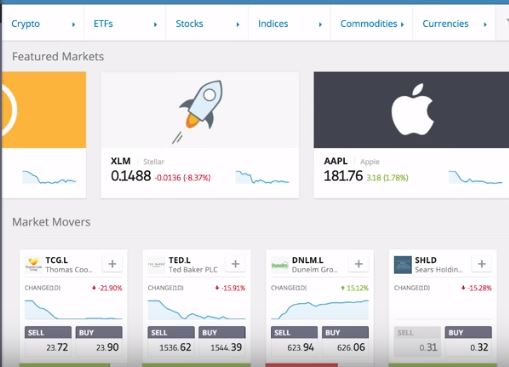

Hi Everyone, so leverage we've all heard about leverage and a lot of people asking you know what does it do and why to be scared of it a lot of people warn against it so here's the eToro home screen kind of nice and glossy it is the blue big picture of mobile and it seems simple and lovely then I'm down at the bottom here there are this quaint ports a little statement. This little statement here if they didn't have to do by European law there's ES MA ESMA they introduced regulations Europe recently we're making sure that all the trading platforms and exchanges and brokerages sort of make themselves transparent. they have to warn the public about certain things that's what this is it says CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage 65% of retail investor accounts lose money when trading CFDs with this provider so what's the CFD every time on eToro every time we make a trade using leverage it turns that trade into a CFD. Which is something you can trade we'll get to what that is later on but you should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money that's a very stark warning that's not a small thing for them to have to put then it's quite serious so a lot of people ask you know what's leverage and why is it so risky so this leveraged sort of you know bad is evil.

The majority of new traders apparently using leverage blow their accounts as losing all their money terrible thing so here if I want to use enable high leverage trading I have to click continue to have to answer a bunch of questions which prove that I know how to trade or have some financial training and then I can use the high leverage if I satisfy those requirements I don't so I'm going to go back so I can use times one, times two, times five if I was trading Forex like sterling against this currency pairs. I can use different amounts of leverage they indices different amounts of leverage it depends on the assets, they'll have different amounts of leverage available to each okay and it usually depends how volatile something is so the more something moves up and down that different things a different volatile they move up and down in during the day or the week of a month. they're different you know, so stocks are very volatile they move up and down a lot naturally, so they will only let you amplify that by smaller amounts you see because that's what leverage does if you're winning you will win much faster if you're losing you will lose much faster the velocity of how fast you win or lose gets higher.

They caution against leverage it's not because there's anything wrong with leverage it's because the combination of leverage and not knowing what's happening is dangerous leverage and knowing what's happening fine but in the beginning to use it before you know it's happening it's dangerous because of your emotions because of your reactions to when the market turns against, what's a CFD and what are the other fees associated with losing leverage there's the general emotional risk and panic and fear that comes with using leverage.

Thanks For Your attention, We will Talk more about leverage trading in Next ARTICLE.