I originally wrote this in a thread on Reddit about Tezos after having several interactions with the Breitmans, the husband and wife team who have designed Tezos and who are raising an uncapped ICO for Tezos. I have modified and updated this in response to the Breitmans' imminent ICO for Tezos and in the spirit of Emin Gün Sirer piece on Bancor's Red Flags, which he co-authored with Philip Daian. Those guys are great. Emin also happens to be an adviser for Tezos, which I think has its own more dangerous red flags. For Arthur Breitman's responses, I encourage you to follow through and read the thread and decide for yourself what you think about the merits of our respective arguments [his name should be obvious from the context]. I encourage people to be critical of anyone raising any amount of money, especially those who ask for an unlimited amount of money in this environment. It is on each and every community member here on Steem and across this space to ask tough questions of people asking for lots of money before it's too late. I took the time to put this together because I care about this space. But this is the extent of the time I have to spend on the subject anymore, so from here on out, you're on your own. This is not investment advice and these opinions are my own. Thanks for your time and attention.

While reading all of the below keep in mind how Ned has conducted himself and managed Steem over the last year. He has faced critics, assholes, trolls and The Internet itself. People have told him to his face he is a scammer, that Steem is a ponzi, and that it would never work. Ned has been graceful, respectful and professional throughout and focused on what Steem could do and on building a positive, engaged community. Steem today is the most used blockchain by normal people. Steem never had an ICO, but Ned has led by example and today's flourishing Steem is the result of that leadership and that example.

TLDR

Tezos management has demonstrated character issues. Blockchain projects have huge dependencies on the character and quality of their leaders, Tezos more than most due its structure. Management has come across as overconfident, scope-drunk, mis-experienced, reckless, greedy, rude, obtuse, and unprofessional. They are about to be very rich and in charge of hundreds of millions and maybe billions of other people's money (OPM).

The Tezos ICO structure is uncapped and reckless. This flies in the face of cryptocurrency standards and efforts to self-police. Not only is this likely to lead to worse outcomes for investors in the Tezos ICO, but this recklessness has negative externalities for all other cryptocurrency projects looking to raise much more modest sums of money and all cryptocurrency participants if it attracts more scrutiny from regulators.

The SEC has said that ICO promoters like the Breitmans for Tezos need to "protect investors". When I talk about self-policing and community standards, this is type of guidance I mean: "Whether or not you are regulated by the SEC, you still have fiduciary duties to your investors," said Valerie Szczepanik, the head of the SEC's distributed ledger group. "If you want this industry to flourish, protection of investors should be at the forefront."

Tezos is scope-drunk and not focused enough. This has morphed from a narrow software project to a giant empire-building exercise with dreams of buying a bank and negotiating with sovereign countries.

Tezos is likely to create a blockchain whose design is structurally captive to a for profit company owned by mgmt. A decentralization technology whose design potentially leads to centralization/capture on-chain, not just socially, is sad.

Tezos gives significantly better investment terms to billionaire investors to the detriment of regular investors. They even state that they prefer connected and powerful Tezzie holders. This, in conjunction with the above, risks creating an Oligarchchain. When it comes to Tezos, some are more equal than others.

There are real governance issues off-chain with their not-for-profit, for-profit, "related party" structure that give rise to agency issues and material conflicts of interest. They are willfully ignorant about this and their lack of experience shows.

/TLDR

Overall, I was biased to like the project, and have participated in ICOs for 50% of all smart contract platforms that have launched to date. I love that they have an MVP, have done the work, and are bright.

But the last couple months have been profoundly disappointing to me with respect to Tezos. Here are some of my concerning negatives.

If their uncapped ICO raises $1bn+, it will be 4x larger than any ICO to date. It says a lot about the Breitman's character that they are ignoring cryptocurrency self-policing and standards and not capping it somewhere from $30mm to $100mm like most other projects have, many of which could have broke away from community standards and raised much more than they did. We're already seeing ICO projects push the limits more and more at the expense of everyone else. The Breitmans' own roadmap shows anything over $20mm in a raise as a "moonshot." So why raise $1bn? Because they can, the worst reason to do anything. It's frankly reckless. It's their project, it's their choice, but nothing happens in a vacuum. I wrote specifically about the dangers that happen when start-ups raise too much, too early -- the culture corrodes, they get arrogant, they build empires, they get scope drunk and they struggle to create value. Arthur Breitman has also taken pains to say that these self-policing efforts come out of an "echochamber" -- no, they come from the mouths of the SEC.

This is the first ICO to my knowledge in which the founders get 8.5% of the fiat proceeds in cash in addition to 10% of the tokens. This means if things go well, they will be extremely wealthy even if their projects fails in 1 year. This 8.5% is through the Breitman controlled US entity, DLS. I wonder how many potential ICO participants do not understand that this ICO is endowing not just the Tezos Foundation (10% of tokens, plus fiat), handpicked by the Breitman's and "philosophically aligned" with them, but also the Breitman's via DLS (8.5% of the cash, 10% of the tokens). The conflicts of interest are many and the structure is murky. This also will put heightened regulatory scrutiny on the Breitmans personally and Tezos in general. If we can't self-police, the SEC may do it for us. And the largest ICO ever, one that solicited US investors and funneled cash to a US entity, seems like the most obvious target to date. Unlike TheDAO, which was a disembodied pooling of capital and in which no one gained any money whatsoever, Tezos has actual targets who are actually raising money. Slock.it was considered greedy but never saw a dime from their ICO the way it was designed. The Breitman's will walk away from their ICO as ultra high net worth individuals (UHNWIs for people who love lingo). If Tezos ever becomes as successful as Ethereum is today in terms of market cap, the Breitman's will be billionaires. That doesn't seem like the appropriate out-of-the-box incentive structure for a decentralized technology platform. The Breitmans are paying themselves upfront and in cash. If Elizabeth Holmes from Theranos infamy had done the same thing, she'd be a billionaire, despite having delivered no working product.

The character of the Breitmans is a concern. Any blockchain project is in part a social project, one that takes its cues from the leaders. You can see this in a million ways but the difference between Ethereum and ETC is one example of how important leadership is and how communities build around their thought leaders. You can see it in Augur, Monero, Synereo, Bitcoin, Steem, Aragon, Maker, Digix -- the leaders and the team set the tone and the community evolves around that seed. I have seen the Breitman's be overconfident, dismissive, and rude to potential investors while they are trying to raise $1bn. The structure of their raise alone is reckless for themselves and the cryptocurrency/blockchain space, given the SEC's guidance has been clear that they expect us to self-police and not do anything crazy for the time being.

In the real world, when a mgmt team has a Jeff Skilling moment, it's just a big red flag. It's great that you are the smartest guy in the room -- but that's not enough, character matters, and being able to work with people and build a community matters. EQ is as important as IQ. I asked Arthur Breitman a critical question and his response to me was "this feels like a negotiation" and then he questioned my motives and responded that Tim Draper disagreed with me (appeal to authority, so it goes. TD also has a different opinion on Theranos than I do). It didn't leave me with the warm and fuzzies. I was pretty shocked when he insulted another potential investor, followthechain, whom I know to be reasonable and diligent and helpful to others. In response to @followthechain allegedly getting the math wrong on an involved bit of financial engineering in their fundraising ICO structure, Arthur Breitman called him "innumerate," said "This isn't scrutiny, this is failure to understand fractions" and then said "kthxby." Worse, by my checking, Arthur was clearly wrong (I show my work below). It was not an example of the kind of leadership that will lead a $1bn social/tech project to greatness. Again, context matters -- Arthur Breitman is the one who is soliciting $1bn in money for his project and himself and in that context, it was a low EQ move, the kind of thing that if it happened in the real world would crater a fundraise. I've met with unicorns and big real world companies' mgmt teams during fundraising processes, including one very large logistics unicorn famous for being difficult who proved it to my face -- and yet that unicorn's hubris was less than what I've experienced from Tezos. My takeaway has been: is this someone you want to be in control of $1bn? Are they ready as leaders? Do they have what it takes? We are learning in project after project that character and the quality of the team are integral.

The scope of the Tezos roadmap is ridiculous (page 19) and belies that investors should not have confidence that the team will use the raised money well. The plans are massive and random and the team doesn't have the necessary expertise to handle the variety. Scope is way too big. This looks like empire building and it's frankly, an unfocused, shoddy plan. The detail in the plan reads fake to me. Pretty obvious that it comes from smart, talented people without much experience but with a lot of confidence. It's not as bad as when TaaS said they would be making a "Bloomberg competitor" on top of running their CEF but it's not far off. They are scope drunk. In my experience with companies, mgmt teams who wants lots of money or a blank check, and have little tangible plan with what they will do with the cash other than "good things" and "humbling scope" burn cash quickly and don't create value. Span of control issues will be rampant here, and it's evident that the Breitmans don't have the experience to even know what span of control is. I like ambition and this whole space is rife with dreamers. But most are not asking for $1bn and derisking themselves with cash payments upfront.

Examples (note that there were also a lot of spelling mistakes on their roadmap -- a document to justify why people should give them $1bn):

"Negotiate with a small nation-state the recognition of Tezos as one of their official state currency, which would immediately give Tezos favorable treatment in terms of financial regulation. Attempt negotiations to purchase or lease sovereign land."

"Purchase a banking license and deploy the Tezos blockchain as a backbone for business operations. Experiment with automation using a blockchain for basic processes.

"Acquire mainstream print and TV media outlets throught [sic] token issuance to promote and defend the use of cryptographic ledger in society."

"Sponsor a leading computer science department with endowed professorships and extensive grants to graduate students in the field of formal verification."

Why won't this evolve into just Breitmanchain or Oligarchchain?

Tezos has been positioned as a reaction to TheDAO and the overall Ethereum governance fallout of TheDAO and to governance problems in Bitcoin. It can adjust the quorum down to solve for voter apathy, amongst many improvements. Breitwoman started this comparison when she penned her TheDAO op-ed in Feb'17 and they've played up the governance failures of TheDAO (they are ignoring other learnings from TheDAO like ICOs should not be uncapped, and if things go wrong, you're better not having a centralized recipient of crowdsale proceeds around as a traget with legal standing in the US...). [Note: their obsession with Ethereum runs deep. They named their language Michelson, after the Michelson-Morley experiment that proved "aether" doesn't exist... :/ ]. But conceptually, how won't Tezos fundraising structure and adjusting quorum lead to centralized capture by the large holders Day 1? The lower the quorum adjusts to, the easier it is for a large holder to dominate the governance. The apathetic majority will be dominated by the Breitmans' and their cabal.

And the design gives a 20% block to "philosophically aligned" entities. The Foundation does not seem independent enough to disagree with the Breitmans in a substantive way, given the foundation was picked by the B's. Why create a decentralized governance solution and then endow the creators with stakes that look like they will dominate voting?

How won't the most endowed, most influential two people not control the governance? Why in a decentralized solution do some people seem more equal than others out of the gate -- the B's have alluded to having an uncapped sale so that people like Olaf and Tim Draper can get in (ironically these people already have benefited from preferential access, so this rationale rings hollow) suggests that some potential Tezos holders are more equal than others and certainly more desirable. Why won't Tezos be captured by oligarchs and the connected? Why use blockchain to recreate existing power structures? It stands out that an oligarch has already bought in and been used to market Tezos.

At the end of the day, people can take a measure of Tezos based on how they treat others and how they comport yourself. They will dominate the governance of Tezos, its design, and hold more of its economic value than anyone else. Maybe they're out over their skis, maybe they're just going too fast, I don't know. But they're going to be measured now, this week, next week, and for the entire length of the Tezos project.

It's because of these last sets of fears that the characters of the Breitmans really matter. They need to act fair, be pragmatic, and foster a decentralized open community for Tezos to succeed. But they will be rich in fiat, the largest Tezzie holders, and they will have already communicated to the public that some Tezzie holders are more equal than others. What's the point of blockchain?

Open questions from my old notes

The Tezos Foundation is separate from DLS but will control the cash that the Breitmans don't pay out to themselves. The board of the TF comprises: Johann Gevers, Diego Ponz, and Guido SchmitzKrummacher. I've never heard of these people and question whether they have the expertise to manage a $1bn budget.

Will the TF be separate from the Breitmans and DLS and will it be captive to the interest of the Breitmans/DLS? Note that when you navigate to tezos.com, and click "Team", you are not shown the 3 Swiss gentlemen above, but the Breitmans. It seems they substantively control both the Tezos Foundation and DLS, while pretending not to control the former. What controls are in place to ensure that Tezos's interests are put before the interests of the Breitmans and their for-profit entity? What controls are in place to prevent the Foundation from acting in the Breitmans' interests further by such actions as making acquisitions of companies with which the Breitmans' have relationships (acquihires and hiring "management consultants" (Kathleen was a management consultant) seem to be on the roadmap, easy paydays for people you know) and to ensure that ALL dealings are at arms length? How do Tezos ICO investors and Tezzie holders exercise their rights to ensure that their best interests are looked after? Honestly this would be an area that in the real world, real investors would be ripping apart a real fundraise even one that was much smaller than this. Check out the "Related Party" section of a typical midcap public company's 10K. These issues and the shenanigans that opaque organizational structures permit are where Enron went wrong.

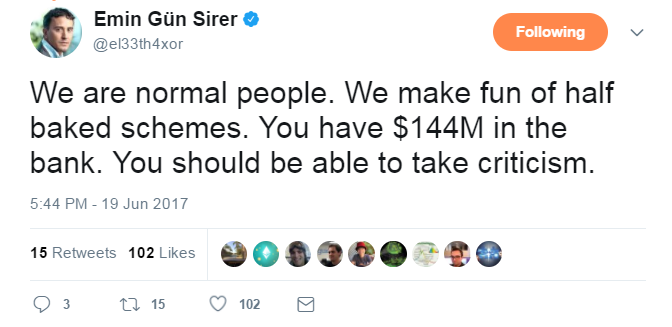

Are the advisors to Tezos -- all great people I respect bigly! --> Emin Gün Sirer, Zooko Wilson, and Andrew Miller -- "philosophically aligned" with a $1bn or uncapped ICO? Have they vetted the Tezos Foundation board members as suitable stewards of such a large project and people that ICO investors in Tezos can trust? What is the extent of the due diligence of the advisors on the Tezos project overall (org structure, ICO structure, foundation composition) and what does their status as advisors mean with respect to this ICO fundraising process? Their names are about to be used to sell a huge $ value of Tezzies. Do they endorse the Tezos ICO as constructed?

If anything above $20mm+ was considered a "moonshot" level raise, why would capping this at $50mm affect the success of Tezos negatively? The structure of the ICO alone seems needless and reckless in a self-policing environment.

One of the best blockchain community members out there is /u/Dunning_Krugerrands/. He has continually received dead silence from the Breitmans when asking straight questions, as have most people who ask anything critical.

I actually have a ton more questions and concerns than I list here (apparently they may not even own the IP they are selling in this transaction? what recourse do investors have if that IP is not owned and this all falls apart?) but my time and attention are scarce. I have learned enough about Tezos to move on and focus on other things. I'm just editing and reposting this so people out there can benefit from the time attention I did spend and so that those same people are properly equipped to make up their minds for themselves. I saw Emin take Bancor to task and decided I should expend at least this effort.

In the real world, these concerns and the questions implied from them would still be kids' glove level of critical inquiry. You might not believe this, but when companies raise money in the real world through IPOs, they are expected to answer 1000's of pointed questions that get into the weeds not just on what the fundraisers want to talk about ("their dreams! their product!") but about reality --> mgmt, org structure, COIs, experience, track record, recourse, how their model breaks, who they are, why they need so much $, use of proceeds, how much they pay themselves, how much they will pay themselves, who owns the IP, who has title to it and under which jurisdiction, what do you mean you want to negotiate with a sovereign country and buy a bank, the list goes on. In the real world fundraisers are also expected to answer questions respectfully -- how they handle themselves is part of the process because management teams who can't answer questions well in the present or who dismiss criticism correlate with management teams who destroy value in the future. Character matters.

I hope the Breitmans prove me wrong by setting a cap, by eschewing a cash payment upfront, by not favoring billionaire and connected investors over normal people, by rethinking their agency issues, and by designing some great tech to reward their investors who will probably be contributing as much as a billion dollars to the Breitmans' Tezos ICO fundraiser. Shortly, they will be rich and have every opportunity to prove me wrong.

I speak out because I care about this space and I do not want to see it wronged. Always do your own due diligence and always be careful, everybody.

Some helpful links

Tezos on Reddit -- I checked in for the first time in a month and it's a disaster zone. Inverted virality.

Zooko Wilcox, Tezos advisor, gives his disclosure just now. Appreciated, but he doesn't say much or appear to stand by Tezos strongly and has no skin in the game.

Why advise anything and let your name be used unless you are willing to stand behind all aspects of a project? As Marlo declared, "my name is my name." It's notable that someone who knows them well and is an advisor states that he is "not investing" in the Tezos ICO.Examples of sloppiness: math mistakes in their white paper. Note that above Arthur Breitman took the time to call @followthechain "innumerate." @followthechain is not trying to raise $1bn from other people, so I think his math mistakes are more forgivable. This is a good example of why you should never be an asshole to other people, especially when asking for money. Also because when you look through the back and forth, it seems like Arthur Breitman is the one who had a "failure to understand fractions" --> @followthechain suggested that if Tim Draper invested $5.6mm to get 33% of DLS (a theoretical exercise just to make a point), Tim Draper would breakeven just from cash received from a $200mm ICO, as DLS gets 8.5% of all cash raised by the Tezos ICO. The equation would be 0.33 * 0.085 * $200mm = $5.6mm.

Dfinity's "Don't Be Evil" article which takes thinly veiled shots at Tezos.

And another thing: Emin tweeted that people should have more fun in their articles and have some liberty to tweak projects that raise crazy amounts of money. My concession to this was to use an online tool to morph Arthur Breitman from Tezos's face with Elizabeth Holmes from Theranos's face. I'd say that the face looks ethereal but Michelson already proved that "aether" doesn't exist. Instead I'll just say that the face just looks like a bad mistake. My other concession was the inclusion of a Juicero graphic because Tezos felt it worth using Juicero to help negatively market Tezos.

Steemians, if you have good color on or critiques of Tezos, please share them below, good or bad. I'll upvote the best quality information.

Thanks so much for this. These sorts of insights are invaluable for those of us newer to the crypto space.

To your point about "character", I saw Arthur interviewed on Bitcoin Uncensored. You can count on Derose to ask some tough questions (even if you aren't a fan of his style). Arthur's responses and general demeanor left something to be desired IMO. Maybe he's a great guy with good intentions, but reading people's facial expressions and tone can be helpful.

It's possible we as a crypto community are an overly skeptical bunch, but sometimes you just have to listen to your gut.

I'd score that: 1 for Arthur, 0 for DeRose, negative 20 minutes for all of us.

Haha, fair enough.

This guy was just focusing on bias pointsC it is impossible to have a normal

Conversation with someone like

Him. He just imposes and chages the topics to his benefit. I know he had some good points but I truly dislike the lack

Of mutual conversation

I sincerely agree with you. I too will NOT be participating in Tezos.

Too many project are building dapps on Ethereum.

It too much of a pain to develop on a different blockchain, and the adoption is uncertain. Ether is certain from all the dapps being developed.

Thank you for the due diligence - I had a similar conclusion after doing my research and reading the whitepaper. One of my closest friends told me he was going to send 40 ETH to the Tezos Crowd Sale and I just about $h!t myself. I tried my hardest to talk him out of it, but I was only able to talk him out of 1/2 of it. He still sent them 20 ETH.

One concern is that it's denominated in BTC and they have said that they don't guarantee any kind of good price in ETH -- it will be a best efforts basis. So it's inadvisable to send them ETH, if you plan in investing their ICO.

I agree with you 200%

Fantastic well researched article, deserves 5 STARS! I believe you have covered just about every major red flag: Uncapped ICO which diminishes futures returns for investors, arrogance of the founders and direct cash payments to the founders regardless of the outcome. There is one other potential red flag issue. I checked the github for Tezos. A single contributor did all of the 463 commits as of June 30, 2017. https://github.com/tezos/tezos This is highly problematic, by comparison ETH has 137 contributors as can be observed at https://github.com/ethereum/go-ethereum. No matter how brilliant the Tezos team may be, multiple developers are needed for testing, hardware wallet integration, security, etc. The value of a genuine crypto token is a function of the code base and strength of the development. team It appears that investors are about to allocate heavily based on hype and promises and likely to end badly.

They had done all the work offline and the basically uploaded it all at once. The existence of code here is a positive.

wow. everyone needs to read this

Thank you for such informative post, my husband and I are Brandi new to crypto and we decided to buy Tezos ICO due to a feeling and a sign. It might sounds crazy but so far my life has worked out great when I follow the signs I get.

Funny story my husband and I were walking around our neighbourhood and started thinking about time travel, we figured if we do time travel in the future we would come back to leave ourselves some kind of a sign.

We found one that was pretty intriguing, a big TENOS sign with a underline under the N. we hadn't no idea what it meant.

My husband a year later was suppose to take a plain to spain but it got cancel so instead they made him go to New York and take a different plane. In this trip he saw someone sitting beside him with his laptop open to an article on Tezos.

He has no idea what it was but he got interested and wrote it down on his phone. His trip never needed up happening he never made it to spain he just came back home to canada.

He told me about Tezos and I said "babe remember the sign TENOS we saw if you turn the N around it's a Z to TEZOS.

It's crazy talk but we truly have a strong feeling about it. We would have never known about Tezos if my husbands plain hasn't been canceled and we wouldn't made anything on it without our TENOS sign.

Since it was way before the ICO wasn't out we figured this is a sign to take action.

At the end who knows we might be completely wrong and off on our gut feelings, but at the same time we never know so we choose to take the leap.

Hope things work out !

Things like this had to happen eventually, when greed starts to take hold, and people start to realize how much they could make if they just ignore the moral stand that others have taken. It's pretty sad, and kinda scary. Thanks for the TL;DR by the way, I'm lazy today ;)

Here's an little exercise relating to contemporary ICO/ITO ventures. Evaluate the red flags you highlight regarding the Tezos ICO and compare them with the TenX ITO. The contrast is stark.

One may end in tears for investors/users/the cryptospace; the other is a case study of Good Potential based upon: attitude, clear concept, execution, fairness, infrastructure, realistic roadmap, and team.

I wish success to both; however, I know where I'll put my hard-earned and trust.

This is a little vague, can you explain what you mean? What are the good aspects of TenX?

Thanks for your reply. These are a few of my favourite things: A means of using a debit card accessing one's various crypto currencies. Near instantaneous approval at merchant level. Solid whitepaper and groundwork with Visa/MasterCard. Intelligent geolocation in a progressive state. Solid legal foundation. Staged, realistic targets with a manageable rollout. An existing and functioning debit card/wallet tested in many countries prior to ITO. Fairness-centric ITO aimed at a wide group. TenX advised over 4,000 persons subscribed to the token sale. The TenX Team's effective use of a number of communication channels to advise and inform. Julian Hosp's attitude and demeanor when presented with critical questions. The payback scheme for PAY token holders and card/wallet users. Other than that, TenX gives one the gut feeling that this team has their stuff together - they can and will deliver their clear goals or at least give it their best shot. Their perceived humility and openness to suggestion.

To each their own; however, without a complete listing of my evaluation, these are some aspects I perceive as "good."

Thanks for the clarification and expansion of your thoughts.

I'm skipping tezos as well, there are plenty of other projects out there with great potential :)

You spent a great time in writing this article or blog pot and i am sure it going to help alot of people as your information is very precise and you presented it with evidences, hope this will help alot of people like me to make decision which will ultimately benefit us in either way and benefit the whole world and society as well.

Yeah Agreed on your findings it should be capped instead of uncapped and there so many drawbacks in Tezos foundation. I was planning to get in Tezos with some ETH but I do research and realised that this is not the right ICO to get in so I left it to participate.

I found from the research in Tezos the only Aggressive management skills in Tezos and not so worthy to get funded unlimited. It should get the red flags from investors / Whales.

The would be Reckless for this much uncapped funds raising. It could be dangerous for the project I don't understand why they are raising unlimited even without having any adopted product or launched products. There are so many stories for Pre-Sale and ICOs mostly they are just an ideas not the reality.

if it turns into reality and mass adoption being started it could be potentially well for the project and its future. they are just testing ideas that's all without any proper pre released products or real use cases tests.

Has no one noted that the Breitmans are former GOLDMAN-SACHS people???

There's your Biggest RED FLAG!

Here is Clif High's synopsis on the "Tezos Foundation" without the buy-sell or long-short recommendation, deleted that because it is paid subscription info.

Tezos Foundation (ICO)

Tezos Foundation is founded by Kathleen and Arthur Brietman. It is being touted as a replacement or competitor to Ethereum as a network, and as a coin/token. The founders are from Goldman Sachs, and other banking interests. There are also associations with very large 'accounting and consulting' corporations. All of that colors their ideas of the 'marketplace' for their product, and is directly influencing both their language and their behavior. There is big money in the form of billionaire (Tim Draper) is said to be 'backing' the ico for Tezos. Critique: Note that Tezos is a 'foundation'. The organization is touting a distributed network competition for Ethereum, and chooses to arrange itself as a 'foundation'. The language of the Tezos site, as well as the many examples being offered in public relations venues by the founder, are providing a view of a group that is in an intense fight. Tezos core developers, and its operating crew are viewing themselves as saviors of the distributed smart contracts world with their 'unique' contribution which is viewed as the use of Michelson proofs for code for smart contracts. Their idea is that Ethereum as a network is languishing due to the failure of Ethereum to provide proof of correctness to code prior to letting contracts be launched. The language offered by the founders in their public appearances, as well as the language at Slack and other coin developer forum postings, is showing some very clear signs to avoid this offering. First there is a delusional perception of themselves as 'saviors' to the Ethereum concept, a failure to note that their one point of differentiation is both easily copied, and not at all on consumers awareness. Further, their language betrays both arrogance, and passive/aggressive patterns. There are slight hints of social themes within the language for/of Tezos, however, given the arrogance of their other language sets, the impression is one of an elitist view at odds with the space they are trying to enter. The math proofs they are touting are not being sought by the market. Their smart contract programming language is OCAML, which, while a decent language, robust, and supported by many libraries, is still a relatively isolated, French focused programming language. It is designed for what are termed 'abstract machines', and while the Ethereum Virtual Machine, upon which all smart contract software runs, certainly fits that description, the OCAML language is not well suited to development of smart contract code. This is due to it being first an interpreted language, and second to the large, and bloated bytecode it produces (a side effect of its robust nature for large scale applications). Even though a descendant of Caml Light, this version of the compiler produces even more bloated bytecode than expected of 'enterprise level programming language'.

As a practical approach, for Tezos to chose OCAML over Solidity has already put them behind the Ethereum adoption curve, and falling further back faster. May well make coin in the ICO. But crowded space already, and growing by the day.

NOW what do you think?

Goldman Sachs is fine, conspiracy theories are silly. Lots of good people and bad people work at Goldman Sachs and have. Same goes for all big companies.

Anarchy has no rules.

Morality is a set of rules.

In the current world of cryptocurrency (anarcho-capitalism to quote a certain person X) Investors have to be extremely careful. There is no safety net.

Wow I didn't understand much of what you said. Just starting out learning about blockchain and don't really understand the tech, as well. I will only talk about what I do understand. The character issue in the business world destroys the value of the supplied tech. This means all by itself that investing in Tezos and by association Breitman, and the DLS is a stinky proposition to say the least. Without the awesome tech it is just plane stupid.

I just got one question for you.

Have you thought about competing for those investors with a better business plan?

You have got the love and character for it!

The fact that the SEC is setting up the Blockchain doesn't surprise me in the least as the modus operandi is always "Problem Reaction Solution and the fact that the ICO's have been warned will never be exposed as the planning of the cabal as you described them.

The good news is that we really do know that it is a blow to the heart of this space and the real question is are we going down or are we going to win.

Good Luck!

P.S I am no genius, but you can look at my wall and if you can think of a way I can help. Aske I can guarantee I will do whatever I can.

Very infomative

Thank you for your time and attention.

Ahhh Juicero. The pet rock of juicers!

Great article, very informative. I was very excited about Tezos concept, but after reading the white paper and doing some research I gradually became more and more disappointed. A lot of red flags. I have a felling their road map is just an illustration of their plans to escape to the moon if they swindle enough people and if they manage to really screw enough people over its Mars or bust! The lack of a market cap shows a lack of organization, control and respect for their investors. Thank you for confirming my concerns putting in the effort to protect potential investors.

Idea= worth investing in

The people behind it= NO

Ideas are interesting as an experiment. They should have raised smally over time on tranches, rather than crush their ideas with unmatchable financial expectations.

Can somebody explain why the promotion system is not working??

Disclaimer: I am just a bot trying to be helpful.

I'm never a fan of meme replies but thanks for reading.

Congratulations @eeks! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPBy upvoting this notification, you can help all Steemit users. Learn how here!

Hey @eeks

** Apprecited Your Work and your doing really good on steemit network all ways publishing valuable content **

I would like to request you please keep posting this type of valueable content for the community of steemit as this platform is growing up day by day .. I would request you that you must support new steemer like me and other .

I am in love with one of my post as a senior steemer I need your Honest feedback regadding that . If you get time from your busy life and write your comment upon it . It will be really apprecited ..

If I missed I do Apoligize for that ...

Lots Of Love For Future Posts

Watch my post to get Entertain Yourself

Your Comment , Upvote and Resteem my post will be really apprecited

Regards Sophia Olive

Hey Sophia, great to have you on Steem. I will check out your stuff when I have some time.

Good idea.

thanks

This is the most undervalued article ever..!!

Congratulations @eeks! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPBy upvoting this notification, you can help all Steemit users. Learn how here!

Good article

Votတယ္ ကြီး

Very nice post and great my dear friend

Follwed and upbote

Dear friend i will be glad if see ur great vote on my page

After reading this article I am now fearful of the Tezos ICO and glad I did not buy into it... I hope you're right!

Wow. I am super amazed at how people are taking advantage of this crypto craze. The whales are dominating this market just the way stock markets are dominated.

The ICOs are the real hope for small investors to make some dough...and now few have found ways to tap into the ICO market as well...in my ICO review series, my verdict was to "STAY on SIDELINES" for Tezos ICO because of the red flags that I noticed then and your article really elaborates on them...Upvoted.

The world is not ready for smart contract

seller and buyer will burn

best way is to manage by hiring people where it won't cost 1$ and hour so this contract can be judge by human

our technology now still can't give us a system better than human services

You had me at "lack of character." I'm out! :) Thanks for taking the time to write this up, AND for encouraging people to follow up on their own.

thank you for sharing this amazing article:-)

Nice post and useful!

Thank you for taking the time to put this together! Excellent post :)

thanks a lot for this post I'm new and I learned a lot of new thing thanks a to for sharing and keep on posting ;)

@ekks How would you compare EOS ICO to TEZOS would love to hear what is your opinion on EOS ICO. Thank you for great post.

https://steemit.com/steem/@cryptopizza/like-my-post-and-let-s-see-how-much-voting-power-do-you-have-you-may-get-more-than-this-in-future-choice-is-yours

Thanks for the well researched article written. I can't speak the language of crypto yet. However, the fact that questions asked cannot be answered with clarity regarding the responsibility of large sums of $$ would make me think twice about investing. Thanks for your hard work. 🐓🐓

most of these ICOs are people jumping on the money ship.

I got the idea of what ico is.. I just upvoted this post. :-)

wow, you should post often man

Inspite of everything this is a good development. ICOs are now the new model for funding instead of IPOs which will eventually starve the Wall Street wolves.

Great post

Follow @polaleye50

@eeks nice article i upvoted i have found a way to see who upvoted and i found that you supported me i also mentioned you in the post here is the link if you like it do upvote thanks

https://steemit.com/stats/@diverse-thinker/tracking-upvoters-made-easy

WOW such an amazing post!!! thanks for sharrring!!!

Now, 5 months after the ICO finished, it (unsurprisingly) turned out that all of the concerns were right. The huge amount of money raised inevitably spawned fighting over it. Starting from the initial red flags, the project as whole became a red flag.

Do you know if there is a kind of comprehensive summary (somewhere online) of what exactly happened after the ICO finished and what the plans for the future are? I mean now, after the buzz is gone, there aren't much updates on the progress of the project (the only news you'll find these days are regarding lawsuits).

I write this comment on Dec 20, 2017.

I am an investor of Tezos and I find that this article is correct. Unlike Ned who focused on Steemit and built engage community, the founders of Tezos are busy fighting to prove who right or wrong and use the community to gain power or control of ICO fund instead of protecting investors - this is a sad truth.