eCoinomic is a Platform that focuses on providing and developing financial services, using Blockchain technology as the basis for its development.eCoComic provides a financial service that users can easily, safely and smarter. eCoinomic provides a better and smarter access to financial services for Crypto Holders.

eCoinomic is developed using a directly integrated system and resources that support the creation of a better financial ecosystem. eCoinomic uses Blockchain technology as the foundation of the Platform, using this technology eCoinomic will bring a better financial service to Crypto Holders worldwide. eCoinomic provides a financial service that will provide users with a management related to their digital assets. eCoinomic provides a lending, investing, hedging, exchange, and crypto payment service, wholly integrated directly into one platform that is reliable and smart. eCoinomic is developed by a team of experienced and professionals in the field, who see that the financial market today has many gaps. eCoinomic provides a secure lending system based on cryptocurrency. eCoinomic provides a better access to the user's investment in the long run or short. eCoinomic is also integrated directly into services like eBay and Amazon, allowing users to be able to pay directly using the eCoinomic payment line. Every transaction made by the user will be based on a CNC token, which can be used by the user to transact or invest directly in a long or short period of time. This token uses an ERC 20 system, based on Ethereum Blockchain. eCoinomic can be a short-term credit solution for startups that require fund injections or long-term or short-term investments. eCoinomic has a solution related to the use of muticurrency. eCoinomic receives more than 10 types of cryptocurrency and supports conventional currency for lending. eCoinomic uses an intelligent contract system, which will regulate every transaction performed by the user. eCoinomic aims to create a transparent and more profitable financial ecosystem and can accommodate the financial needs of users.

Lending backed by crypto assets

This is the most popular and apprehensible service to date on the cryptocurrency market. Loans backed by crypto assets present a unique opportunity for their owners:

To use fiat money for business expansion e.g. renew miner hardware

To hedge the exchange rate risk and thereby reduce the exposure to market volatility

To take prompt advantage of crypto assets potentia

The valuation of the collateral can vary from 50 to 70% depending on the type of asset, user rating and application of the loyalty program. The minimal loan amount is 200 USD, the maximum loan amount is 10 000 USD. The loan term is 1 month. In the 4th quarter of 2018 upon the launch of the platform the service fee for issuing a loan will be.

Highlights

Soft Cap reached

We reached USD 6 million and closed Development stage of Crowdsale on May 16. These funds are the minimum amount required for the technical and organizational implementation of our project. We will regularly post reports on the implementation process and involve the community in the limited platform testing sessions.

Please be advised that the launch capabilities directly depend on the Reserve funds raised in the next stage of the Crowdsale. The more funds go into the Reserve, the more our project will be able to attract fiat money for loans.The Hard Cap of USD 106 million will be assigned to the Reserve stage starting June 1.

Pre-Sale results

We raised over $4.7 million in Pre-Sale. Twenty-eight percent of the Soft Cap was reached in 10 hours. eCoinomic.net sold 94,780,255 CNC tokens and distibuted 20,851,656 bonus tokens, thanks to our whitelist members and founders promoting the project at international industry events.

Our token sale continues in May with 25,219,745 CNC tokens left for the Сrowdsale development stage. We plan to reach our Soft Cap of USD 6 million by May 31. The Hard Cap of USD 106 million will be assigned to the Reserve stage starting June 1.

Top 6 strong points of the eCoinomic platform

1.Multicurrency

The eCoinomic platform will accept as collateral:

BTC, ETH, LCH, BCH + TOP10 cryptocurrencies.

Loans will be issued in: USD, EUR, GBP, JPY, CHF, CNY.

2.Fiat money transaction speed

With the help of the built-in payment agent,

the crediting time for fiat funds will only take several minutes.

3.Price monitoring system

The system checks collateral value every minute based on the data from several crypto exchanges.

4.Security and transparency

Smart contracts regulate the procedures of blocking, returning or liquidating collateral assets.

5.Insurance reserve fund

It is designed to enhance the attractiveness of the project for large and small investors.

6.Fully functional alpha version

Will be available for testing after the Pre-Sale

eCoinomic believes that with a team and a solid and reliable system, eCoinomic can provide Users, a secure and transparent financial service, and provide users with diverse benefits and conveniences in their every financial activity. The Team also believes that with systematic and professional development, the Team can build a better platform than similar platforms.

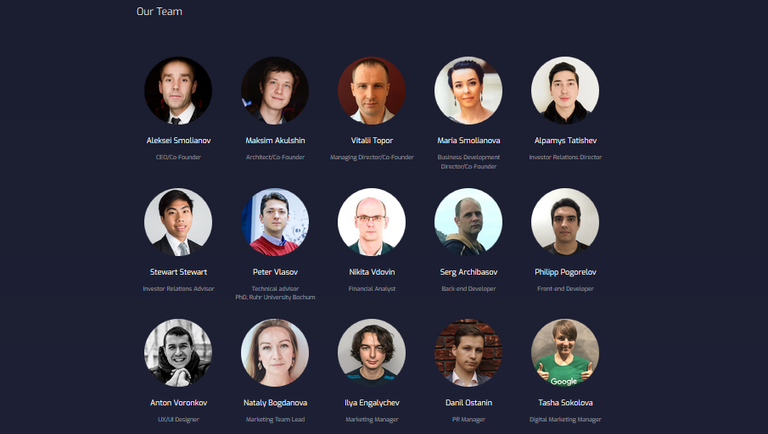

OUR TEAM

Engineering features of the platform

The platform is based on the Ethereum ecosystem. Smart Contracts are built with Solidity. The main programming language is Python. All registered users who make a loan application can independently establish credit conditions: the loan amount and interest rate. The platform allows to automatically search/recommend a counterpart to sign a loan contract. Applications with similar conditions are formed into clusters that operate on the basis of FIFO (first in, first out). Any user of the platform can be both a borrower and a lender. In order to guarantee the declared volume of investments and ensure the speed of funds transactions the lender is required by the platform to open a deposit for the amount of at least 10% of the sum in the loan application. In order to guarantee the assets pledged as security the deposit is transferred to the personal account of the platform user. In case if the crypto asset is not blocked by the current loan agreement, the owner can withdraw it from the platform at any time. Every user can sign any number of loan contracts for a term not exceeding 30 calendar days. The contract can be further prolonged under condition of paying interest and service fees.

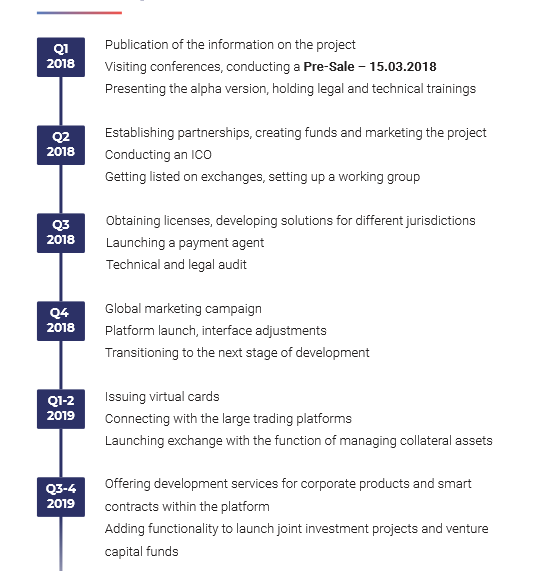

Roadmap

For more information, visit:

Website: http://www.ecoinomic.net/

Twitter: https://twitter.com/Ecoinomicnet

Facebook: https://www.facebook.com/ecoinomic/

Telegram: https://telegram.me/eCoinomicchatroom

AUTOR:https://bitcointalk.org/index.php?action=profile;u=1929991