Cryptocurrency die-hards face difficulties because true investors do not want to cash out, but there is always a need to spend money. As a true believer of cryptocurrency, you do not want to spend or withdraw your crypto assets but look for a way to use your cryptocurrency as collateral for temporary loan.

Unfortunately, cryptocurrency (i.e digital assets) are not widely recognized as financial assets and therefore cannot serve as collateral. Due to this challenge Crypto investors face when it comes to Crypto assets as collateral, eCoinomic has emerged to bring a definite solution and balance to the challenge.

There are two major roles in the eCoinomic network, Lenders and Borrowers. Lenders are financial institutions such as investment banks, family offices, or funds. They will provide loan terms in fiat currency and will be protected by eCoinomic with maximum lending procedures to minimize their risk.

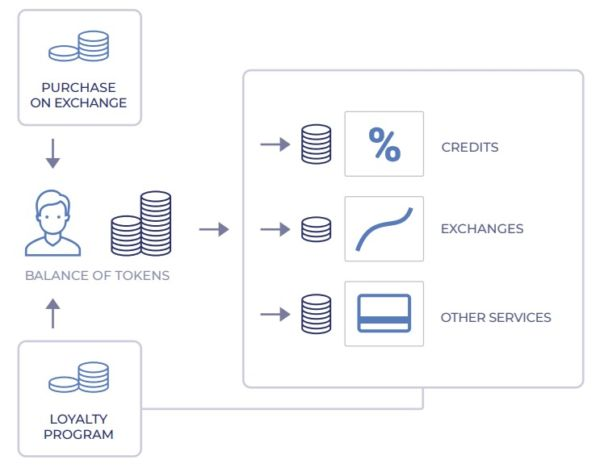

Meanwhile, the borrower may be an individual business or a small business. They need a CNC token role to use the eCoinomic platform. The mechanism for accessing eCoinomic is quite simple. Users have to go through a registration process that requires legal KYC procedures.

After that, the user must have a CNC token and add it to their new personal account. And after the eCoinomic launch, the CNC token price will be based on their exchange list, and the CNC token can also be used as collateral. The main language that will be used in the eCoinomic platform is Python.

And this platform will be based on Ethereum blockchain which will include Smart Contract program. The Smart Contract will liquidate the change from the form of the collateral into a loan and will pay the interest rate. The maximum number of single loan contracts in eCoinomic up to USD 10,000 and the maximum period for each user to sign their contract is for 30 days.

Getting Started Development

eCoinomic is developed using integrated systems and integrated resources that support the creation of better financial ecosystems. eCoinomic uses Blockchain Technology as a Platform foundation, using this eCoinomic technology will bring better financial services to Crypto Holders around the world.

eCoinomic provides financial services that will provide user management associated with their digital assets. eCoinomic provides lending, investment, hedging, exchange, and crypto payment services, fully integrated into a reliable and intelligent platform.

eCoinomic is developed by a team of experienced and professionals in the field, who see that the financial market today has many loopholes. eCoinomic provides a secure lending system based on cryptocurrency. eCoinomic provides better access to user investment in the long run or short.

eCoinomic also integrates directly into services like eBay and Amazon, enabling users to be able to pay directly using the eCoinomic payment line.

Each user initiated transaction will be based on a CNC token, which can be used by the user to transact or invest directly in a long or short period of time.

This token uses an ERC 20 system, based on Ethereum Blockchain.eCoinomic can be a short-term credit solution for startup that requires cash injections or short-term or short-term investments.

eCoinomic has a solution related to the use of muticurrency. eCoinomic receives more than 10 types of cryptocurrency and supports conventional currency for loans.

eCoinomic uses an intelligent contract system, which will govern every transaction performed by the user.

Token sale:

The token symbol is CNC, which is a ERC20 utility token. Total token supply is 2.1 billion and the tokens available during the sale are 1.55 billion. The token sale is divided into 3 stages – presale, crowd sale and reserve.

The presale stage ended on 21st April, the price of 1 CNC was 0.05 USD with a maximum bonus of 25% (bonus tokens will be locked for 2 months after the reserve stage).

The crowd sale is between 1st and 31st of May, the price of 1 CNC is 0.05 USD and the hard cap during this stage is 6 million USD.

The reserve stage starts on June 1st and goes on till August 1st, the maximum tokens to be sold are 1,400,000,000. Hard cap during this stage is 106 million USD of which 81% is put aside as reserve.

Need for a high reserve:

The hard cap during the reserve stage is 106 million USD of which 81% (~81 million USD) will be put aside as reserve which will be locked in an escrow account.

The high reserve acts as a catalyst to attract large financial institutions at present and also in the future, also during the initial stages the eCoinomic team provides full financial coverage of the amount borrowed, so this amount of equity provides a smooth cushion.

This sounds reasonable since no institution investor would we willing to lend unless the project is backed by adequate financial resources.

Distribution of funds:

56% – marketing costs, launch of the alpha version;

22% – research and development for the platform;

22% – legal and organizational costs.

Distribution of funds collected during the main ICO:

37% – of the funds will be operating and insurance funds;

12% – development;

9% – marketing;

2% – technical security audit;

2% – legal support;

1% – operating expenses.

Roadmap

A fairly long roadmap extending till 2020, the token sale will be done by Q3 2018 and the Platform will be launched in December 2018.

In 2019 the major focus is on securing partnerships with financial organisations and institutional investors.

Launch of the crypto bank and its IPO will happen during 2020.

Team

Website: https://ecoinomic.net/

Whitepaper: https://ecoinomic.net/docs/eCoinomic_WP_0219.pdf

Telegram: https://telegram.me/eCoinomicchannel

Facebook: https://www.facebook.com/ecoinomic/

Twitter: https://twitter.com/Ecoinomicnet

Profile: https://bitcointalk.org/index.php?action=profile;u=1636284