Would you like to rip people off? Steal their money? Fool them to get all their Bitcoin? This is how you can do it!

Please note: This information is really supplied so you don’t get cheated. Do you own homework after you see how I do it!

Create a Pump and Dump!

Take over an existing coin, or start you own. Whatever you do get on CoinMarketCap.com

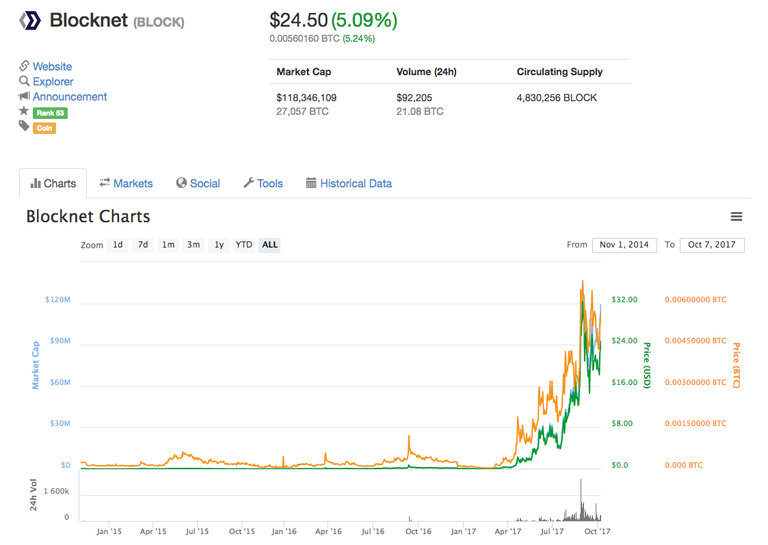

Make a cool looking chart like this.

I like uptrends. I am not in it. I might miss out. I had better send them some money right away. I don’t want to miss out!

Here let me help out with how to really read the chart.

Yep. It is all fake. I am saying all of Blocknet is FAKE! It is all false! It is a FRAUD! It is a scam! It is a lie! Those are strong words! Do I have proof? Just wait!

So how do you fake an entire chart?

You just take one lie and multiple it by a million.

The devil is in the details!

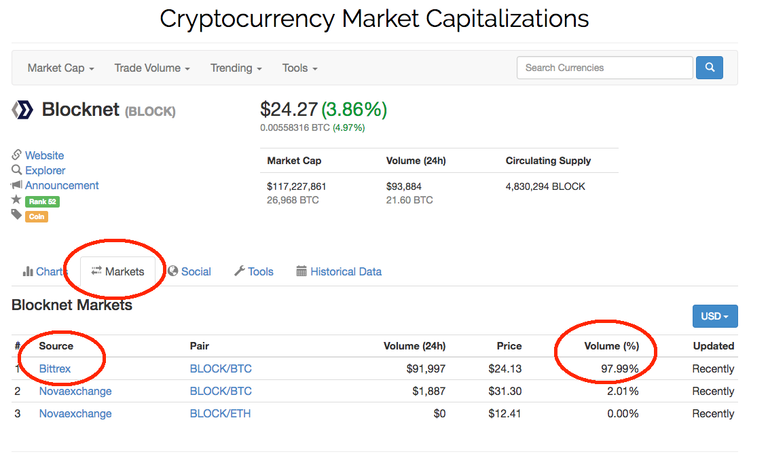

You can see where the Alt coin trades by looking at the markets.

And then you can the exchange website.

Note: Bittrex is one of the main cryptocurrency exchanges!

https://www.bittrex.com/Market/Index?MarketName=BTC-BLOCK

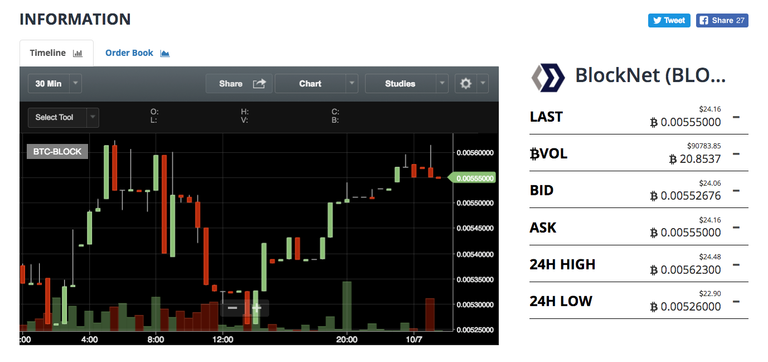

Before we get excited by the blinking lights and cool charts lets look at the trades.

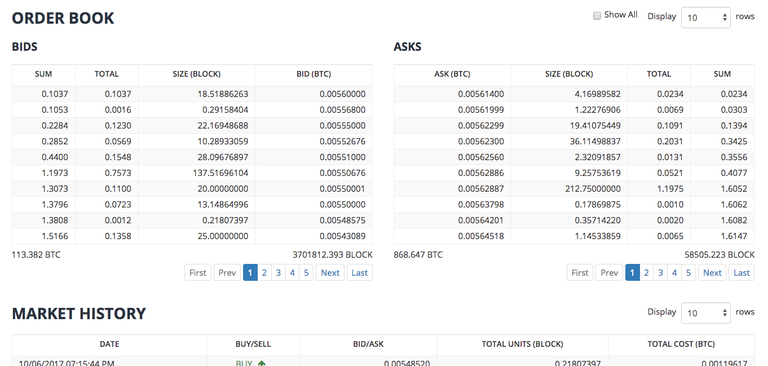

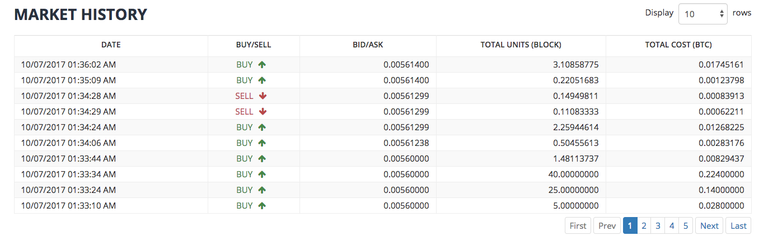

At the bottom on the screen you can see the last 10 trades. Now remember this exchange represents about 97% of all activity.

So give me a second! Look at the seconds!

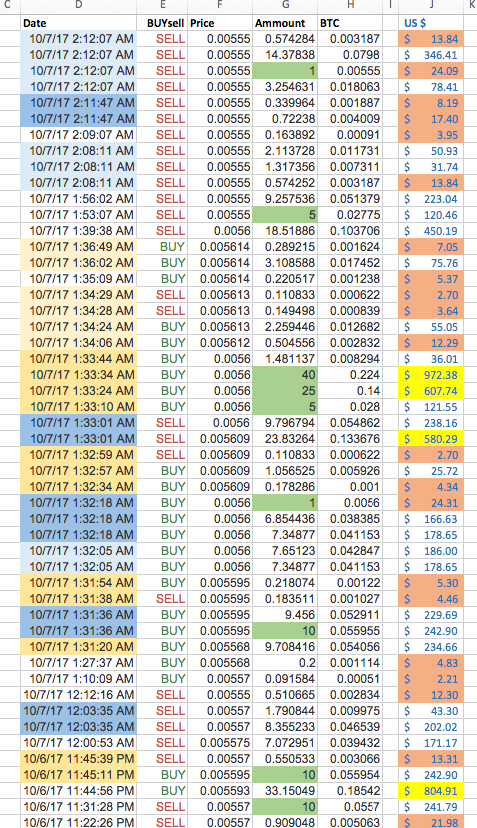

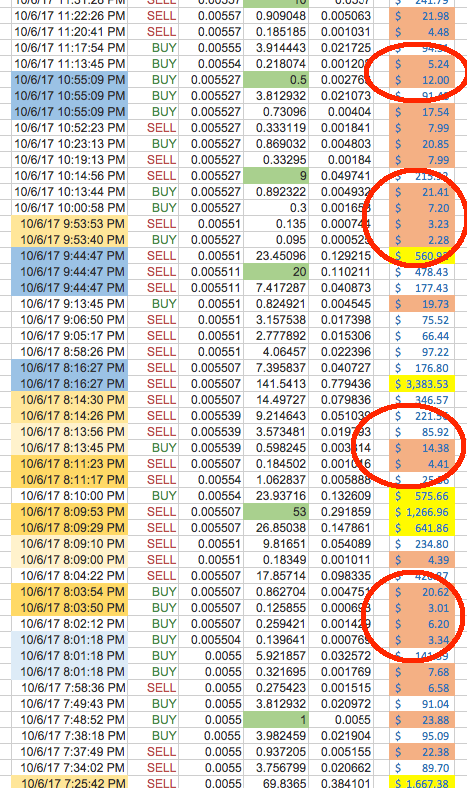

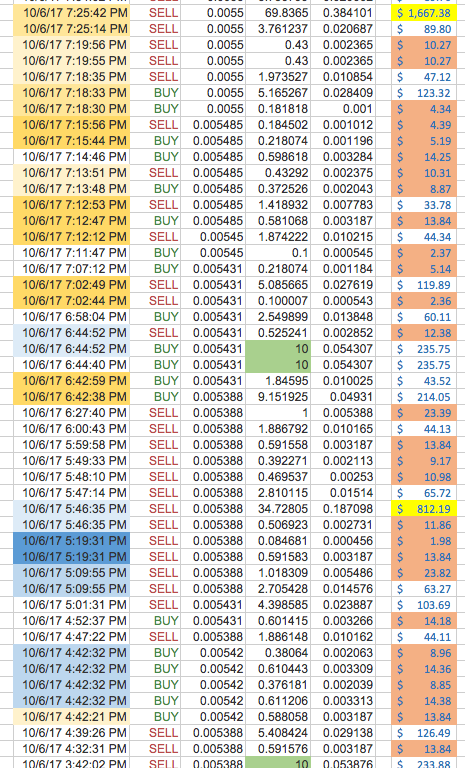

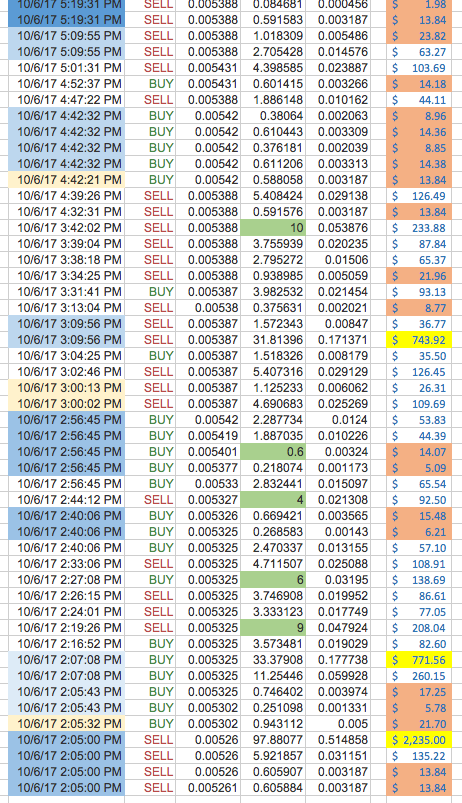

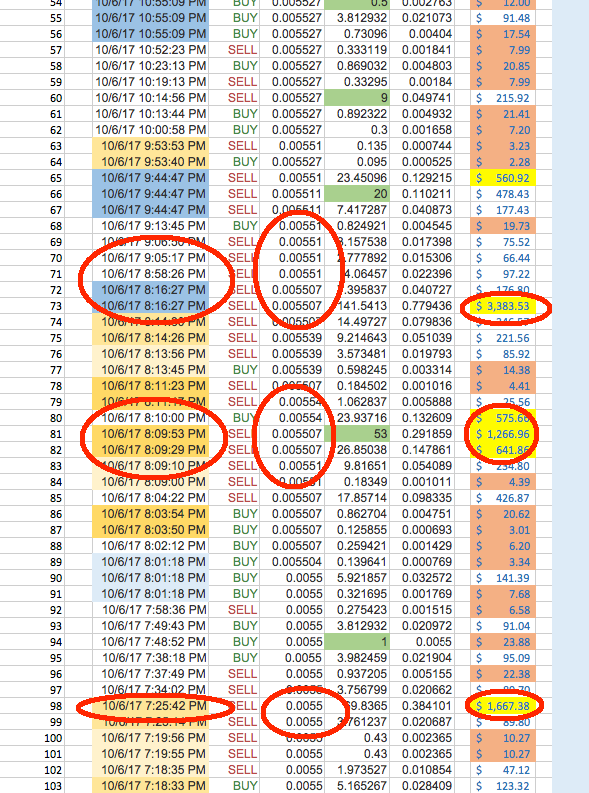

I have taken this data out of the exchange and into excel for easier analysis. You can too… copy and paste.

How many of these trades look like there are real trade?

A real trade might be one that is put on by a human, is not computerized and represents the outcome of fundamental research into the company and a belief into the long term potential of the firm?

Not Many.

First off humans typically do not enter multiple trades in the same second. We are too slow. If you look at the trades, and I offer some color coding to help out, lots of them were all entered in the same second or in the same minutes. Some of these trades may be the result of a split order, where one buy order bought out multiple sell orders, but at the moment lets just call this suspect.

Now lets look at the buy amounts. If some guy wants to invest in the cryptocurrency he is probably going to make the investment worth his time. Let me pick a number $25. If this man is working at a job he is either going to A) not invest or B) invest over $25. It just doesn’t pay. Of the trades I looked at 83 of the 180 trades -46%- were for less than the equivalent of $25 USD. That looks fishy.

When is someone going to invest? People have lives. They eat, they sleep, they drive on interstates. These trades are done around the clock and do not show natural rhythms of life.

If you are observant you would have noticed I should have been in bed when some of these screen shots were taken. I couldn’t sleep. This fraud is keeping me up at night.

The pattern is the same earlier in the day.

Do these trades follow a normal pattern? Are they relatively randomly distributed. The US stock market closes, most people go home. Most of the trading happens during exchange hours. These crypto markets are open round the clock. But humans go to bed. Do these trades show human like tendencies. No. They are all computerized.

Now some may argue that all Wall Street is computerized, all these trades are no different. Except there are real companies behind those trades.

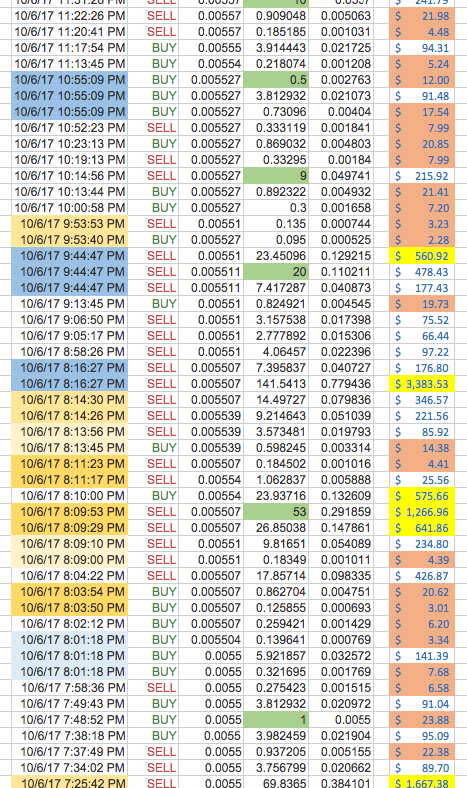

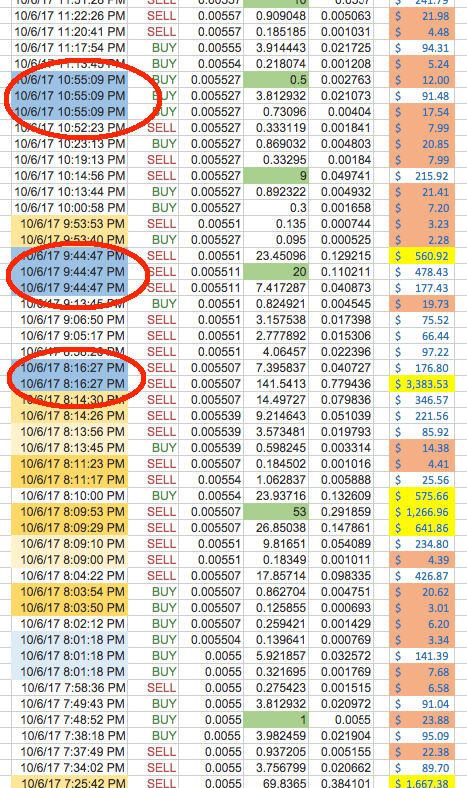

So lets look through more of the numbers…

People like to buy things in round numbers… I want 1 share, 5 shares, 10 shares. People don’t say, I want to go buy 1.7342529 shares! How many of these trades are in round numbers? 21 trades out of 180. I highlighted the even numbers in green. That is 12% This does not look good. Look at how few were in round numbers.

And then many of those trades are by what we have already identified as computers, in that they traded at the same second as other trades. Lots! Fishy!

OK.

So lets back up and look at the volume. My sample of trades here shows about 12 hours of activity. I have 180 trades in 12 hours so there is about 360 trades a day total. There is 1,440 minutes in a day so that is about one trade every four minutes.

Over the last 5 days the block net averaged about $200,000 in US dollar volume. That would mean each trade is about $555? Hhmm… Seems fishy. Maybe it is just the big trades that are real and small trades that are fake?

No.

Now I don’t know if you ever tried to buy a bunch of stuff in a market with a bunch of small trades, but when a $2,000 order hits a market with little trades it should clean out the order book and move the market higher or lower. When these “big orders” (bright yellow) hit the market completely randomly and do not move the markets. How fake.

Now one would be wise to look at the time stamps. I have seen it before where orders always came in at the same time every hour. I suspect there is a pattern here, but I have not found it yet. It would be real easy to program a bot to buy every 47.8 minutes, and then sell every 17.3 minutes. I suspect something of the sort was done here, but you spend the time to find the pattern and share with us in the comments below.

Bitcoin prices are constantly changing. I would suspect people would invest even US dollar amounts. Here though, -with the volatility of bitcoin prices- it is hard to detect the actual prices for even dollar amounts. That said, these dollar amounts do not “look right” to me. They are not distributed as if they were done by humans.

Every way I look at this data, it looks completely faked by a computer.

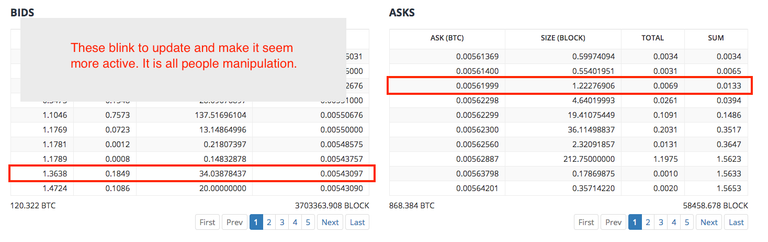

So lets pull out of the data for a second. If you look at the bids and ask when the Bittrex page comes up, you will notice the order book updating. The bids and asks are constantly changing. You will see an update every couple of seconds.

I like flashy things!

The flash is there to fool you!

That is all just there to look good. It is all to fool you. No I believe they order book has really changed. But it is a computer that has changed it, just to look good. Just to manipulate you and your emotions. If feels more like a “real” stock market. We know –based on the last 12 hours- that trades happen about every four minutes. So there really shouldn’t be a reason to update the order book every 3 seconds.

Now that we have seen that it is bots that are buying and selling, it is real easy to increase the volume. All you have to do is add some zeros to your bots and you can “pump” this alt coin as much as you want. You can make the volume numbers anything you want. Do they follow patterns like you would expect? I wouldn’t bet on it.

Now lets talk about the price. If you run a bot that controls both the buying and the selling what price is it going to do that at? Whatever price you want! You can have the bot drive up the price when ever you want.

But couldn’t someone buy a bunch of the coins cheap and sell them later?

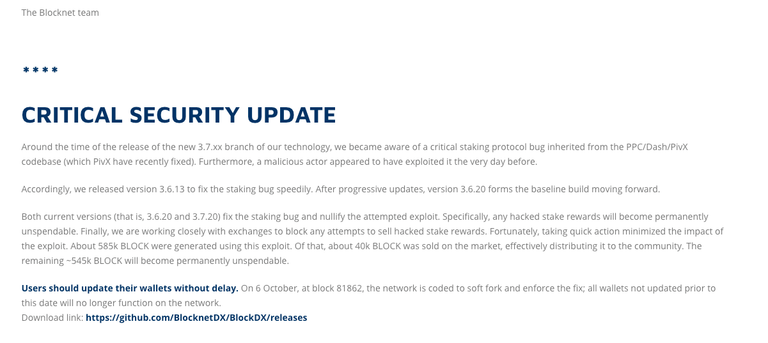

Well good, I am glad you are thinking about that. I was too. You will be wiped out when the fraud company updates the wallet. They will call it something like “illicit staking.” From what I can read between the lines, someone bought a few coins realized they were pumped up and sold them back the fraudsters. Since the fraudsters were losing money. They called it illicit. So they released and emergency wallet update which invalidated all previous wallets.

https://medium.com/@theblocknetchannel/critical-security-update-88115403b59f

http://blocknet.co/?p=368

Why would the exchange let this happen?

They get a cut.

The exchange can get a piece of the trading.

Fees vary, but you do the math. They end up making bank!

These exchanges have been known to have a whole lot of other problems.

What about the website? People at the company? I looked into this. Let’s just say it failed many of the tests I through at it.

I did my own research. I ran across this company looking at Alt coins that had a large increase in the last several years. This Alt coin is “up” about 773 times. There are a whole lot more problems with this analysis. The company has “changed focus,” I think the current volume is set up for a future promotion. It might be the joke of a couple of guys over beer mocking the alt coin market. I think the price will be driven up, then driven down, then promoted. When people see the company it will have this “long history,” a good story and they will invest without realizing it is all “fake”. Yes, every one of those trades happened. But it is all programmed by a computer to manipulate you. It is not real. I suppose one could always argue I can’t prove it. I have seen this on other exchanges where I had access to buy and sell account data. In some of those cases it was “BotA” buying from “BotB.” I even saw trades where “BotA” buys from “BotA.” We know even Wall Street has had issues with fake volume. We even know the recent Wells Fargo –fake accounts scandal.

I have to admit. It is a real beauty of a chart. In makes we want to invest. They do a great job manipulating emotions. But I am going to call them on it.

What do you think?

What have I missed?

Comment Below!

Share your Thoughts!

Please share. Spread the word. Upvote!

Have I saved you from a bad investment?

Help a blogger pay his rent: Quality Journalism takes time and effort!

Donate HERE:

Bitcoin: 1FmyFjydAiPgoQcpchwbVLhe2roN2M16BB

Ether: 0xCf8cFA3e80a9a3f5841B54224Dae4D8d8c026A9e

I'm sorry to disappoint/disagree with you, but that activity is something known as "margin bots".

They do constantly sell/buy tokens at a low amount. And they'll always outbid you by 1 satoshi whenever you try to buy/sell something.

They make money by you being impatient, they force you into buying, suprise suprise, their position. Any coin with a decent trading volume has them, and quite often more than one.

Usually those bots follow the trend however In general I'd say they're always driving price down.

Thanks for your thoughts. To me these bots seem to be moving a significant volume of traffic. In the above screen shots you can see thousands of dollars of volume. Is this normal for margin bots? I suppose this could be the result of different bots crossing (using different strategies.) but it still seems very weird.

Well, exactly 5 days ago something strange did indeed happen at bittrex - some people say it was upBit buying alts at a discount from bittrex, some say it was bittrex moving alt fees into BTC, some say it was just a colossal mistake. It's still not clear what happened.

So yes, it does seem very strange, but if you check data 1, 2, 3 months old it will be much less wild.

Congratulations @cryptick! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPSo it appears coin market cap might not be so innocent. https://medium.com/@coinmarketcapped/intro-how-coinmarketcap-cmc-manipulates-the-market-by-showing-fraudulent-information-to-the-c1246a953144

It is interesting to come across this article well over a year later. Certainly, it has been written about many times about how 80% of all crypto trading is wash trading. This first area does clearly show bot activity. Apparently Blocknet is trying to build a decentralized exchange and now Biannace is stealing from them.

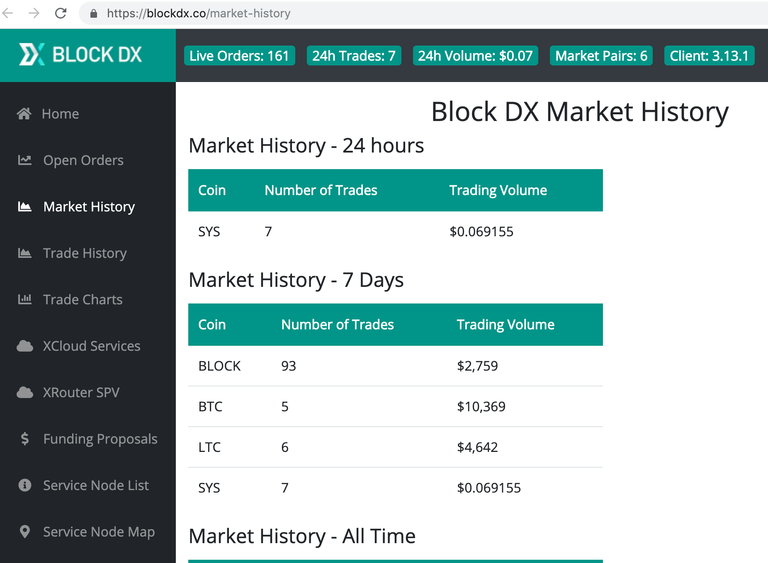

Wow, all this is crazy. While most of the article is about what is wash trading, the rest of blocknets plans were not forthright. It just doesn't pay to spend time worrying about this one.So I have to admit it is sorta interesting to run into your own posts two years later. So they sorta have something working. https://blockdx.co/market-history

That said I also ran into some recent promotion of this exchange. There are many ways to rate or grade projects. Is it a scam? Is it a failed Project? Is it a troubled project started by someone with good intentions? Is it a bad copy of some some working software to try to create another project. Crypto is full of a wide variety of actors and scams. I would not trust Blocknet my research above has forever given me warning about not trusting them.