(these ones will be a slightly different posts from the usual HPUD ones I do, but for some time I wanted to, hopefully, shed some more light into how to use or read the information visible from diesel pools on Hive Engine side-chain)

Understanding Liquidity Pools on Hive Engine

A Hive Engine based Series you might want to call a Guide 😜

For this particular "guide", I will use my preferred front end, https://beeswap.dcity.io for most examples and https://tribaldex.com for some of the other features present in Hive Engine.

Although I am using these as examples, there are other around that could provide you similar or near quality of such information. And I will make examples from my ATX token and respective pool (although most of this will apply to any other token/pool).

Since I wish these post series to be as effective as possible, for the ones not yet familiar with liquidity pools, here it is a summary of all the posts in this series:

InTo Basics

- 🤯 What is a Liquidity Pool?

- 📊 Adding, Removing and Swapping

The Real Deal

- 🤑 What do Liquidity Providers Win?

The Importance of Understanding

- 😎 The Depth of Liquidity Pools APR's

- 🤫 Options and Strategies

Made with lots of ❤️ from @atexoras.witness, @forykw and its dark soul @forkyishere

(Disclaimer - these topics might need corrections over time, so please take that into consideration, and I would encourage U to contribute if you wish/can)

😎 The Depth of Liquidity Pools APR's

Now, we are reaching the part I wanted people to pay attention. Many will look at the APR numbers and either get super excited or bored with something some quickly realize as "not being real".

Usually because IRL people know that an APR of 20% for example is already something that has some high risks and guarantees over long periods is likely non existent. Banks for example (that I know) are around 1 to 5% ranges and then above that is usually investment pools or other financial tools using trading methodologies.

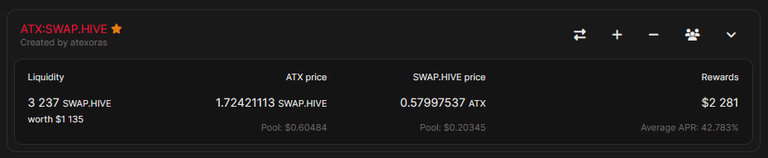

In the case of Hive Engine tokens, and on the pools, the APR respective to the rewards I previously explained (you can see in the picture above, on the right side), this APR is respective to the value you have as liquidity provider inside that specific pool, and how much value are you winning on rewards daily.

This APR does not account for the fees you also get as liquidity provider.

Now you may inquire, how are things being calculated, right? If we have tokens (in this case SWAP.HIVE and ATX), how is the value of each calculated?

Understanding the $$$ values 🤑

First, we have to understand which are the markets that exist in order to make sure we are comparing apples with apples. And in this case, HIVE is the quoted, and lets call it, "primary root". For many reasons here, being the most important one the fact that Hive Engine is a layer 2 chain, dependent on the layer 1, which is Hive.

The primary root, HIVE, is valued something... let's lock now with 0.35 USD for exemplification. That means that we can start representing every other tokens on Hive Engine through how those respective tokens trade against its representative HIVE pegged token (SWAP.HIVE).

So, for example, if ATX is trading on the market (and this is a key point, NOT ON THE POOL) at 1 to 1 (one ATX for one SWAP.HIVE), then it means that 1 ATX will be valued also 0.35 USD.

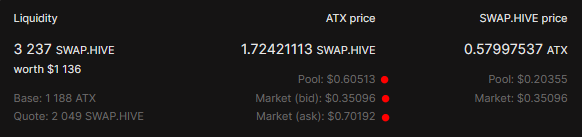

And from that calculation we can find that part where you read "worth $1136" in the above picture.

You might or might not have noticed, that from the picture above, the pool has around 2049 SWAP.HIVE, but "worth" indicates only 3237 SWAP.HIVE... how come you may have asked? (and for the ones that didn't yet got this... a pool has to have equal value on both sides of the pair, hence if we have 2049 SWAP.HIVE, then 1188 ATX at ~1.72 SWAP.HIVE/ATX, is the 2049 SWAP.HIVE, and so we should have total worth approximate value of 4098 SWAP.HIVE instead)

So, why the worth is less? That's because the quoted market bid (~0.35096 USD) is currently less than the pool exchange rate of ~1.72 SWAP.HIVE per ATX (or ~0.60513 USD per ATX).

At this point, my @forkyishere side complaining to me with "SIMPLE WORDS MATE", because everyone reading up to here have lost track of everything... 😭

Terms and more terms!!! 🤯

Right... lets try to help a bit with more simple examples (using the same picture as above, but first lets address the 3 values behind the red dots I am pointing in the picture bellow):

From top to bottom...

- Pool value of the ATX token: This is the price you will be paying for swapping SWAP.HIVE for ATX via the pool.

- Market value of the ATX (bids - aka people offering SWAP.HIVE to buy ATX): This is the price you will get if selling ATX on the market, instead of using the pool 😉 - now some might be starting to get it

- Market value of the ATX (asks - aka people offering ATX for a SWAP.HIVE price): This is the price you will get if buying ATX on the market, instead of using the pool 😉 - DAMN NOW MAKES SENSE!

So, in the above example, where does it make sense to buy ATX? Market!

And likewise, where it does make sense to sell ATX? Pool!

You are welcome!

The same applies to the other side values, but here its a bit more complicated because of (in this case) ATX only being quoted in SWAP.HIVE...

Again, from top to bottom...

- Pool value of SWAP:HIVE token: This is the price you will be paying for swapping ATX for SWAP.HIVE via the pool.

- Market value of SWAP:HIVE token: This is the price you will be paying for buying SWAP.HIVE in the market, which because its a pegged token to HIVE cryptocurrency, it's the same value HIVE is valued in the internal market. This is the part that can be hard to interpret for other pool pairs that don't pair against SWAP.HIVE.

But that's basically it. Confused? Drop questions bellow.

Rewards APR Conclusions 💡

So, given that you now understand where the prices come from... and why the pool is worth less than what you would have thought (because the market price, aka bids, of ATX is lower than the pool price)...

You can now understand that the price of ATX inserted into the rewards distribution is valued at the market price (bids) and therefore represents a "lower" (in this example) value from what you see represented on the pool, influencing the value of the total rewards change, and respectively the associated APR.

Example!

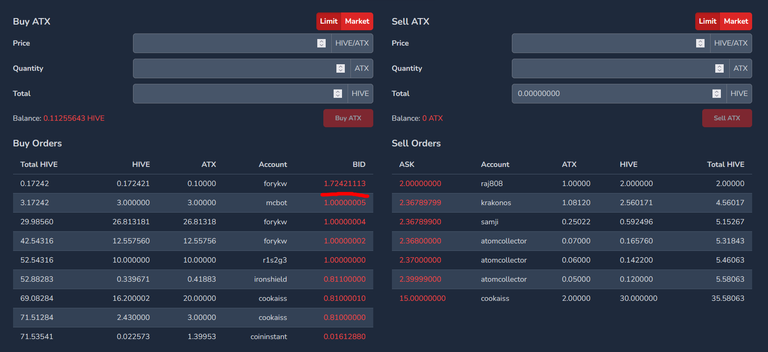

If I go now (which I did) and broadcast a position on the market on the bids side, at ~1.72 SWAP.HIVE per ATX, you will see a completely different rewards value and associated APR.

Comparing it with how it was before...

And there you go as well, the perfect pool worth of 4098 SWAP.HIVE or 1445 USD. 🤗

🤫 Options and Strategies

Right... so, you should now understand that you should pay attention in looking at pools and their respective token markets, especially because of the price, APR or market volume, as prices might not be "realistic" for specific volumes to be traded or swapped.

Aka, for the example on my pool (and example above), I have "unrealistically" inflated the value of the APR with a bid that is worth just 0.172421 SWAP.HIVE worth (check picture of Hive Engine market with my position), making it not real the actual value of the rewards being represented in the pool, especially IF (and this is important) everyone just wants to sell their ATX via the market.

In this case, ATX is not widely distributed yet, and therefore the risk of people selling on the market is lower (way lower) than people using the pool which will in any case get you more SWAP.HIVE. (SO PLEASE STOP SELLING ATX AT LOWER PRICES and USE THE FRICKING POOL if the prices there are better!!! LOL) - 🤣

This applies to any other pool! And that's the part where I want to be effective with these posts. Use the fricking pools more often, because if you don't you are loosing most of the time! They have, most of the times, way better prices. And its instantaneous...

Trading is mostly for whom is able or prone to wait for better positions. More reward yes, but also more needed skills and time consuming if you don't have access to trading bots.

Side note for ATX distribution 🤓

If you are trying to help, thank you! 🙏 Teach others or use the ATX pool distribution as an example. It will help both the pool and, as people get skilled, the overall participants (liquidity providers) in the pool.

Because the current distribution is via the pool (you can only get ATX via other two events, but they will change), and rewards are kind of high and for a very long period (hence why I did a 5 year distribution), it's going to be very hard for the rewards to NOT attract more people, even with higher amounts of distribution when we pass 1 year (where APR will increase a lot for some time).

Selling or buying will need to be an educated exercise for whom wants to think long term. Especially after 1 year, because the distribution will large increase and by then getting ATX via other places might be less attractive.

I hope to also make this a fun exercise... where you learn. If you profit, well done mate!

With this, I conclude my series of posts about pools. I hope to have not bored you much and made the attention you deposited in this post useful. If you learned, then I was successful! And if you use my token to learn how this all works, HUGE thanks!!! The point of this is to entitle you to be skilled enough to get skilled on using any other pool.

Appreciate the reading!

Thanks for the explanation, I have a lot of doubts and questions about Hive and its ecosystem, I will summarize them for you to see if you can help me.

1; if for example I have 1000 HP, I earn 2.94% apr and if I vote regularly what apr% do I earn approximately from the votes?

What if I voted for my own posts and comments? Is it legal or not?

Where does the 20% APR from save HBD come from?

Can you see somewhere the approximate monthly % APR % of the pools by commissions ? even if they're past

Regarding your ATX token, WHAT UTILITIES WILL IT HAVE, WHAT WAYS ARE THERE TO EARN IT, IS THERE A DELEGATION OR CURATION SYSTEM OR WHAT IS THE BUSINESS MODEL?

Thank you for your time and help

!PIZZA😎

Lots of good questions, I have wondered about many of them myself. I am not expert on anything but am happy to share the bit I have learned.

apr% from voting has a lot of variables I don't fully understand but I believe it one of the factors is now old the post is your voting on. I just focus on trying to use at least 20% of my voting power daily and see any rewards earned as a bonus.

I do not vote on my own posts or comments as I believe it is frowned apron by some and could attract a down vote, but I do not think it is illegal.

I believe the 20% APR HBD comes from all the hive transactions that cost a fee. Is it sustainable or does it weaken the liquid hive price might be a better question but only time will tell, both seem to be doing ok.

I have not found any where that shows historical APR of the pools.

There is no ATX delegation or curation at the moment that I known of, but you can earn it by posting in the pub community or participating the power up day challenge.

!LUV

!HUG

!PIZZA

GRACIAS POR TU RESPUESTA, ESTE ENLACE RESPONDE A VARIAS DE MIS DUDAS

https://inleo.io/@kevinnag58/how-do-hive-backed-dollars-hbd-work-including-the-hbd-stabilizer-the-hbd-debt-limit-and-the-haircut-rule

!PIZZA😎

Ah yep, that one is quite good! Glad to see you kept searching and found something.

Agree with all! =)

Only one detail:

The 20% APR is decided from the majority of what the top 20 witnesses select, but the source of it is not as simple to explain. This model is explained somewhere (I saw some posts in the past) but its not coming from transactions fees because, hive has no transaction fees. The "fees" on hive are coming from something we call Resource Credits, which is a sort of "pool" parallel to the voting power, but used for costing all the actions being broadcasted into the chain.

The 20% APR HBD comes from a much more complex economics. It goes along the lines of the balance between how much depth exists overall (in the printing of HBD) vs the amount of HBD that is converted to/from HIVE.

This part is quite complex to explain even for me... need to find that post! @dalz has a very cool tool for people to monitor HBD (not sure if him knows a good post about explaining HBD APR that does not dwell into the code complexities too much, I will keep looking and link here if I find one):

https://www.hbdstats.com

Also, check his posts as he has a tone of great ones with lots of detail about things (1 example):

https://peakd.com/hive-133987/@dalz/hive-inflation-for-november-2023-or-same-as-the-projected-one

@new.things, sorry!

You are out of hugs for today.

You can call the HUG bot a maximum of 3 per day.

The current call limits are:

@new.things sent you LUV 🙂 (3/10)

Made with LUV by crrdlx

I am going to have to read this a couple of times. I thought I had an understanding of the pools but maybe not.

!LOL

!LUV

!ALIVE

!PIZZA

😂 - happy to get into a chat behind the scenes...

Yes thanks makes way more sense now.

!BEER

🤓

View or trade

BEER.Hey @forykw, here is a little bit of

BEERfrom @new.things for you. Enjoy it!Do you want to win SOME BEER together with your friends and draw the

BEERKING.@new.things sent you LUV 🙂 (2/10)

Made with LUV by crrdlx

@forykw! You Are Alive so I just staked 0.1 $ALIVE to your account on behalf of @ new.things. (3/10)

The tip has been paid for by the We Are Alive Tribe through the earnings on @alive.chat, feel free to swing by our daily chat any time you want, plus you can win Hive Power (2x 50 HP) and Alive Power (2x 500 AP) delegations (4 weeks), and Ecency Points (4x 50 EP), in our chat every day.

Nice effort bro, thanks for explaining this very important topic

Anytime! =) the next stage of fun about these, will come! !BEER

View or trade

BEER.Hey @zaibkang, here is a little bit of

BEERfrom @forykw for you. Enjoy it!Did you know that <a href='https://dcity.io/cityyou can use BEER at dCity game to buy cards to rule the world.

thanks for tips 👍👍

!LOLZ

!PIZZA

lolztoken.com

You are out of jokes for the day!

@speedtuning you can call @lolzbot a maximum of 6 times per day.

Level up by buying more $LOLZ so you can share more jokes per day!

Cheers with !BEER

We NEED more series like this one, helping people better understande how things work!

This made me !LOL ahahahah I often see people filling buyorders on the market at lower prices than what they would have been able to get from a pool and I'm always like "but why are you doing that?"... but then I realize that LPs are often outlooked by people, because they don't understand their main and basic feature: allowing people instantly swap between one token and the other. Simple as that, yet most are completely missing it!

!PGM !PIZZA

I have seen this sooooooo many times on SOOOO many pools... I struggled to even take advantage of it. 😂

I always see a lot of bots taking advantage of it! I guess whoever is running them makes a good amount of money from those "bad" tradings !LOL

yep... I don't have the patience anymore. Bots look cool, but sometimes they require a lot maint...

I lack the basic knowledge to even run one! Ahahah

!LOL

lolztoken.com

He had no Monet to buy Degas to make the Van Gogh

Credit: reddit

@forykw, I sent you an $LOLZ on behalf of arc7icwolf

(6/10)

NEW: Join LOLZ's Daily Earn and Burn Contest and win $LOLZ

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

lolztoken.com

Me: I would say my biggest weakness is listening.

Credit: reddit

@forykw, I sent you an $LOLZ on behalf of arc7icwolf

(5/10)

Delegate Hive Tokens to Farm $LOLZ and earn 110% Rewards. Learn more.

We're seeing a lot of interest from you guys in all of these coins, and there are a lot of profitable pools that people are benefiting from.

The point is... using more swaps when the trade pair exists. As its usually much better. And quite easy!

Appreciate the share! Tag me if people have questions.

I've been creating liquidity pools on many tokens hoping to get done badges and benefits, but yeah, I really dunno what I'm doing. Understanding the financial benefit might make me more keen into inserting some more significant amount.

If you have any questions at any time... I am happy to help!

I actually read this paragraph and got very confused. Maybe a drawing might help. I understand that both most have equal part of swap hive and atx, but didn't get the surplus of value versus amount of token.

Nah... its because the worth value or value of ATX (that is included in the worth value), is quoted from the higher bid on the market (https://atexoras.engine.splex.gg/trade/ATX) and not from the price you see in the pool. Hence why the worth changes... depending on what bids are set on the market.

Effectively, what I am trying to say, is, if the market bids follow the pool price, then the shown worth will be correct/aligned with the real worth of the pool. Otherwise, it will show a different value (usually lower) than what it is (given the case of the pool being the place where there are most of the tokens/volume, etc).

For pools where this plays around (aka, most volume and tokens are on the market), then usually the pool aligns easily to the price represented on the market.

Congratulations @forykw! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 850 posts.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out our last posts:

We have fast learners!

@baconface

😂

Yay! 🤗

Your content has been boosted with Ecency Points, by @bhattg.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

$PIZZA slices delivered:

arc7icwolf tipped forykw

new.things tipped forykw

aurikan tipped new.things

aurikan tipped forykw

new.things tipped aurikan

@speedtuning(8/10) tipped @forykw

Pools aka Exit Liquidity :D

Usually like this...

Although I am more like this:

'Mixed Martial Arts Sport GIF by UFC' what

🤣

Ho Ho Ho! @forykw, one of your Hive friends wishes you a Merry Christmas and asked us to give you a new badge!

The HiveBuzz team wish you a Merry Christmas!

May you have good health, abundance and everlasting joy in your life.

To find out who wanted you to receive this special gift, click here!

You can view your badges on your board and compare yourself to others in the Ranking

Check out our last posts: