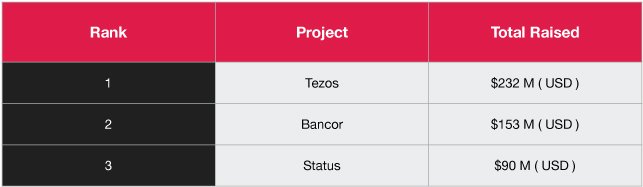

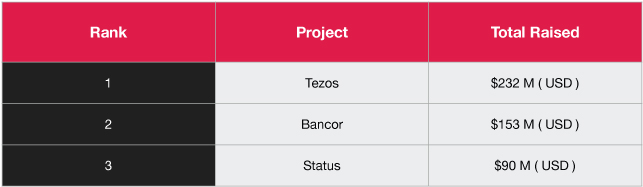

2017 has been a record year for Initial Coin Offerings in several aspects. Not only has ICO fundraising surpassed all the Venture Capital funding invested in Blockchain start-ups since the inception of Blockchain, ICOs have raised more than seed funding raised in 2017. So far, 92 projects have raised a combined $1.3 Bn of token sales. What’s interesting is, the top 3 ICOs combined have raised more than $375M, which comprises around 30% of the total ICO fundraising to date.

1. Tezos

While all Blockchains offer financial incentives for maintaining consensus on their ledgers, no ledger has a robust on-chain mechanism that amends the protocol governance rules and rewards protocol development. Tezos addresses one of the largest and under-addressed challenges in Blockchain protocol – the governance system. Tezos is the first self-amending cryptographic ledger and has developed a self-governing platform to address the scaling shortcomings of some of the legacy cryptocurrencies. Tezos allows the members of the network to submit proposals that would maximize the benefit to the network and dynamically change the network rules. Tezos will incorporate these value add features into the primary Blockchain rather than enabling the creation of the third party distributed applications which makes the incentive mechanism much different than Ethereum.

2. Bancor

The Bancor protocol is a standard that allows anyone to easily create completely liquid “smart tokens” that calculate their own prices. Moreover, Bancor enables any single party to convert any token to another, without requiring the second party to exchange with. These “smart tokens” hold one or more other tokens in reserve (any ERC20 standard token or Ether) and permit any party to instantly purchase or liquidate the smart token in exchange for any of its reserve tokens. The transaction executes directly through the smart token’s contract, at a continuously calculated price, according to a formula which balances buy and sell volumes. The premise of Bancor is to make a liquid market in the tokens by using the ICO sale proceeds to provide a price floor for the reserve tokens.

3. Status

Ethereum has introduced an entire ecosystem of decentralized applications (DApps). Status is an open-source messaging platform and browser that interacts with DApps that run on Ethereum Network. Status is also the first use case of implementing Ethereum on mobile platforms such as iOS and Android – as such we can use DApps that are powered by Ethereum.

In spite of this year’s robust ICO activity, the ICO fundraising has slowed down, albeit the falling cryptocurrency prices in June and July. In June Blockchain companies raised over $550M in funding, compared to ~300M in July. Check out our ICO calendar for the past, current, and upcoming ICOs.

Read more posts here: https://cryptocanucks.com