In this second case-study into dividend investing, we take into account the differing effect money-management strategies have on income derived from investment dividends and the effect this has on compounding returns per annum. As previously discussed in the Countinghouse blogs, money management and drawdown strategies empower the investor to extract maximum potential from an investment product as per their risk appetite and income preferences. Where some investors prefer to compound their returns over a per annum (PA) period in order to increase a financial product’s maximum yield, others prefer to slow PA compounding growth and boost their immediate income, either PA or even monthly. We will look at a PA and monthly method in this blog.

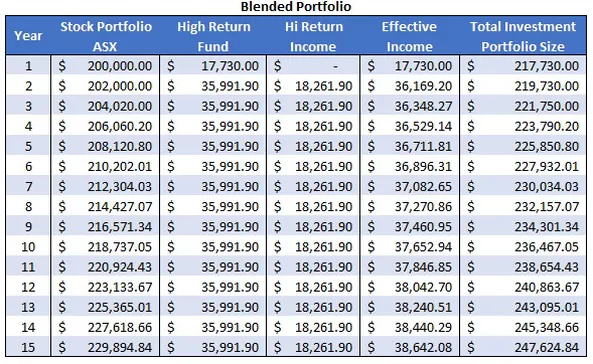

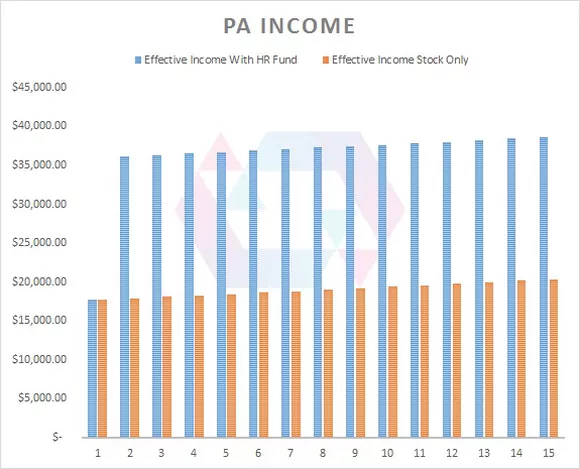

The first case study involves the same dividend stock portfolio that we introduced last week, taking expected passive portfolio growth for a year and investing that into an active, high-return product such as our algorithmic trading platform. However, instead of reinvesting the yearly profits from the high-risk, high-return fund back into the stock portfolio, those profits are instead drawn down as annual income (Table One). This of course has a significant effect of portfolio growth, but at the advantage of a much more rapid boost to income (Figure One).

Table One: Blended-risk portfolio drawdown strategy.

Figure One: Showing increased PA income when integrating a high-return fund into a passive portfolio.

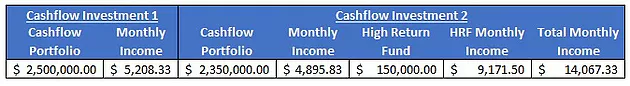

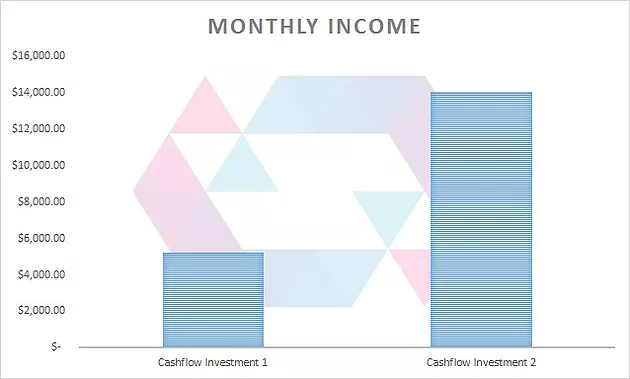

Another effective boost to dividend income can be found in the integration of an active, high-return fund into a low-risk product geared towards paying monthly returns. This low-risk product could range from anything from an interest-bearing bank account to a debenture or fixed-term deposit. This blended-risk portfolio will still yield monthly profit, albeit with more significant return on investment. The example used in this instance is that of an investor with 2.5 million dollars invested in a low-risk cash-flow portfolio which pays a monthly return based on 2.5% PA profit per year. The investor takes 150 thousand dollars out of the 2.5 million dollars and invests that money into an active high-return fund, drawing down the profits from that high-return fund alongside the existing income from the low-risk product (Table Two). As seen on Figure Two below, this blended portfolio maintains monthly draw down, though with more significant returns.

Table Two: The methodology behind a blended-risk portfolio incorporating an active, high-return product into a low-risk cash product portfolio.

Figure Two: Showing the significant increase in monthly income when using a blended-risk portfolio.

Over the last four weeks, we have frequently seen the benefits of integrating a high-return fund into a passive income product. A blended-risk portfolio can increase the overall ROI across many instances, from stocks to property, from compounding investment strategies to PA or even monthly dividend income methodology. The constant force that ties these portfolio improvements together is that of the appropriate integration of a high-risk, high-return product into an investment portfolio as well as considered and disciplined money-management. With these tools, and investor can significantly bolster their portfolio income over the short or long term.

Valuable information about strategies.Thanks.

Counting House is deep mathematical principles, combined with expertise in human and market psychology in order to bolster their investment portfolio and deliver market-beating returns

Visit Please : https://www.countinghousefund.com/ico

#CHT #Countinghouse #hedgefund

If you want to invest you can , One of the best platform is counting housing, Through here your invest for better security and more profit.