Images Source: istockphoto.com

Introduction

The Central Bank is an 'apex' body that operates, controls, regulates and direct the entire banking and monetary structure of the country. It is known as supreme or apex body because it occupies the top position in monetary and banking system in a country. All the financially developed countries has there own central bank. India' central bank is known as the Reserve Bank of India it was established in April 1 1935.

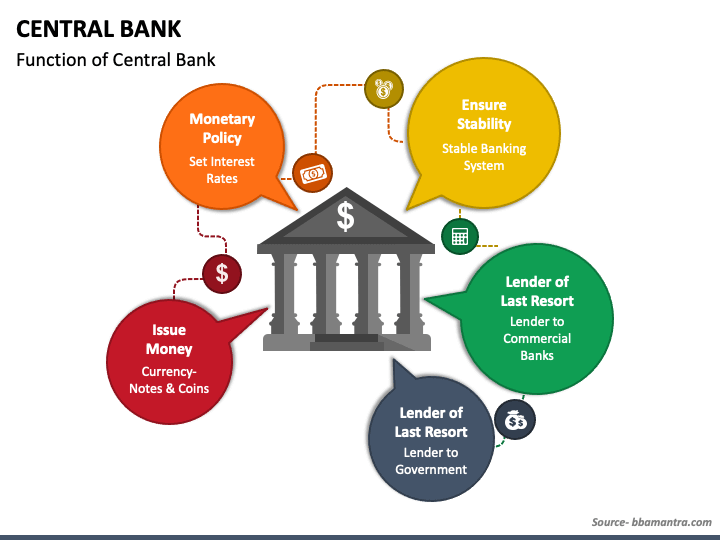

Function of the Central Bank

Image source: sketchbubble.com

###Currency authority

Central bank has whole authority for issue of currency in a country. The reserve Bank of India has a full and sole right of issuing paper currency notes.

Banker to government

The reserve Bank of India acts as a banker, agent and a advisor of finances to the government and state government.

- it maintains a current account for keeping cash balances.

- it accepts receipts and makes payments for the government and carries out exchanges.

Banker's bank and supervisor

There are many commerical banks in a country. There should be an agency to regulate and supervise their proper functioning. i. Custodian of cash reserves: the banks are required to keep a portion of deposits with the central bank. ii. Lender of the last resort: when a bank fails to meet their financial requirements they approach the central bank to give loans and advances as lender .

Controller of money supply and credit

The reserve Bank of India regulate the money supply in the economy through the monetary policy.

Instruments of monetary policy

Image source: Shutterstock.com

Repo rate

Repo rate is the rate at which Central bank of a country lends money to commercial banks to meet their short term needs.

Bank rate

Bank rate is the rate at which the central bank lends money to commercial bank to meet its long term needs.

Reverse repo rate

Reverse repo rate is the rate of interest at which commercial banks can deposit their surplus funds with the central bank for a shorter period of time.

This post has been manually curated by @theindiankid from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share 100 % of the curation rewards with the delegators.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

Read our latest announcement post to get more information.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.