36 Months Compiled Forex

There has been an interest in seeing something similar to the published reports of our fund’s crypto trading performance but for our forex fund, the only issue is that our Forex fund doesn’t have tradable units, and isn’t on an exchange. Instead of doing public reporting over the whole fund as we do in our crypto-fund, we give individual quarterlies to individual investors in our Forex iteration. Because the units are not tradable, investors all have different details in their quarterly depending on three main factors; the amount they have invested, their withdrawal strategy, and their chosen risk multiplier. This is one of the big benefits of running our new fund on the blockchain; the complexity of individual statements and customised withdrawal/risk options is all taken care of by the investor themselves, allowing the fund to run leaner and the investor to have total control. A win-win scenario, as often blockchain solutions are.

To generate the required tables and charts shown in this blog took quite a lot of processing. First, if we wanted to show a trade-by-trade resolution, we couldn’t just compile quarterlies (as this would only show a quarterly resolution). Instead we had to download the trade history for all of our clients and their trading pairs. We had to go through the data and make the growth change relative to the amount in the account at that time (to factor out the effect of deposits and withdrawals) by using a relative division field added to each of the raw data reports. We then compiled all the client’s data down to just the trading pairs so that we get an average of risk multipliers. We subsequently compile the pairs to generate relative drawdown statistics of overlapping trades. Following this, we had the required data to generate equity lines that are not effected by deposits and withdrawals (percentage of growth rather than actual fiat balance) and the data for drawdown. Winning ratios are easy and don’t need as complex an approach. Average trade growth is more easily surmised once the above is compiled.

We didn’t get into deep stats, like Z or R scoring, or predictive stats like Monte Carlo testing, and we also haven’t included stats that we think are not relevant to most investors (for example trade times or win/loss per day of month average). We are also wanting to do a similar blog to this for the five quarters prior to this, dating to the very start of our liquidity introduction participation. We are splitting these blogs to both make them more digestible and to get this one out earlier for those who are interested in it.

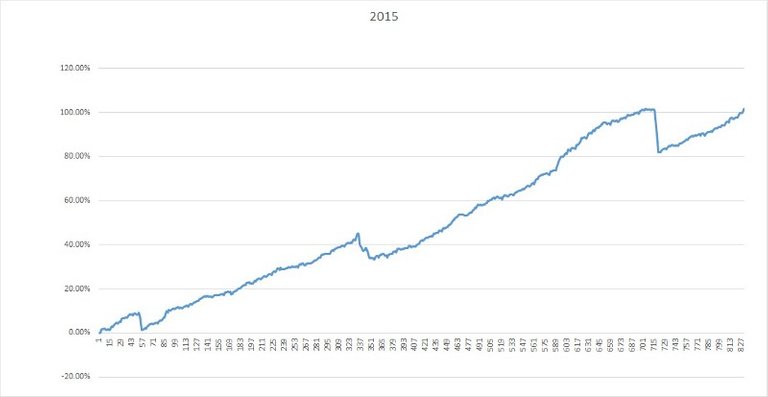

2015

2015 was a strong growth year for the fund, and the first year using a more evolved version of a previous algorithm, we named this new bot “The Mintie”. The Mintie was a bit too aggressive, and we slowly tuned it down over the year to reduce the regularity of failed hedges, these are seen as a sharp dip in the graph below. If we had not had these failed hedges 2015 could have been the highest performing year in Forex for Countinghouse.

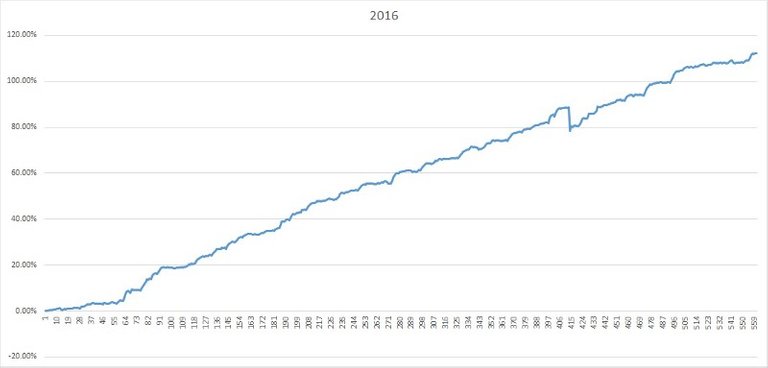

2016

After the tuning of our algorithms in 2015, we had a more patient and relaxed Mintie. Fewer trades but a larger average profit. Because of the fewer failed hedges, we had a better year overall (see the graph below).

You can see that the equity line is smoother with fewer failed hedges and only one major failed hedge. This year didn’t bring as much ‘tuning’ of the algorithm but some was still done to try to reduce the chances further of hedges failing.

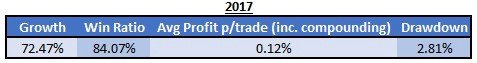

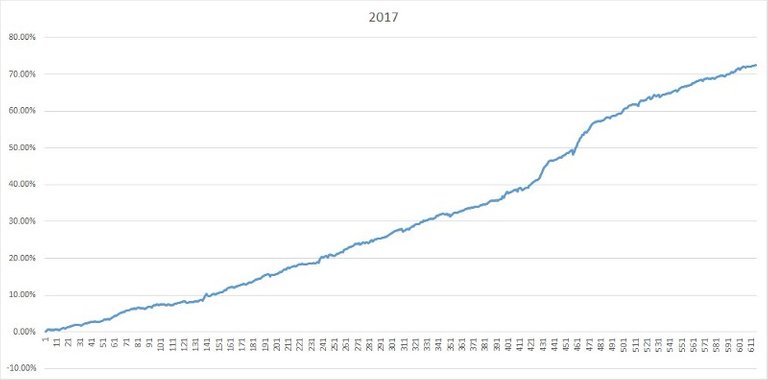

2017

You can see in 2017 that there was a big reduction in volatility in the forex markets, this is evident in the reduced profit per trade and the overall reduced profit. Of course, one upside of lower volatility is lower drawdown. The algorithm had a better strike rate in winning trades, but with the volatility as low as it was this didn’t translate into increased profits.

The equity line is very smooth in 2017 as there were no major failed hedges. There are still smaller failed hedges that happen rather frequently but do not have a large effect on the total fund. This is of course an unavoidable part of direct hedging when also taking steps to mitigate loss and risk.

As of the time this blog was written, 2018 was still underway. There has been some added volatility due to political unrest and this has been good for the fund. The real excitement has come from the crypto experiments and the building of the new fund. We look forward to growing Countinghouse and our funds with our existing and new investors!

Hey @countinghouse, want free resteems? All ya gotta do is follow me...

Excellent post. From my view who are previously experienced on forex crypto could be a great goldmine from them. Thanks.

Nice post, and soon.. I think cryptocurrency will be the main option to gain profit for all forexs trader and made crypto as they future investment

Excellent project. Also very useful. Thanks.

Tim Dawson,Mike Pomery is our Director

Visit Please : https://www.countinghousefund.com/ico

#CHT #Countinghouse #hedgefund