The Main Object of the Libra Credit :

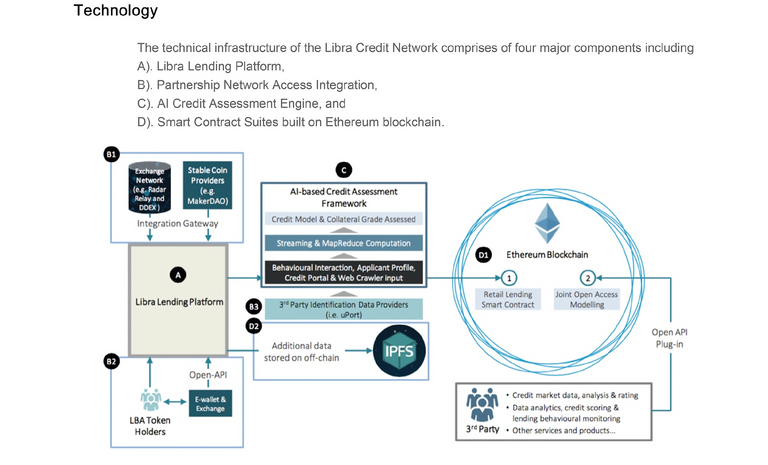

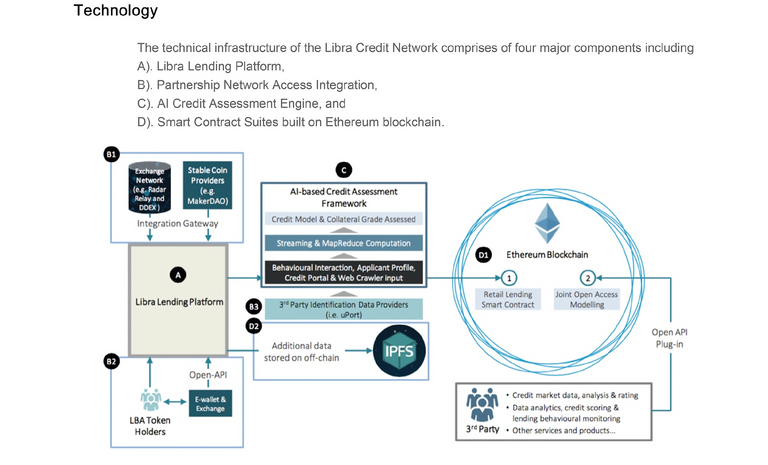

In-house Proprietary AI-based Credit Model(s)

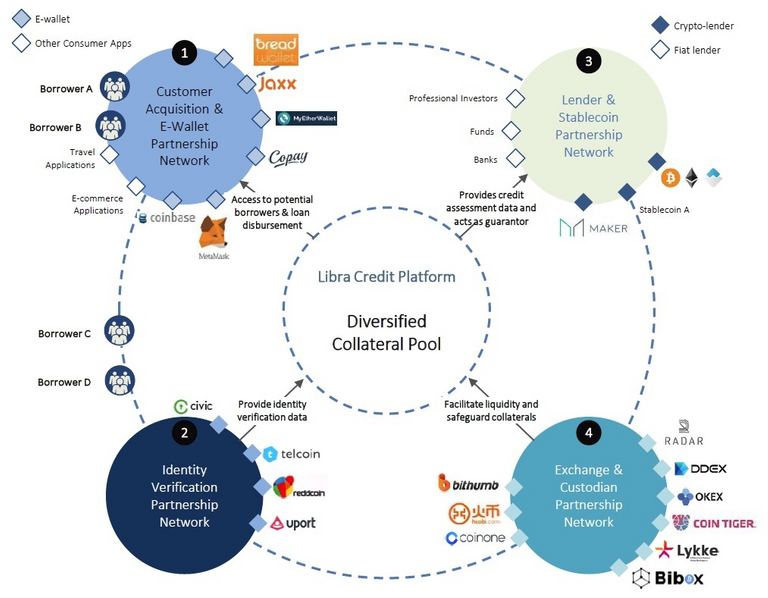

Customer Acquisition & E-Wallet Partnership to drive adoption

Lenders & Stable Coin Partnership to drive liquidity

Extensive Exchange Partnership Network to minimize default

Identity Verification Partnership Network to expedite KYC & verification process

Problem with Present Traditional Credit Services:

Borrowers :

•High barriers to credit services due to limited or unrecognized personal credit data

•Unsatisfied lending experience due to complicated KYC procedures, long processing times, low application transparency and high borrowing costs

•Difficulty in cross border, cross currency and cross time-zone lending

Lenders:

•Increased lending difficulty due to lack oftraditional records of the digital savvygeneration

•Opportunity cost of uncaptured digital savvymarket segment

Problem of the Crypto Market:

Liquidity Issues:

• Lack of liquidity and integration into fiatfinancial service offerings

•Difficult to convert between digital assets and traditional assets (i.e. gold, stocks,bonds, real estate, etc.)

Limited Applications:

• Lack of recognition and application as ageneral payment method / asset class

•High volatility and speculation with little tono asset backing

LIBRA CREDIT FOUNDATION:-

Libra Credit aims to offer a seamless digital lending process that can be completed in 5 steps: application, verification and credit assessment, confirmation, collateral deposit, and disbursement.

Libra Credit ecosystem:

Libra Credit Token Value:

Membership – Platform access fee that allows borrowers to submit loan applications.

Transactions – Medium of exchange on the Libra Credit platform, service fees for successful transactions.

Rewards – Token rewards will be granted to stakeholders that contribute to the project through development or referrals.

Governance – LBA token holders will have the right to vote on specific projects and proposals to facilitate platform development.

The usage of LBA tokens is tied to the level of activities of the Libra Credit platform, the more activities the platform has more valuable LBA tokens should be.

Team:

Lu Hua, Co-Founder & CEO – He has experience in the payments, financing, and risk management industries. He was previously the CEO of moKredit, one of China’s top digital credit servicing companies. Lu was also the Head of Core Payments for PayPal China and the Head of Global Banking Platform for PayPal US.

Dan Schatt, Co-Founder & COO – He previously worked as the Chief Commercial Officer at Stockpile Inc., a leading fintech company, and as General Manager of Financial Innovations at PayPal.

Howard Wu, Chief Scientist – He is a blockchain and cryptography expert who is a Founding Partner of Dekrypt Capital, Advisor of Blockchain at Berkeley, and Software Engineer at Google. He advises the project in a technical capacity and has received a Master’s degree in Electrical Engineering and Computer Sciences from UC Berkeley.

Advisor:-

Shuoji Zhou:- Experienced Crypto Hedge Fund Manager in Asia Founding partner of FBG Capital; a leading digital asset management firm in blockchain-based capital market Early investor of a broad spectrum of blockchain companies; accumulated extensive experience in digital assets trading and investment.

Kenneth Oh: Senior Partner with Dentons Rodyk & Davidson’s Corporate Practice

Shoucheng Zhang:- CEO of Danhua Capital & Physics Professor at Stanford.

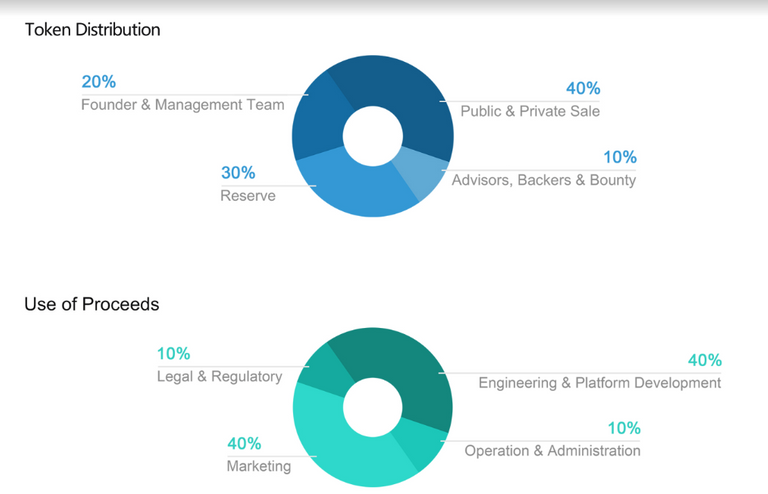

Token Metrics:-

Ticker: LBA

Token type: ERC20

ICO Token Price: 1 LBA = 0.0001 ETH

Total Tokens: 1,000,000,000

Token Sale already completed.

For More details visit:-

Website: https://libracredit.io

Whitepaper: https://www.libracredit.io/page/Libra%20Credit%20Whitepaper.pdf

Blog: https://medium.com/libracredit

Telegram: https://t.me/libraofficial

Twitter: https://twitter.com/LibraCredit

GitHub: https://github.com/librabot

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://crushcrypto.com/libra-credit-ico-review/