ICO Basics, To Invest or Not? Cutting Through The Bullshit. There are many terms associated with the cryptocurrency world that has become, more or less, very mainstream over the last 4-5 years. Everyone has an idea about what a “blockchain” is and people definitely know what a “bitcoin” is.

Lately, however, one term has been gaining more and more mainstream attention. That term is “ICO” or Initial Coin Offerings and has raised OVER $1.3 Billion for blockchain based start ups. It has been called everything from “revolutionary” to “a Ponzi scheme. Before we get into the meat of this, we need to understand everything that surrounds this astounding phenomenon.

In the real world, companies can always secure funds by approaching angel investors and venture capitalists but by doing that, they would have to give away a share of their equity to them. What companies wanted, was to get a lot of funds without giving away equity and ownership. The only way that they could do that was by going public.

The way companies do this is by holding an IPO aka Initial Public Offering. How does an IPO work?

In an IPO a private company basically decides to put up its private shares up for sale to the general public. Anyone anywhere can buy the shares of the company. Initially, these shares are dirt cheap and if the company hits it big then there is a chance of your shares ballooning up to exorbitant prices. We have all heard stories of the masseuse who became a multi-millionaire after her 500 “useless” stocks in Google matured over time.

So, people started wondering what would happen if we used the same concept and put it on a blockchain based environment. This is what gave birth to the concept of ICOs. ICOs are pretty similar to IPOs but with 3 major differences.

Firstly, the ICO was decentralized with no central authority, secondly, the ICOs lacked the tedious red tape that most IPOs were bogged down by and finally, they were unregulated while IPOs have always under been heavy regulation. Now there was a problem that blockchain based companies were facing when it came to ICOs. In an IPO, the investors got shares in return of their investment. What would a blockchain based company give away in exchange of capital? They had to invent the blockchain equivalent of a share and that was when they came up with the idea of “Tokens”.

What is a Token?

An ICO is a sort of mixture of an IPO and a crowd-sale. When you are interested in a particular project in the blockchain, the way you can gain access to it is by sending the developing team some amount of money, which is usually paid in Bitcoin or Ethereum and getting the equivalent amount of tokens in return.

Tokens have gained even more prominence since the advent of Ethereum. Ethereum provides a platform where you can use the blockchain technology not just for making currency, but to make decentralized applications (DAPPS) as well. If you want to use these DAPPS then you will need the tokens that are native to its respective environment. There are two categories that all tokens fall under:

Usage Tokens.

Work Tokens.

Usage Tokens: These are tokens that act as native currency in their particular environment and can be exchanged for other tokens or FIAT money. Ether is a great example of a usage token. In short, usage token is a currency.

Work Token: Not all tokens, however, act as currency. Some tokens are there to give you various rights within their native environment. Eg. If you were a DAO token holder, then you had the right to vote on whether a particular DAPP could get funding from the DAO or not.

How do you make a token?

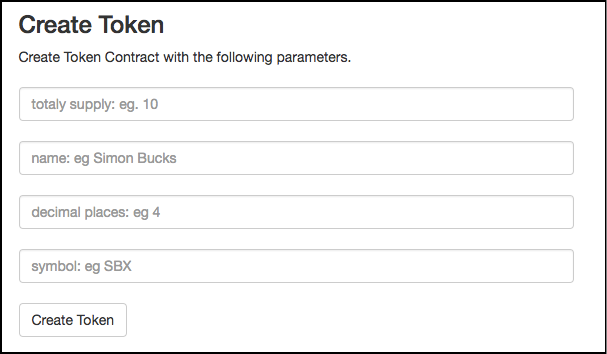

Making a token is deceptively simple. By far the easiest method is to go on Token Factory and fill up the following fields:

Firstly, you will have to determine the total supply. You don’t want a humongous amount of tokens available, that will kill their value.

Then you have the name field. Give your tokens any name you want. Make it sounds professional though if you want a good and profitable ICO.

Determine how many decimals places the value of your tokens will go to.

And finally, decide on a symbol for your token! It is that simple.

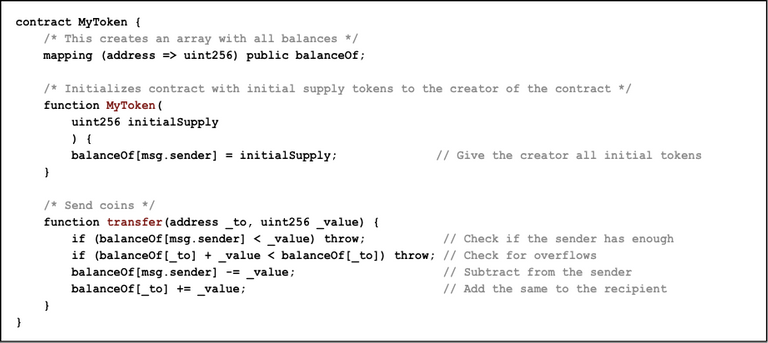

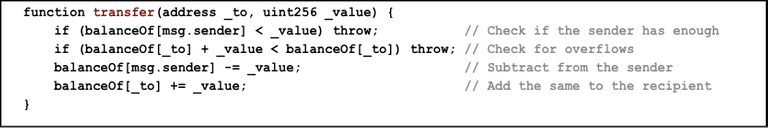

Now., if you are one of those DIY types who would prefer coding their tokens then that is a possibility as well. If you are making a DAPP in Ethereum you can simply use the solidity code to create your own token contract. This is what a simple token contract looks like:

The block of code is divided into 3 parts:

The Mapping.

Giving the creator all the tokens.

Transfer the sender the requisite amount of tokens for the ether.

Now we will go into the code and understand what is exactly happening and how it is working. It may appear complicated on the surface but once you go deep into it, you will see how simple and easy to understand it is.

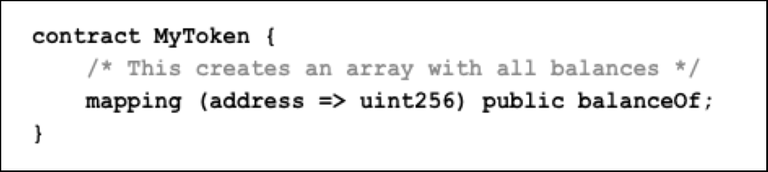

The Mapping:![image5-1.png]

( )

)

Ethereum, like all cryptocurrency, is an open ledger. So it makes sense that all token made on an Ethereum contract will be registered on an open database clear for everyone to see. The mapping function makes sure of that.

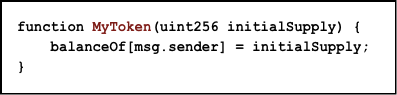

The creator getting all the tokens:

When all the tokens are created, the entire supply goes to the contract creator who can then send the tokens to anyone who funds the project with ETH.

The Transfer:

The last part of the code is the transfer.

You will give your tokens an initial value and based on the amount of ETH that you are getting paid by the sender, they will get the requisite amount of tokens. The same number of tokens will cut from your balance and it will be added to the sender’s balance.

As you may have already guessed, there are thousands of tokens out there, and while that’s a good thing, there is also a major flaw that needed to be addressed. Think about this, if everyone designed their own tokens giving it their own unique twist, it will be an absolute horror show to save them in a wallet. Many times you will have to follow elaborate and needlessly complicated steps just to store your tokens in a wallet. That would have been a nightmare. What was needed was a standard or a basic blueprint for all tokens to follow. Fabian Vogelstellar, one of the founders of the Mist Wallet came up with the solution with his ERC20 token standards.

What is the ERC20 Token Standard?

The ERC20 standards have been put in place so that all Ethereum tokens follow a particular rule and standard. While this is not an enforced rule, most DAPP developers are encouraged to follow the standards to ensure that their tokens can undergo interactions with various wallets, exchanges and smart contracts without any issues.

These standards also helped others gain an idea of how future tokens are expected to behave. ERC20 tokens have gotten widespread approval and most of the DAPPS sold on ICO’s have tokens based on the ERC20 standard. So what are these standards?

They are basically a set of 6 functions which, when executed, do the following 4 activities:

a. Get the total token supply.

b. Get the account balance.

c. Transfer the token from one account to another.

d. Approve the use of the token as a monetary asset.

How does an ICO work?

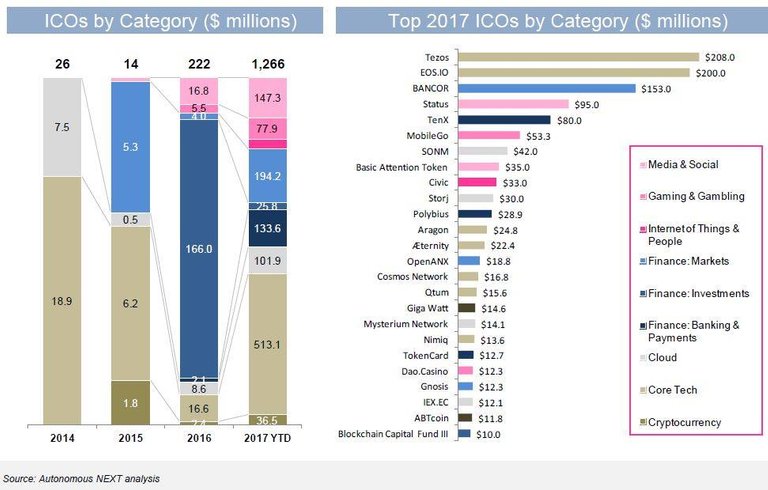

So now that you have gotten a crash course on what tokens are and how they work, let’s do a deep dive on ICOs and why, for better or for worse, people are calling it the new “Gold Rush”. A number of millionaires that ICOs have made in the last year or so is staggering. Check out this graph:

Check out this graph:

Over the past 12 months, have raised over $600 million as opposed to $140.30 million by established Venture Capitals. That is mind-boggling! So what is it about ICOs that has attracted so many investors? ICO is the rockstar of the investment world, it is the untamed wild genius wearing a torn t-shirt and baggy jeans, living among a group of suit-wearing snooty businessmen. There is something extremely seductive about the concept.

Think about this, anyone, with an idea for a project, can gain massive financial backing from a community without being bogged down by politics or endless red tape. The idea that anyone anywhere can get the financial backing they need in an unregulated manner was a welcome idea for all. No longer will investments be reserved just for the uber-rich, anyone can gain the funds to make their dreams a reality.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://blockgeeks.com/guides/ico-basics/