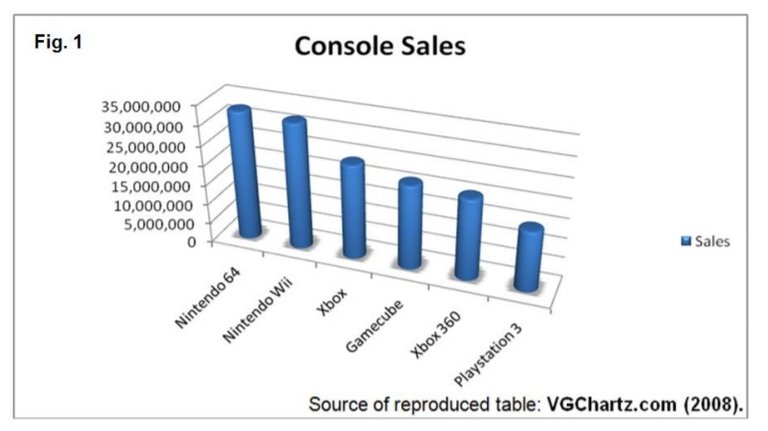

Before I start to suggest any relations between the sales figures column and any other column, it is essential to highlight the relationship games sales figures has, with console hardware sales figures. Fig.1 below gives a representation of how large each market is, outlining an approximate number of potential customers per console.

This information helps to realize exactly how successful a game is in ratio to its potential customers. Kerr (2006b, p.43) highlights an industrial perspective, where developers are thought to decide upon which console to develop a game for, by looking for favourable “market segment.”

Data Analysis

Platform

It is clear from the relationships between Table 1 and Fig.1 that the amount of consoles in the public domain does affect the amount of game copies sold. However, one example; Jumper: Griffin’s Story, sold less on the Wii than the Xbox 360, even though there are more Wii’s in the public domain. This could highlight a number of variables that may have been overlooked by development, like the previously mentioned importance of demonstrating both the technical abilities of the hardware, innovation in the game idea and balancing the two, especially the adaptable design needed for this sort of demonstration in multi-platform releases. Another variable is that it simply suited one console’s market demographic more than the other, but the greater trend shows increased sales for games released on the more popular consoles.

Review Score and Sales

Comparing Mario Party 7 and 8’s review score to the amounts of copies sold shows an unexpected increase in sales, as the review score dropped by 2 points. Even after taking into account that there are more Nintendo Wiis than Gamecubes in the public domain, the sales should not have increased that much without reason. The sales could be because of the pull of a new console, but more importantly MCV

(2008) reveal “Nintendo’s marketing campaign for Mario Party 8 is one of the biggest that the publisher has ever put behind a first-party title.” The combination of the two provide an explanation for these results, but the general results show if a game receives good review scores, it will sell better.

Developer and Publisher

Table 1 shows varied performance amongst developers, but one trend seen is that the main bulk of games in the table are developed and published by the console owner which achieve largely respectable scores in terms of reviews and sales. Of course this is the example of Mario, which in reference to previous marketing methods from Nintendo, it’s no wonder Mario can reach the highest sales on the table, but it has to be mentioned that the Mario platform game has come to always set the standard of quality for the competition.

Titles from Goldeneye to Halo 3 have shown extremely respectable results, proving that developing for Microsoft or Nintendo might not be so bad after all. This may be even truer, as Cnet News (2000) reveals that Microsoft bought Bungie Software. Bungie were the makers of Myth: The Fallen Lords, a very popular title, suggesting acquisitions tend to be offered to high performance developers. CNN Money (2002) proves this point by stating that Microsoft acquired Rare soon after the production of Perfect Dark, which allowed them access to not only the Perfect Dark franchise for development on their consoles, but other IPs as well. These results give truth to the methods seen in this paper, where companies scale up acquisitions to access IPs and reveal the true power of original IP. The fact that Bungie left Microsoft soon after, in order to develop for other consoles, shows that there are ways out of ‘strict console licensing agreements’, but it may cost the rights of the franchise, as Microsoft managed to retained the rights to the Halo franchise Register Hardware (2007).

The examples of third party development: Jumper: Griffin’s Story and Sonic the Hedgehog were used to provide a contrast of results, at the bottom end of the spectrum, not particularly for their party status, whereas Dead or Alive 3 & 4 were picked for diversity in party status. Dead or Alive seemed to do well, not forgetting that ‘self-funding’ allows full creative control over the project, and a bigger cut of the profits, holding their sales score in higher regard.

Licensed and Original Intellectual Property

The varied results shown in Table 1 show how unpredictable the games industry is, and fortifies the fact that a license can not make a bad game sell well, but increase familiarity with the consumer, thought still, a wider cross-section of results, focusing on licensing, sales and review score will serve to see what the trend is between licensing and original IP.

Rocca (2005, pp.40-41) says that the downside to licensing is that control over original IP is lost, “since the publisher is not in a position to sell rights in what they do not own or control” and Baggaley (2005, p.166) adds that “…the concept of intellectual property (IP) plays a huge part in your company’s success. Your company’s value is measured as much by its IP as by its physical assets”, this is certainly true from the analysis of the results shown so far.

Sequels

Table 1 does not show any irrefutable evidence that sequels increase the sales of a game, but what it does highlight is the value of the sequel against review scores, as similar review scores are commonplace. Though, fluctuating sales figures shows that even if sequels already have a confirmed audience, it does not mean the same amount of consumers will buy the game again. Crawford & Rutter (2006, p.151) bring the interesting argument to the debate that might help explain the variables here. They state that the sharing of “game[s] engines” reduce innovative capacity, what is true is consumers waiting for the next instalment of a game also await the marvel of its developments, waiting to unwrap new elements of the game in each new release and if no product innovation is delivered, sales may suffer.

Release Dates

Taking into account how recent a game has been released is important, as will highlight that the game may not have completed its’ product lifecycle and reached it maximum capacity of sales, whereas the older games have.

Walker (2003, pp.192-193) gives two industry guides below, of firstly, when not to release a video game, and then secondly, profitable times for release:

Times not to release:

“In February - Christmas and the Christmas return season are long gone

July – everyone is playing outside

The week after your major, blockbuster competitor’s title releases

If the shelves are already filled with games of the same genre

If the game isn’t ready for release – first get it right…”

Times to release:

“Just before Thanksgiving- you want them on the shelves for that big Friday

after ThanksgivingAround the time of the Electronic Entertainment Exposition – it generates

lots of pressRight after school starts-the kids are looking for an escape

When the game is well tested and bug free”

Results from Table 1 show that release dates are the most important factor in affecting games sales. It shows the most successful times to release games are May, September and November, which corroborates Walker’s advisory of times to release. Looking at Dead or Alive’s released dates, Dead or Alive 4 just missed Christmas, and also lost 0.62 million in sales, in comparison to Mario Party 7 which had a lower review score, but was released in November before Christmas in the same year, shows a gross of 0.52 million more in games sales.

Results from Table 1 to show the worst times to release games are also corroborated by Walker’s schema. February and January are seen to be the worst times to release; Jumper: Griffin’s Story was released in February, as a movie release tie-in. It is not for certain whether or not the movie version controlled the release date of the game version, but if it did, it definitely adds to the negative sales of the game. Therefore, it is important to negotiate the release date of a game-movie tie-in for simultaneous release, as Table 1’s results, with Walker’s schema proves release dates to be a major variable in sales.

Lastly, it is worth contributing the idea that console launch titles meet little competition within the platform at the time of release, as only a handful of games are made available for launch.

Price Sensitivity

Prices of games differ from console to console, so it is worth mentioning that Nintendo games are usually cheaper than other console games, with PS3 games retailing for higher prices than Xbox 360, who are in the middle. Of course, this is not true for every case, but a consumer is more likely to purchase a product that costs less, and offers the same content as a more expensive version. This is what I term the ‘value for money’ concept.

Other Factors

One point to remember in analysis of sales figures is that they are the recorded sales figures; some sales will go unrecorded, such as second hand sales. It is clear if second hand purchases rise, the games industries will see fewer profits.

Summary

In order to gain a reputable analysis of the market, a larger cross section in regards to increasing the amount of games analysed in Table 1, including as many games on as many consoles as possible would provide more comprehensive results. Global economic states such as the ‘credit crunch’ etc and market trends in relation to consumer buying habits, in electronic entertainment, also needs further investigation to in provide a more informed argument.

Table 1 and Fig.1 still provides inconclusive results for validation of my hypothesis, to reveal what role innovation plays in the industry. This is why I propose the method I term The Screenshot Test.

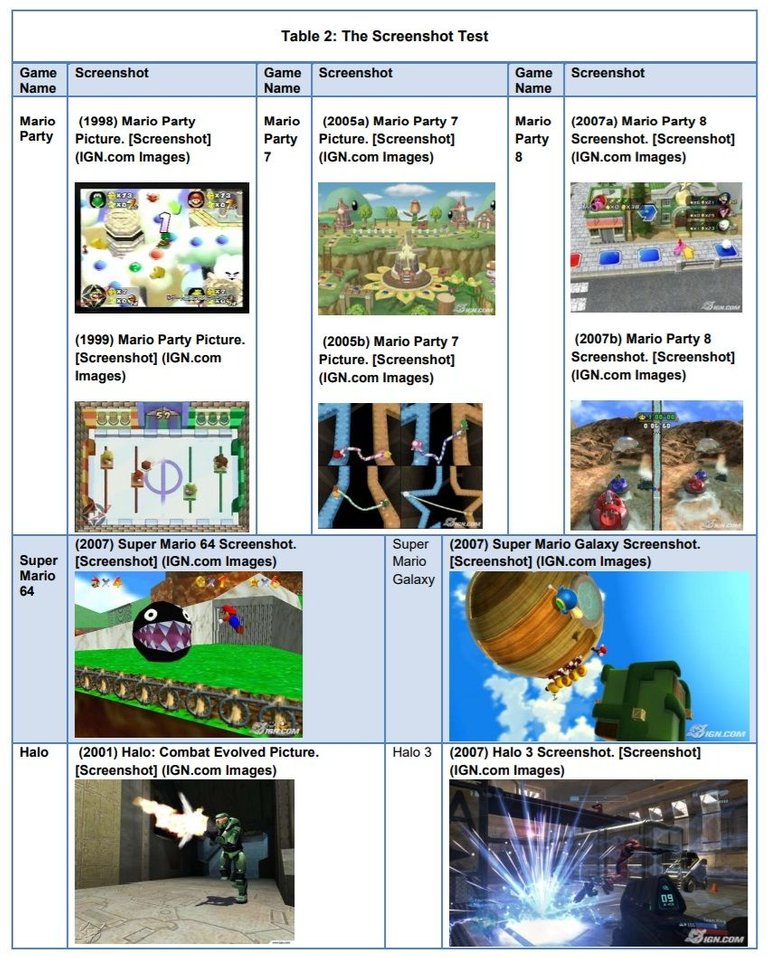

The Screenshot Test

The formal elements of a game should be the makeup of a great experience. Walker (2003, pp.33-47) usefully asserts which aspects of the game could help determine how well it sells. He focuses on the word ambience to describe a wealth of elements, which all help attribute to the suspension of disbelief in a game, and the quality of the immersive experience. He covers attractive graphics, audio, gameplay, well written storylines and physical stimuli or force feedback. Combination these with a unique topic for a game will help increase sales, as it avoids competing with other games of a similar nature (Walker 2003, pp.92-93). Essentially, the focus is on game content, which means hard work for the developer. Fullerton, et al., (2008, p.21) expresses a similar opinion, believing that creating innovative games requires “unique play mechanics – thinking beyond existing genres of play”, and “emotionally rich gameplay” created by intelligent design in the interaction between elements of

“story and gameplay”, all of which are design elements of the games content. Developers thus apply certain techniques in the pursuit of these goals; some techniques employ the organization of the business and others, frame of mind, but what I focus upon here is the simple test of whether or not a game idea has developed.

The idea is, to measure how much innovation there is in a game; improvements must be seen from version to version. Taking a screenshot from each version for comparison can highlight how much immediate change can be seen and more importantly one can ascertain if there has been any improvement, be it in visuals, gameplay and quality. These aspects are increasingly important as consumers and society are used to experiencing cycles of technological advance which exponentially increases the custom for consumer to expect perpetual improvements from their products.

Looking at Table 2’s first example of the development of ideas in Mario Party, Mario Party 7 and Mario Party 8, you can see how similar Mario Party and Mario Party 7 are, showing not many signs of innovation at all. The fact that Mario Party 7 also came with a free microphone to use with the game, and was released before Christmas prime selling time and received weaker performance results in Table 1 than its prequel Mario Party, which was released in February, one of the worst times for sales shows adverse consumer reaction to lower levels of innovation. Mario Party 8 sees a better development of ideas, with much improved visuals and gameplay, which is reflected in games sales, rather than review score. Having played Mario Party 8, I can also attribute advantageous fact that the developers did demonstrate use of the console’s motion sensing abilities.

The development of the idea between Super Mario 64 and Mario Galaxy in Table 2 is visually clear. A complete graphical and gameplay overhaul is apparent, without even taking into account the fact that the developers did also demonstrate effective use of the console’s innovative controls, it is obvious that there is a clear improvement in development of the game idea. This development essentially shows the galvanization of the platform game, to include: space travel amongst systems of platforms, each with their own gravitation pull, innovative upside-down gameplay and vibrant visuals, hence one could claim that Mario 64’s sequel has added a fourth dimension to platform gaming. This Screenshot Test shows innovation upon all elements of the makeup of a game’s quality Walker (2003, pp.92-93) and Fullerton, et al., (2008, p.21) describe, which is also corroborated by the title’s respective performance in Table 1. Super Mario Galaxy has high sales, even though it is a recent release.

The improvements of quality and visuals of the title Halo in Table 2 is explicit in this

Screenshot Test; the title has evolved, with an obvious improvement of the game’s engine and from having played all editions of the franchise, I can say that development of gameplay has also evolved in the most important part of the mechanics of the game; weaponry. Visual and gameplay improvement added to the overall quality of the game and combined with release in optimal market conditions resulted in increased sales to the tune of 1.76 million, and could have probably earned a further 0.27 million in sales, if it was released in November.

Conclusion

The appeal of interactive gaming is widespread, but could be larger. The public pays money to experience something different and better than the last. The problem is there is no exact formula for creating a game that appeals to the majority of consumers, but positively, the research in this paper shows that there are methods, variables and limitations associated with the industry and thus provides a structure that underlines situations needed to cultivate and bring to market an innovative game idea.

Innovation plays two roles in the industry; improvement in games technology and games ideas. Successful examples of innovative games companies, demonstrate in their game content, ability to balance innovation between these two roles. Rather than approaching the games industry with the perspective that it is risk averse, and thus innovation is hindered, adopting the view that the industry prefers ‘safe’ innovation is beneficial and more positive for the industry.

Research in this dissertation has not yet disproved the hypothesis that ‘game ideas with more innovation sell better, than ones with less’, in fact the evidence supports this belief. But, this research has clarified the hypothesis, adding that where there is lack of innovation or unbalance, there is drop of sales and review scores.

The decision of which game idea to bring to market is most reflective of its survival, as the content of the game is paramount. Whether or not a developer has total creative control over a game idea, when approving game ideas, the question ‘which game idea has unique improvements in quality of visuals and gameplay that develop the underlying mechanic of the game, in contrast of the current market competition?’ should always be asked. It is important that the game idea gels with development team, as games that developers enjoy making involve more passionate input from individuals who

strive to set the game apart from the rest.

Recommendations

Software such as Adobe Flash, allow anyone with programming skill, to publish games on the internet with minimal cost, the only cost being time. This low risk investment allows the publishing of innovative content to a wide audience.

Companies should exploit this when prototyping to help get an idea of how the content and game idea will be received.

In order to expand into new markets new research methods at the heart of the organizational structure of a business has to develop. Kerr (2006a, p.98) gives the example of gender and games is widely debated, but “traditional market research” by large companies such as Microsoft, go by a finance and economy vein, including

“testing with ‘expert users’ and sales/registered user data to decide what works, what sells and to whom.” This traditional approach can be limiting to innovation, as the research shows “their core market is male, ranging from 13 to 25 years of age.” If innovation is to flourish, “new markets, new genres, new design strategies,” and “non-standard retail channels” have to be explored. “Purple Moon” a games company set about developing games for women “employed both quantitative and qualitative research methods to inform their design principles and product development.” This “was an interesting attempt to explore potential rather than existing users.”

Further research to develop the methods used in this chapter to establish the role of innovation in the industry and to validate the hypothesis, will benefit our understanding of what the consumer wants. I would suggest starting by increasing the data in Table 1, Table 2 and Fig.1 to start this process.

Also, accompanying research into current and past financial standings of the economy should be referenced, in order to encompass broader variables that could affect market conditions, such as the current (at the time of writing this paper) credit crunch.

Bibliography & References

Books

Baggaley, S., 2005. Development Misery and How to Avoid It. In: Laramee, F. ed. Secrets of the Game Business, 2nd ed. Massachusetts: Charles River Media, Inc.

Berkun, S., 2007. The Myths of Innovation. Canada: O’Reilly Media, Inc.

Christensen, C., 2000. The Innovator’s Dilemma. When New Technologies Cause Great Firms to Fail. New York: Harper Business.

Clausen, G., 2005. Price Sensitivity for Electronic Entertainment: Determinants and Consequences. Florida: Dissertation.com.

Crawford, G. & Rutter, J., 2006. Digital Games and Cultural Studies. In: Rutter, J. & Bryce, J. eds. Understanding Digital Games. London: Sage Publications Ltd.

Drucker, P., (1993) Innovation and Entrepreneurship. s.I.: Collins.

Edquist, C., 2006. Systems of Innovation: Perspectives and Challenges. In: Fagerberg, J., Mowery, D. & Nelson, R. eds. The Oxford Handbook of Innovation. New York: Oxford University Press. Ch. 7.

Fagerberg, J., 1987. A Technology Gap Approach to Why Growth Rates Differ. s.I.: Research Policy. Pp.87-99.

Fagerberg, J., 2006. Innovation: A Guide to the Literature. In: Fagerberg, J., Mowery, D. & Nelson, R. eds. The Oxford Handbook of Innovation. New York: Oxford University Press. Ch. 1.

Fagerberg, J. & Verspagen, B., 2002. Technology-Gaps, Innovation-Diffusion and Transformation: An Evolutionary Interpretation. s.I.: Research Policy. Pp.1291-1304.

Farson, R. & Keyes, R., 2003. The Innovation Paradox, The Success of Failure, the Failure of Success. New York: Free Press.

Fuller, S., 2001. Thomas Kuhn, A Philosophical History for Our Times. Chicago: The University of Chicago Press.

Fullerton, T., Swain, C. & Hoffman, S., 2008. Game Design Workshop. A Playcentric Approach to Creating Innovative Games, 2nd ed. Burlington, MA: Elsevier Inc.

Gershenfeld, A., Loparco, M. & Barajas, C., 2003. Game Plan. The Insider’s Guide to Breaking In and Succeeding In the Computer and Video Game Business. New York: St. Martin’s Press.

Granstrand, O., 2006. Innovation and Intellectual Property Rights. In: Fagerberg, J., Mowery, D. & Nelson, R. eds. The Oxford Handbook of Innovation. New York: Oxford University Press. Ch. 10.

Hall, B., 2006. Innovation and Diffusion. In: Fagerberg, J., Mowery, D. & Nelson, R. eds. The Oxford Handbook of Innovation. New York: Oxford University Press. Ch. 17.

Kelley, T. & Littman, J., 2004. The Art of Innovation. Lessons in Creativity from IDEO, America’s Leading Design Firm. London: Profile Books Ltd.

Kerr, A., 2006a. The Business and Culture of Digital Games. Gamework/Gameplay. London: Sage Publications Ltd.

Kerr, A., 2006b. The Business of making Digital Games. In: Rutter, J. & Bryce, J. eds. Understanding Digital Games. London: Sage Publications Ltd.

Kline, J., & Rosenberg, N. 1986. An Overview of Innovation. In: Landau, R. & Rosenberg, N. eds. The Positive Sum Strategy: Harnessing Technology for Economic Growth. Washington, DC: National Academy Press. Pp.275304.

Kline, S., Dyer-Witheford, N. & De Peuter, G., 2005. Digital Play. The Interaction of Technology, Culture, and Marketing. Canada: McGill-Queen’s University Press.

Kuhn, T., 1996. The Structure of Scientific Revolutions. 3rd ed. Chicago: The University of Chicago Press.

Laramee, F. ed., 2005. Secrets of the Game Business, 2nd ed. Massachusetts: Charles River Media, Inc.

Lazonick, W., 2006. The Innovative Firm. In: Fagerberg, J., Mowery, D. & Nelson, R. eds. The Oxford Handbook of Innovation. New York: Oxford University Press. Ch. 2.

Nelson, R. & Winter, S. 1982. Evolutionary Theory of Economic Change. s.l.: Harvard University Press.

O’Sullivan, M., 2006. Finance and Innovation. In: Fagerberg, J., Mowery, D. & Nelson, R. eds. The Oxford Handbook of Innovation. New York: Oxford University Press. Ch. 9.

Pavitt, K., 2006. Innovation Processes. In: Fagerberg, J., Mowery, D. & Nelson, R. eds. The Oxford Handbook of Innovation. New York: Oxford University Press. Ch. 4.

Posner, V., 1961. International Trade and Technical Change. s.I.:Oxford Economic Papers. Pp.323-41.

Rocca, J., 2005. Invasion of the IP Snatchers: Exploring Licensed Versus Original Games. In: Laramee, F. ed. Secrets of the Game Business, 2nd ed. Massachusetts: Charles River Media, Inc.

Rogers., E., 2003. Diffusion of Innovations. Free Press.

Rutter, J. & Bryce, J. eds, 2006. Understanding Digital Games. London: Sage Publications Ltd.

Schumpeter, J., 1939. Business Cycles: A Theoretical, Historical, and Statistical Analysis of the Capitalist Process, 2 vols. New York: McGraw-Hill.

Schumpeter, J., 1934a. The Theory of Economic Development. Cambridge, Mass: Harvard University Press.

Schumpeter, J., 1934. The Theory of Economic Development. An Inquiry into Profits, Capital, Credit, Interest, and the Business Cycle. Translated by Elliott, J., 2008. New Jersey: Transaction Publishers.

Smith, K., 2006. Measuring Innovation. In: Fagerberg, J., Mowery, D. & Nelson, R. eds. The Oxford Handbook of Innovation. New York: Oxford University Press. Ch. 6.

Steinberg, S., 2007. Videogame Marketing and PR. Lincoln: Power Play Publishing.

Thompson, D., ed, (1992). The Pocket Oxford Dictionary of Current English, 8th ed. Oxford: Oxford University Press.

Verspagen, B., 2006. Innovation and Economic Growth. In: Fagerberg, J., Mowery, D. & Nelson, R. eds. The Oxford Handbook of Innovation. New York: Oxford University Press. Ch. 18.

Walker, M., 2003. Games That Sell! Texas: Wordware Publishing, Inc.

Winter, S. (1984). Schumpeterian Competition in Alternative Technological Regimes. Journal of Economic Behaviour and Organizational. Pp.287-320. s.l.:s.n.

Games

Dead or Alive 3 [Tecmo, Xbox, 2001]

Dead or Alive 4 [Team Ninja, Xbox 360, 2005]

Goldeneye 007 [Nintendo, Nintendo 64, 1997]

Halo [Microsoft, Xbox, 2001]

Halo 2 [Microsoft, Xbox, 2004]

Halo 3 [Microsoft, Xbox 360, 2007]

Jumper: Griffin’s Story [Brash Entertainment, Xbox 360, 2008]

Jumper: Griffin’s Story [Brash Entertainment, Wii, 2008]

Mario Party [Nintendo, Nintendo 64, 1999]

Mario Party 7 [Nintendo, GameCube, 2005]

Mario Party 8 [Nintendo, Wii, 2007]

Max Payne [Rockstar Games / 3D Realms, Xbox, Playstation 2 & PC, 2001]

Myth: The Fallen Lords [Bungie Studios, PC, 1997]

Perfect Dark [Nintendo, Nintendo 64, 2000]

Uncharted: Drake’s Fortune [Sony, PS3, 2007]

Sonic the Hedgehog [Sega, PS3, 2007]

Super Mario 64 [Nintendo, Nintendo 64, 1997]

Super Mario Galaxy [Nintendo, Nintendo Wii, 2007]

Images

(2001) Halo: Combat Evolved Picture. [Screenshot] Available at: http://uk.xbox.ign.com/dor/objects/15922/halocombat-evolved/images/bg4.html From home page/ Home page/search field/Halo/images [Accessed 14 September 2008].

(2007) Halo 3 Screenshot. [Screenshot] Available at: http://uk.xbox360.ign.com/dor/objects/734817/halo3/images/halo-3-20071203102208003.html From home page/ Home page/search field/Halo 3/images [Accessed 14 September 2008].

Mario Party Picture. [Screenshot] Available at: http://uk.ign64.ign.com/dor/objects/10397/marioparty/images/mariopavi3.html?page=mediaFull From Home page/search field/Mario Party/images [Accessed 14 September 2008].

Mario Party Picture. [Screenshot] Available at: http://uk.ign64.ign.com/dor/objects/10397/marioparty/images/marparty13.html From home page/search field/Mario Party/images [Accessed 14 September 2008].

(2005a) Mario Party 7 Picture. [Screenshot] Available at: http://uk.cube.ign.com/dor/objects/748414/mario-party7/images/mario-party-7-20051104033449725.html From home page/ Home page/search field/Mario Party 7/images [Accessed 14 September 2008].

(2005b) Mario Party 7 Picture. [Screenshot] Available at: http://uk.cube.ign.com/dor/objects/748414/mario-party7/images/mario-party-7-20051104033447381.html From home page/ Home page/search field/Mario Party 7/images [Accessed 14 September 2008].

(2007a) Mario Party 8 Screenshot. [Screenshot] Available at: http://uk.wii.ign.com/dor/objects/853824/marioparty-8-/images/mario-party-8-20070223082508227.html From home page/ Home page/search field/Mario Party 8/images [Accessed 14 September 2008].

(2007b) Mario Party 8 Screenshot. [Screenshot] Available at: http://uk.wii.ign.com/dor/objects/853824/marioparty-8-/images/mario-party-8-20070427102735858.html From home page/ Home page/search field/Mario Party 8/images [Accessed 14 September 2008].

(2007) Super Mario 64 Screenshot. [Screenshot] Available at: http://uk.ign64.ign.com/dor/objects/606/supermario-64/images/super-mario-64-virtual-console-20070131013937793.html From home page/ Home page/search field/Super Mario 64/images [Accessed 14 September 2008].

(2007) Super Mario Galaxy Screenshot. [Screenshot] Available at: http://uk.wii.ign.com/dor/objects/748588/super-mario-galaxy/images/super-mario-galaxy-images- 20071012105818946.html?page=mediaFull From home page/ Home page/search field/Super Mario Galaxy/images [Accessed 14 September 2008].

Internet

Ask Oxford. 2008. Compact Oxford English Dictionary. [Online] Available at: http://www.askoxford.com/concise_oed/innovation?view=uk From home page/search field/innovation. [Accessed 12 August 2008]

Cnet News. 2000. Microsoft Buys Bungie to Boost Xbox Development. [Online] Available at: http://news.cnet.com/2100-1040-242066.html [Accessed 22 September 2008].

CNN Money. 2002. Microsoft Buys Game Developer Rare. [Online] Available at: http://money.cnn.com/2002/09/20/news/deals/rare/index.htm [Accessed 22 September 2008].

IDEO. 2008a. We are a Global Design Consultancy. We Create Impact Through Design. [Online] Available at: http://www.ideo.com/ From home page. [Accessed 3 September 2008].

IDEO. 2008b. Case Studies. [Online] Available at: http://www.ideo.com/work/ From home page/work. [Accessed 3 September 2008].

IDEO. 2008c. Awards. [Online] Available at: http://www.ideo.com/awards/ From home page/news/awards. [Accessed 3 September 2008].

MCV. 2008. The Market for Computer and Video Games, (Mario Party 8). [Online] Available at: http://www.mcvuk.com/recommended-games/49/Mario-Party-8 From home page/search field/Mario Party 8. [Accessed 22 September 2008].

Metacritic.com. 2008. Movie Reviews, Music Reviews, TV Show Reviews, Game Reviews, Book Reviews. [Online] Available at: http://www.metacritic.com/ From home page. [Accessed 15 September 2008].

Register Hardware. 2007. Microsoft and Bungie Part Ways. [Online] Available at: http://www.reghardware.co.uk/2007/10/05/microsoft_spins_bungie/ [Accessed 22 September 2008].

VG Chartz.com. 2008a. Video Game Charts. [Online] Available at: http://vgchartz.com/games/ From home page/games category. [Accessed 15 September 2008].

VG Chartz.com. 2008. Hardware Comparison Charts. [Online] Available at: http://vgchartz.com/hwcomps.php?weekly=1 From home page/chartz/hardware from launch. & http://vgchartz.com/worldcons.php?date=39142&sort=1 From homepage/world/hardware shipments [Accessed 15 September 2008].

Thanks buddy! I hope more people like it! I'll upvote and follow!